What is a tax deduction

Every taxpayer who receives income and pays personal income tax at a rate of 13% has the right to claim preferential compensation in the event of certain expenses.

A deduction is the amount of benefit by which a citizen’s tax base is reduced. It is issued only by those citizens who are residents of the Russian Federation and receive income subject to personal income tax. All earnings that are subject to taxation as a general rule are reduced by the amount of the annual income tax. The result will be a reduced tax base. Citizens also have the right to submit an application to the territorial Federal Tax Service for compensation for the share of overpaid personal income tax.

A citizen has the right to receive a benefit both through material compensation from the territorial Federal Tax Service and from the employer by providing the necessary documents for a tax refund and an application for processing a refund. Often the list of documents includes various kinds of confirmation registers - various certificates and notifications.

Only residents of the Russian Federation receive the benefit, whose income is taxed at a rate of 13%. Those employees who are exempt from paying taxes or pay personal income tax at other rates (for example, 6%, 9%, 15%, 30%) do not have the right to draw up deductions for the reporting year.

Regulates the rules for returning money to citizens of the Tax Code of the Russian Federation.

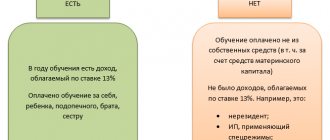

Who and for what training can return 13% of its cost?

One of the social tax deductions is the education tax deduction. The Tax Code of the Russian Federation establishes the following categories of citizens who have the right to expect a refund of 13% of the amount spent on training:

- Persons receiving education in any form of education: full-time, part-time, evening or other, paying for it themselves;

- Persons who pay for the education of their own child or children. Moreover, the age of each child should not exceed 24 years and the form of education at the educational institution should be full-time;

- Persons who pay for the education of children other than their own, that is, guardians. The age of the child under guardianship must not exceed 18 years, and education must be carried out full-time;

- Persons who pay for the education of children who previously had guardianship. In this case, training must also be on a full-time basis, and the child’s age should not exceed 24 years;

- Persons who spent their own money to educate a full brother or sister (full brother - having the same father and mother). The age of the brother or sister must not exceed 24 years, full-time education. This rule also applies to half-siblings (that is, having only a common father or mother).

Important! This social tax deduction can only be provided if the educational institution has state accreditation.

According to the Law “On Education”, institutions in which, after studying, you can return 13% of the funds spent, include:

- kindergartens;

- schools;

- educational institutions for adults aimed at obtaining additional education. These can be advanced training courses, centers teaching foreign languages, driving schools, as well as centers operating on the basis of the employment service;

- institutions whose educational program is additional in nature. This refers to various art schools, sports sections for children, music schools and other types of additional education;

- secondary vocational and higher educational institutions (academies, institutes, universities, technical schools and others).

Types of tax deductions

Depending on the type, the package of documents required for a taxpayer to receive a tax deduction changes. An article about what a tax deduction is will help you understand the current types of deductions. The Tax Code of the Russian Federation states that taxpayers have the right to claim the following deductions:

- Standard - Art. 218 Tax Code of the Russian Federation. Employees receive standard benefits directly from their employers. Organizations act as tax agents. Standard tax deductions are issued for oneself and for children (one child, disabled children). Standard compensation is applied at the employee’s request from the beginning of the year until the salary reaches the limit of 350,000 rubles.

- Social - Art. 219 of the Tax Code of the Russian Federation. Compensates for overpaid personal income tax for paid training of the employee himself or his immediate family, expensive treatment, charity, formation of the funded part of a pension, or in the case of voluntary pension insurance. Such compensation is received from the employer in the current year after writing an application and providing supporting documentation (checks, contracts). The employee has the right to submit a package of documents for compensation to the territorial Federal Tax Service. They apply to the tax office only after the end of the reporting year.

- Investment - Art. 219.1 Tax Code of the Russian Federation. Those citizens who, during the reporting period, carried out transactions with securities, deposited money into a special investment account, or received profitability from transactions carried out through an individual investment account are entitled to receive it. Compensation is provided starting in 2021. They receive a refund both from the Federal Tax Service after a year and from the employer. For this purpose, an application and supporting documents are prepared.

