The general director of the company is elected by the general meeting of its participants (Clause 1, Article 40 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”; hereinafter referred to as Law No. 14-FZ). The founders can appoint a person to this position, either from among themselves or from outside.

In general, an employment contract is concluded with the elected manager (Article 275 of the Labor Code of the Russian Federation). The employer in relation to the employee - general director is the organization represented by one of its owners. On behalf of the organization, the agreement is signed by one of the participants to whom the general meeting has granted such powers.

An employment agreement (contract) is signed by different persons on each side. It includes all mandatory and additional conditions provided for by the Labor Code (including wages - the size of the employee’s tariff rate or salary, additional payments, allowances and incentive payments).

The General Director works under an employment contract in accordance with Chapter 43 of the Labor Code. The provisions of this chapter apply to heads of organizations, regardless of their organizational and legal form and forms of ownership. But there are exceptions - in particular, this provision does not apply to heads of organizations who are the only participants (founders) of the organization and the owners of its property (Article 273 of the Labor Code of the Russian Federation).

Position of officials

There is no normative answer to the above questions in the current versions of the legislation. Neither the Labor Code of the Russian Federation, nor other laws and regulations contain a clear answer as to whether the director of an LLC - founder can work without a salary.

An employment agreement must be concluded between the employer and the employee. But in accordance with the latest recommendation from officials, the founder of an LLC cannot enter into an employment contract with himself (Rostrud Letter No. 177-6-1 dated 03/06/2013). The owner is only authorized to assign responsibilities for the management and management of the company by independent disposal. Consequently, in the absence of an employment contract, there is no question of wages or other forms of remuneration for work.

Officials from the Ministry of Finance clearly agreed with the position of representatives of Rostrud, expressing their opinion on the issue of whether a director can work without a salary in Letter No. 03-11-11/52558 dated October 17, 2014.

IMPORTANT!

Departmental letters do not relate to normative acts, but act only in the status of clarifications and recommendations. Therefore, one should not unequivocally assume that the founder can work without payment. In addition, keep in mind that officials may change their position.

Salary or dividends - that is the question

The director, who is the sole founder, may receive several types of payments. It could be:

- wage;

- dividends.

Wages are remuneration for work performed under an employment contract. If the manager is the only participant, in the absence of a written employment contract, the amount of his salary can be provided for in the staffing table.

But wages may not be paid. In the absence of a “paper” employment contract, the director can only receive dividends.

Important

In case of non-payment of wages, labor laws are violated. This violation is punishable under Article 5.27 of the Code of Administrative Offences. And entails a fine in the amount of:

•

from 30 to 50 thousand rubles for organizations;

•

from 1 to 5 thousand rubles for officials.

In the event of a repeated violation, at the request of the labor inspectorate, the court may decide to disqualify the manager.

Dividends are any income received by a shareholder (participant) when distributing net profit. The company has the right, once every quarter, half-year or year, to make a decision on the distribution of its net profit among the company's participants (clause 3 of article 28 of Law No. 14-FZ).

If you decide to pay only dividends to the founding manager, you must follow the general rules for processing such payments. Payments must be made:

- no more than once a quarter;

- at the expense of the organization’s net profit remaining after paying all taxes;

- based on the owner's decision.

At the time of making a decision on the payment of dividends, it is necessary to take into account that:

- the authorized capital is paid in full;

- the organization has no signs of bankruptcy and will not become bankrupt after payments are made;

- after payment of dividends, the value of net assets will not be less than the authorized capital and reserve fund (if any).

If these rules are not followed, then both the tax inspectorate and extra-budgetary funds checking the correctness of payment of insurance premiums will try to prove that these payments are the manager’s salary, and not dividends, and may decide to charge additional taxes and insurance premiums.

To avoid controversial and dangerous situations, you can pay both dividends and salaries. In this case, the salary may be the minimum, but not lower than the established minimum wage or the industry average.

Design principles

Whether the general director can not pay himself a salary is decided by the head of the company himself. If the general director nevertheless decides to save on himself, then the situation does not require special registration. It is enough to issue an order to assign managerial responsibilities to the creator - the founder of the company. Moreover, it is not necessary to indicate wage standards in this order.

