Family life can bring surprises. And one of them is an inheritance inherited by one of the spouses from a close relative and not only.

Then the couple has a natural question: is the inheritance divided during a divorce? Practice shows that the answer to this question is not as clear-cut as it seems at first glance.

Well, in this article we will talk about whether the spouse’s inherited property is subject to division. We will also describe cases in which division of inherited property is possible, as well as how to do this with minimal costs and, most importantly, correctly.

How and when is inherited property divided during a divorce?

As a general rule, property inherited by one of the spouses cannot be divided. Let's explain why.

Let's open Article 36 of the Russian Family Code. There, in particular, it is said that inherited things belong to the personal property of one of the spouses.

So what happens when the inheritance is never shared?

In fact, there are several options and some ways of dividing inherited property.

Thus, the law does not prohibit the division of such assets by agreement between spouses. It can be either a prenuptial agreement or an agreement to divide property in the event of divorce.

In one of the mentioned documents, the husband and wife have the right to independently stipulate how the inheritance received during the marriage is divided during a divorce.

It is important to remember that all written agreements between spouses will be valid if they are certified by a notary. These are the requirements of the law and there is no escape from it.

Joint inheritance

It does not always happen that only one of the spouses becomes the heir. A situation may arise in which both of them may be heirs. The reasons for this are usually:

- death of joint children;

- an option in which both are heirs under the will.

On the one hand, we can say that then the inheritance received during marriage is divided upon divorce. On the other hand, legally, each of the spouses will be able to receive, upon division of property, only that share of the inheritance that is legally due or in accordance with the will. Upon entering into inheritance rights, each of them registers the accepted property as personal property, after which the inheritance is no longer included in the list of jointly acquired property of the spouses. In cases where inheritance is carried out according to law or the will did not determine the size of the share for each heir, both spouses receive equal shares.

There are situations when spouses decide to combine their inheritances into one property. For example, by each selling their inheritance and purchasing housing together. In this case, the property will be divided in accordance with the invested funds on the part of each spouse. Otherwise, if one of the spouses received an inheritance while married, he does not share this property with the other during a divorce. Except in cases mentioned as exceptional.

In what situations can you avoid sectioning?

Even if the spouses did not sign any agreements with each other, there are cases when the court can order the division of the inheritance during a divorce.

Read below about when the division of inheritance cannot be avoided.

Increasing the value of an inheritance at the expense of one of the spouses or joint funds

Let's assume that one of the spouses inherits an apartment or a car. However, through the efforts of the second half or through general savings in the property, a set of improvements was made, as a result of which the property increased significantly in price.

With this option, the object of inheritance can be recognized as common property and divided by virtue of a court decision.

Using inheritance for family needs

Let's imagine such a situation. One of the spouses inherited a country house from their grandmother.

It turned out to be not particularly needed, and at the family council it was decided to sell it and add the proceeds to purchase a new apartment. Such real estate will fall under division in the event of a possible divorce.

In practice, there are other examples where spouses manage to divide inherited property with the help of the court. And here the work of a lawyer and his professionalism play an important role.

Legal circle of heirs

Spouses are a separate category of heirs.

In the case of a formal marriage, each can make a will for the other. But if there is no stamp in the passport, the common-law husband/wife will not be able to claim a share, since they are considered simply cohabitants. Former spouses are considered separately, since at the time of divorce their mutual responsibilities and rights end. In most cases, inheritance to a spouse after divorce is impossible. In accordance with the Civil Code of the Russian Federation, the composition of the heirs is determined by the grounds for accepting the inheritance:

- There is an order from the deceased spouse. If a person left claims in the event of his death and identified his ex-husband/wife as an heir, then he can enter into the inheritance on an equal basis with other applicants. In this situation, divorce is not a reason to recognize the spouse as an invalid heir.

- Legal norms. Russian legislation specifies the order of inheritance: children, parents, spouses (legally registered). Brothers/sisters, grandparents, and then all other relatives of the deceased belong to category 2 of inheritance claimants. Spouses are representatives of marriage ties, not blood ties. Therefore, if the spouses are divorced, then the blood relatives will have the right of inheritance.

- Mandatory share. If the former spouse was a dependent, then he can count on the obligatory part. This is a disabled spouse who has lived together for at least 1 year and has a common household.

In accordance with Russian legislation (Article 89 of the RF IC), a spouse, after the dissolution of a union, can claim alimony if the ability to work was lost during marriage or within 12 months after the divorce. Evidence of financial support can be: a court decision on financial support of the ex-spouse or an agreement on the payment of alimony.

