Borrower actions

Court decisions are always expressed in a special order. This indicates that proceedings are often conducted without the presence of the defendant. If the case has been transferred to bailiffs , they will be the ones who will collect the debt, sometimes this is done with the help of bank representatives. If the bank has already won the case, you should do the following:

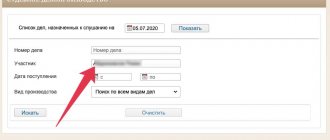

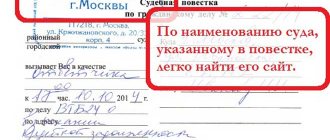

- Find out where the hearing was held. This can be clarified directly with the bailiff or at the bank;

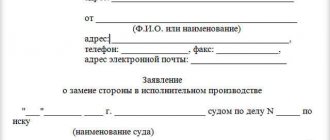

- Visit the court, namely its reception or office. The first thing you should do is express your disagreement with the court’s decision, as well as your desire to cancel the order. There must be a justifiable reason for this. This may be a disagreement with accrued interest or if the bank did not clarify that there was a court case;

- Claims are drawn up on a special form or form, it is provided in court, here you can appeal a case referred to bailiffs ;

- Everything is filled out in accordance with the form and submitted back to the office. A sample application hangs on the information stand;

- The notification of acceptance of the application should be retained;

- Within 3-10 days, the petition is submitted and, if possible, the court order is withdrawn.

Having received the notification, you can go to the bailiffs to write an application to terminate the enforcement proceedings. This can be done on the same day; there is no need to wait for a court decision.

Recognition of a person as notified in case of non-receipt of a letter

In the following cases, the debtor is considered automatically notified of the bailiffs' message:

- Personal refusal to receive the item at the post office or failure to accept it from the courier;

- The fact of receipt of a letter with a summons was confirmed by mail, but the debtor did not appear before the bailiffs at the appointed time;

- The letter was sent to the address previously indicated by the debtor as relevant during the production process, but the debtor did not receive the letter;

- A message sent by courier can be delivered to other adults living in the apartment. After this, the debtor is considered notified, even if he claims that nothing was transferred to him.

Thus, refusal to receive the letter does not bring any benefits to the debtor, since he is still considered notified. Also, you should not pretend that the letter did not arrive if it was found in the mailbox or there was a notification to receive it at the post office. The fact of delivery of the notice and delivery of the letter can be officially confirmed by the post office.

Important points

Once the bank has taken the matter to court and the defendant has been notified of a hearing and has received a formal subpoena and not merely information from a bank officer or any third party, the writ cannot be vacated. The bank will receive a writ of execution and the bailiffs will have the right to begin performing their duties.

To stop the case, you can seek help from a lawyer. Sometimes, in case of non-payment, the bank may sue a second time; this happens if the amount is large enough. Cancellation of the decision in this case is not possible; the court will definitely inform the defendant about a future hearing.

If the bank has increased the interest rate, you can appeal this point, demanding that the amount be written off in the form of a penalty or fine. This way you can reduce your debt by a maximum of ten percent of the debt amount. It is advisable to seek legal assistance in this matter. The specialist will be able to represent the client’s interests in court, help draw up a claim, and also achieve a significant reduction in debt.

The advantage of this solution is that the amount of debt is fixed. When the bank is undemanding, you can agree with the bailiff to repay the debt subject to minimum payments. It is important to make a decision in time to prevent a bailiff from coming to the debtor’s house to take an inventory of property or seize it. The contractor has the right to come to the workplace to demand that the manager deduct the corresponding amount from the debtor’s salary, which will subsequently be transferred to the bank.

Seizure of property that is not the property of the debtor

The bailiff service ensures that debtors fulfill their obligations under enforcement proceedings in various ways as provided by law.

There are cases when the debtor does not pay the debt on time, and then they start looking for him; bailiffs come to his home and inventory his property. Most often, debtors refer to their ignorance of the debt or the initiation of a case. But now this fact is not so easy to prove. Bailiffs must notify debtors and other participants in the case about enforcement proceedings. To do this, they use various methods: they call, write SMS, and always send a resolution on enforcement proceedings by registered mail. The fact of receipt or non-receipt of such a letter is perfectly monitored in our time, and a letter not received twice automatically transfers the debtor to the “notified” status. This means that bailiffs can come and describe the property, and they may not inform you about their visit in advance, so you should be very careful when receiving notifications from bailiffs.

Do you need legal advice on bailiffs?

We will analyze your prospects for free!

+7

Preparation for the process

If the bank goes to court, the first thing you need to do is prepare in advance. The following steps need to be taken:

- Visit the bank to obtain an account statement for the full term of the loan. This is not difficult to do;

- Draw up a claim sent to the bank;

- Prepare an objection, expressing disagreement with the actions of the bank;

- Write down notes of conversations that were held with bank employees. If there was pressure, it is desirable that it be clearly audible;

- If the debtor’s home contains property that does not belong to the client, documents for it should be prepared in order to subsequently transfer them to the bailiffs.

A competent approach to solving this problem comes down to contacting a qualified specialist. This will make it possible to save a significant amount of money, much greater than what will be taken away by the bailiffs.

Communication with the bailiff

If the bank managed to win the case, bailiffs will begin working with the debtor. If the debtor fails to fulfill his obligations within thirty days, the bank can do everything according to the law and turn to the bailiff. The case is assigned to a specific official who has the right to initiate proceedings in this case, of which the debtor is notified in writing. If the bank has not received the funds within the prescribed period, the bailiff has the right to call the debtor to resolve the issue.

