In what cases are you entitled to a deduction What can be included in the deduction What cannot be included in the deduction If payment documents are lost When can you apply for a deduction Documents for deduction when building a house Amount of deduction when building a house Did you take out a loan to build a house? House finishing costs

If you built a house, you can get back some of the money spent on construction. It doesn’t matter whether it was your personal savings or borrowed ones. This is stated in paragraphs. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation. In the first case, you receive a tax deduction for the construction itself, in the second, you also receive a tax deduction for the interest you paid to the bank for the loan.

In order to receive a property deduction for a built house, a number of conditions must be taken into account.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

In what cases are you entitled to a deduction?

1. You purchased a plot of land and built a residential building on it

We are talking specifically about a residential building, and not about a residential building. The Letter of the Federal Tax Service of the Russian Federation dated 02/15/2018 N GD-4-11/ [email protected] “On the procedure for applying the property tax deduction for personal income tax” and the Letter of the Ministry of Finance of Russia dated 02/08/2018 N 03-04-07/7700 states :

“In accordance with the current legislation of the Russian Federation, the terms “residential building” and “residential building” are not identical.”

Thus, from paragraphs. 3 and 4 clauses 1 art. 220 of the Tax Code of the Russian Federation follows:

“...there are no grounds for applying property tax deductions provided for in Article 220 of the Code during the construction or acquisition of a residential building that is not recognized as a residential building.”

It should be taken into account that, according to Letter of the Ministry of Finance of Russia No. 03-04-05/27085 dated 05/03/2017:

“If a residential building is recognized as a residential building, a property tax deduction, the taxpayer has the right to receive the specified tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of Article 220 of the Code, taking into account the established requirements.”

So, one thing is important for us - you can return the tax if you built a residential building with the right to register in it, registered it with Rosreestr and received an extract about it.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

Example:

In 2021, you bought a plot of land for personal subsidiary plots (personal subsidiary plot) and built a house on it. According to the documents, it is registered as a residential building without the right of registration. In this case, you are not entitled to a tax deduction. But if the house is recognized as a residential building with the right to register in it, you can receive a property tax deduction for it.

2. You bought a house under construction and completed it

Attention! If you plan to receive a refund not only for the purchase of the house, but also for its construction, carefully draw up the purchase and sale agreement. It must indicate that you are purchasing an unfinished construction project.

Example:

In a cottage village, a plot of land with an unfinished house was for sale. You have correctly drawn up the purchase and sale agreement and stated that you are buying an unfinished construction project.

After you finish building the house and receive an extract from the Unified State Register of Property Rights, you can submit documents to the tax office. The deduction will include both the costs of purchasing an unfinished house and construction costs.

Example:

You found a house you liked and rebuilt it as you saw fit: you carried out various types of reconstruction, expansion and improvement. Since you purchased a finished house and not an unfinished construction project, you will not be able to include construction costs in your tax deduction.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Legislation

According to the law, a citizen can indicate any amount for building a house:

- Article 220 of the Tax Code of the Russian Federation says that money for the construction of a private house can be returned.

- Federal Law No. 212 regulates the list of persons who may qualify for personal income tax (parents, guardians, children).

- Letter of the Ministry of Finance of Russia dated May 14, 2015 No. 03-04-07/27582 indicates the possibility of receiving deductions by a spouse.

- According to letters from the Ministry of Finance dated May 14, 2015 No. 03-04-07/27582 and dated March 25, 2015 No. 03-04-07/16238, it is possible to receive property compensation to repay loan interest.

Important! The taxpayer should not overestimate or underestimate the amount of deductions: this may result in a fine.

What can be included in the deduction

When applying for a property deduction for building a house, keep in mind that not all of your expenses will be taken into account when returning your personal income tax.

