Employers must withhold personal income tax (PIT) from their employees' paychecks. Therefore, if an employee has a salary of 30,000 rubles, he will receive only 26,100 rubles in cash minus personal income tax of 13%, if without any difficulties.

In order for some groups of employees to receive more, tax deductions were invented. The deduction works like this: they take the employee’s income, reduce it by the amount of the deduction, and calculate the tax from this amount. That is, they reduce the tax base, and not the tax itself.

Example

Florist Katya has a salary of 30,000 ₽ and a deduction of 1,400 ₽ for her daughter, which means they will deduct from her salary:

- in January: (30,000 - 1,400) × 0.13 = 3,718 ₽

- in February: (60,000 - 2,800) × 0.13 - 3,718 = 3,718 ₽ and so on.

Remember, personal income tax is always considered an accrual total from the beginning of the year as in the example.

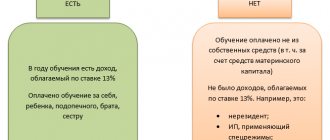

Deductions for personal income tax are different: standard, property, social and professional. Most often, employees come with standard tax deductions: for themselves or for a child.

Standard tax deductions reduce income, which is subject to personal income tax at a rate of 13%. Standard deductions are not applied to income at other rates and dividends. Non-residents cannot use deductions either. Let us remind you that a non-resident is an individual who stays on the territory of the Russian Federation for less than 183 days within one year.

Child deduction

Parents are entitled to a deduction for each child under 18 years of age. If the child is a graduate student, resident, intern, student or cadet and is studying full-time, then the age limit is increased to 24 years.

The following may receive a deduction:

- each of the parents - no matter whether they are married, divorced or never married;

- husband or wife of a parent;

- each of the adoptive parents, guardians, trustees, when there are several of them;

- each of the adoptive parents, if there are two of them.

If the only parent or the second parent refused the deduction, you can count on a double deduction. Moreover, only a working parent can refuse the deduction: if the parent does not work, then he does not have the right to the deduction, which means there is nothing to refuse.

HOW WILL IT HAPPEN IN PRACTICE?

Experts believe that at the first stage you should not rely on short terms and clarity of procedures. Firstly, it will take time to establish interaction with banks and other tax agents. They will be connected to the system gradually. For example, judging by the Federal Tax Service website, so far only one bank cooperates with tax authorities on the issue of tax deductions - VTB.

Secondly, it is not yet clear how the inspectors themselves will cope with the flood of applications. After all, if it becomes easier to serve them, then there will be more people willing. Nevertheless, almost 100% of taxpayers submit declarations for the return of property and investment deductions. Therefore, it is unlikely that there will be much more work. At the same time, the Federal Tax Service does not yet plan to simplify the receipt of social deductions, where the upper limit is limited to 15.6 thousand rubles per year (13% of 120 thousand) and which many citizens do not apply for due to small amounts.

Amounts of deductions for children

The deduction amounts are currently as follows:

— for the first and second child — 1,400 ₽

— for the third and each subsequent — 3,000 ₽

Children are counted regardless of age. For example, an employee has three children. Two are already adults: 25 years old and 23 years old, and the third is 16 years old. An employee is entitled to one deduction for a third child - 3,000 rubles.

There are more deductions for disabled children:

— for parents and adoptive parents — 12,000 ₽

— for guardians, trustees, foster parents — 6,000 ₽

It does not matter what type of disabled child is in the family. You can also add general deductions for children. For example, for an only disabled child, the deduction will be 13,400 rubles. After all, parents are entitled to a deduction for their first child - 1,400 rubles and for a disabled child - 12,000 rubles.

Important: provide a standard tax deduction for a child until the month in which the employee’s income from the beginning of the year exceeds 350,000 rubles.

Interesting fact

If a child grows up quickly and gets married, then you can no longer get a deduction for him - now he provides for himself. But if he decides to try his hand at work, then his parents still have the right to a deduction. In general, marriage is a responsible matter :)

Receiving a deduction through your employer

You can receive a deduction through your employer before the end of the calendar year, and you do not need to generate and submit a 3-NDFL calculation. To do this, it is enough to collect the necessary package of documents, which in principle are similar to those submitted when receiving a deduction through the tax office. The only exception is that the employee must contact the Federal Tax Service, which will issue a notification. It will confirm the employee’s right to receive a tax deduction.