An employment agreement should not be drawn up and signed either. The director and founder as one person are not included in the timesheet and payroll, and salaries are not calculated.

Sample order on assignment of powers

Results

Any business company must have a general director. It may also be the founder of the organization. He has the right to carry out his activities under an employment contract and have the same labor rights and obligations as other employees.

You can learn more about the specifics of various legal relationships with the participation of the general director of an enterprise in the articles:

- “Can the CEO work part-time?”;

- “Job description for the general director of an LLC - sample”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to include in PFR reporting

Disputes arose regarding filling out reports to the Pension Fund of Russia using the SZV-M and SZV-STAZh forms. Accountants are at a loss what to include in reporting if the LLC has only one director and he is not paid a salary.

The latest clarifications from the Ministry of Finance have eliminated the contradictions - they are given in Letter No. 17-4/10/B-1846 dated March 16, 2018. Now information about the sole founder must be reflected in pension reporting for 2021.

Example.

Vesna LLC has one founder. There is no employment contract or GPC agreement concluded with the founder, and no wages are accrued. But information about the owner of the company must be included in SZV-M and SZV-STAZH.

"Salary" taxes

Both salaries and dividends are subject to personal income tax, but at different rates. Salary - 13%, dividends - 9%.

Dividends are paid from the net profit of the organization to shareholders (participants) if they have a property right to a share in the authorized capital of the organization. This is not a work activity. Dividends are also not payments related to the performance of work (services) under any civil contract. Therefore, they are not the basis for the calculation and, accordingly, payment of insurance premiums (letter of the Federal Insurance Service of the Russian Federation dated December 18, 2012 No. 15-03-11/08-16893).

On a note

In the event of liquidation of an organization, the director, the sole founder, can assert his rights both as a creditor and as a shareholder.

As a creditor, he will, in the second place, qualify for payment of severance pay in the amount of average monthly earnings (Article 178 of the Labor Code of the Russian Federation).

As a shareholder, he lays claim to the property remaining after satisfying the claims of all creditors (Clause 1, Article 58 of the Law).

When calculating wages, an obligation arises to pay insurance contributions to extra-budgetary funds. They are accrued on all remunerations and payments in favor of the employee made within the framework of labor relations and civil contracts for the performance of work or provision of services (Article 7 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation , Social Insurance Fund of the Russian Federation, Federal Compulsory Medical Insurance Fund"). This also applies to the payment of salaries to the director - the only founder. For an organization, this is a waste of money. But for a person it is undoubtedly a positive factor, since he has the right to all types of social insurance benefits - temporary disability benefits, maternity and child benefits - on an equal basis with all other employees. This is directly indicated in subparagraph 1 of paragraph 1 of Article 2 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Thus, the manager has to make a choice and take into account that with the payment of dividends and a lower income tax rate, he will have to make contributions for future pension provision from personal funds.

How to appoint a general

Having figured out whether the founder and director in one person can not accrue salaries, we will determine what to do if earnings still need to be accrued. For example, the general director decided to refuse charity and assign himself a reward for backbreaking work. In this case, it is necessary to issue a similar order for appointment to the position. The procedure for remuneration of the general director can be established at a general meeting of LLC participants. The decision of the founding council may be to conclude an employment contract with the general director; then an order of appointment or an order to take office is issued.

For information on how to draw up these administrative documents, read the article “Sample order for the appointment of a general director.”

Director's labor rights: vacation and sick leave

Like any other employee, a director, having hired himself, will be obliged to provide himself with vacation - the duration determined by the norms of the Labor Code of the Russian Federation, and accrue vacation pay accordingly. At the same time, he does not have the right to carry out labor activities without going on vacation for 2 years in a row.

If the Labor Inspectorate, during an inspection, finds out that the director has not gone on vacation for more than 2 years, it may fine the company on the basis of clause 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation in the amount of up to 50,000 rubles. Therefore, leave must at least be formalized - while the director can actually go to work.

You can familiarize yourself with the features of calculating vacation for an employee in the article “Calculating the number of vacation days in 2020 - 2021 - example.”