If you inherited an apartment, how to divide it?

Real estate that is the subject of an inheritance is often of particular interest in the event of a divorce. Therefore, the question becomes relevant: is an apartment received by inheritance subject to division?

We have already said above that the option of dividing inherited real estate is allowed when the spouses, using joint funds, have made major repairs in the residential premises, which significantly increased the market value of the apartment.

Certain nuances exist if the apartment has a mortgage. After all, the testator may die without having time to fully repay the real estate debt.

In this case, the spouses contribute the remainder of the loan together from their common savings and income. Accordingly, during a divorce, such an apartment can also be divided in proportion to the part of the loan repaid by the husband and wife.

At the same time, it is important to submit to the court all documents that confirm the repayment of the debt by a specific spouse. For example, these include bank receipts.

Arbitrage practice

The issue of division of inherited property is most often resolved through the court. If we look at judicial practice over the past few years, it becomes obvious that such property is very rarely divided. Only if there is serious documentary evidence of the fact that general funds were invested in the property.

We need checks, bank statements, etc.

Otherwise, the judges decide to transfer the property to the party who is the heir. The burden of collecting evidence will rest entirely with the plaintiff. The rules for the division of joint property do not apply to property received by inheritance. With rare exceptions, the right to it is retained by the person who is the official heir.

Former spouses and heirs: is it necessary to negotiate?

There are situations when a husband or wife receives an inheritance at the same time.

For example, this happens due to the text of the will or when a common child of the parents dies. In this case, the question arises, what to do with the property when both spouses are heirs?

If there are no written agreements in this regard, then it is understood that the share in the inheritance of each spouse is assigned to him. It’s a different matter when the inheritance is divided by voluntary agreement. In it, the signatories have the right to outline a different way of distributing property.

Many people are also interested in how to divide property if both spouses are named in the will?

There are no specific features here. Real estate items included in the testator's will remain with each spouse.

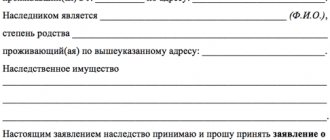

It is worth remembering that each of the spouses acquires their rights to inheritance only after completing their proper registration with a notary.

If people are on good terms and there is a need to protect the interests of the children, then it is best to draw up a competent and detailed agreement with a notary.

This step will lead to significant savings in time and nerves. In addition, it will be possible to save financially due to the absence of legal costs.

Division of inheritance by voluntary agreement

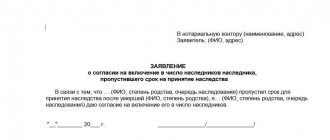

One of the possible solutions when dividing a disputed inheritance between a husband and wife who have decided to divorce is a voluntary agreement. That is, a mutual decision is made as to what exactly and what part of the property will be transferred into the ownership of each of the spouses.

But it is worth considering that the agreed decision must be notarized in order to legitimize its validity. After all, without a notary’s signature, a kind of receipt from the spouses will only have a formal character.

In this case, it should be indicated that you will need to incur expenses in the form of payment for:

- assessment of shared property;

- notarial services;

- for re-registration of property rights.

You will also need to pay a state fee, which is 0.5% of the assessed value of the property.

When partition is not possible in principle

In fact, if the inheritance was received during marriage, and the second spouse did not make any efforts to improve the property, and common money was not spent on it, then it is unlikely that it will be possible to divide the property.

In addition, care should be taken to ensure that all necessary documents regarding the inheritance are completed.

Otherwise, it is possible that the second spouse may challenge the fact of acceptance of the inheritance and raise the issue of dividing property in court.

Partition Agreement

If there is mutual consent, the spouses can, in a written agreement, determine the future fate of the apartment that the first spouse inherited on the basis of a will.

The law does not establish any restrictions or obstacles to the voluntary division of property, with the exception of strict control over compliance with the rights of minors.

In case of voluntary division of an apartment, it is impossible to deprive a minor child of the only living space or to worsen his living conditions compared to those in which he lived before the divorce of the spouses.

If a violation of the child’s rights is revealed, the guardianship and trusteeship authorities will not give their consent to the transaction (if there is a registered share of the child in the disputed apartment) or will challenge the already completed transaction in court.