What expenses are deductible:

- acquisition of land for construction;

- purchase of an unfinished construction project (residential building);

- ordering and payment of design and estimate documents;

- connection to general engineering networks and communications: electricity supply, water supply, sewerage, gas supply;

- construction of autonomous networks and communications: electricity supply, water supply, sewerage, gas supply;

- construction/finishing materials;

- construction work and finishing.

Do not forget to save all payment documents for purchasing materials and placing paid orders. It is on the basis of these documents that you will claim your right to a tax refund.

Quick deduction service: personal income tax refund in 7 days, not 4 months!

Order service

Tips and tricks

Difficulties may arise when filing a property deduction. For example: the recipient of payments is a woman who went on maternity leave. To return the funds, she does not need to go to work; it is enough to give her husband permission and a power of attorney to receive all payments (in case of official marriage). This is feasible if the woman is the owner of the constructed housing.

Another difficulty arises with buildings on summer cottages. The way out of the situation lies in documents where there should not be a “dacha”, “non-residential” building.

All payments should be made out in your name, otherwise it will be impossible to prove that you paid for the money spent.

Attention! If difficulties arise, you can contact accounting firms for help. They will easily prepare and submit all the papers.

It is not difficult to issue a tax deduction, and if you have any questions, you can use the services of a lawyer at the right time.

What cannot be included in the deduction

According to letters from the Ministry of Finance of Russia dated January 20, 2011 No. 03-04-05/9-15; dated August 24, 2010 N 03-04-05/9-492; dated January 20, 2011 N 03-04-05/9-15; dated September 15, 2010 No. 03-04-05/9-545 the tax deduction does not include:

- redevelopment of premises in a built house;

- redevelopment and reconstruction of a built house, including the construction of floors or extensions;

- installation of plumbing, gas and other equipment;

- construction of adjacent buildings: swimming pool, bathhouse, garage, barn, fence, etc.

- a gas boiler;

- air conditioning systems;

- any plumbing equipment: shower, bath, toilet, faucets, water meters;

- production and installation of loggia glazing;

- cost of purchasing plastic windows;

- warm floor;

- sound insulation;

- installation of electrical wiring, telecommunications, computer network and cable television wiring.

Example:

You bought a plot of land with an unfinished house, completed construction and decided to build a swimming pool on the plot. Costs for the pool will not be included in the tax deduction. You will receive a tax refund only for the purchase of land, purchase of a house, construction and decoration.

Information support from a tax expert of the online service NDFLka.ru means a correctly completed 3-NDFL declaration and receiving the maximum possible tax deduction when building a house!

The procedure for calculating VAT during construction and installation works

To calculate VAT when performing construction and installation work for the taxpayer’s own consumption, the following steps are performed sequentially:

- The tax base for completed construction and installation works is calculated.

- The tax period in which VAT must be calculated and the tax amount must be calculated is determined.

- An invoice is drawn up for the cost of construction and installation work performed.

- The amount of VAT on purchased materials, works, services necessary to carry out construction and installation work, and the amount of VAT accrued on the volume of construction and installation work performed are subject to deduction.

- A completed VAT return is submitted to the tax authority.

- Tax is paid to the budget if the declaration reflects the amount of VAT payable.

When can you apply for a deduction?

In order to receive a personal income tax refund, you need to contact the tax office. According to paragraphs. 6 clause 3 art. 220 of the Tax Code of the Russian Federation, among other documents, it is necessary to provide an extract from the Unified State Register of Real Estate.

This means that until you have registered title to the house and received a statement, you cannot claim the property deduction.

So, first you need to complete the house, then register it as a residential building (not as a residential building!) and receive a document of ownership. Only after this should you contact the Federal Tax Service at your place of residence.

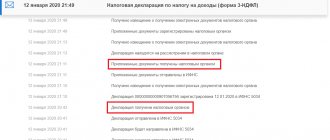

You can submit a 3-NDFL declaration and an application for a deduction for building a house the next year after receiving an extract from the Unified State Register of Real Estate. In order not to wait for next year, and start receiving a deduction this year, contact the tax office for a notification and apply for a property deduction from your employer.