Regarding sick leave, an employed director similarly has the same rights and responsibilities as any employee. If he gets sick, he will be able to apply for sick leave, which will be paid in the manner prescribed by law.

If activity is suspended

What to do if the company's activities are suspended? If there was no salary, then there is no need to accrue anything. Therefore, can the CEO not receive a salary? Answer: maybe. When suspending the company's activities, no additional orders are required.

But if earnings were still assigned, then additional documentation is required. For example, the general director must issue an order on leave without pay or issue an order on downtime with the preservation of part of the average earnings, in accordance with the norms of the Labor Code of the Russian Federation. But without completing additional paperwork, payments cannot be stopped.

Labor rights of the director - the sole founder: receiving a salary

Having concluded an agreement with himself, the founder of the company will be obliged to pay himself a salary - not lower than the minimum, which is established by the norms of the Labor Code of the Russian Federation (in cases provided for by law - increased using “northern” coefficients and allowances). The same insurance payments are charged on the salary (taking into account all allowances) as on the salary of an ordinary employee.

You can learn more about the calculation of “northern” coefficients and salary bonuses in the article “The size of the northern bonus in the Far North regions.”

At the same time, salary, as well as social contributions from it, can be used to reduce the tax base - for example, when calculating income tax under the OSN or simplified tax system “income minus expenses”.

IMPORTANT! Various remunerations that are not provided for in the contract are not applied when optimizing the tax base (Clause 21, Article 270 of the Tax Code of the Russian Federation).

In turn, if a director manages a company without an employment contract concluded with himself (that is, earns from dividends), then the amount of dividends, as well as the tax on them, cannot be considered expenses to reduce the tax base.

Filling out form P13014 when changing the director

The rules for filling out P13014 when changing the director are similar to the rules for filling out form P11001: only capital letters; can be filled out manually in black ink or on a computer in Courier New font 18 points high; printing on only one side of the sheet, etc. You can find out all the requirements for filling out in full in the order of the Federal Tax Service dated August 31, 2020 N ED-7-14/ [email protected]

We have written step-by-step instructions on filling out form P13014 when changing directors.

Which sheets of form P13014 should be filled out when changing the director? Total 7 pages:

- title page, where information about the organization is indicated;

- sheet I - page 1 (for the former director);

- sheet I - pages 1 and 2 (for the new director);

- sheet N – all 3 pages (information about the applicant).

Who applies for a change of director - the old or new director? On the one hand, information about the new director has not yet been entered into the Unified State Register of Legal Entities, on the other hand, the previous director has already been deprived of his powers. More than 10 years ago, there was a practice of signing an application by the old director as a person whose information was included in the state register (letter of the Federal Tax Service dated October 26, 2004 N 09-0-10/4223). Later, by decision of the Supreme Arbitration Court of the Russian Federation dated May 29, 2006 N 2817/06, this provision was declared invalid, as inconsistent with the Law “On LLC”.

Moreover, the courts have repeatedly emphasized that the powers of the former leader terminate from the moment the corresponding decision of the participants is made (for example, the decision of the Supreme Arbitration Court of the Russian Federation dated September 23, 2013 No. VAS-12966/13). Based on this, the application in form P13014 can only be signed by a new director; the previous director no longer has any relation to the LLC.

Please note: unlike form P11001, which does not need to be notarized if the applicant personally appears at the Federal Tax Service, application P13014 must be certified. For this reason, the applicant’s personal signature on the last page is affixed only in the presence of a notary.

An example of filling out form P13014 when changing the director can be found at the link below.

Exception method: a contract is needed, but it cannot be civil law

So how do you formalize your relationship with a manager who is also the sole founder of the organization? In our opinion, in the current situation of legal uncertainty, it is possible (and necessary) to resolve this issue using the exclusion method.

Let us recall that relations regarding the management of an LLC are regulated by a special Federal Law dated 02/08/98 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as the LLC Law). By virtue of paragraphs 1 and 4 of Article 40 of this law, the company’s relations with the sole executive body (that is, the director) are in any case formalized by an agreement. This law does not establish any exceptions for the manager - the sole participant of the LLC.