How can the fate of a bequeathed apartment be decided during voluntary division?

| No. | Situations when an apartment can be recognized as joint |

| 1 | An apartment can be recognized as joint property and divided into shares |

| 2 | The apartment can be taken into account when dividing other property and transferred to his account to the other spouse |

| 3 | The apartment can be transferred to the other spouse in exchange for other property, free of charge or for monetary compensation |

Example. Spouses A. decided to divide their jointly acquired property voluntarily. The car purchased during marriage and a small joint business - a flower shop - were subject to division. The husband, considering that the division of the business would have a negative impact on the conduct of business, offered to transfer to his wife the apartment he received on the basis of the will, in which the spouses lived during the marriage. Thus, the wife was given the apartment, which was the personal property of the husband, and the husband received the car he needed for work, as well as the flower shop.

It is strongly recommended that the property division agreement be notarized. Otherwise, if a conflict arises after reaching an agreement, it will be extremely problematic to prove your case even through court.

The court is inevitable, what to do: step-by-step instructions

If the objects of the inheritance are nevertheless subject to division between the former spouses, then it is unlikely that it will be possible to do without lengthy legal battles. Therefore, it is worth thoroughly preparing for them.

Our instructions can help in this matter. Here are its main points.

How to prove

If one of the spouses claims to divide the inheritance, then he must confirm investments in the property at the expense of common family assets.

The following may be suitable for this purpose:

- Receipts for the purchase of goods.

- Acts for payment of repair work.

- Bank statements (if expenses were paid by bank transfer).

- Certificates of income and wages.

In general, everything that can confirm the improvement and increase in the value of the inherited property due to the joint income of the spouses.

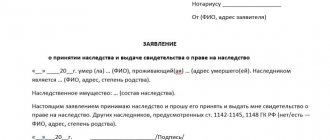

What documents are needed

The claim must also be accompanied by a copy of the marriage certificate and its termination (if the division occurs after the official end of the divorce).

You will also need evidence of registration of inheritance for the house, documents for disputed property.

Property valuation

It must be done to determine the exact amount of the state duty for the upcoming appeal to the court.

It should be noted that the assessment of things is done at the current moment in time.

State duty

It must be paid as a certain percentage of the total value of the disputed assets. All necessary calculations should be made based on the rules of Article 333.19 of the national Tax Code.

If, simultaneously with the division of property, the issue of divorce is raised, an additional 600 rubles must be paid.

Cost of claim

It is indicated at the very beginning of the application and represents the value of the property that the plaintiff ultimately wants to obtain for himself.

Filing a claim in court

The choice of judicial institution largely depends on what is included in the disputed property. If the list contains real estate or land, then the statement of claim for division of property must be filed with the district court at their location.

In other cases, you need to contact the justice authority in the territory where the defendant (that is, the other spouse) lives.

Preparing a claim for division of property, including that inherited by a former spouse , can be quite a difficult task for many.

Therefore, it is advisable to seek the help of a lawyer (advocate) who specializes in divorce cases.

Participation in court and court decision

The plaintiff has the right to support his position before the court and the other party both independently and through his own representative. To do this, he needs to issue a notarized power of attorney.

After the court pronounces its decision, care should be taken to obtain its full printed text. To do this, it is better to submit a separate application to the court office.

Performance list

It is necessary for compulsory division of property. It is issued by the court of first instance after the month allotted for filing an appeal, or after the case has been considered by a higher court.

Further, bailiffs will help resolve issues with property.

Distribution of inheritance among first-degree heirs. Shares

We have already touched on this issue in previous sections. Now let’s summarize all the information about legislative norms and summarize:

- The inheritance is divided equally among all representatives of the first stage

- If the testator’s spouse is among the first-priority heirs, first the “marital half” is allocated from the entire property (relatively speaking, the part that the spouse would receive in the event of a divorce). After this, the spouse participates in dividing the remaining part of the inheritance on an equal basis with the rest of the heirs

- If there is only one heir of the first stage, he inherits solely, completely

- If there are no first-line heirs, a disabled dependent may claim 1/4 of the inheritance

- Heirs by right of representation receive the share of the direct heir of the first stage who died before the testator. The only heir by right of representation has the right to a share the same as that of all heirs of the first priority. If there are several of them, they divide the share of the direct heir equally.

ATTENTION! Despite legal requirements, heirs of the first stage are not obliged to equally divide each object included in the inheritance. They can draw up an agreement on the basis of which, for example, one takes the car, the second garage, the third and fourth own the dacha in half, and so on. If an agreement cannot be reached, the division of property can be carried out through court proceedings.

Are there statutes of limitations?

We will proceed from the fact that the object of inheritance has all the signs of joint ownership of the spouses.

The legislation for its division provides a three-year limitation period. Its course begins from the moment when the second spouse became aware of the infringement of his rights.

Let's explain in more detail. The fact is that even after a divorce, joint property continues to remain so.