Example:

In 2021, you bought a plot of land and began building a residential building. In 2021, construction was completed, in the same year you registered your property rights, about which you received an extract from the Unified State Register of Real Estate. You can send documents to the tax office no earlier than 2022. The month of submission of documents does not matter.

It is not necessary to go to the Federal Tax Service next year. Since the property deduction works without a statute of limitations, you can do it in a year or two. But remember: if you want a refund for past periods, this refund will only apply to the last three years.

Example:

You received title to the house in 2015. They decided to contact the Federal Tax Service in 2021. You have the right to get a tax refund for 2021, 2019, 2021.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

If the object is being built under an investment agreement

When concluding an investment agreement, tax amounts are presented not to the investor, but to the intermediary (customer), who organizes the construction process. Chapter 21 of the Tax Code does not contain the procedure for applying the deduction when concluding an investment agreement, which gives rise to the existence of different points of view on the very possibility of its application.

Some experts believe that since investment activities are not subject to VAT, the investor does not have the right to deduction. Investors attribute the “input” VAT to the cost of the capital construction project. This position is supported by some courts (resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated March 10, 2006 in case No. A29-502/2005).

According to another point of view, only the transfer of property that is of an investment nature is not subject to VAT, while construction operations for the implementation of this investment project, which are paid by the investor, are subject to taxation. In accordance with this position, the “input” VAT that the investor transfers to the customer can be deducted.

The customer carrying out activities under an investment agreement is, in fact, an intermediary between the investor and contractors (suppliers). The funds he receives from the investor are a source of targeted financing and are not subject to VAT. However, costs incurred by the customer to contractors and suppliers generally include VAT. When the customer transfers the result of construction to the investor, there is no VAT subject to taxation, since there is no fact of sale (ownership of the constructed object initially belongs to the investor). In this case, the object is transferred at its actual cost, including VAT.

The fact that the tax amounts presented by suppliers and contractors to the developer can be transferred by the latter to the investor is confirmed by the Presidium of the Supreme Arbitration Court of the Russian Federation (resolution dated June 26, 12 in case No. A38-1216/2011). This is done on the basis of a consolidated invoice, which is drawn up by the customer to the investor.

Documents for tax refund when building a house

In most cases, the right to a property deduction applies not only to the purchase and construction of a house, but also to the purchase of a land plot.

All these expenses can be entered into one 3-NDFL declaration. Below we provide a complete list of documents for tax refunds for the purchase of land, houses and construction.

You will need copies of:

- Passport. To check with the Federal Tax Service, you must present the original.

- Extract from the Unified State Register of Real Estate to your home.

- Extract from the Unified State Register of Real Estate for land.

- House purchase and sale agreement.

- Contract of purchase and sale of land.

- Payment documents for the land plot (bank statements, checks, receipts, receipts, etc.).

- Payment documents for the purchase of a home (bank statements, checks, receipts, receipts, etc.).

- Register of construction costs.

- Design and estimate documentation, contract agreements, certificates of completed work.

- Payment documents for all construction and finishing materials (checks, bank statements, receipts, payment receipts).

You will need the originals:

- Declaration 3-NDFL.

- Help 2-NDFL. Obtain from your employer. Required condition: the certificate must be for the year the deduction was issued. If in 2021 you submit a declaration for 2021, the 2-NDFL certificate must be for 2021.

- Application to the tax office for personal income tax refund. Among other data, it indicates the account for transferring money.

If you include mortgage interest in your tax deduction, then attach an agreement with the bank and a certificate from the bank about the interest paid.

Quick registration and help from a tax expert!

Register

List of expenses included in the list available for reimbursement

According to the letter of the law, there is a list of certain expenses during the construction of a residential property, for which you can apply for partial reimbursement. All of them are presented in Article 220 of the country’s main set of rules governing tax legal relations.

