Is it possible to get income tax back on a car purchase?

There is a misconception that when buying a car you can get 13 percent back. In fact, the right to a 13% refund applies to those citizens who purchased real estate, paid for education or medical services. Since the car is not on the list of essential items, it is not eligible for a 13% refund.

Tax benefits for a car are established when it is sold and income is received from the transaction. For each profit from the sale of property, you must pay 13% income tax. But if the vehicle has been owned for at least 3 years, then you do not need to pay personal income tax, just like you do not need to prepare a declaration to the Federal Tax Service.

The period is calculated as follows:

- when purchasing – from the moment of completion of the purchase and sale transaction;

- in case of inheritance - from the date of death of the testator;

- in the case of a gift agreement - from the moment of signing this agreement.

Learn more about the property deduction when buying a car

Tax deductions are designed to improve the well-being of Russians by reducing economic pressure. You can take advantage of such a generous offer from the state to pay for medical services, improve education and improve living conditions. If the benefit is issued in full compliance with the current law, the citizen receives back part of the amount spent.

A citizen who regularly pays state fees and meets the following requirements has the right to a property deduction

- land for development or real estate intended for residential purposes is purchased;

- the cost of the purchased plot, construction of the living space and possession of the finished home is paid from a mortgage loan, for the use of which interest is paid.

There is also no mention of a car here. According to the Tax Code, relaxations are carried out in two ways: by reducing the tax base or by returning the money paid in the amount of the personal income tax rate.

According to current legislation, citizens' income is subject to a 13% tax. It is this amount that is implied when it comes to providing a property deduction.

Who is entitled to a 13% interest refund?

A bill is being considered in the State Duma that proposes introducing a new personal income tax deduction in the amount of 13% of the amount of expenses for purchasing a car. It is assumed that the deduction will be available to citizens who purchased a new (not used) Russian-made passenger car for family or personal needs. The total amount of expenses is strictly up to 1 million rubles. The largest planned deduction amount is 100 thousand rubles.

If the bill is adopted, then taxpayers will be able to return 13 thousand rubles from the budget.

The following rule was also established: if a person took advantage of such a deduction, he will be able to receive it again in the future, but at least 5 years must pass from the date of the previous application for a refund.

This law is attractive to the state in the sense that it will encourage citizens to purchase domestic cars, developing the Russian automobile industry.

general information

To answer the question whether it is possible to return 13% of the purchase of a car or any other vehicle, it is worth understanding the conditions and rules for receiving a refund.

The following persons can receive a tax deduction:

- Residents of Russia who are officially employed and who have not previously received the money paid for taxes in full.

This is interesting! Every citizen must clearly distinguish between the concepts of “resident” and “non-resident”. In simple words, a resident is a person who permanently resides on the territory of the Russian Federation. But there are some additions, for example, the person must have citizenship or residence permit in Russia. In this case, the citizen must reside in the Russian Federation for at least six months and not have a residence permit in another country.

- Pensioners who meet the above conditions. In this case, the pensioner must have worked for some period 36 months before submitting the application for the deduction.

Refunds are made for purchases (costs):

- Real estate (apartment, house, dacha, land plot for the construction of residential premises).

- Children's education.

- Treatment of yourself or close relatives.

- Charitable purposes.

It is important! The car is not included in the list on which you can return the paid tax.

This means that 13 percent of the purchase of a car or any other vehicle cannot be returned. But is there any way to get the money back? Or save money on purchasing a car? Let's figure it out.

How is the deduction amount calculated?

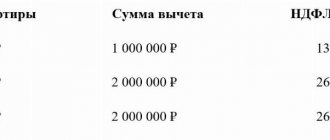

If the taxpayer purchased an apartment, a private house, paid for construction or took out a loan for these purchases - up to 2 million rubles, then an amount of up to 260 thousand (13% of the purchase price) is returned.

Such calculations do not work with a car, since there is no deduction for the vehicle.

How to get 13 percent back from buying an apartment

Calculation example

If a person sold a car for 300 thousand rubles, but the certificates and papers confirming the purchase were lost, then it is possible to use a deduction of 250 thousand rubles and pay 13% on 50 thousand (300 – 250 = 50). If there is documentation (for example, the car was purchased for 280 thousand), then 13% is calculated from 20 thousand rubles (300 – 280 = 20).

What is a tax deduction?

All income of individuals is taxed. Persons receiving official wages automatically pay a percentage to the state treasury. Subsequently, this money goes into the budget and is distributed to support socially significant categories (the work of special services, state and municipal facilities: schools, kindergartens, etc.). This area is regulated by the Tax Code, Chapter 23 “Personal Income Tax”.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Attention

Some part of the income under certain circumstances is not taxed, or it is possible to return part of the amount already paid to the treasury. This measure is considered a kind of benefit for the population. It's called a tax deduction.

