Individuals have the right to receive a tax deduction of a property or social nature from their employer.

The first is related to the acquisition or construction of residential real estate, and the second is related to training or treatment. A deduction is a failure to pay or return personal income tax from the budget, taking into account the limits established by law.

To receive a tax deduction from an employer, you must provide a package of documents, on the basis of which the accountant will reflect the provision of the deduction in the 1C: Accounting program for payroll calculation.

Let's look at the main points in more detail, and also analyze the accountant's actions necessary when providing tax deductions to an employee.

Receiving a deduction through your employer

You can receive a deduction through your employer before the end of the calendar year, and you do not need to generate and submit a 3-NDFL calculation. To do this, it is enough to collect the necessary package of documents, which in principle are similar to those submitted when receiving a deduction through the tax office. The only exception is that the employee must contact the Federal Tax Service, which will issue a notification. It will confirm the employee’s right to receive a tax deduction.

Receiving a deduction through an employer means that the accountant will withhold less personal income tax from the employee’s income within the limits of the deduction amount that corresponds to the submitted documents and legislation. Only an individual with whom the company has an employment agreement can apply for a deduction, and the duration of its validity is not important. If a GPC agreement has been drawn up with a person, then the company cannot provide him with a tax deduction, as stated in the Letter of the Ministry of Finance dated October 14, 2011 No. 03-04-06/7-271.

Do not control the process of accepting documents

When filing a return for deduction through the taxpayer's personal account, some people do not control the process of actually accepting the documents. That is, the electronic form can be sent, but, in fact, the desk audit will not begin, because the documents have not received the “accepted” status, say representatives of the personal income tax service. According to them, many simply do not realize that this is even possible, and wait several months for the due return. And when they don’t receive it and begin to figure out what’s going on, various kinds of errors are revealed that prevented the documents from being accepted. This leads to the fact that the deadline for receiving the deduction may actually occur in six months or a year instead of the maximum four months.

How to avoid

When filing electronically, you should always check that all documents have been accepted by the tax office. You can track this in the “Messages” section of your personal account on the website nalog.ru.

Documents for receiving a deduction through an employer

If an employee decides to receive a deduction through an employer, he must provide the following package of documents to the accounting department:

- written application to receive a personal income tax deduction. It is drawn up in any form, but for convenience, the accounting department can develop a standard form. In addition, specifically for receiving a social deduction, there is a regulated application form contained in the Letter of the Federal Tax Service dated January 16, 2017 No. BS-4-11 / [email protected] ;

- notification from the Federal Tax Service confirming the right to receive a deduction. Without this official document, the accountant has no right to provide the employee with a deduction. The notice is issued for a specific calendar year, which means that the employer provides a deduction in this particular period. The employee should receive a new notice for the next calendar year.

To receive the notification, the employee must submit to the tax office an application and a package of documents confirming the fact of spending the funds. As a rule, a 2-NDFL certificate is not required, but it is still a good idea to obtain one from the employer.

Tax refund limited to the last three years

As we said above, there is no statute of limitations for obtaining a deduction when purchasing a home, but according to clause 7 of Article 78 of the Tax Code of the Russian Federation, tax paid can only be returned for the previous three years . For example, in 2021, you can only return taxes for 2021, 2021 and 2020. It is no longer possible to file returns and refund taxes paid in 2021 and earlier years.

Note: The only exception is the ability to carry forward the deduction for retirees. In this case, a refund is possible not for three, but for the last four years (for more details, see the article “Receiving a deduction when buying an apartment as a pensioner”).

Example: In 2009, Izyumova I.K. I bought an apartment. By contacting the tax office in 2021, she will be able to file returns and refund taxes for 2021, 2021 and 2021. It is no longer possible to receive a deduction and return taxes for earlier years. If for 2018-2020 the deduction is not fully received (the tax paid is not enough to exhaust the deduction), then Izyumova will be able to continue to receive the deduction in subsequent years: submit documents for a tax refund for 2021 - in 2022, for 2022 in 2023 etc.

