It’s not uncommon today to hear: “Have you bought an apartment? Did you return the tax? Yes, it's convenient and profitable. Who would refuse this? At first, it took us a long time to get used to the property tax deduction for housing, it all seemed like fairy tales, but today every realtor, and even ordinary buyers and sellers, know what a personal income tax refund is when buying a home and the intricacies of this issue.

But also quite often today you can hear the question, is there a tax deduction for the purchase of a car (car)?

Is it possible to get income tax back on a car purchase?

There is a misconception that when buying a car you can get 13 percent back. In fact, the right to a 13% refund applies to those citizens who purchased real estate, paid for education or medical services. Since the car is not on the list of essential items, it is not eligible for a 13% refund.

Tax benefits for a car are established when it is sold and income is received from the transaction. For each profit from the sale of property, you must pay 13% income tax. But if the vehicle has been owned for at least 3 years, then you do not need to pay personal income tax, just like you do not need to prepare a declaration to the Federal Tax Service.

The period is calculated as follows:

- when purchasing – from the moment of completion of the purchase and sale transaction;

- in case of inheritance - from the date of death of the testator;

- in the case of a gift agreement - from the moment of signing this agreement.

Basic facts about the tax deduction

A tax deduction is an amount of money reimbursed for tax previously paid for a certain reporting period. The funds are returned to the payer from the regional treasury. At the moment, there are several options for compensation of expenses associated with the acquisition of various types of property. However, this does not include the car tax deduction.

Categories of expenses that are reimbursed to citizens at the expense of the state:

- Individual housing construction.

- Reconstruction, major repairs of a residential building.

- Repayment of mortgage loans.

- Costs incurred in obtaining higher education.

- Payment for services of medical institutions.

- Formation of a material fund for future retirees.

Thus, receiving state compensation becomes possible in different cases and situations. But at the moment, the car tax deduction in 2021 is not approved by law and is valid only for the sale of a vehicle. The existing restriction is explained by the fact that a car is not an essential item, unlike housing, real estate repairs, and the cost of medical procedures.

Who is entitled to a 13% interest refund?

A bill is being considered in the State Duma that proposes introducing a new personal income tax deduction in the amount of 13% of the amount of expenses for purchasing a car. It is assumed that the deduction will be available to citizens who purchased a new (not used) Russian-made passenger car for family or personal needs. The total amount of expenses is strictly up to 1 million rubles. The largest planned deduction amount is 100 thousand rubles.

If the bill is adopted, then taxpayers will be able to return 13 thousand rubles from the budget.

The following rule was also established: if a person took advantage of such a deduction, he will be able to receive it again in the future, but at least 5 years must pass from the date of the previous application for a refund.

This law is attractive to the state in the sense that it will encourage citizens to purchase domestic cars, developing the Russian automobile industry.

Receipt procedure

The collected documents must be submitted to the Federal Tax Service. This can also be done online using the State Services portal. It is important to remember that in order to receive a tax refund on a car purchase in 2021, you must meet several requirements that are presented in the tax amendment bill.

These include the following:

- The maximum deduction amount should not exceed 500 thousand rubles.

- The opportunity to get a tax refund when buying a car only applies to new cars.

- The right of compensation applies to vehicles manufactured and released on the territory of the Russian Federation

How is the deduction amount calculated?

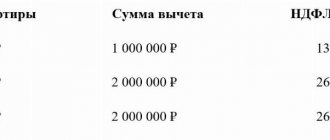

If the taxpayer purchased an apartment, a private house, paid for construction or took out a loan for these purchases - up to 2 million rubles, then an amount of up to 260 thousand (13% of the purchase price) is returned.

Such calculations do not work with a car, since there is no deduction for the vehicle.

How to get 13 percent back from buying an apartment

Calculation example

If a person sold a car for 300 thousand rubles, but the certificates and papers confirming the purchase were lost, then it is possible to use a deduction of 250 thousand rubles and pay 13% on 50 thousand (300 – 250 = 50). If there is documentation (for example, the car was purchased for 280 thousand), then 13% is calculated from 20 thousand rubles (300 – 280 = 20).

Why is there no tax deduction when buying a car?

Either the legislator underestimates the role of the car in modern life, its influence on the development of the transport system, or considers cars a luxury and not a necessity.

