When and in what amount can I receive a deduction?

You can apply to the tax authorities for a deduction after registering ownership of a residential building purchased or newly built on this site.

Thus, you can receive a deduction for a land plot in two cases:

- when purchasing a plot of land with a residential building located on it;

- when purchasing a plot of land with subsequent construction and registration of a residential building.

You should contact the tax authorities for deductions at the end of the calendar year in which the residential building was registered as your property. Or, without waiting for the end of the calendar year, you can receive a deduction from your employer - more about this in our article Obtaining a property deduction from your employer).

The edition of the Tax Code, which was in force until January 1, 2010, did not contain information about tax deductions for expenses for the acquisition of land. In this regard, only those citizens who registered ownership of the residential building located on it after January 1, 2010 have the opportunity to include in the deduction the costs of acquiring a land plot.

In this case, it is the date of registration of ownership rights to a residential building that is important, since it is considered the moment the right to deduction arises. The date of the purchase and sale agreement for the plot and other documents does not matter. Reason: Letter of the Federal Tax Service dated April 13, 2012 No. ED-4-3/ [email protected] , Letters of the Ministry of Finance of Russia dated December 1, 2011 No. 03-04-05/7-981, dated May 21, 2010 No. 03-04-05/9 -278.

Example: In 2021 Ivanov I.I. bought a plot of land with a residential building located on it. Ivanov has the right to a property tax deduction in the amount of expenses for purchasing a house and land. Apply for deduction to the tax authority Ivanov I.I. maybe after the end of the 2021 calendar year, that is, in 2021.

Example: In 2010 Petrov S.S. bought a plot of land, built a residential building on it and registered its ownership in 2020. Petrov can receive a deduction in the amount of expenses for building a house and purchasing a plot of land. Petrov can submit documents for deductions to the tax authority in 2021.

Example: Sidorov V.V. bought a plot of land for the construction of an individual residential building, but did not build anything on it. Sidorov will not be able to receive a deduction for the specified land plot until he builds a residential building on it.

Tax deduction when buying an apartment with a mortgage: how to return up to 650,000 rubles

Briefly about the deduction and why it is needed

- When and who has the right to deduct when buying an apartment?

- Amount of deduction when purchasing an apartment

- How many times can you get a tax deduction?

- Statute of limitations for tax deductions

- Documents for registration of deduction for an apartment

- How to quickly and inexpensively issue a deduction

Briefly about the property deduction and why it is needed

Property tax deduction is an opportunity to return previously paid income tax when purchasing property. “But I didn’t pay any taxes,” you say, and you’ll be right. Income tax (also known as personal income tax) of 13% is withheld and paid by your employer on a monthly basis. Of course, if you are officially employed and receive a salary.

The scheme is this: when purchasing an apartment, residential building or land, the state gives you the opportunity to return 13% of the purchase amount to your account. However, not everything is so simple - the purchase amount has a certain limit. You will learn about it from this article.

When and who has the right to deduct when buying an apartment?

If you are a tax resident of the Russian Federation (clause 2 of Article 207 of the Tax Code of the Russian Federation) and buy an apartment with your own funds or with a mortgage, then you receive the right to a deduction on all legal grounds. The main thing is to keep documents confirming the fact of payment for real estate. Read below for specific documents.

If you are married and buy an apartment, then both spouses have the right to deduct the full amount, or they can distribute it by agreement (Letters of the Federal Tax Service dated November 14, 2017 No. GD-4-11 / [email protected] , GD-4 -11/ [email protected] ).

You will not receive a deduction if you buy an apartment from a related person: spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward (Article 105.1 Tax Code of the Russian Federation).

Amount of deduction when purchasing an apartment

The right to deduction appears if you buy an apartment with your own funds or borrowed funds (mortgage).

When using a mortgage, you can receive two types of deductions at the same time:

- main deduction for the purchase price;

- on interest paid.

The maximum amount of the main deduction for the cost of an apartment is 2 million rubles (clause 1, clause 3, article 220 of the Tax Code of the Russian Federation). But only 13% of this amount - 260 thousand rubles - will be returned to your account.

In an example it looks like this:

If you bought an apartment with a mortgage, you can get a deduction for the interest paid. The maximum deduction for interest paid is 3 million rubles. This means they will return you only 13% - 390 thousand rubles.

It wasn't always like this. Before January 1, 2014, tax refunds on interest had no restrictions. Personal income tax could be returned from any amount.

An important point: if your apartment was purchased before January 1, 2014, and since then you have not paid personal income tax on the mortgage, then you are entitled to a deduction for the full amount of expenses incurred.