- Property - Art. 220 Tax Code of the Russian Federation. Provided for the purchase of an apartment or other residential real estate, construction of housing, sale of property, or purchase of property from another taxpayer for state or municipal needs. The property deduction is issued either at the territorial inspectorate or at the employer, providing the necessary application and appropriate documents. Such compensation has a certain limit. The maximum for purchasing housing is 260,000 rubles (limit amount is 2,000,000 rubles × 13%). Taxpayers also compensate repaid interest on loan and mortgage agreements and agreements for refinancing previously taken loans. Limit - 390,000.00 rubles (3,000,000 rubles × 13%).

- Professional - Art. 221 Tax Code of the Russian Federation. A professional tax deduction is provided in case of income generation by individual entrepreneurs and persons engaged in private practice (lawyers, notaries, etc.). Taxable income includes royalties and earnings under civil contracts. Receive a professional tax deduction directly from the tax agent paying the income by submitting an application and all required attachments. Compensation is also issued by inspectors of the Federal Tax Service.

Who is entitled to a refund of 13% of the amounts spent on treatment?

— The one who paid for medical care and accompanying medications when treating himself;

— The one who paid for treatment and medications for a spouse or their children under 18 years of age; — The one who paid contributions to insurance organizations under personal health insurance contracts, or similar contracts for a spouse and/or own children. What is important to pay attention to here: the purchase of medications necessary for the course of treatment should not be carried out on an independent initiative, but solely as prescribed by a doctor . In this case, it is imperative to save all the referrals from the attending physician and receipts for payment for medicines produced at your own expense.

Important! The state returns 13 percent if a citizen: received medical care in medical institutions of the Russian Federation; bought medications (prescribed by a doctor) at his own expense; resorted to expensive treatments in Russian medical institutions.

Medical services include diagnostic and preventive care, treatment and rehabilitation. It does not matter where exactly the assistance is provided: at a resort, in a sanatorium, in cases of provision, in a hospital or during outpatient treatment.

Medicines for which payments are due: anesthetics; analgesics; antiseptics; vitamins; medications that affect various vital systems of the body (cardiovascular, endocrine, reproductive systems); medications for the treatment of various allergies, heart failure, gastrointestinal diseases, complex infections.

Expensive treatment includes (29 items in total): surgical treatment of various pathologies, anomalies and severe organ disease; therapeutic assistance for acute forms of diseases; combined treatment of severe disease and pathologies (blood clotting, anemia, osteomyelitis, eye disease, etc.); comprehensive care for severe burns (more than 30 percent); prosthetics, implantation, plastic surgery; organ transplantation; treatment of cancer; infertility treatment (IVF and EXI); rehabilitation of newborns (born prematurely) children (up to 1.5 kg), orthopedic treatment services for citizens with congenital or acquired dental defects; medical services provided as part of palliative care, which involves the use of medical products at home that support the functioning of the human body.

In 2021, the list of expensive services related to reproductive technologies for infertility treatment was expanded.

How to apply for a tax deduction through an employer or the Federal Tax Service

Almost every taxpayer asks questions: how to compensate for expenses, how to restore education costs or receive social compensation. The table lists which documents are provided to the tax office to obtain a tax deduction by type of benefit.

| Type | List of documents for obtaining a tax deduction |

| Standard |

|

| Social |

|

| Property |

|

| Investment |

|

With such documents we issue a tax deduction through the Federal Tax Service.

| Type | What documents are needed |

| Standard | If a citizen has violated the deadline for submitting documentation to the employer (the application must be submitted to the accounting department before the end of the reporting year), then he submits to the Federal Tax Service a 3-NDFL declaration, an application for NV and similar supporting documents |

| Social for treatment |

|

| Social for training |

|

| Property | The most popular type of tax benefit. Applies to purchased property and to a loan or mortgage issued for the purchase of housing. Taxpayers (individuals) need the following documents to return a tax deduction in 2021:

|

| Investment |

|

Who can open an IIS

Any citizen of the Russian Federation over 18 years of age can open an account and use the right to deduction, for whom personal income tax is transferred to the budget. There is no minimum amount established by law for opening an individual investment account; it all depends on the brokers’ tariffs. In theory, you can deposit 10,000 rubles into your account. and then make a tax deduction from this amount.

To open an account, you will need a passport and TIN.