Yes, and the transfer of ownership is just as complicated as with housing: the same registration, the same state fees, queues, etc. By the way, the costs are comparable. Transactions involving the equivalent exchange of a car for an apartment or vice versa are not uncommon. But the fact remains a fact and we will firmly emphasize it once again: the legislation does not provide for a property tax deduction for the purchase of a car.

Basic options for saving

1. If the vehicle was sold for an amount of up to 250 thousand rubles, then the profit received is not subject to taxation - despite the fact that the seller made a profit. But if you owned the car for less than 3 years, you will still need to send a declaration to the Federal Tax Service. At the same time, it is not recommended to deliberately underestimate the cost of a car - Federal Tax Service employees will detect this and bring the violator to justice.

2. If the seller has owned the car for more than 3 years, he does not need to pay tax.

3. If the car was owned for less than 3 years, you will need to send a 3-NDFL declaration indicating the sale price. If there are documents that confirm the sale of a car is more expensive than its purchase, then the seller pays 13% personal income tax on the difference.

Offsetting as a way to save

If in the past year a person sold a car and bought property, then you can use mutual deduction - mutual coverage of one tax by the second. If you purchased housing for 1.5 million rubles and sold a car for the same amount, you must pay 13% from the sale of the car, and then return it as a deduction from the purchased apartment.

You can use the mutual deduction only 1 time.

Conditions for returning the deposit

A refund of the advance payment for a car is possible if you cancel the purchase if the car is found to have defects. To terminate the transaction, you must contact the salon within 15 days. During this time, it is necessary to prove the detected defects. After 15 days, a refund can only be made if there are significant deficiencies that prevent you from driving the car.

You can also return the advance if the seller violated his obligations to timely transfer the goods. The dealer is obliged to compensate the buyer for losses and pay a penalty for each day of delay.

The advance payment for the car is returned to the buyer under the following conditions:

- the seller did not fulfill his obligations - did not deliver the car on time, the car was incomplete or of poor quality;

- The buyer has the right to refuse the purchase at any time, while paying the costs of fulfilling contractual obligations.

What documents need to be prepared

Requested documents include the following:

- PTS containing information about the transaction;

- purchase and sale agreement, which specifies the amount received from the transaction;

- documents confirming the transfer of funds (receipts, checks, receipts);

- passport;

- photocopies of TIN;

- Declaration 3-NDFL.

What to do if the car purchase documents have not been saved

If the purchase and sale agreement is lost, it can be restored - for example, by contacting the seller and requesting a photocopy of the document, or going to the traffic police (contracts are stored in archives for more than 3 years). Thanks to the purchase and sale agreement, you can restore the title if it is lost, and declare that there are no grounds for paying tax on the sale of vehicles.

Deadlines for submitting the declaration

If the seller has owned the car for less than 3 years, then he needs to send a declaration to the Federal Tax Service by April 30. Afterwards, you need to pay 13% of the sale amount before July 15 of the year following the reporting year (in which the purchase and sale transaction was completed).

Income tax refund upon sale of a vehicle

To answer the question of whether it is possible to obtain tax benefits when selling a car, you must first determine the period of ownership.

Case 1. You have owned the car for more than three years. You are completely exempt from paying taxes upon sale. There is no need to even file an income tax return.

Case 2: You have owned the car for less than three years. Clause 1 Art. 220 NK offers 3 possible scenarios:

- If the price of the car is 250 thousand rubles or less, then when it is sold, a copy of its technical passport (PTS) and the sales agreement are attached to the declaration of Form 3-NDFL. These papers will confirm that the transaction did not exceed the specified amount.

- The sale price of the vehicle exceeded 250 thousand, but no documents confirming this were preserved. If the income exceeds the predetermined deduction, then a tax of 13% is imposed on the difference. If the difference is negative, no income tax is paid, but a tax return is filed on a general basis.

- The income from the sale exceeded 250 thousand and the necessary documents are on hand. In this case, a person has 2 outcomes - calculate the tax base as the difference between income and the amount of 250 thousand or as the difference between income and the cost of the property sold.

What are the conditions for receiving a tax deduction?

- The seller is a Russian citizen and tax resident;

- He has documents in his hands that indicate the fact of selling the car (purchase agreement);

- There is a copy of the title on hand, which will confirm that the car sold belonged to the taxpayer. It is best to make this copy after the new owner’s details have been entered into the PTS. Then the document will serve as additional evidence of the sale itself.