What an accountant needs to consider when providing a deduction

When providing a deduction, the accountant must take into account the following points:

- an employee can receive both property and social deductions through the employer;

- receiving a standard deduction for yourself or for children does not require notification from the tax office;

- the notice is valid for a specific calendar year. If the employee does not use it, he must receive a notice for the next year;

- The notification form was approved by orders of the Federal Tax Service. Before providing a deduction, the accountant must make sure that the document is drawn up in accordance with the law;

- The accountant must check the information contained in the notification from the Federal Tax Service, namely about the employee and the company. If he discovers inaccuracies or errors, the employee will have to contact the Federal Tax Service again to receive a new notification with the correct data;

- the accountant has the right to contact the tax office that issued the notification to verify the authenticity of the document;

- The notice must be kept for 4 years. It is advisable not to destroy the original document, even if the employee was fired before the end of this period;

- if circumstances change, for example, an employee is transferred to another structural unit, the right to deduction is not canceled, since the employer remains the same;

- When the company is reorganized, the employee needs to receive a new notice, because the employer will change;

- if an employee quits and the accountant was unable to provide him with a deduction in the full amount, then the employee will be able to use the rest of the deduction through the Federal Tax Service at the end of the calendar year;

- the accountant provides a social deduction starting from the month in which he received the documents from the employee;

- on the issue of providing a property deduction, there is no clear tax and judicial practice regarding the moment when its effect begins. It is advisable to contact your tax office for written clarification on this issue;

- an employee can provide several notifications from the Federal Tax Service, for example, if he first pays for training, and after a while - treatment, or purchases real estate. In this case, the accountant needs to monitor that the total deductions do not exceed the limits established by law.

Tax cannot be refunded for years preceding the year in which the right to deduction arose

According to the Tax Code of the Russian Federation (clause 6, clause 3, article 220), the right to a property deduction arises:

- when purchasing under a purchase and sale agreement - in the year of registration of ownership rights according to an extract from the Unified State Register of Real Estate (certificate of registration of ownership rights);

- when purchasing under an equity participation agreement - in the year of receipt of the Apartment Acceptance Certificate.

You can return the tax (receive a deduction) only for the calendar year in which the right to it arose and for subsequent years. It is not possible to refund taxes for years preceding the year in which the right to deduction arose.

Note: more detailed information about the moment when the right to deduction arises can be found in the article “When does the right to tax deduction arise when purchasing a home?”

Example: In 2021 Matantseva G.S. entered into a share participation agreement for the construction of an apartment. In 2021, the house was completed, and she received an Apartment Acceptance Certificate. This means that G.S. Matantseva has the right to deduction. arose in 2021. At the end of 2020 (in 2021), she can file for a tax refund for 2021.

If the deduction is not fully used (the tax paid is not enough to fully receive the deduction), then she will continue to receive it in subsequent years. Refund tax for earlier periods (for 2021, 2021, etc.) Matantseva G.S. can not.

Example: In 2021 Borisov A.A. I bought an apartment under a sales contract. The certificate of registration of ownership was received in the same year. This means that A.A. Borisov has the right to a property deduction. arose in 2021. Accordingly, now (in 2021) Borisov A.A. can submit documents to the tax authority for a tax refund for 2021 and 2020.

You can submit documents for 2021 only after it ends. If the deduction is not fully used (the tax paid is not enough to fully receive the deduction), then he will continue to receive it in subsequent years.

Receive a deduction (return tax) for earlier periods, for example, for 2021 and 2021, Borisov A.A. cannot, since in these years the right to deduction has not yet arisen.

The only exception to this rule is when a retiree carries over a deduction. Pensioners have the right to transfer the deduction to three years preceding the year the right to it arose. This situation is discussed in detail in the article “Obtaining a deduction when purchasing an apartment by a pensioner.”

An example of personal income tax calculation taking into account tax deductions

We note the following: the amount of the deduction is indicated in the notification from the Federal Tax Service, so the accountant does not need to make any calculations on his own. The algorithm for providing a tax deduction is as follows:

- the employee’s income subject to personal income tax is initially determined;

- then a tax deduction is subtracted from the amount received;

- after this, the remaining difference is multiplied by the personal income tax rate - 13%.

Important! The difference obtained when subtracting a tax deduction from income cannot be negative. If the employee’s monthly income is less than the deduction provided, then the amount from the notification is not used in full, and the remainder is carried over to the following months.