Consequently, its disposal must be carried out with the approval of the other spouse, even the former. And if this rule is neglected, the statute of limitations will begin to run for the purpose of dividing property.

What are children's rights

Children always retain the right of inheritance with their parents.

The inherited property is divided among all 1st line claimants. The child receives the inheritance even if the parents no longer have parental rights or have divorced. You can change the order in which the inherited is obtained:

- when drawing up a will;

- when adopting a child;

- when recognizing children as unworthy heirs.

If a minor retains property and non-property rights, he gets the opportunity to inherit from his natural parent, regardless of whether he has a spouse or children in another marriage. An adopted child is equal to natural children when the adoption claim is recognized as legal. It will not be possible to terminate or refute this, especially in the case of minor children.

Frequently asked questions and their answers

In this block of our material, we have collected the most frequently asked questions to experts on the topic of the possible division of property passed to one of the spouses by inheritance.

Sold an apartment received by inheritance

If new real estate is purchased with the proceeds, in which the spouses will henceforth live, then such an apartment will become the object of division, minus the amounts invested after the sale of the inherited property.

There are two possible scenarios here:

- The spouse claims ½ share of the property, with half of the invested money paid to the second spouse.

- The spouse does not claim a share in the apartment, but demands half of the money paid from joint savings.

Let's give an example:

The apartment was purchased for 2 million rubles, 600 thousand were invested from accumulated savings, 1 ml. 400 thousand from the sale of the house and land that the husband inherited.

Then, if a woman wants to recognize ownership of ½ share in the apartment, she will have to pay her ex-husband 700 thousand rubles, exactly half of the sale of the inherited property.

With the second option, you can demand 300 thousand rubles from 600 thousand rubles invested jointly.

If the money from the sale is deposited into a personal bank account, then it is unlikely that it will be possible to divide it.

If the husband received an inheritance during marriage

The list of all property will remain personal for the divorce and will not be divided during the divorce.

The land was inherited, a new house was built, and how will it be divided during a divorce?

The house will be common, and the land will be private. Another thing is that it is necessary to subsequently decide the order of use of these two pieces of property.

This is best done by mutual agreement of the spouses. You can entrust its preparation to an experienced lawyer.

I submitted documents before entering into inheritance before marriage, and received a certificate after the wedding

In this case, the property will still remain personal.

If you inherited debts and loans along with property

They are also assigned to the heir. Unfortunately, you cannot refuse obligations by registering only the property in your name.

Another thing is that spouses can pay creditors with joint funds. This will affect the procedure for dividing property between spouses after a divorce.

I made renovations in the apartment that my wife inherited. Can I claim a part of it?

Yes it is possible. In this case, it will be necessary to confirm all your own expenses in court. Collect all invoices, cash receipts, and available payment receipts.

What can be done with housing that has become shared ownership?

Continue to use together. Each spouse lives in his own room, and they use the kitchen, etc. together.

You can sell a share , but it is difficult to find a buyer for a share, and not for the whole apartment.

The easiest way is to sell the apartment and split the money. The purchase and sale agreement must be signed by two people .

If the apartment is on the ground (a house for 2-4 owners), you can try to divide it into two independent ones.

Agreement for the sale and purchase of a share of an apartment.

Consulting and legal support

As we can see, dividing inherited property between former spouses is difficult, but possible. Before starting this whole long process, it is useful to talk with a lawyer. He will study the situation, documents and give his forecast regarding the real prospects of the case.

If necessary, a lawyer for inheritance and family disputes will draw up a statement of claim and represent the interests of one of the spouses in court hearings. At the same time, the specialist will operate not only with the norms of legislation, but also with the current judicial practice of the Supreme Court and other authorities.

A lawyer is also necessary when the case of division of property is already being considered in an appeal or cassation. After familiarizing yourself with all the materials, a specialist may have a completely different legal position on the essence of the dispute.

Author: Oleg Vladimirovich Roslyakov, source.

Is an apartment or property divided between heirs after death?

According to current legislation, inheritance can be transferred both by law and through a will. However, the transfer of ownership of some property, such as an apartment, does not mean that the successors were able to dispose of this property in a simultaneous manner, and therefore, the latter have a need to carry out its division.

By default, if no one has filed claims for division through the court or has not reached an agreement with the other heir peacefully, the apartment should be registered as the property of the heirs in equal shares. Let’s say an apartment, legally due to two daughters of the deceased, will belong to them in ½ share each, which must be registered with Rosreestr after registering the inheritance and receiving a certificate of inheritance.