Basic options for saving

1. If the vehicle was sold for an amount of up to 250 thousand rubles, then the profit received is not subject to taxation - despite the fact that the seller made a profit. But if you owned the car for less than 3 years, you will still need to send a declaration to the Federal Tax Service. At the same time, it is not recommended to deliberately underestimate the cost of a car - Federal Tax Service employees will detect this and bring the violator to justice.

2. If the seller has owned the car for more than 3 years, he does not need to pay tax.

3. If the car was owned for less than 3 years, you will need to send a 3-NDFL declaration indicating the sale price. If there are documents that confirm the sale of a car is more expensive than its purchase, then the seller pays 13% personal income tax on the difference.

Offsetting as a way to save

If in the past year a person sold a car and bought property, then you can use mutual deduction - mutual coverage of one tax by the second. If you purchased housing for 1.5 million rubles and sold a car for the same amount, you must pay 13% from the sale of the car, and then return it as a deduction from the purchased apartment.

You can use the mutual deduction only 1 time.

What can I get a tax deduction for?

There are several types of tax deductions:

- standard , regulates the rules of taxation of social categories (disabled people, low-income people, veterans, victims of radiation, etc.);

- social (study, participation in charity projects, donations, treatment, activities of religious organizations, etc.);

- investment (participation of an individual in investment programs);

- professional (individual entrepreneurship, royalties, tax on services, etc.);

- property (purchase of residential premises, creation of a project and construction of a house, movable property).

Article 220 “Property tax deductions” lists cases that are not subject to mandatory payments. This is usually part of the total amount. The personal income tax rate is 13%. The amount of income subject to taxation is reduced by this value. This amount can be returned in the following cases:

- buying a property;

- construction;

- charity;

- treatment, payment for medications and stay in a medical institution;

- obtaining a profession in a special or higher educational institution.

What documents need to be prepared

Requested documents include the following:

- PTS containing information about the transaction;

- purchase and sale agreement, which specifies the amount received from the transaction;

- documents confirming the transfer of funds (receipts, checks, receipts);

- passport;

- photocopies of TIN;

- Declaration 3-NDFL.

What to do if the car purchase documents have not been saved

If the purchase and sale agreement is lost, it can be restored - for example, by contacting the seller and requesting a photocopy of the document, or going to the traffic police (contracts are stored in archives for more than 3 years). Thanks to the purchase and sale agreement, you can restore the title if it is lost, and declare that there are no grounds for paying tax on the sale of vehicles.

Deadlines for submitting the declaration

If the seller has owned the car for less than 3 years, then he needs to send a declaration to the Federal Tax Service by April 30. Afterwards, you need to pay 13% of the sale amount before July 15 of the year following the reporting year (in which the purchase and sale transaction was completed).

Ways to save

So, we have already found out that a tax refund when purchasing a car is impossible. But there is still a way to save on transactions. But you can get your money back not when buying, but when selling a vehicle.

Every citizen of the Russian Federation knows that when making a profit, he must pay taxes. And it is on this tax that you can save a significant amount of money.

If a profit was made from the sale of a car that was owned for less than three years, then the citizen must pay 13 percent on it to the state. And if the car was sold by a non-resident, then you will have to pay 30 percent.

How is the tax amount calculated?

As you know, tax is paid only on profits. It is calculated like this:

The cost of purchasing a vehicle – the cost of sale = profit on which tax is levied.

This is interesting! It is possible to calculate the purchase amount only if documents confirming the initial cost are provided. If such documents have not been preserved, then the entire cost of the sale is recognized as the amount of profit.

But in this case, you can use a tax deduction when selling a vehicle. It is equal to 250,000 rubles and allows you to reduce the tax base.

Let's give an example. The owner of the vehicle sells it for 1 million rubles. He bought it for 200,000 rubles. But no documents confirming the cost of acquisition have been preserved. This means that the entire cost of the sale is recognized as profit.

That is, 13 percent tax will have to be paid on 1,000,000 rubles, which is a lot. But a tax refund for a car when it is sold allows you to reduce the tax base by 250 thousand. That is, taxes will have to be returned on 750,000 rubles.

And if the car was sold for 250 thousand or less, then there is no need to pay tax at all. This is how you can return 13% of the purchase of a car if you previously sold a car that you owned for less than 3 years.

In case of ownership for more than 36 months, taxes are not paid at all.

Conclusion. It is impossible to return 13 percent of the purchase of the car, but this can be done upon sale. This means that if the car owner decides to change the car, then a tax refund is possible using a tax deduction.

To use a tax deduction when selling, a citizen must be a resident of the country, otherwise it will not be possible to return taxes.