At the same time, from the analysis of the Law on LLC it follows that this agreement can be civil if it is concluded with a professional manager in the manner prescribed by Article 42 of the Law on LLC. Obviously, in this case, the person claiming to be the manager (that is, in our case, the sole founder) will carry out entrepreneurial activities in managing the LLC. This means that he will have to register as an individual entrepreneur (subclause 2, clause 2.1, article 32 of the LLC Law).

So, a civil contract is not suitable in the situation under consideration. We exclude him. And as a result we get the following. First, you need to conclude an agreement with the manager. Secondly, this agreement cannot be civil law. Thus, there is only one option left for formalizing relations with the director of the LLC - concluding an employment contract with him. The legislation does not yet provide for any other option.

Draw up and print out an employment contract and order for free using Form No. 1-T

Features of an agreement with a director in a state organization

When applying for a job as a director of a government institution, he, like any employee, must

- obtain a passport, work book and tax identification number. In addition, he must submit: a certificate of his own income and property;

- a similar certificate regarding the income and property of the spouse and minor children.

Certificates are submitted at the time of hiring and are updated annually.

You should know that a contract with the head of a state organization must be concluded according to the standard form from Government Decree No. 329 of April 12, 2013. But an employment agreement with the director of a commercial company can be developed independently - there is no standard form provided.

Sample act of acceptance and transfer of documents upon change of director

A director is a person responsible for the safety of the organization’s documents and part of the property assigned to him. Upon dismissal, the director must hand over his files, but no specific procedure is established by law. The procedure for changing the general director in an LLC can be enshrined in a local act of the company. In any case, the LLC participants do not have the right to delay the dismissal of the director under the pretext that he did not transfer any documents or property, but they can claim them as part of legal proceedings.

If a change of director occurs with a conflict between the parties, and the new director or participants for some reason do not accept the documents, then the previous director can deposit them with an archival organization or a notary.

Drawing up an act of acceptance and transfer of affairs when changing the general director is, first of all, in the interests of the former manager himself. The transfer and acceptance certificate can be signed either by two directors among themselves, or with the participation of the owners of the organization. You can familiarize yourself with our document acceptance certificate template and change it to suit your situation.

Logical contradiction

The position of Rostrud is dubious, because in fact there can be no talk of any coincidence of the parties. After all, the contract is signed by the employer - the general director as a representative of the LLC, and on the other hand - by an individual (employee). The provisions of the Labor Code themselves do not mean that in such cases labor relations do not arise. On the contrary, from the content of Articles 11, 273 of the Labor Code, it follows that if a person appointed to the position of general director of a company is its employee, then the relationship between them is regulated by labor law.

The position of Rostrud is also questioned by the courts. The absence, in the department’s opinion, of labor relations allows, for example, the Social Insurance Fund to refuse reimbursement of expenses for compulsory social insurance. Thus, the dispute resolved by the Resolution of the Ninth Arbitration Court of Appeal dated May 26, 2010 No. 09AP-10226/2010-AK in case No. A40-13990/10-154-41 seems interesting. The arbitrators declared illegal the refusal of the Social Insurance Fund to reimburse the Company for the costs of maternity benefits to the general director, the only participant. At the same time, the court rejected the Fund’s argument with reference to Article 273 of the Labor Code that the only participant in the company cannot be an employee of this company, as untenable and based on an erroneous interpretation of the law. The court in this case indicated that the general director is an employee by virtue of Articles 255 and 256 of the Labor Code of the Russian Federation and has the right to maternity leave with the payment of state social insurance benefits in the amount established by law.

For what period is the contract concluded?

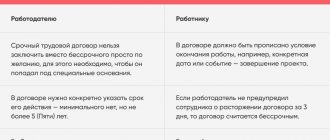

Typically, an employment contract is for an indefinite period - this applies not only to the director. Only employment agreements that are temporary in nature have a term. For example, when a specialist is hired to replace an employee who has been absent for a long time. In this case, the period is determined by agreement of the parties and in accordance with the constituent documents of the employer. The contract must indicate why it is urgent. The maximum period for which a fixed-term employment contract can be concluded is 5 years.