Important! For the period from January to May, personal income tax was excessively withheld in the amount of 19,500 rubles. (3,900 * 5 months). This amount, upon application of the employee, can be transferred to his bank account.

The 1C Accounting 8.3 solution allows you to process such deductions correctly and without much time. All their sizes and types are stored in the program directory on types of personal income tax deductions.

You can check how correctly the personal income tax deductions are recorded in 1C Accounting using the available reports.

Still have questions? Order a free consultation with our specialists!

Receive a deduction from maternity capital

When calculating the amount of tax deduction, you need to subtract the amount of invested capital from the total amount of expenses, since it is not included in income taxed at a rate of 13%. For example, in 2021 an apartment worth 2.2 million rubles was purchased. 450 thousand were contributed from maternity capital funds. Then in the “Declaration 2019” program, in the “Cost of the object (share)” box, you need to enter the amount of 1.75 million rubles (2 million - 450 thousand rubles). Otherwise, there is a risk of receiving a subpoena from the court, where the tax authorities will file a claim to recover the amount of unjust enrichment.

In Russia, it will be easier to obtain a tax deduction when buying an apartment, house or land. Now, in order to receive a deduction, the applicant will only need to fill out an application in the taxpayer’s personal account, and it will be generated automatically

The State Duma has received a bill on a simplified procedure for obtaining a property tax deduction for the purchase of an apartment, house or land plot. The bill concerns deductions for the costs of purchasing housing and repaying mortgage interest, as well as investment deductions for transactions accounted for in an individual investment account.

Earlier, the government approved the Ministry of Finance's proposal to simplify the procedure for obtaining a tax deduction when purchasing real estate.

“Collecting various documents and filling out a declaration causes difficulties for people and often they simply do not have this opportunity. The government will simplify this procedure,” Prime Minister Mikhail Mishustin noted at a government meeting on December 10.

Now you can return 13% of the cost of the apartment, and complete all the necessary documents online, without leaving your home. This simple procedure will be even simpler in the near future. We tell you how you can apply for a tax deduction for the purchase of an apartment on the website of the Federal Tax Service (FTS) in a simplified and usual manner.

How to simplify your tax deduction process

Now, in order to receive a tax deduction, you need to submit a declaration at the end of the year in Form 3-NDFL and documents confirming the right to this deduction. According to the new rules, individuals will be able to reimburse personal income tax with just one application - without drawing up a 3-NDFL declaration; confirmation of their right to deduction, as well as scanning and uploading many documents in the taxpayer’s personal account on the website of the Federal Tax Service (FTS) will not be required. All you need to do is fill out an application, indicate the bank details to which you want to transfer funds, and it will be generated automatically. The automated system of the Federal Tax Service will process the information by contacting the necessary sources, for example, the bank that issued the loan or through which the funds were transferred.

Deadlines for processing property deductions

In addition to a significant reduction in the list of required documents, a simplified desk audit will significantly reduce the time required to obtain a tax deduction. Now just checking the submitted documents with the Federal Tax Service takes three months, another 30 days will be required to transfer funds to the account.

According to the new rules, a desk audit will take 30 days from the date of filing an application for a tax deduction, and money will be transferred to the account within 15 days after its completion. However, the period of the desk audit can be extended to the same three months if the tax office suspects that you are violating the laws on taxes and fees.

When will the simplified procedure take effect?

If the State Duma passes the law, it will come into force no earlier than the 1st day of the next tax period for personal income tax. The new simplified rules will apply to tax deductions arising from January 1, 2021, with the exception of provisions for which this article sets a different date for their entry into force, the draft law notes. That is, already in 2021, Russians will be able to apply for a tax deduction for the 2020 tax year in a simplified manner.

Zhanna Kolesnikova, head of commercial practice at the law firm Pleshakov, Ushkalov and Partners:

“In my opinion, this will make life much easier for taxpayers, since now they just need to fill out an electronic application and will not have to fill out a tax return. As a rule, it is precisely because of incorrect completion of the declaration that most taxpayers are denied a deduction. In addition, there is no need to collect and scan supporting documents.