Receiving a deduction through an employer means that the accountant will withhold less personal income tax from the employee’s income within the limits of the deduction amount that corresponds to the submitted documents and legislation. Only an individual with whom the company has an employment agreement can apply for a deduction, and the duration of its validity is not important. If a GPC agreement has been drawn up with a person, then the company cannot provide him with a tax deduction, as stated in the Letter of the Ministry of Finance dated October 14, 2011 No. 03-04-06/7-271.

Documents for child support

First, the employee needs to write a free-form deduction application and attach supporting documents to it: a birth certificate or a certificate from an educational institution.

Deduction application template

If an employee has not been working since the beginning of the year or works part-time in another organization, ask him for a certificate in form 2-NDFL from other places of work. She will confirm that income since the beginning of the year has not exceeded 350,000 rubles.

Important: do not provide an employee with standard tax deductions that he did not receive from his previous employer or did not receive in full.

In some cases, other documents will be needed. For example, from a spouse who is not the child's parent or guardian, ask for a statement from the child's mother or father stating that the spouse is providing for the child.

Some documents need to be updated every year. The general rule: if a document confirms the right to deduction only in one period, then it needs to be updated in the next. For example, request a certificate from the university every year, because the situation may change next year.

Documents for receiving a deduction through an employer

If an employee decides to receive a deduction through an employer, he must provide the following package of documents to the accounting department:

- written application to receive a personal income tax deduction. It is drawn up in any form, but for convenience, the accounting department can develop a standard form. In addition, specifically for receiving a social deduction, there is a regulated application form contained in the Letter of the Federal Tax Service dated January 16, 2017 No. BS-4-11 / [email protected] ;

- notification from the Federal Tax Service confirming the right to receive a deduction. Without this official document, the accountant has no right to provide the employee with a deduction. The notice is issued for a specific calendar year, which means that the employer provides a deduction in this particular period. The employee should receive a new notice for the next calendar year.

To receive the notification, the employee must submit to the tax office an application and a package of documents confirming the fact of spending the funds. As a rule, a 2-NDFL certificate is not required, but it is still a good idea to obtain one from the employer.

Child benefit period

Provide a deduction from the month in which the employee confirms that he has a child. If the employee submitted an application in the current year, then provide deductions from the beginning of the year. Even if he declared his right to a deduction in the middle or end of the year.

Example

Alice has been working in the organization since the beginning of the year, but she only remembered that she had the right to a deduction in May, and then she submitted an application. Alisa is a mother and has two minor sons. This means that from January to May, deductions amounted to 14,000 rubles (1,400 × 2 × 5).

Alice has a salary of 40,000 ₽, in total, from January to April, Alice was credited 160,000 ₽ (40,000 × 4) and withheld personal income tax - 20,800 ₽.

In May, the accountant will calculate all unaccounted deductions and only personal income tax will be withheld from the salary in the amount of 3,380 ₽ ((200,000 - 14,000) × 0.13 - 20,800), instead of 5,200 ₽ (200,000 × 0.13 - 20,800). This means that Alice will receive 36,620 ₽ (40,000 - 3,380), instead of 34,800 ₽ (40,000 - 5,200).

But if an employee had the right to a deduction last year and forgot to declare it, then he can only receive this deduction on his own through the tax office.

WHAT DEDUCTIONS CAN BE OBTAINED SIMPLERLY?

As the tax office explains, for now only two types of deductions can be obtained in a simplified manner:

1. Investment

It is provided within the framework of IIS - individual investment accounts. The restrictions on them are as follows: money cannot be withdrawn from the account for three years, you can return 13% either from 400 thousand rubles deposited during the year, or not pay income tax on profits received from investments of one million rubles per calendar year. In the first case, you can receive up to 52 thousand rubles per year, in the second - an unlimited amount (it all depends on the profit received).

2. Property

You can get it once in a lifetime - when buying real estate. If you did not use the entire deduction the first time (for example, if the cost of the home was less than 2 million rubles), you can use the remainder on the next transaction.

This deduction consists of two parts:

— Deduction from the purchase of real estate. Here you can get 13% of two million rubles, that is, no more than 260 thousand rubles.

— Deduction from mortgage interest. Here you can get 13% of the three million rubles paid to the bank, that is, no more than 390 thousand rubles.

Total - the total refund amount can be no more than 650 thousand rubles.

