How many times can you get a property tax deduction when purchasing property?

When purchasing apartments, rooms, residential buildings, plots with a built house or for housing construction, as well as shares in any of these objects, the law has the right to receive a personal income tax deduction in the amount of expenses incurred (subclauses 3, 4, clause 1, art. 220 of the Tax Code of the Russian Federation). The deduction is limited to RUB 2 million. per individual during his life. But how many times you can make a tax deduction within the specified amount depends on the year of acquisition and registration of the property:

- If the registration of ownership of the property took place after January 1, 2014, then in case of incomplete use of 2 million rubles. For one object, the balance can be transferred to the next and further until the specified amount is completely drawn.

- If the ownership of the home was registered before December 31, 2013 inclusive, then the unused balance of the deduction is not transferred to the next purchase. The version of the Tax Code in force at that time did not provide the possibility of transfer. That is, if an individual purchased and registered an apartment for 1.2 million rubles. in 2012 and received a deduction in the amount of expenses incurred, then the remaining 800 thousand rubles. are no longer carried forward to the future. It is considered that the person has taken advantage of the right to deduction (subclause 3 of clause 1 of Article 220 of the Tax Code, letter of the Ministry of Finance dated 08/07/2015 No. 03-04-05/45663).

Next, we will find out who can claim a tax deduction when purchasing residential real estate.

The legislative framework

Before claiming financial compensation, it is necessary to familiarize yourself with the current legal framework governing the tax refund process. Paragraph 3 of Article 220 of the Tax Code indicates that all taxpayers have the right to return a tax deduction for the purchase of an apartment.

Article 218 of this code describes the amounts and types of possible compensation, and also provides a list of categories of citizens who can count on payments. Any information regarding deductions is provided by articles 218 to 222.

Who and how many times can take advantage of the property deduction when buying a home?

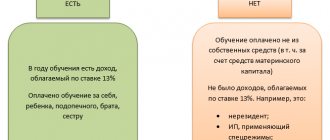

Only residents of the Russian Federation who register real estate can claim the right to deduction. In this case, a mandatory condition is the presence of income taxed with personal income tax at a rate of 13%. The amount of dividends cannot be reduced by property deductions.

NOTE! Individual entrepreneurs who are simplified or individual entrepreneurs who use PSN, as well as individual entrepreneurs who impute (until 01/01/2021), in the absence of other income except from business activities, cannot take advantage of deductions for objective reasons: they do not have a personal income tax base, so they simply cannot apply deductions for what.

The deduction can be used by parents (including adoptive parents), guardians and trustees if they purchase real estate and register it in the name of children under the age of 18. Subsequently, these children will be able to claim a property deduction for personal income tax in relation to their own income, and for parents, part of the deduction or the entire deduction is considered used.

Deduction is not available when:

- housing is purchased from a dependent person, for example from a close relative;

- expenses for the purchase of residential real estate were incurred by third parties or at the expense of capital or government subsidies.

So, housing has been purchased, expenses have been incurred, ownership has been registered - all the conditions for the personal income tax payer to receive a deduction have been met. Then you can go in two ways. Let's talk about each of them in more detail.

How many times can you return a tax deduction through the inspection?

At the end of the year in which the property was registered, the following is submitted to the tax authorities:

- declaration 3-NDFL;

- certificate of income 2-NDFL at the request of the inspectorate;

- documents confirming expenses and ownership of real estate.

The deadline for filing the declaration depends on whether it contains, in addition to deductions, any income on which personal income tax must be calculated for the past year. If there is no such income, then the declaration can be submitted at any time. Otherwise, the deadline is set to April 30 of the year following the reporting year. The tax office reviews the documents for three months. If no violations are found, the amount will be credited to the applicant’s bank account within a month.

You can return personal income tax for three years preceding the year in which the deduction is claimed.

If the deduction has not been used in full, its balance can be carried forward to future periods. This is allowed to be done until the deduction amount is selected in full. In the following years, only the declaration is sent to the tax office; supporting documents no longer need to be attached.

Features of receiving compensation

According to the law, obtaining is possible based on tax documentation for the last three years that preceded the current one. That is, it is currently possible to apply for a deduction, which will be calculated depending on the official taxable income received for 2021, 2015 and 2014.

If during this period of time a person did not work officially or did not receive the additional income specified above, he will not be able to receive the benefit. You are allowed to get an official job and immediately apply for a deduction.