What expenses can be reimbursed?

Among them:

- costs aimed at purchasing a plot of land for subsequent construction of housing;

- funds given for the purchase of a plot of land with an unfinished building standing on it, which is meant to be a residential building upon completion of construction work;

- costs of purchasing materials for the construction of a residential property, as well as the necessary finishing elements;

- funds spent on the preparation of design and estimate documentation;

- money given for the installation and connection of utility networks and other communication systems to the building.

Note! A verbal description of costs is not a sufficient basis for receiving money. To return funds, you must provide documentary evidence of expenses incurred, in the form of checks or receipts.

List of expenses that are not grounds for refund of contributions

Now let's look at the list of expenses for which you can apply for funds from the state:

- when spending money on reconstruction and other improvements to an already built and registered house;

- when carrying out redevelopment in a finished house;

- when installing necessary equipment, such as a toilet, bath or shower, electric, gas heating boiler, etc.;

- if extensions and utility compartments, as well as any other separate objects, such as a bathhouse or garage, were built on the site.

Let's give an example. You built a cottage on your own land, and then installed a brick garage and a wooden bathhouse. You do not have the right to add the last two objects to the list of expenses eligible for compensation, since according to the law only funds spent on the construction of a residential property (house) and finishing work in it are included there.

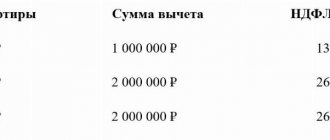

Amount of deduction for building a house

The total amount of property deduction cannot exceed 2 million rubles . This amount includes the purchase of land, the purchase of a house and the construction/repair of an unfinished construction project. The maximum refund is 13% of the tax deduction: 260 thousand rubles = 13% x 2 million rubles.

The tax deduction cannot be greater than the amount of your expenses . If you spent 1.5 million rubles when buying and building a house, then the tax deduction will be 1.5, not 2 million rubles.

The annual refund cannot exceed the amount of income tax you paid . If during the year you did not receive the entire amount, the balance does not expire and is transferred to subsequent years until the allotted amount is completely exhausted.

Example:

You bought a plot and built a house. The total cost was 8 million rubles. Since the maximum amount of property tax deduction is set by law at 2 million rubles, you can receive a refund based on this amount. This means that you will receive 260 thousand rubles into your account.

Important addition! If you are officially married, then your husband/wife can also claim a deduction. As a result, each of you will receive 260 thousand rubles, that is, 520 thousand rubles per family.

Quick deduction service: personal income tax refund in 7 days, not 4 months!

Order service

Maximum amount available for receipt

The amount of compensation from the state issued for the construction or completion of a residential building on a land plot is determined according to the standard scheme for property deductions, that is, in the same way as for other types of property.

What can be the amount of compensation?

The maximum you can return is no more than 13% of the total amount of costs incurred during the construction of the object, and it is not allowed to exceed the amount of 2,000,000 rubles.

Every year you have the right to return an amount not exceeding the total funds deducted from your income to the country's budget at the same time. If within the specified time you do not receive the money in full, then the remaining amount is transferred to payment for the next 12 months and so on until all the money in the due amount is returned.

Let's give an example. In 2014, you built a house on the site for further living in it. The total funds spent on the construction procedure and finishing work amounted to 10,000,000 rubles. You have the right to a tax refund based on covering costs in the amount of no more than 2 million rubles of the amount. However, since you are married, your husband can also claim a return of funds in the amount of 13% of two million, and it turns out that out of 10 million only four will be compensated.

If you took out a mortgage and built a house not in 2014, but in 2013, then you can repay all the interest paid in full, without restrictions, since such restrictions came into force only in 2014, from the first day of January.

If, as in the problem above, the house was purchased in 2014, then you can get a maximum of 13% of 3,000,000 rubles to cover interest, that is, 390,000 rubles.

