When and in what amount can I receive a deduction?

You can apply to the tax authorities for a deduction after registering ownership of a residential building purchased or newly built on this site.

Thus, you can receive a deduction for a land plot in two cases:

- when purchasing a plot of land with a residential building located on it;

- when purchasing a plot of land with subsequent construction and registration of a residential building.

You should contact the tax authorities for deductions at the end of the calendar year in which the residential building was registered as your property. Or, without waiting for the end of the calendar year, you can receive a deduction from your employer - more about this in our article Obtaining a property deduction from your employer).

The edition of the Tax Code, which was in force until January 1, 2010, did not contain information about tax deductions for expenses for the acquisition of land. In this regard, only those citizens who registered ownership of the residential building located on it after January 1, 2010 have the opportunity to include in the deduction the costs of acquiring a land plot.

In this case, it is the date of registration of ownership rights to a residential building that is important, since it is considered the moment the right to deduction arises. The date of the purchase and sale agreement for the plot and other documents does not matter. Reason: Letter of the Federal Tax Service dated April 13, 2012 No. ED-4-3/ [email protected] , Letters of the Ministry of Finance of Russia dated December 1, 2011 No. 03-04-05/7-981, dated May 21, 2010 No. 03-04-05/9 -278.

Example: In 2021 Ivanov I.I. bought a plot of land with a residential building located on it. Ivanov has the right to a property tax deduction in the amount of expenses for purchasing a house and land. Apply for deduction to the tax authority Ivanov I.I. maybe after the end of the 2021 calendar year, that is, in 2021.

Example: In 2010 Petrov S.S. bought a plot of land, built a residential building on it and registered its ownership in 2020. Petrov can receive a deduction in the amount of expenses for building a house and purchasing a plot of land. Petrov can submit documents for deductions to the tax authority in 2021.

Example: Sidorov V.V. bought a plot of land for the construction of an individual residential building, but did not build anything on it. Sidorov will not be able to receive a deduction for the specified land plot until he builds a residential building on it.

Personal income tax deductions when purchasing real estate: a complete guide

All the nuances of returning money from the budget.

Many happy owners of houses, apartments, garages and other similar properties sooner or later think about selling this property for various reasons. And almost the same number of people are preparing to purchase all these properties in the near future.

For the first and second categories of persons, the law provides for various deductions. This article will discuss personal income tax deductions for individuals when purchasing real estate. All the nuances of obtaining a property tax deduction are regulated by Art. 220 Tax Code of the Russian Federation.

The legislation provides for the provision of a property tax deduction, but, unfortunately, not for all categories of real estate.

pp. 3, 4 p. 1 art. 220 of the Tax Code of the Russian Federation provide for the provision of property deductions in the amount of expenses actually incurred in the following cases:

- for the construction or acquisition of residential buildings, apartments, rooms or shares in them;

- for the acquisition of land plots or shares in them for individual housing construction;

- for the acquisition of land plots or shares in them, on which the acquired residential buildings or shares in them are already located.

- to repay interest on targeted loans (credits), as well as to repay interest on loans received from banks for the purpose of refinancing when purchasing the above-mentioned real estate.

Thus, when purchasing or constructing a garage, when purchasing a plot of land for a garage, purchasing a dacha land plot, the construction of country houses and other real estate on the territory of horticultural partnerships, the provision of property deductions to citizens is not provided for by law.

Although pp.

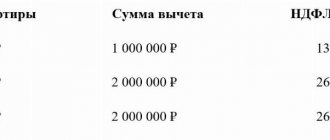

3 and 4 clauses 1 art. 220 of the Tax Code of the Russian Federation and provide for the provision of deductions in the amount of expenses actually incurred, but this amount still has its limitations, provided for in paragraphs. 1 clause 3 and clause 4 art. 220 Tax Code of the Russian Federation. Thus, the deduction for the purchase of real estate and land cannot exceed the maximum amount of 2 million rubles. The deduction for repayment of interest on targeted loans (credits) cannot exceed an amount of 3 million rubles. The right to a property tax deduction has a number of features for certain categories of taxpayers. For example:

- if the right to a deduction when purchasing real estate is claimed by persons receiving pensions, then in accordance with clause 10 of Art. 220 of the Tax Code of the Russian Federation, such a taxpayer has the right to transfer a property deduction to previous periods, but no more than three years preceding the year in which the carry-over balance of the property deduction was formed, the eligibility of this is confirmed by the letter of the Ministry of Finance of the Russian Federation dated November 2, 2018 No. 03-04- 05/78803;