An example of calculating a deduction for interest paid:

In order to receive a deduction in full - 260 thousand rubles, your annual salary must be at least 2 million rubles. Otherwise, the deduction amount is distributed over several years until the entire personal income tax is returned to you. This condition also applies to the tax deduction for interest paid.

Let's give an example.

In 2021, you bought an apartment for 3 million rubles. Your salary for 2021 is 1 million rubles. The employer paid a tax of 13% for you - 130,000 rubles. You can return the 13% tax not from 3 million rubles, but from the maximum limit amount - 2 million rubles, namely 260 thousand rubles. But the employer withheld only 130,000 rubles from you, which means you can only return this amount in 2021. The remaining 130,000 rubles can be transferred to the next year.

The situation is similar with mortgage interest. If your annual income is 1.5 million rubles, and the amount of mortgage interest paid is 3 million rubles, then you will receive a deduction for two years.

How many times can you get a tax deduction?

Before January 1, 2014, the main property deduction could be obtained only once and exclusively for one piece of real estate. Since 2014, the deduction limit has not changed, but the balance can be transferred to other real estate properties (clause 1, clause 3, article 220 of the Tax Code of the Russian Federation).

Let's look at examples.

If before 2014 you used your property deduction for only 1.5 million rubles, then you will no longer be able to return the remaining 500 thousand rubles of the tax deduction, and from them 13% - 65 thousand rubles.

In 2021, you bought an apartment for 1.5 million rubles, and received a deduction for it - 1.5 million rubles. In 2021, you are planning to purchase another apartment, to which you will transfer the balance of the deduction - 500 thousand rubles, and receive a tax account - 65 thousand rubles.

It should be remembered that a property deduction for interest paid can be obtained only for one object (clause 8 of Article 220 of the Tax Code of the Russian Federation).

Statute of limitations for tax deductions

The tax deduction does not expire, and the tax can be refunded for three years preceding the year of filing the tax return. Even if you have already sold an apartment, and only now found out about the possibility of receiving a deduction, you can still receive your deduction.

The right to deduction appears from the year in which the title documents are received. This should not be confused with the date of filing the declaration, which you can submit only after the end of the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation).

Let's look at an example.

You bought an apartment in 2014. The title documents were received only in 2015. Therefore, you will have the right to deduct in 2015, but you can submit a declaration only in 2021. But you forgot to do this, and only remembered about your legally required money in 2021. So in 2021, you file 2021, 2021, and 2021 returns.

Pensioners have special privileges; they can receive a deduction for 4 years at once: for the year when the apartment was purchased and three years before that. At the same time, it doesn’t matter at all if a pensioner works or no longer works.

Documents for registration of deduction for an apartment

You can submit documents for a tax deduction either in person to the tax office - department for working with taxpayers, or send them through the taxpayer’s personal account.

List of documents for registration of deduction:

- A copy of the certificate of ownership or an extract from the Unified State Register of Real Estate.

- A copy of the apartment purchase and sale agreement or the share participation agreement.

- The act of acceptance and transfer of the apartment.

- Payment documents (receipt, bank statements about the transfer of funds from the buyer's account to the seller's account, cash receipts).

- A copy of the marriage certificate (if the apartment is common joint property).

- Application for distribution of the amount of property tax deduction between spouses.

- Certificate in form 2-NDFL (when filing a declaration).

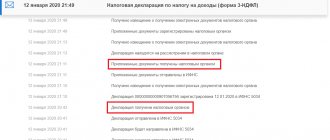

- Completed tax return in form 3-NDFL.

How to quickly and inexpensively issue a deduction

In the process of collecting documents for the tax office, you will more than once regret taking on this matter. What will definitely plunge you into deep despair is filling out a tax return. And in this difficult situation, the specialists of the Return.tax company will help you get your money back as soon as possible.

In less than 24 hours, you will be advised on deductions, filled out a declaration, prepared and submitted documents to the tax office. Minimal participation is required from you. The cost of filing a deduction for one calendar year under the “Standard” package is 1,690 rubles.

If, during a desk audit, the tax office undercounts your taxes or delays their return (a frequent occurrence), specialists will quickly and competently resolve this issue. The Premium package offers full verification support from the moment of submission until the money is received in your account. The cost of filing a deduction for one calendar year under the Premium package is 3,190 rubles.

Deduction amount

Since the deduction for the purchase of land is not a separate type of deduction, its size is regulated by the standard deduction rates for the purchase of housing. Read more in the article “Tax deduction amount”.

The total amount of the deduction, including expenses for the purchase of land, purchase or construction of a house, cannot exceed 2 million rubles (260 thousand rubles to be refunded).