Deduction for yourself

Some adults are entitled to a deduction of 500 ₽ or 3,000 ₽. The amount depends on which benefit category the employee belongs to. Among them are disabled people who suffered from the Chernobyl disaster, participants in military operations, heroes of Russia and many others. All categories can be viewed in paragraphs. 1 and 2 paragraphs 1 art. 218 Tax Code of the Russian Federation.

To receive a deduction, the employee brings an application and documents confirming his right to the deduction.

Such deductions cannot be added and used at the same time. If an employee is entitled to several standard deductions, provide one of them - the maximum. But there is no income limit - provide deductions for yourself regardless of the amount of income received.

What is a simplified tax deduction procedure?

On May 21, 2021, the Federal Law of April 20, 2021 No. 100-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” came into force, which introduced a new way to issue a deduction.

It's called hands-off, or proactive, because you don't have to do anything. The tax office itself collects information about your income and expenses and decides whether you are entitled to a deduction. If yes, then a pre-filled application will be sent to your personal account on the Federal Tax Service website. It will need to be signed - probably with an electronic signature, which can be issued there, on the tax office website.

Since the Federal Tax Service has all the data, there is no need to check it for three months, as usual. They promise to get it done in no more than one. It will take up to 15 days to transfer money. That is, the waiting time for funds compared to filing a declaration will be more than halved.

Income exempt from taxation in accordance with paragraph 1 of Art. 217 Tax Code of the Russian Federation

List of income not subject to personal income tax:

- State benefits.

- All types of compensation: compensation for harm to health; free provision of housing and payment of utilities; payment in kind; payment for the training process and participation in sports competitions, food, gear, equipment and everything that is necessary for such events; upon dismissal of employees (except for payment of severance pay to the management of enterprises located in the Far North); in case of death of employees while on duty; reimbursement of expenses for employee training; payment for travel to and from the place of rest for workers living and working in the Far North, including luggage and travel for non-working family members with luggage; payment for moving to work in another area.

- Payments related to work trips, taking into account the provision of documents confirming expenses.

- Payments of field allowance in the amount of 700 rubles.

Tax transfer

Pay taxes and contributions in a few clicks in the Kontur.Accounting service! Get free access for 14 days

Income tax is transferred to the budget within the following periods:

- if the organization pays wages in cash, we transfer the tax on the day the money is received from the bank;

- if the organization pays salaries non-cash, we transfer the tax on the day the funds are transferred to the employees’ cards;

- if the organization pays salaries from other sources (for example, from revenue without withdrawing money from a bank account) - we transfer the tax the next day after the income is issued;

- if an organization transfers material benefits and income in kind, we transfer the tax the next day after it is withheld.

Sometimes income taxes are paid in multiple payments within a month due to different types of payments. Withheld income tax is transferred according to the details of the tax service where the organization is registered. Separate divisions transfer personal income tax according to the details of the tax office in which they are registered.

Citizens who pay personal income tax on their own based on the 3-NDFL declaration transfer the tax no later than July 15 of the year following the expired tax period.

On what income is tax paid?

Tax is paid not only on wages. The tax base includes all incentives, bonuses and other additional payments, including material benefits and income that the employee received in kind. The tax is calculated as follows:

- sum up all employee income;

- deduct official expenses from this amount;

- We charge a tax of 13, 15 or 30% on the received balance.

Certain types of income, which are listed in Art. 217 Tax Code of the Russian Federation. These are state benefits (except for unemployment benefits), pensions, donor rewards, alimony received, lump-sum assistance amounts and other payments. Since 2021, this list has been supplemented with compensation; compensation for travel on vacation and back has been separately allocated for workers from the Far North and equivalent areas.

Pay taxes and contributions in a few clicks in the Kontur.Accounting service! Get free access for 14 days

Fines for personal income tax violations

The employer’s actions must comply with the requirements of the law and fit within the stated time frame, otherwise fines and penalties cannot be avoided:

- if the employer did not withhold or transfer income tax without legal grounds, he will face a fine of 20% of the amount of the untransferred tax;

- in case of evasion of personal income tax on a large scale, the violator may face a fine of 100-300 thousand rubles or a fine in the amount of salary for 1-2 years, deprivation of the right to hold certain positions for 3 years and even arrest for 6 months or imprisonment for up to 2 years.

Calculate personal income tax automatically and transfer tax using the Kontur.Accounting web service. Here you can easily keep records, calculate salaries, generate and send reports, and also benefit from the support of our experts. The first month of using the service is free.

Try for free