- if real estate is purchased from an interdependent person who is such in accordance with Art. 105.1 of the Tax Code of the Russian Federation, then in accordance with clause 5 of Art. 220 of the Tax Code of the Russian Federation, a property tax deduction is not provided to the taxpayer. Interdependent persons in accordance with Art. 105.1 of the Tax Code of the Russian Federation includes an individual, his spouse, parents (including adoptive parents), children (including adopted children), full and half brothers and sisters, guardian (trustee) and ward. Please note that in this article, on general grounds, parents of spouses, grandparents of spouses, uncles (aunts) of spouses are not equated to interdependent persons. So, for example, as specialists from the Ministry of Finance of the Russian Federation note in letter dated January 18, 2019 No. 03-04-05/2228, when a spouse receives a property deduction for personal income tax when buying an apartment from the spouse’s grandmother, if interdependence is not established between the spouse and the spouse’s grandmother , then the spouse has the right to claim a property tax deduction;

- if real estate is acquired in the joint ownership of spouses, then regardless of whose name the real estate and payment documents are registered, each spouse has the right to receive a property tax deduction in the amounts established by paragraphs. 3, 4 p. 1 art. 220 Tax Code of the Russian Federation. However, for this it is necessary to submit an application for the distribution of expenses to the Federal Tax Service. If such an application for the distribution of expenses is not submitted, then the deduction will be provided only to the spouse in whose name the expense documents will be issued.

According to paragraph 3 of Art. 220 of the Tax Code of the Russian Federation, the right to property deductions arises from the year in which all the conditions for receiving them are met. It is impossible to receive deductions earlier than the year in which an individual was issued documents confirming ownership of real estate. This means that the right to receive a property tax deduction arises from the moment when the ownership of real estate is registered in the Unified State Register of Real Estate or a transfer deed or other document signed by both parties is received on the transfer of the property by the developer to the participant in shared construction, if housing is purchased in a house under construction.

Please note that according to paragraphs. 6 clause 3 art. 220 of the Tax Code of the Russian Federation, to confirm the right to a property tax deduction when purchasing an apartment, the taxpayer submits documents confirming ownership of the apartment. And if you purchase an apartment in a building under construction, then according to paragraph. 4 pp. 6 clause 3 art. 220 of the Tax Code of the Russian Federation, the right to receive a property tax deduction is determined not only if there is an agreement for participation in shared construction, but also a transfer deed or other document signed by the parties on the transfer of the shared construction object by the developer and its acceptance by the participant in shared construction. Those. The taxpayer has the right to apply to the tax authority for a property tax deduction when purchasing an apartment in a building under construction based on income for the tax period in which the act of transferring the apartment was signed.

The right to receive a property tax deduction in relation to a land plot for development can be exercised only after the right to a residential building built on this plot has been registered.

In this case, the date of registration of land ownership does not matter. Not everyone has the opportunity to take advantage of the property deduction. Individuals may have the right to receive a property deduction if they have income for which a tax rate of 13% is applied, determined by clause 1 of Art. 224 Tax Code of the Russian Federation. If the property is registered in the name of a person who does not have income taxed at a rate of 13%, it will not be possible to issue a deduction until the owner of the property has such income. For example, an apartment was purchased in 2021, but income taxed at a rate of 13% an individual did not have one in 2021. Property tax deductions for 2021 will be denied. However, since tax legislation does not limit the period when the owner can take advantage of this deduction if he has taxable income, the deduction can be received later.

The only point worth paying attention to is that, according to paragraph 7 of Art. 78 of the Tax Code of the Russian Federation, you can submit an application for offset or refund of personal income tax within three years from the date of payment of the specified amount. For example, an apartment was purchased in 2017, the right to receive a property deduction for income taxed at a rate of 13% exists at any time during 2018-2020.

As a rule, it is not always possible to fully take advantage of the property deduction in one calendar (tax) year, and in this case the unused balance in accordance with the provisions of clause 9 of Art.

220 of the Tax Code of the Russian Federation can be transferred to subsequent tax periods until they are fully used. If only part of the property deduction has been used for the acquired property, then you can use the remaining part up to the maximum amount of the deduction in the future when purchasing or constructing another property in accordance with clause 1, clause 3 of Art. 220 of the Tax Code of the Russian Federation, but only in terms of the tax deduction provided for in paragraphs. 3 p. 1 art. 220 Tax Code of the Russian Federation. The legislation does not provide for transferring unused deductions for interest payments on a target loan (credit) to other real estate properties.