Example: Korolev A.A. bought a plot of land for 3 million rubles and built a house on it for 5 million rubles. Despite the fact that the total expenses for purchasing land and building a house amounted to 8 million rubles, Korolev will be able to deduct only 2 million rubles and return 260 thousand rubles.

Tax deductions have no statute of limitations

Tax legislation does not contain restrictions on the period for receiving a property deduction, therefore the right to a deduction when purchasing a home does not have a statute of limitations . You can claim a deduction either 10 years or 20 years after purchasing a home.

Example: In 2003, Degtyarev M.O. bought an apartment. In 2021, he learned about the property deduction, submitted the relevant documents to the tax office and received the deduction.

Example: In 2021 Kalacheva E.Z. I bought an apartment, but since the beginning of the year she has been on maternity leave to care for children and plans to stay on it for the next 6 years. Accordingly, at the moment Kalacheva E.Z. cannot receive a deduction (since he does not work and does not pay income tax). After she returns to work in 2026 and begins paying taxes, she will be able to exercise her right to a property deduction.

Despite the fact that there is no statute of limitations for receiving a property deduction, remember that you can only return taxes for the previous 3 years. More about this in the next paragraph.

Purpose of the site for obtaining a deduction

Land plots vary depending on their intended use. For example, land for individual housing construction (IHC) is intended for the construction of residential buildings on it, but the intended use of a site intended for gardening does not provide for this possibility.

However, for the purposes of obtaining a tax deduction, the key condition is not the purpose of the land plot, but the presence of an individual residential building on this plot (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated December 10, 2012).

Thus, the possibility of obtaining a deduction when purchasing a land plot directly depends only on the possibility of obtaining a deduction for a residential building located (built) on this plot.

Example: Krasilnikov V.V. bought a plot of land and built a country house on it (not a residential building). Krasilnikov will not be able to receive a property deduction, since the deduction is provided only for a residential building. However, if a country house is recognized as a residential building, in addition to the deduction for the house, it will have the right to include in the deduction the costs of purchasing a land plot.

Two options for obtaining a property deduction

Option 1 - at the end of the year, receive the entire amount from the tax office,

Option 2 - during the year for which a deduction is obtained, by underpaying the tax and receiving a deduction from the employer (or other tax agent).

To receive a property tax deduction from the tax office, you need to submit documents to the tax office at the end of the year for which you want to return taxes, see the list below. The tax office will check the documents, the Treasury will transfer the refunded tax to your personal account.

Documents for receiving a deduction

To apply for a property tax deduction when purchasing land you will need:

- identification document;

- declaration 3-NDFL and application for tax refund;

- documents confirming ownership of land and a residential building: certificate of registration of ownership or extract from the Unified State Register of Real Estate;

- documents confirming expenses for the purchase of land/house: sales contracts, payment documents;

- documents confirming the paid income tax (certificate 2-NDFL).

You can find a detailed list of documents here: Documents for property tax deduction .

You can submit documents for a tax refund for a calendar year only after its end.

The 3-NDFL tax refund declaration is always submitted for the entire calendar year, regardless of the month in which the housing was purchased and in which months the taxes were paid. At the same time, you can submit a declaration for a calendar year only at the end of it (clause 7 of Article 220 of the Tax Code of the Russian Federation). You cannot submit a tax refund return for a calendar year before its end.

Example: Titarenko E.S. I bought an apartment in January 2021. In February 2021, he quit his job. Other income in 2021 from Titarenko E.S. not expected. After the dismissal of Titarenko E.S. I wanted to immediately file a tax return and, due to the deduction, return the tax paid in January-February 2021.

However, Titarenko E.S. can do this. cannot, since he needs to wait until the end of 2021, and only then submit the 3-NDFL declaration for 2021 to the tax office.

Note: You can take advantage of the opportunity to receive a deduction through your employer without waiting for the end of the calendar year. Read more in our article “Obtaining a property deduction through an employer.”

Example of calculating property tax deduction

For example, when buying an apartment with a mortgage worth 4 million rubles.

Purchasing an apartment with a mortgage: RUB 4,000,000.

Amount of interest on the loan (taken from the bank’s calculation): RUB 1,300,000.

Amount for which you can receive a tax deduction: RUB 3,300,000. (RUB 2 million limit + RUB 1.3 million%).

Tax deduction: 429,000 rubles (3.3 million rubles x 13%).

Deduction is NOT provided

1. when purchasing an apartment/house from dependent persons (spouse, children, parents, brothers/sisters, employer);

2. if a person has already exhausted his right to property deduction

When to submit documents

If the matter concerns only the purchase of an apartment, then the declaration and documents can be submitted at any time. You can get your tax refund for the last three years.