You have the right to receive compensation for credit interest only if the house was registered as housing with the right to register in it. Among other things, you have the right to submit a deduction also for expenses incurred during construction, and not just for mortgage interest.

Did you take out a loan to build a house? Get a tax deduction on interest

If you used a mortgage loan to buy and build a house, you have the right to return income tax on the interest paid to the bank.

The amount of interest accepted for deduction is 3 million rubles. The calculation includes interest actually paid to the bank.

Keep in mind: Before January 1, 2014, the mortgage interest tax deduction was unlimited. For a house built before this time, you will receive a full deduction for the entire amount of interest paid to the bank.

Important addition! If you are officially married, then your husband/wife can also claim an interest deduction. As a result, each of you can receive up to 390 thousand rubles, that is, up to 720 thousand rubles per family.

Example:

In 2012, you took out a targeted mortgage loan in the amount of 15 million rubles and bought an unfinished house. In November 2014, you completed construction and received a title deed. They decided to apply for the deduction in 2021.

To date, you have paid 4 million rubles in interest to the bank. Since the house was registered before January 1, 2014, you are entitled to a deduction for the entire amount of interest.

Namely: 13% x 4 million rubles. = 520 thousand rubles. If you continue to pay principal and interest, you can take an annual deduction for the interest actually paid during the past year.

Detailed information in the article “Tax deduction when purchasing with a mortgage.”

Tax concierge - consultations with a tax expert for only 83 rubles per month!

Order service

The procedure for drawing up and recording a consolidated invoice

So, in order to pass on the input VAT to the investor, the customer must draw up a consolidated invoice. This is done on the basis of invoices received by the customer from suppliers and contractors, and purchased construction and installation works and goods are allocated as a separate item.

It should be noted that the legislation has never introduced such a document as a consolidated invoice. This so-called concept document was proposed by the Ministry of Finance in 2006. Its introduction was caused by a surge in investment activity. And for 10 years now, developers have been drawing up a consolidated invoice to investors in order to transfer the “input” VAT to them.

The consolidated invoice is drawn up in two copies. The first of them is transferred to the investor - it is on its basis that VAT is accepted for deduction. Along with it, the investor must receive copies of invoices that suppliers and contractors issued to the customer, as well as copies of primary documents accompanying the operations. The investor registers a consolidated invoice in the purchase ledger and reflects it in the Journal of Issued and Received Invoices.

As for the customer, he reflects his copy of the consolidated invoice in the first part of the Journal. Please note that this document is not reflected in the sales book.

The customer issues a separate invoice to the investor for the amount of his remuneration - it is not included in the summary document. The developer must reflect this invoice not only in the Invoice Journal, but also in the sales book.

Results

VAT on the construction of fixed assets is calculated and deducted at the end of each tax period.

The basis for calculating the tax is the costs incurred during the construction campaign. VAT refundable is taken into account in the purchase book as materials and work are received, as well as the necessary documentation is received. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reasons for refusal

Not all applicants receive a tax deduction for the construction of a house, even if they have provided all the necessary documents and completed the application correctly. The reason for the refusal may be different. In any case, the receiving authority must indicate on what basis it did not approve the request.

to receive a tax deduction in the following cases:

- The taxpayer does not have a source of income taxed at a rate of 13%. These segments of the population include the unemployed, pensioners and even some entrepreneurs under certain tax conditions.

- The applicant’s own personal or borrowed funds were not used in the construction of the residential building. That is, money allocated by the employer or received from any state social support program (for example, from maternity capital) was used for construction.

- The transaction for the purchase and sale of real estate under construction was concluded between interdependent persons.

- The citizen did not register ownership of the built house. For residential real estate under construction, the intended purpose of the development must instead be indicated.

Thus, a tax deduction can only be counted on if the payment was made using one’s own or borrowed funds, and also if the citizen has a source of income that is not directly related to the state budget. In addition, if the applicant bought a house that is already under construction, then he should not be in an interdependent relationship with the seller.