Previously, in the Tax Code, in relation to housing purchased before January 1, 2014, a tax deduction both in terms of direct acquisition costs and in terms of expenses aimed at repaying interest on targeted loans (credits) was provided only in relation to the same real estate property property, and if the taxpayer has already taken advantage of this property deduction, then the individual no longer has a basis for receiving the deduction again in relation to another piece of real estate (letter of the Ministry of Finance of the Russian Federation dated October 31, 2018 No. 03-04-05/78306)

After the property tax deduction has been used in full, the law does not provide for the re-provision of the deduction when purchasing subsequent real estate properties; this is directly indicated by clause 11 of Art. 220 Tax Code of the Russian Federation.

In order to exercise the right to receive a property tax deduction, you must provide the tax authorities with a list of required documents. Their list is given in paragraphs. 6, 7 p. 3 art. 220 Tax Code of the Russian Federation. Depending on which property an individual plans to take advantage of the property tax deduction for, it is necessary to provide:

- a copy of the real estate purchase agreement and documents confirming ownership;

- a copy of the agreement for participation in shared construction and the transfer deed or other document on the transfer of the object by the developer to the participant in shared construction;

- a copy of the certificate confirming the ownership of the land plot and documents confirming the ownership of the residential building built on this plot;

- documents confirming the payment of funds when purchasing real estate or constructing it (these can be receipts, cash and/or sales receipts, bank statements from current accounts, receipts, acts on the purchase of materials from individuals, etc.). Please note that if the apartment was purchased in common shared ownership, then payment of the share from the account of another buyer cannot be a refusal of a property tax deduction (information from the Federal Tax Service of Russia dated January 25, 2019, decision of the Federal Tax Service of Russia dated November 23, 2018 No. SA -3-9/ [email protected] ));

- a copy of the loan agreement and a certificate from the credit institution about the amount of interest paid on the loan;

- certificate of income taxed at a rate of 13%.

So, the property has been purchased, the right to take advantage of the property tax deduction is available, and supporting documents are available.

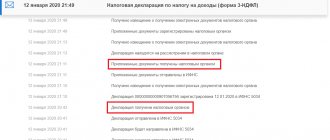

Where and how to apply, an individual has the right to independently, choosing one of two options, receive a property deduction by submitting a tax return to the tax authorities at the end of the calendar year when the right to a deduction arose, or by directly contacting the employer without waiting for the end of the tax period when submitting a written application to the employer, provided that this right to deduction is confirmed by the tax authorities. If you plan to receive tax deductions through the tax office, then at the end of the calendar year you must fill out a 3-NDFL tax return, attach copies of supporting documents and fill out an application for a refund of the overpaid amount of personal income tax. If at the end of the year a declaration is submitted solely for the purpose of obtaining a tax deduction, then it can be submitted at any time after the end of the expired calendar year, but no later than three years after its end, as stated above. If, in addition to receiving a tax deduction, the taxpayer is required to report on the income received for the past calendar year, then the declaration must be submitted by April 30 of the year following the year in which the right to a property tax deduction arose.

After receiving the declaration, the tax inspectorate is obliged to conduct a desk audit within three months and, in accordance with clause 9 of Art. 78 of the Tax Code of the Russian Federation, at the end of this period, send the taxpayer a message about the decision made to offset (return) personal income tax amounts, or a decision to refuse to carry out the offset (return). If the decision is positive, the amount of overpaid tax must be returned to the bank details specified in the tax refund application no later than one month from the day such an application was submitted to the tax authorities. To speed up the process of receiving funds, we recommend submitting a return application along with the 3-NDFL declaration.

If a taxpayer plans to receive a deduction from an employer, then the following algorithm must be followed. A package of supporting documents, together with an application to confirm the right to a property deduction, is submitted to the tax authorities at the place of residence; please note that in this case it is not necessary to provide a 3-NDFL declaration. In this case, according to the deadlines established in paragraph. 4 paragraph 8 art. 220 of the Tax Code of the Russian Federation, within 30 calendar days from the date of filing the application, the tax authorities must confirm the right to receive a property tax deduction. After receiving confirmation, the taxpayer must draw up a free-form application for a property deduction and, together with a notice confirmed by the tax authority, send it to the employer.