How to get 13 percent on a car purchase - step-by-step instructions

You cannot count on deductions from buying a car. In the case of an apartment, the procedure will be as follows:

- prepare documents, including a return application and 3-NDFL declaration;

- send them to the Federal Tax Service at your registration address;

- wait for funds to be credited to your current account.

If the deduction is issued through the employer, you will need to issue a tax certificate confirming the right to a refund and submit it to the accounting department of your company.

Purchase on credit

The question of whether tax compensation is provided for persons who purchase a car on lease or on a car loan is quite relevant. At the moment, the article of the code regulating the procedure for obtaining a deduction does not contain information regarding transport or other movable property. Based on this, until the adoption of a new law, it is impossible to return the funds spent on tax when buying a car.

The question of whether it is possible to return the tax paid when purchasing a car is relevant for many citizens. Current legislation provides for a number of cases in which it is possible to receive a deduction in the amount of 13% of the value of the property. However, the list only includes real estate properties. Therefore, it is impossible to refund the amount of tax paid when purchasing a car until amendments are made to the tax code.

Who doesn't have to pay car tax?

The legislation defines a list of persons who are exempt from paying tax on the sale of a car:

- Car owners who have owned the car for more than 3 years. This circumstance frees the seller from the need not only to pay taxes, but also to submit a declaration to confirm the funds received from the sale.

- Owners of cars whose cars cost less than 250 thousand rubles.

However, even if the owner of the car sold an inexpensive car that he had owned for less than 3 years, he still must file a declaration to confirm the income received from such a transaction.

Who is required to pay car tax

In accordance with the tax legislation of the Russian Federation, taxes must be paid by:

- All car owners, if the cost of their vehicle exceeded 250 thousand rubles.

- Drivers who have owned a car for less than 3 years.

- If the amount of the sale of the car exceeded the cost of its purchase.

Questions regarding car tax deduction

Despite the fact that the legislation clearly defines the methods and procedure for receiving payment for the sale and purchase of vehicles, many car owners still have a number of questions in this area.

Are there any innovations in legislation?

Unfortunately, as of 2021, no changes have been made to the tax legislation of the Russian Federation. In the near future, there are no plans for any innovations in the current legislation or the creation of a new law.

Despite the fact that the issue of receiving a property payment for the purchase of a car was first raised back in 2013, there is still no active policy on this issue.

The State Duma reports that the issue of including vehicles in the category of property objects for which tax payments are due was not only not considered, but was never even brought up for discussion.

It is for this reason that it is not yet possible to talk about making any changes.

What to do if the car was purchased on credit?

In the event that the purchase was purchased using loan funds under the agreement, the motorist will still not be able to count on receiving a tax deduction for the car.

In accordance with the law, only persons who need to repay interest on a loan taken for the construction of residential premises can receive a deduction for loan funds. The Tax Code does not indicate the possibility of obtaining funds to purchase a car on credit, regardless of the size of the loan and its repayment period.

Are there restrictions for pensioners?

The right to receive 3-NDFL for purchasing a car is not stipulated in any article of the Tax Code. Accordingly, Russian legislation does not provide for exceptions for pensioners to receive such a deduction.

This rule applies to all preferential categories, which include:

- Disabled people.

- Participants of the Great Patriotic War.

- Persons who suffered from radiation sickness during the elimination of the consequences of the accident at the Chernobyl nuclear power plant and Mayak station.

- Pensioners.

Accordingly, no category of citizens can count on receiving 3-personal income tax, regardless of whether they have any benefits.

What is the property deduction for?

The owner can count on receiving a property deduction when purchasing the following types of property:

- Real estate whose value does not exceed 2 million rubles. Such property includes apartments, a house or any other building intended for permanent or temporary residence.

- A separate plot of land that is purchased for its further development with residential premises.

- In the event that a citizen of the Russian Federation took out a loan for the development of a plot of land (construction of premises suitable for living on it), if he needs additional funds to repay the interest on the loan.

Except in cases where a citizen purchases residential property for himself, he can count on receiving a tax deduction in the following cases:

- If a person is studying at an educational institution on a commercial basis, and he needs additional funds.

- If a person undergoes long-term, expensive treatment in a private medical institution.

- If a citizen spends his money on charity.

The law does not provide for a tax deduction for the purchase of a car. However, according to Article 200 of the Tax Code, a deduction for a car can be obtained if it is sold.