This way, the tax office will be able to calculate how much the employer would have to transfer into her account from your salary. As a result, the taxpayer is exempt from paying taxes on his salary. For all subsequent months, the citizen receives a salary without deduction of taxes when registered through the current employer.

Even if the apartment was purchased five years ago, this scheme is legal and works. If for the last three years there is data on official income and taxes withheld from it cover an amount of 13% of the purchase price of real estate, you can safely apply for monetary compensation.

It should be remembered that housing should not be purchased from a relative or person who provides financial support, and also without the support of funds allocated in the form of maternity capital, federal or state financial support. In other words, a citizen has the right to return only the tax that he paid from his own pocket - immediately or on a mortgage, it does not matter.

https://youtu.be/miawHj2dkKc

Registration with the employer: how many times can you use the tax deduction

In the year of registration of ownership of the purchased residential property, the taxpayer can apply for a notification to the tax authorities with a package of documents confirming the expenses incurred and the state registration of the housing. There is no need to submit a declaration. Having received the notice, the individual gives it to the employer along with an application for a property deduction for income tax.

IMPORTANT! If there are several employers, a separate notification is generated for each of them. The number of notifications and names of employers are indicated by the individual upon request to the tax office.

Based on these papers, the employer must provide a deduction starting from the month in which the employee brought the notice. In this case, the deduction applies to all income from the beginning of the year. If the total income is less than the amount of deductions, then personal income tax is not withheld from the employee until the end of the year.

The employer must return personal income tax withheld until the notification is received.

If the property deduction for personal income tax is not used in full during the year, then its balance can be transferred to the following years. In this case, you will again need to receive a notification from the tax authorities.

What are the pros and cons of self-employment?

Pros:

— Tax — 4-6%. The application itself will calculate the tax and prepare the payment.

— No insurance premiums. When business is on pause, you won’t have to overpay.

— There are no online cash registers. The application will prepare electronic receipts for customers.

- No reporting. The tax office sees all your payments; there is no need for it to receive documents with summary amounts.

Minuses:

- Less pension. Due to the lack of insurance contributions, the pension period freezes. But there is a way out: pay pension contributions voluntarily.

- Low status. Business is still not used to the self-employed: there is a stereotype that real entrepreneurs open individual entrepreneurs or LLCs. Your counterparties may be concerned that you can be deregistered at any time. If so, you can propose to include in the contract a condition that you must warn in advance about the change of status.

Results

A property deduction for personal income tax is given to a resident individual when purchasing housing, land, shares in the amount of 2 million rubles. for the whole life. The ability to carry forward the remaining unused deduction for one property depends on the year in which the property was registered.

A tax deduction can be obtained through the tax office by returning previously paid tax, or through an employer by reducing the personal income tax base by the amount of the deduction specified in the notification of the tax authority.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sberbank service for tax refunds

In order to simplify the procedure for reimbursement of paid tax payments, the bank, together with its partner, launched a special service.

Groups of expenses for which it is possible to return the money paid

With its help, you can return annual expenses associated with:

- Purchasing any real estate (apartment, house, plot, cottage), including mortgage. The maximum amount of compensation is 650 thousand rubles.

- Trading activities and receiving investment income from trading securities (maximum 1 million rubles).

- Opening an investment account, conducting transactions using an individual investment account (maximum 52 thousand rubles)

In addition, clients of a banking institution can return 15.6 thousand rubles. behind:

- insurance services;

- in connection with treatment, receipt of medical services and purchase of medications;

- teaching children at school, on educational courses, and also for paying for kindergarten.

Two tariff options to choose from: optimal and maximum.

To use the online service, you need to choose a service tariff:

- “Optimal” (RUB 1,499). The tariff includes the service of a personal consultant, connection to a special mobile application “Return Tax” and preparation of a declaration online.

- “Maximum” (RUB 2,999). In addition to these services, the tariff additionally includes courier services for delivering the declaration to the Federal Tax Service).

The procedure for registering a tax deduction on the service is as follows:

- The client submits an application on the website. A personal consultant contacts the user and helps him choose the desired tariff and calculates the amount of deduction.

- The user installs the “Tax Refund” application on his phone. Then you need to take a photo of the necessary documents, upload them to the application and send.

- After this, the consultant, taking into account the provided documents, fills out a declaration to the Federal Tax Service.

Three simple steps to return paid tax payments

If the user purchased the “Optimal” tariff, then he will need to submit a completed declaration himself, sending it through his personal account to the Federal Tax Service or by personally contacting the tax service. For clients with the “Maximum” tariff, this function will be performed by bank employees.