If it is impossible to reach an agreement, the executor has the right to come to the debtor and impose a penalty on his property. It is much easier to collect debt from officially employed people. If the bank cannot return the funds, they are deducted from the salary, leaving alimony and other payments in favor of the debtor.

How does the bailiff end at the debtor’s place of residence?

Once the bailiff gets into the apartment, there can be only two outcomes.

1. The bailiff draws up a statement of impossibility of execution.

This act means that the debtor does not have property that can be sold to cover the debt. This actually means that at the moment there is no chance of returning the money to the claimant, since the defendant has neither finances nor property.

In this case, if the claimant is the state, the proceedings are simply postponed and continue to hang on execution. If not the state, then the proceedings are terminated, and the writ of execution is returned to the claimant with a note indicating the impossibility of execution (the bailiff must put a date, signature and the abbreviation b/i ).

IMPORTANT! The recipient of the debt has every right to present the writ of execution, which was returned without execution, again. But it is worth noting that only a citizen can resubmit a writ of execution for execution without any fear, i.e. individual.

If the claimant is a legal entity, then it is better not to rush and submit a document for execution only if it is known that he has acquired property that can be foreclosed on.

To do this, it is best to wait some time for the debtor to relax and acquire property.

2. An act of inventory and seizure of property is left with.

As you can already understand, if the debtor has valuable property that can be seized, then an act of arrest is drawn up. The act itself indicates the name of the property that is seized, the degree of its deterioration, as well as its value. The bailiff determines the cost independently.

By law, it must be based on standard prices in a given area, but in practice everything happens much simpler. The assessment is made by eye, i.e. valuable property worth a lot of money can be seized for literally pennies.

Bailiffs sometimes do this deliberately. The reason is that if the property is valued at a large amount, then there is a high probability that the debtor will not be able to pay it, i.e. the property will need to be seized and sold. It is much easier if the property is purchased by the debtor himself. Then it will not need to be implemented, and accordingly, the bailiff will have less work.

It turns out that in this way they help not only themselves, but also the debtors, although in most cases they do not even understand this. But the fact remains that the lower the value of the seized property, the easier it will be for the debtor to contribute money to redeem it .

If the debtor or claimant is not satisfied with the value at which the property was seized, then it can be challenged by requiring the bailiff to evaluate it from a specialist. True, in this case you will have to pay for the operation, and the one who demands it pays. Simply put, you can protest the value of the seized property, but this is very rare in practice.

As a rule, collectors send a writ of execution to the enforcement service and simply periodically inquire how the case is progressing.

Therefore, in most cases, the claimant simply acts as an outside observer, who may lose his nerve if the bailiff is delaying the execution of the proceedings.

Separately, it is worth considering the issue of assessing property, the value of which is difficult to determine by eye. As a rule, these are real estate, vehicles, enterprises, cultural assets and the like. In such cases, the act of arrest establishes only a preliminary value, and the real price is determined through an assessment carried out without fail.

Receiving installments

When the amounts are significant, the borrower has the right to do everything to achieve installment payments. You can get this opportunity by going to court within five days, but you must go to the judicial authority that issued the initial verdict. Every debtor has this right. The application must contain the date the decision was made, the amount of the amount collected, as well as the date on which the decision comes into force. The person must state that a one-time execution of the court decision is impossible due to a specific reason:

- Having a dependent;

- Alimony obligations;

- Payment of utility services;

- Payment under the lease agreement.

If the bank wins the case and demands compensation, the most important thing is to prove its own financial insolvency. The installment period varies. It is advisable to indicate the amount of the monthly payment in the application.

Other points

If the bank requires payments, but it was not possible to immediately submit a decision on installment payments to the bailiff, then you will need to additionally meet with the executor, drawing up an application, to which a copy of this decision must be attached. The algorithm is similar if there is a decision to suspend legal proceedings.

You should not enter into conflict with the bailiff, because this person acts exclusively on legal grounds. It is innocent of the problems that the debtor has. The best option would be to negotiate with the bailiff, explaining the situation to him and informing him of the desired payment schedule for obligations.

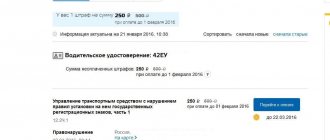

If the bank takes the case to court, it is better to pay off the debt. Don't try to hide by changing your contacts. When the debtor owns a car, it has the right to be seized. In the absence of any property in the property, the guilty person will be sought in every possible way. If it is not possible to find him, the person may be entered into the appropriate database, which is why the person becomes prohibited from leaving the country. If the bank needs to pay a large sum, the debtor may even be put on the wanted list throughout the country, and what is especially undesirable, may be prosecuted. It is important to remember that every debt requires repayment, at least in parts. Simply deciding to hide from the bailiffs will not achieve anything good. A qualified lawyer is the main assistant in solving problems of this kind.

Author of the article

Tip 4. Minimize payments

You need to eat. And also get to work, pay utilities and loans. This is what needs to be regulated.

You can agree on this through an application to the bailiff. We describe the situation, the bailiff endorses the application from the authorities, profit. You pay the agreed amount, and you won't be touched - in theory.

In my case, once every couple of months the bailiff goes through all the sources. Punches apartments, new and old cards. If there is anything lying around, rest assured: it will fly away whistling.

There is an option to fix the payment through the court. I haven't done this, but I advise you to. Perhaps you will live more peacefully. There are no detailed instructions here either; be sure to consult with a lawyer.