Reducing labor costs is possible

If the organization is not functioning, you can send yourself on leave without pay and pay nothing. You will only need to submit zero reports for yourself: SZV-M every month, 4-FSS, RSV, 6-NDFL once a quarter and sometimes SZV-STAZH. That is, it won’t happen that you don’t work, but still incur some expenses.

If you work, you can simply assign yourself a small salary. With a small salary and taxes are small. You can settle for 0.5 wages and pay no more than half the minimum wage in your region. In Moscow it is no more than 10 thousand. But don’t settle for less than 0.5 bets. They say that it is better not to pay the director anything at all than to pay little - in the second case, they will notice something is wrong faster. Although the interview with Konstantin in my video says otherwise.

Dismissal of the director

So, the director is a difficult worker. Moreover, the company cannot function without it. However, he can be dismissed on general grounds, like any other employee of the organization. Moreover, Article 278 of the Labor Code of the Russian Federation provides additional grounds for dismissal of a director :

- in accordance with the requirements of bankruptcy legislation (the director is dismissed due to removal from office);

- in accordance with the decision of the owners or authorized body of the organization; on other grounds specified in the employment contract.

However, there are cases when a director cannot be fired . However, this applies to any employee of the organization. All such situations are somehow related to children. You cannot fire:

- a woman during pregnancy;

- a woman with a child under three years of age;

- single mother of a child under 14 years of age or a disabled child under 18 years of age;

- another person who is raising a child under 14 years of age or a disabled child under 18 years of age without a mother;

- a person who is the sole breadwinner of a child under 3 years of age, if there are three or more children in the family, or a disabled person under 18 years of age.

This does not mean that the persons mentioned cannot be fired. For this, there are special grounds for their dismissal, provided for in Articles 81 and 336 of the Labor Code of the Russian Federation.

An employment contract cannot be terminated if the employee is on vacation or sick leave. The exception is the liquidation of the company.

Introductory information

The situation when a company is headed by its “founding father” is not uncommon in practice. Moreover, often such a manager is ready to perform his functions without receiving a monthly salary. There can be many reasons for this. There is a banal lack of funds, a desire to save on taxes and contributions, and simply a reluctance to “bother” with additional accounting and personnel issues. Unfortunately, regulatory agencies also play a significant role in this approach; they cannot decide whether the director, the sole founder, needs an employment contract. So such a manager works without a salary and an employment contract. But how safe is this approach for the company?

Practical conclusions

In conclusion, we present some practical conclusions.

- Current legislation does not provide for any other option for formalizing relations with the director - the sole founder (who is not an individual entrepreneur), other than concluding an employment contract with him. Without an agreement, the activities of such a manager acting on behalf of the organization may be recognized as unlawful upon the claim of one of the company’s counterparties, which could jeopardize the business as a whole. Thus, an employment contract is needed, first of all, to protect the business, that is, the decisions that the manager makes and the documents that he signs.

- Labor relations, by virtue of the direct and repeated instructions of the Labor Code, imply the calculation and payment of wages. Violation of this rule is fraught with at least an administrative fine. Accordingly, if an employment contract has been concluded with the manager, the sole founder, then such employee must be accrued and paid wages in the amount specified in this contract. The law does not allow replacing wages with dividends.

- Concluding an employment contract with the manager, the sole founder, is a step that resolves numerous conflicts with regulatory authorities. Thus, such an agreement removes uncertainty regarding the calculation of insurance premiums (they must be calculated) and the reporting of contributions (they must be provided). In addition, the employment contract allows you to safely pay various social benefits to the manager. Finally, an employment contract makes it possible to include wages in expenses when determining the tax base for income tax, the unified “simplified” tax or the Unified Agricultural Tax, and in the event of claims being made, to successfully defend this right in court.

Who is the director

Regardless of what company the director heads - a small company or a large organization - he is the sole executive body of the legal entity . The position may be called differently, but this does not change the essence. A small company is headed by a director or CEO, while a corporation may have a president. Moreover, there may be several directors: financial, commercial, and so on. But there is always one main person to whom all other leaders report. Most often this is the CEO.