To return cash dividends, you must submit a declaration within the deadlines established by law on the sale of the car, in which you must indicate the fact of using a tax deduction, which will allow you to save on taxation.

Offsetting as a way to save

Offsetting will also help you return 13 percent when purchasing a car. Let's assume that you sold a car and paid a tax of 100,000. In the same year, a citizen purchased an apartment, from the purchase of which he returned 260,000 rubles. That is, the benefit amounted to 160,000 rubles. If a car was purchased in the same year, then we can assume that you have returned the funds for its purchase. Of course, this is not a refund when purchasing a car. However, money was still saved.

It is not recommended to save money on buying a car using illegal methods. But some still do it. For example, they indicate a deliberately incorrect sales price, due to which they do not pay taxes at all. This is not profitable for the state, so the authorities are trying to deal with lawbreakers using various methods.

If the violator is caught, you will have to pay many times more. First you will have to pay a fine, then the amount of tax with interest, as well as fines for failure to submit a declaration to the tax office. Also, most likely, the evader will bear all legal costs.

You can learn about some other ways to get a tax refund when purchasing a vehicle by watching the video:

Deadlines for submitting the declaration

According to legislative acts, the declaration must be submitted to tax offices by April 30 of the year following the year in which the purchase and sale transaction was concluded. And the tax, if necessary, is paid before July 15 of the same year after filing a declaration with the tax office.

Let's summarize:

- According to the law, it is impossible to return 13 percent of the purchase of a car, since it is not included in the list for which a tax deduction is received. But still, a refund from the purchase of a car is possible.

- You can get money back from the sale of a car if you sell another car that has been owned for less than 36 months. In this case, you can save by using a tax deduction of up to 250,000 rubles.

- You can also make a kind of offset. For example, receive a tax deduction when purchasing an apartment or other real estate. Then part of this money can be spent on buying a new car.

Technically, it is impossible to return 13 percent from the purchase of a car, since this is not provided for by law. But this can be done when selling.

How to get 13 percent on a car purchase - step-by-step instructions

You cannot count on deductions from buying a car. In the case of an apartment, the procedure will be as follows:

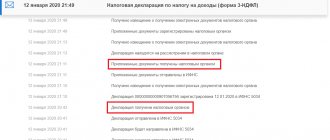

- prepare documents, including a return application and 3-NDFL declaration;

- send them to the Federal Tax Service at your registration address;

- wait for funds to be credited to your current account.

If the deduction is issued through the employer, you will need to issue a tax certificate confirming the right to a refund and submit it to the accounting department of your company.

Who can make a payment

Let's determine which categories of persons have the right to receive a tax privilege from an expensive purchase, for example, an apartment:

- Citizens of the Russian Federation paying income tax.

- Pensioners who have a legal source of income other than a pension.

- Foreigners who have become residents of Russia and have a stable income.

When registering a transaction for a minor, the registration of a property tax deduction is entrusted to his official representatives - parents or guardians. However, it is important that they fall into one of the above categories.

According to Russian legislation, tax compensation when buying a car is not provided; even the car is registered in the name of a child, which is acceptable.

The advantage of this action is that a citizen under sixteen is not subject to administrative fines. But parents should remember that they will not be able to control the fate of the car if it is registered in the name of a child. This rule applies to all types of property owned by a minor.

Persons conducting business activities cannot receive a standard tax deduction, since it is compensated by personal income tax, which businessmen do not pay for themselves. Along with this, entrepreneurs have their own tax preferences if a car is purchased by a company and not by an individual.

How to return tax at 13%

Let's look at how the seller can avoid paying part of the tax on the sale of a vehicle. You need to exercise your legal right and apply the deduction in your calculations. The benefit will allow you to reduce the income received from the sale of the vehicle by a certain amount. From the amount of income remaining after the reduction, you need to calculate personal income tax. Thus, the amount of tax payment in the amount of 13% from the sale of a vehicle for payment to the state budget will also decrease.

Calculation of the amount

The standard tax deduction for movable property is established by the Tax Code of the Russian Federation in the amount of 250 thousand rubles.

The car seller can choose an amount that will reduce income:

- 250 thousand rubles. (if there are no documents confirming the cost of purchasing the car);

- the amount of declared expenses in rubles (if there are documents confirming both the cost of purchasing the car and the amount of declared expenses).

Documentation

The seller must enter the data obtained on the calculations performed in the tax return in Form 3-NDFL. A set of copies of documents must be made along with the declaration.