What else is new in a simplified manner

The refund of the amount of overpaid tax in connection with the provision of a tax deduction in a simplified manner if the taxpayer has a debt subject to collection will have to be made only after the amount of overpaid tax has been offset against the arrears (debt).

It is also assumed that if the deadline for returning the amount of overpaid tax in connection with the provision of a tax deduction is violated, interest will be accrued, starting from the twentieth day after the decision to provide it is made.

How much can you get back from the budget?

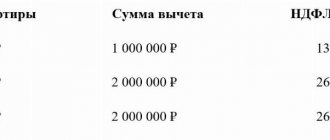

Russians who have official income and pay personal income tax can return 13% of the cost of the apartment. The state has set a limit - the maximum amount with which a citizen can receive the 13% due to him is 2 million rubles. Thus, you will be able to return 260 thousand rubles. If the apartment cost less than the established limit, then you can use it when buying another apartment.

You can also get paid taxes back from the budget if the apartment was purchased with a mortgage. Russians can receive 13% from the budget from interest paid on a housing loan. At the same time, the deduction limit is higher - 3 million rubles. Thus, you will be able to return 390 thousand rubles. This right can only be used once.

In total, these two deductions amount to a serious amount - 650 thousand rubles. If the property was acquired during marriage and is joint property, then each spouse has the right to deduction. Thus, the family can return up to 1.3 million rubles. from taxes paid.

Instructions for registering a property deduction

Let's look at the rules that apply before the simplified procedure comes into effect. To apply for a property deduction, you must register in the taxpayer’s personal account on the Federal Tax Service website. You can also log in if you already have an account on the government services website. After completing registration in your personal account, you need to obtain an electronic digital signature and you can begin filling out an application for a property deduction from the purchase of real estate.

Here you need to select the territorial tax authority for filing the declaration and the year for which you want to receive a property deduction.

Next, fill out the tax return (in Form 3-NDFL) on the website. It will be loaded automatically with the necessary data from the certificate in form 2-NDFL. If the Federal Tax Service website does not contain data on taxes paid for previous years, then a certificate can be obtained from the accounting department at the place of work.

We select a property for which you need to receive a property deduction, and enter the amount of expenses spent on acquiring the property.

To receive a property deduction online, you need to make scans of the documents:

— an extract from the Unified State Register of Rights to Real Estate and Transactions with It (USRP);

- when purchasing an apartment or room - an agreement on the purchase of an apartment or room, an act of transfer of an apartment or a share in it, or a certificate of state registration of the right to an apartment or room (a share/shares in it);

- when repaying interest on a loan - a target credit agreement or loan agreement, a mortgage agreement concluded with credit or other organizations, a schedule for repaying the loan (loan) and paying interest for the use of borrowed funds;

- documents confirming expenses for the acquisition of property (receipts for receipt orders, bank statements on the transfer of funds from the buyer’s account to the seller’s account, sales and cash receipts, acts on the purchase of materials from individuals indicating the address and passport details of the seller, and others documentation);

- extracts from the taxpayer’s personal accounts, certificates from the organization that issued the loan about the interest paid for using the loan about the payment of interest on the loan or mortgage agreement.

After downloading and sending all the necessary documents, you need to write an application for a refund of taxes paid from the budget, indicating the account number where you want to transfer the deduction. Next, wait for the application to be reviewed by the tax authority. This usually takes three to four months.

Actions in case of delay in tax deduction refund

The Tax Code provides for the accrual of penalties for late performance of official duties by tax authorities within the period established by law.

To do this, you need to submit a written application to the higher body of the Federal Tax Service, in which you indicate all the circumstances of the case. The amount of the accrued penalty is the daily refinancing rate by the Central Bank as of the date of registration of the application:

- The annual refinancing rate is divided by the number of days in the year: 9.65%: 365.

- The result obtained is multiplied by the transfer delay period: 9.65: 365 x days of delay.

- The amount of the penalty will be a share of the calculated tax: 9.65:365 x days of delay x personal income tax to be reimbursed.

In the video - tax deduction and refund:

To receive additional income tax assessments in the form of penalties to the Federal Tax Service, you must prove:

- that the tax authorities had the entire package of documents, including an application for a personal income tax refund;

- the applicant did not receive notification of the completion of the desk audit;

- he learned about it in violation of the notification deadlines;

- didn't have any information.