Please note that when choosing any option for receiving a property tax deduction, either through the tax office or directly through the employer, if the unused balance of the tax deduction is transferred to the next calendar (tax) year, you must again submit a declaration 3- personal income tax, and receive a notification about confirmation of the right to a property tax deduction, respectively.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

The personal income tax deduction calculator will tell you how much the state owes you.

You can quickly calculate the amount of tax deduction when buying an apartment, paying for treatment or training.

If necessary, you can contact the personal income tax company specialists who will help you get your money back.

Deduction amount

Since the deduction for the purchase of land is not a separate type of deduction, its size is regulated by the standard deduction rates for the purchase of housing. Read more in the article “Tax deduction amount”.

The total amount of the deduction, including expenses for the purchase of land, purchase or construction of a house, cannot exceed 2 million rubles (260 thousand rubles to be refunded).

Example: Korolev A.A. bought a plot of land for 3 million rubles and built a house on it for 5 million rubles. Despite the fact that the total expenses for purchasing land and building a house amounted to 8 million rubles, Korolev will be able to deduct only 2 million rubles and return 260 thousand rubles.

Income tax refund amount

The taxpayer has the right to receive a property deduction for personal income tax in the amount of its actual confirmed value, but not more than 2 million rubles. This maximum amount is total for the totality of expenses for the construction and acquisition of residential real estate and land plots (Article 220 of the Tax Code of the Russian Federation). Previously, the deduction was provided only for one property; now the remainder is allowed to be used for other properties. Please note that the property deduction when purchasing and merging 2 land plots has no specific amount; the limit is 2 million rubles. Even if the real cost of land is much higher.

There is a separate limitation on the amount of expenses for paying interest on a mortgage loan (loan) received for the purchase of land (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation):

- for loans received during the period from 01/01/2014 - a maximum of 3 million rubles;

- for loans received before 2014 - without restrictions.

Such a personal income tax refund is provided only for one property. You will have to choose whether to receive it based on the plot or the house on it or other housing.

Purpose of the site for obtaining a deduction

Land plots vary depending on their intended use. For example, land for individual housing construction (IHC) is intended for the construction of residential buildings on it, but the intended use of a site intended for gardening does not provide for this possibility.

However, for the purposes of obtaining a tax deduction, the key condition is not the purpose of the land plot, but the presence of an individual residential building on this plot (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated December 10, 2012).

Thus, the possibility of obtaining a deduction when purchasing a land plot directly depends only on the possibility of obtaining a deduction for a residential building located (built) on this plot.

Example: Krasilnikov V.V. bought a plot of land and built a country house on it (not a residential building). Krasilnikov will not be able to receive a property deduction, since the deduction is provided only for a residential building. However, if a country house is recognized as a residential building, in addition to the deduction for the house, it will have the right to include in the deduction the costs of purchasing a land plot.

Features of filling out an application

When purchasing land for individual housing construction without a house

If you purchase a plot for construction, there is no point in writing an application; you must wait until the residential building is built.

Only after assigning a cadastral number to an object and obtaining ownership rights can owners apply for a tax deduction. In the application submitted to the Federal Tax Service “Form for KND 1150058” there are no special filling details .

In the document for the accounting department at the place of work, it is necessary to indicate the cost of the plot, and immediately below information about the house in connection with which the right to refund the tax arises.

There is a recommended application form to confirm the taxpayer’s right to receive property tax deductions for personal income tax.

With a finished house

In the application for the employer, it is also necessary to indicate the presence of two real estate objects (their values will be summed up) - land and house. It is necessary to indicate cadastral numbers, the date of registration and the cost, again, of two objects .

Garden in SNT or dacha

There is no difference in the processing of applications, despite the fact that the land with the house is located in a dacha or garden village. It is necessary to wait for the assignment of ownership rights to the built house and fill out the form in the same way as for the land with the house in the example above.

Documents for receiving a deduction

To apply for a property tax deduction when purchasing land you will need:

- identification document;

- declaration 3-NDFL and application for tax refund;

- documents confirming ownership of land and a residential building: certificate of registration of ownership or extract from the Unified State Register of Real Estate;

- documents confirming expenses for the purchase of land/house: sales contracts, payment documents;

- documents confirming the paid income tax (certificate 2-NDFL).

You can find a detailed list of documents here: Documents for property tax deduction .

Is property return due?