All documents and their copies, as a rule, relate to the car seller and confirm the following points:

- acquisition of property for sale (agreement);

- period of ownership of the car;

- sale transaction (agreement);

- the identity of the owner (a copy of the PTS (vehicle passport) with a note indicating who the car is registered with the traffic police);

- the amount of income received from the sale of the vehicle (receipt from the buyer for full payment of the transaction);

- a statement of the right to use a property deduction when selling property. The application must be completed according to the standards required by the tax office.

Procedure step by step

The procedure for a car seller to apply for a tax deduction when selling a car is simple.

The procedure consists of the following steps:

- Fill out a tax return in form 3-NDFL.

- Collect the necessary documents and make copies of them.

- Submit a declaration with a package of copies of documents to the tax authority. The deadline for submitting or submitting a report is established by the Tax Code of the Russian Federation from January 1 to April 30 of the year following the one in which the income was received.

- Pay personal income tax to the state treasury. The deadline for transferring or paying tax is established by the Tax Code of the Russian Federation until July 15 of the year in which the declaration was submitted.

On the official website of the Federal Tax Service of Russia you can obtain accurate information about which MI of the Federal Tax Service of Russia serves the assigned region.

There are several options to fill out form 3-NDFL:

- personally (on your own);

- contact a specialist in the financial or legal field (that is, with the help of a consultant);

- in writing by hand on special printed forms that can be downloaded and printed;

- in electronic form, using any specialized service or program (online).

Watch a master class from an accountant on how to fill out a declaration.

There are several options for submitting documents to the tax authority.

The car seller can:

- send electronic files through the government services portal of the Russian Federation;

- send the declaration by a valuable letter with a list of attachments and copies of documents through the Federal State Unitary Enterprise “Russian Post” from any post office;

- send an official representative on your behalf to the Federal Tax Service with documents (you will first have to issue and notarize a power of attorney);

- take the documents in person (visit the Federal Tax Service of Russia during opening hours and reception of citizens using a live electronic queue or pre-make an appointment online and come at the designated time).

What taxes are there when buying a car?

There are two parties involved in a car purchase and sale transaction: the buyer is the future owner of the car and the seller is the current owner.

The buyer does not pay any taxes under any circumstances. The seller does not owe anything to the state if the car has been his property for three years or more, and also if it was sold for less than 250 thousand rubles.

The seller must pay personal income tax (personal income tax) if the car has been his property for less than three years.

The personal income tax payment amount is:

- 13% of the amount received for the sold car, if the seller has the status of a resident of the Russian Federation;

- 30% of the amount received for the car, if the seller is not a resident of the Russian Federation.

The status of the seller is determined based on the results of the year in which the purchase and sale transaction was carried out. To confirm resident status, a citizen must spend more than 183 days in the Russian Federation in a year. One hundred and eighty-three is the total number; the periods of stay do not have to be consecutive. If a citizen of the Russian Federation spent less than 183 days on the territory of the Russian Federation during the year, then his status as a non-resident of the Russian Federation will be confirmed.

A car is considered an expensive property, so the amount of personal income tax payment from the sale of a car can be quite significant. The tax must be paid to the state budget. The tax amount refers to the seller’s expenses, which can still be reduced in some cases.

Deduction from a car purchased on credit

Considering that at the moment there is no compensation for the purchase of a car, even if it was purchased on credit, it will not be possible to receive a preference. Noting whether it is possible to get back part of the finances when purchasing on credit, we will indicate that this is feasible. But the procedure will only apply to purchases of property and services from the narrow category of essential ones.

Income tax refund is a procedure that assumes that a citizen has made contributions to the federal budget within the year. At the same time, he made an expensive purchase from his own funds. As an incentive, the state compensates for a person’s obligatory contribution by returning the money in a one-time payment.

This year, a bill is being considered that would provide a tax refund when purchasing a car, but at the moment it has not been adopted. Such a procedure will be beneficial for all parties, since people will no longer underestimate the real price of the car when forming a sales contract.

Only the seller can save money through a vehicle deal, and they have a range of options when it comes to saving money. Both employed citizens of the Russian Federation and foreigners have the right to receive a tax deduction. As for pensioners, they will be able to return the money provided they have a legal source of income in addition to the pension.

Who can count on receiving a refund

So, the car buyer will not be able to return the tax on the funds spent on the purchase. But the seller of the car has the opportunity to receive a deduction. This is confirmed by paragraph 2 of the same article 220 of the current tax code. As you know, the seller is required to pay income tax on the profit received from the sale of a car. However, he is entitled to a deduction in the amount of income received, under the following conditions:

- the car was owned by him for less than 3 years;

- the maximum amount of deduction is RUB 250,000.

Important! This rule applies not only to vehicles, but also to any property, with the exception of securities.

So, tax refunds are available only to car sellers. The buyer, alas, cannot hope for benefits from the Federal Tax Service. Is there any way he can reduce transaction costs or recoup some of them later?