What if the tax authority does not calculate the deduction within the established time frame?

Sometimes the Federal Tax Service does not transfer the funds declared by the citizen within the time limits established by law. In this case, you need to figure out why the money is not being transferred to you.

Note ! If you were not credited with tax deduction money on time due to an error by an employee of this institution, then for each day of delay the amount is subject to a penalty based on the current rate of the Central Bank of Russia.

There can be many reasons for delays in the transfer of funds.

Table "The most common reasons."

| Cause | Description |

| Reason one | The desk verification activities of the data specified in the declaration have not been completed. |

| Reason two | The amount of tax paid in excess acted as compensation for existing tax debt, if any. These checks are carried out by the tax authority, without additional applications. The money that remains after compensation will be sent to the citizen’s account. |

| Reason three | The application for a refund of overpaid tax was lost by the tax authority. To protect against such cases, it is advisable to make a copy of the application and ask the employee to mark the receipt of the documentation with the date. If you have such paper, you can request interest compensation (in a situation where, from the moment the application was sent, the period specified by law for the return of the requested funds has expired). |

There are several reasons for delays in deduction payments

Note ! If the funds are not credited according to your details, then you have the right to file a complaint with a higher institution or court.

There is a possibility that the tax-paying citizen is to blame for the fact that contributions to him are delayed.

Table “Frequent reasons provoked by the applicant himself.”

| Cause | Description |

| Reason one | An incomplete package of documentation was sent or there is not enough information to conduct a full audit. Then the tax office employee will try to call you by phone or send you a letter with the relevant information: that you need to show the remaining documents. However, there are situations when a person ignores calls or lives at a different address and does not receive letters sent to him. |

| Reason two | The details to which funds should be credited were not specified, or an error was made in these data. Then the tax office will try to transfer the money to you, but, naturally, this will not end in anything. |

| Reason three | The citizen who submitted the application has debts on taxes, penalties or fines. Then the funds remaining after compensation of the said debts are credited to his account. And if the debt is higher than the requested amount, then the debt is partially closed - naturally, in this case, no money is credited to the person. Please note that employees in such situations are not obliged to inform you about these manipulations. |

| Reason four | The person did not submit an application for compensation of the necessary funds attached to the declaration. But in this application the data is written according to which the funds are credited. Naturally, in such a situation it is simply impossible to send you money. |

Sometimes the citizen himself is to blame for delays in payments

You don't have to wait until four months have passed to start finding out why the IRS is not sending a tax deduction to your account. There is a possibility that the employee was not able to clarify all the sharp corners regarding the documents you provided. This will become clear three months later (at the end of the desk verification activities). So if after the specified period everything is quiet, you can go to your personal account or, in situations where you sent all the papers yourself, you need to go to the tax office and report the results of the audit.

When the desk verification activities are completed, a verdict is made in your favor and the application for the required amount of money is sent, then the probable reason why the money has not been received into the account may be your mistake in the application. There are often situations when applicants write the details incorrectly, so the tax office simply cannot send the money.

If the applicant himself indicated the details incorrectly, the money will not be sent

If you are sure that you have not made any mistakes, but the money is not credited to you, what should you do? You can write an application to the Federal Tax Service by sending it by mail or giving it during a personal visit to the institution. The same can be done using the tax service website. If the funds do not arrive within the legally established time frame, you must send a complaint to the Federal Tax Service, and then to higher authorities.

Deadlines for filing a complaint:

- to the Federal Tax Service: one year from the date when the payment deadlines were violated;

- to court: 3 months from the date when the citizen was notified of the decision not in his favor.

Note ! The claim must be written in two copies. The paper remaining with the applicant must contain the entry number and signature of the employee involved in processing. You can also send documentation by registered letter with an inventory.

You can file a complaint if money has not been credited for a long time

If the actions taken were not enough, the citizen has the right to file a claim in court, which indicates the deadline for filing the application and completed form 3-NDFL.

Alas, the mechanisms for paying tax deductions are far from ideal. There are frequent cases of delays. Tax institutions have room for improvement. To avoid delays, you need to immediately visit the tax inspector after completing the desk audits and find out how long it will take for the funds to be credited to you.