Both individual entrepreneurs and self-employed people can open an investment account. Since such citizens do not have personal income tax withheld from their income, but other taxes, they can take advantage of the right to a type “B” deduction. Or, if personal income tax appears, receive a deduction of type “A”.

Pensioners can also open an account and receive the right to a type “B” deduction. They also have the right to type “A” deduction, but then they must somehow pay personal income tax to the budget. For example, if a pensioner gets a part-time job, he will be able to return the tax paid for him.

Procedure for applying for a tax deduction

The procedure and sequence of actions for each type of benefit are similar. If a citizen applies for compensation through an employer, then the application is generated directly during the reporting period. For example, when applying for a standard tax deduction, we write an application addressed to the manager and attach copies of all supporting documents (birth certificates, marriage certificates, certificates or certificates of disability, guardianship documents, etc.).

The procedure for processing a refund through the Federal Tax Service is the same for all types of deductions. The package of documents is submitted strictly after the expiration of the reporting period - the next year after the purchase of housing, payment for education or treatment, transactions with securities, etc. The application is submitted throughout the year following the reporting year; the filing deadline is not regulated in any way. Together with the application for a tax deduction, a declaration in form 3-NDFL is submitted as part of the package of supporting documents. Federal Tax Service specialists have approved the procedure for filing a tax deduction and the list of documents for filing a 3-NDFL declaration in 2021:

- passport of a citizen of the Russian Federation;

- certificate of income from the employer in form 2-NDFL;

- all necessary copies (agreements, checks, certificates, certificates, certificates of interest and amounts paid, payment orders).

A citizen has the right to choose whether to return overpaid income tax to his current account or offset it against future periods.

Documents are submitted directly to the tax inspector. All originals are duplicated with copies, along with copies - all originals for review. The applicant has the right to submit an application through the taxpayer’s personal account on the website https://www.nalog.ru.

IMPORTANT!

In 2021, the 3-NDFL declaration form was updated. It was approved by order of the Federal Tax Service of Russia No. ED-7-11 / [email protected] dated 08/28/2020. According to the new rules, an application for a credit or refund of overpaid income tax is submitted as part of the 3-NDFL declaration.

Changes in 2021 and 2021

How can you get 13 percent back? The list has not changed in 2021 or 2021. There are only quantitative changes - registration of tax refunds for property transactions has become reusable.

You can receive refundable tax payments:

- from the employer;

- at the inspectorate to which the taxpayer is assigned.

For what can you return 13 percent to the tax office? All types of deductions are processed here. Around June-July, the amount of the refunded tax will be transferred to the taxpayer by bank transfer.

Return deadlines

A declaration certifying the taxpayer’s income and confirming the amount of income tax paid is submitted to the Federal Tax Service after the expiration of the reporting period in which payment for the service occurred, which makes it possible to return personal income tax.

In ch. 23 of the Tax Code of the Russian Federation explains how to submit documents for a tax deduction: submit documentation in paper or electronic form (through the taxpayer’s personal account) throughout the entire year following the reporting year. Memo to taxpayers: benefits (regardless of their type) are refunded only for the last 3 years. For pensioners, a refund for the previous 4 years is possible. It turns out that in 2021, citizens will be refunded the overpaid funds for 2021, 2019, 2021 (2021 is also available for pensioners).

After submitting documentation to the Federal Tax Service, a desk audit is mandatory. The inspector checks the papers within three months. After the check, the citizen will receive a notification of a positive or negative decision on return. If the answer is satisfactory, the funds will be transferred to the current account specified in the application within 1 month after a positive decision is made.

What limitations does the IIS have?

There are several nuances that you should know before opening such an account.

The account must be open for at least 3 years

If you close it earlier, the right to deduction is lost. This means that if you received money under a type “A” deduction, you will have to return it to the budget.

You need to deposit money into the account every year

If you decide to earn a maximum of 156,000 using the “A” deduction, you will have to deposit a minimum of 400,000 rubles into the account.

We'll have to freeze the money

You will not be able to withdraw money from your IIS without closing the account. If the account is closed before three years, you will lose the right to deduction.

You cannot top up your account with more than 1 million rubles

The limit is updated on January 1 of each year.

You should only have one account. If you make several accounts with different brokers, you will still be able to receive only one tax deduction.