How do you know if personal income tax can be reimbursed?

Tax residents of the Russian Federation who are in the country for more than 183 days a year, have official work and pay income tax of 13% every month have the right to refund the tax when purchasing a plot and land with a house.

In addition, a tax resident can receive a deduction for past years of work, even while unemployed.

Pensioners who have additional income subject to tax are eligible to receive a tax refund. In this case, the income must be above the subsistence level.

Citizens who bought a house or land after 2014 have the right to receive a tax deduction for the amount that they did not use before (it is allowed to receive no more than 260 thousand rubles)

How to get a tax deduction for building a summer house

Summer residents will be able to indicate the costs of building a house as part of their property deduction for personal income tax. It will be possible to return 13% of the total cost, but no more than two million rubles will be offset. Thus, the maximum amount for refund will be 260 thousand rubles.

To receive a tax deduction, you no longer need to fill out a declaration. Instead of a declaration, which the tax authority now has three months to verify, you will need to submit an application through your personal account on the Federal Tax Service website. The tax office will have only 30 calendar days to check, plus 10 working days to transfer funds in the event of a positive decision on the tax deduction.

The simplified procedure will be in force from January 1, 2022 in relation to the right to deduction that arose from January 1, 2021.

Results

Individuals - residents of the Russian Federation, when purchasing a land plot, can take advantage of a property deduction in the amount of expenses incurred, but not more than 2 million rubles. In this case, the acquired plot must be intended for residential construction or a residential building must already be built there.

The sale of land may also be accompanied by a personal income tax deduction: either in the amount of expenses previously incurred when purchasing the land, if supporting documents are available, or in a fixed amount of 1 million rubles.

A deduction for land tax is 6 acres, which are not taxed for the categories of individuals listed above.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What is a tax deduction for land tax of 6 acres

The calculation of land tax is carried out by the tax authorities. An individual can only check its correctness and, in case of disagreement, contact the tax authorities with an application and relevant documents for recalculation.

Starting from 2021, when calculating land tax, a tax deduction has been established, reducing it by the cadastral value of 600 square meters. m for one plot of land. This means that if the area of the plot does not exceed 600 sq. m (6 acres), then no tax is charged, but if it exceeds, then the liability will be calculated for the remaining area.

The deduction is applicable to the persons listed in clause 5 of Art. 391 of the Tax Code of the Russian Federation: pensioners, veterans, disabled people, etc.

conclusions

- Please note that the tax deduction is calculated from the amount specified in the purchase and sale agreement. Therefore, if the seller owns the plot for less than 3 years, then he will have to pay sales tax and, most likely, the seller will want to reduce the amount specified in the agreement.

- It is worth noting that the total amount of real estate transactions exceeding 1 million rubles per year is subject to a 13% sales tax.

- Since 2015, for the “tax-free” sale of a single residence, it is still required to own real estate for more than 3 years, but for each subsequent property owned, the ownership period has been increased to 5 years.

How to get a benefit?

In the Federal Tax Service department

You can apply to the tax authorities for a deduction at the end of the calendar year in which the residential building was registered as a property.

Document preparation procedure:

- All documents must be prepared.

- Complete a tax return for the past year.

- Fill out the original application to the Federal Tax Service.

- If within 3 months the money is not transferred to the resident’s account, contact the tax service again; Most likely there is an inaccuracy found somewhere in the documents.

How to get back 13% of the property value

To use the tax deduction when buying a house with land and get back 13 percent of the cost, you have to:

Step 1 - Fill out your tax return

First, you need to get a 2-NDFL income certificate from the accounting department at your place of work. Then, based on the data received from 2-NDFL, print and fill out a tax return in form 3-NDFL, or fill out the 3-NDFL declaration electronically.

Step 2 - prepare documents

To legally claim an income tax refund, you will need the following documents:

- Make a copy of your passport certified by the accounting department. You need to copy pages with basic information and registration;

- Prepare originals and copies of documents evidencing payments: payment orders, receipts, checks, receipts, etc.;

- If at the time of purchase of the plot the taxpayer was legally married, then a copy of the marriage certificate will be required;

- If a citizen has minor children for whom he has already received a standard deduction, copies of birth certificates will be required;

- Order an extract from the Unified State Register of Real Estate for your house and land.

Please note that RosReestr sends extracts from the Unified State Register within 3 days (there may be delays). If you want to receive information faster, I recommend ordering statements directly through the RosReestr API - this way you will receive the document within a day. The cost is the same - 250 rubles, the official data is from the Unified State Register of RosReestr and is confirmed by the registrar’s electronic digital signature (EDS).

Extract from the Unified State Register of Real Estate, which I recently ordered through the RosReestr API

Step 3 - submit documents to the tax office

Next, you need to fill out an application to the tax office at your place of registration with a request to receive a tax deduction in accordance with the costs incurred for the purchase of a house and land (you will receive the form on the spot). Here, in the application, the personal data of the taxpayer is indicated - full name, home address and registration address, if they do not match, contact telephone number, INN. The address of the house and a list of documents attached to the application are also indicated.

After reviewing the application (10-90 days depending on workload), the tax office makes a decision to satisfy the request, refuse or suspend consideration due to incorrect provision of data or billing period (submitted a year earlier than required). You can also receive a refusal during a desk audit.

At the discretion of the taxpayer, an application can be made to redistribute the deduction between husband and wife. This document is drawn up only for legal spouses and is not classified as mandatory.

Who and how can claim a deduction when purchasing land?

Only residents of the Russian Federation have the right to a tax deduction if they have income taxed at a rate of 13% (except for income in the form of dividends). At the same time, they must purchase land at their own expense and register it or the house on it (a share in the said property) in the name of themselves, their minor children (including adopted children) or wards under the age of 18.

The deduction will not be processed if:

- The purchase and sale of land, housing or shares was carried out between interdependent persons, for example close relatives.

- Expenses for land, housing or shares were paid at the expense of employers, maternal capital, and funds from the state subsidy program.

The taxpayer is given a deduction:

- by the tax inspectorate at the end of the year after filing and verifying the declaration in form 3-NDFL and other documents by returning income tax to the applicant’s bank account;

- by the employer on the basis of a notification from the tax authority by reducing the tax base for the tax by the amount of the claimed deduction.

The taxpayer decides independently how it is more convenient to receive the deduction.

Find out what documents are needed to confirm your right to deduct in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

How to quickly and inexpensively issue a deduction

You can submit documents in person to the tax office, remotely through the taxpayer’s personal account, or apply for a deduction through your employer. No one will give you a guarantee that the tax office will accept your documents without problems, and no one will bother you for three months of a desk audit.

Repeatedly you will have to spend time and effort proving to the tax authorities the legality of including certain construction works as deductible expenses. You may have to wait more than three months for your tax refund. These are the harsh realities of the work of tax authorities. But everything is being resolved.

In less than 24 hours, the specialists of the Return.tax company will advise you on deductions, fill out a declaration, prepare and submit documents to the tax office. Minimal participation is required from you. The cost of filing a deduction for one calendar year under the “Standard” package is 1,690 rubles.

The Premium package offers full support for the verification from the moment of submission, resolution of controversial issues and until the receipt of money in your account. The cost of filing a deduction for one calendar year under the Premium package is 3,190 rubles.

When is a property tax deduction applicable when selling a land plot?

Not only the purchase of housing is accompanied by a deduction for personal income tax. When selling a plot of land, an income tax deduction is also provided, but in a slightly different form. After all, if upon purchase submitting a declaration and receiving a deduction is a voluntary matter, then when selling property, submitting a declaration (if the maximum period of ownership of such property of 3 or 5 years has not been exceeded) with the calculated tax payable is the responsibility of an individual.

How to fill out the 3-NDFL declaration when selling a land plot is described in detail in ConsultantPlus. Get free demo access to K+ and get tips from the experts.

The amount of the deduction is provided in the amount of documented expenses that an individual incurred to purchase the property being sold. If there are no supporting documents, then the value is 1 million rubles. - the maximum for reducing the taxpayer’s income received from the sale of his own housing (houses, apartments, rooms), dachas, garden houses, land plots and shares in all listed property.

IT SHOULD BE NOTED! When selling other property, such as motor vehicles, the deduction is limited to 250 thousand rubles.

What expenses are included in the deduction?

Do not think that absolutely all costs of building a house are included in the deduction. The tax code only specifies expenses:

- for the development of design and estimate documentation;

- for the purchase of construction and finishing materials;

- for construction and finishing works;

- for connection to electricity, water supply, gas supply and sewerage networks.

Remember that if you bought a built house and remodeled it, you will not be able to claim a deduction for construction costs. For this purpose, the house must have the status of an unfinished construction project.