A legally savvy homeowner will easily understand how to get a tax deduction for property renovations. But for all other people, such a procedure will become a serious problem. You will have to take into account many pitfalls and nuances of the situation itself:

- what to do if the property belongs to several owners;

- how to receive funds separately from property return after purchase;

- what documents are needed when applying for a military mortgage, etc.

Without a detailed and professional analysis of each issue, it will be difficult to issue a tax deduction for apartment renovation. Therefore, we offer detailed recommendations for completing the procedure.

Conditions

First you need to understand who is entitled to such a benefit. You can count on it:

- Citizen of the Russian Federation, officially employed and receiving a salary;

- A person who pays income tax on all types of earnings;

- An owner of residential property who has not previously received such payment.

All of the above conditions must be met in their entirety. How much you will get back from the funds invested in the renovation depends on the amount spent.

It will have to be documented. A tax deduction is allowed for repairs in a new building or in an old house, but this also has its own characteristics. We will talk about each of them below.

Is it possible to receive compensation for repairs separately from property coverage from the purchase of an apartment?

It is not possible to receive a separate deduction for repairs. Repair costs are taken into account as part of the property deduction due for the purchase of an apartment and in total cannot exceed 13 percent of 2 million - this is in the amount of 260 thousand rubles (for example, real estate costs 1.5 million, then you can increase the amount of deduction due to repairs up to 2 million). You can arrange both options if you act correctly. The following points will have to be specified in the housing purchase agreement:

- indicate that the living space is transferred to you without finishing;

- check for the wording “unfinished apartment”;

- there is partial finishing - describe all the work done.

When purchasing real estate in a new building from a developer, you can apply for such a benefit without any special difficulties. The main thing is to draw up the contract correctly. If you are counting on a tax deduction for the renovation of an apartment in a new building that you purchased from someone other than the developer, then difficulties may arise.

Additionally, you should check the list of works according to a special classifier (it is indicated in the Tax Code). It also says that the following expenses may be included in actual costs:

- purchase of materials for interior decoration;

- requesting alteration services;

- development of a project or estimate by third-party specialists.

It turns out that the listed costs can be safely added to the list for personal income tax compensation.

About finishing costs specified in the mortgage agreement

When purchasing an apartment with a mortgage, two deductions are provided - a deduction for purchase costs and a deduction for paying interest on the mortgage (clauses 3 and 4 of clause 1 of Article 220 of the Tax Code of the Russian Federation). Sometimes the mortgage agreement specifies two amounts that buyers borrow from the bank. For example, 2 million rubles. — for the purchase of an apartment, 1.5 million rubles. - for its finishing. This is usually done when the sellers have owned the apartment for less than 3 years, which means they will be required to pay a tax of 13% * (the cost of the apartment is 1 million rubles). Here 1 million rubles. This is a standard deduction on which no tax is paid. All this is indicated in clause 17.1 of Art. 217 and paragraphs. 1 item 2 art. 220 Tax Code of the Russian Federation.

Is it possible to include mortgage interest on the amount specified in the loan agreement as the cost of finishing the apartment? In our example with 1.5 million rubles. No, you still won’t get a deduction for this amount. Because deductions can be provided only for interest that is used to purchase housing. This is indicated in paragraphs. 4 paragraphs 1 art. 220 Tax Code of the Russian Federation. This position is in the letter of the Ministry of Finance dated August 17, 2012 No. 03-04-05/7-963.

Other articles

How to register in your apartment - step-by-step instructions.

If you have questions, you can consult for free. To do this, you can use the form below, the online consultant window and telephone numbers (24 hours a day, seven days a week): 8 Moscow and region; 8 St. Petersburg and region; all regions of the Russian Federation.

What objects are payments made for?

To apply for a tax deduction for the renovation of a house or other residential property, certain conditions must be met. The circumstances of the work, as well as the type of object, also matter.

- When purchasing housing on the secondary market or in a new building from a developer or realtor, reimbursement of expenses incurred for remodeling is allowed.

- If you purchase real estate from close relatives (1st and 2nd degree of relationship), you can’t count on a personal income tax refund.

- When buying housing from people with a distant degree of relationship, funds are paid in the general manner if you prove the legal right to provide them.

- There are no restrictions on cost, although the amount of coverage cannot exceed the value specified by law - 2 million.

- Receive a tax deduction for home repairs (a private house or cottage), if the documentation indicates a house and not a building. Moreover, the object should be considered unfinished.

- If you are building a house yourself, after registering the rights to it (while continuing to decorate the premises), you can include expenses in covering construction costs.

In general, each situation must be considered separately. There are other nuances with real estate that you need to remember when applying for compensation.

What is a property tax deduction

To encourage citizens to purchase real estate, Russian tax legislation provides for such a benefit as the provision of a property deduction. At its core, this is a refund of income tax paid to the budget, which amounts to 13% of the income of a working citizen. However, the law sets a limit on the amount with which such a deduction can be granted. It is 2 million rubles per person. The simplest mathematical calculation shows that the maximum amount of tax refundable is 260 thousand rubles.

It is worth considering that both spouses can receive a deduction for housing purchased after 2014. Moreover, everyone can claim their 13%. For example, a couple purchased an apartment for 4.5 million rubles. By law, each of them has the right to receive a deduction from 2 million rubles, that is, 260 thousand. You need to know that only taxes actually paid are returned. That is, if you paid 100 thousand rubles to the budget in a year, then only this amount will be paid to you. The remaining money must be repaid in subsequent years.

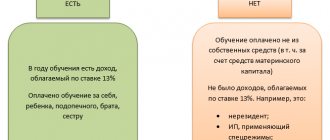

The law clearly establishes the criteria for obtaining a property tax deduction:

- Citizens who carry out labor activities under an employment contract, as well as under a civil law contract, are entitled to it, if 13% of income tax is withheld from their salary;

- Citizens who do not have official employment, maternity leave, individual entrepreneurs, pensioners (if the apartment was purchased after retirement), students and other persons whose income is not subject to income tax cannot receive a deduction;

- the deduction can only be received by the owner of the purchased property;

- the property must be residential, that is, intended for living;

- the apartment must be purchased with your own or credit funds, and not accepted as a gift and not paid for by an organization or a third party;

- To calculate the deduction, only the amount specified in the purchase and sale agreement is accepted, but not more than 2 million rubles.

It is noteworthy that the final amount may include not only the actual cost of the apartment, but also the costs of finishing it. If the housing is purchased with a mortgage, then a deduction is provided for interest in excess of this 2 million, but that’s another story.

A property tax deduction is provided to all personal income tax payers when purchasing housing for an amount not exceeding 2 million rubles, which may include finishing costs in the case of purchasing a new building.

Is it possible to return 13% for renovations in a secondary apartment?

It is possible to receive a tax deduction for the renovation of a secondary apartment, but it is important to take into account some specific features of the situation. Lawyers recognize this procedure as the most problematic - usually in such objects, repair work was carried out by the previous owners. And no matter what quality they were, refinishing is not considered when issuing funds.

In order for the money to be paid to you, you need to purchase housing where the premises have not yet been finished. This is often possible by entering into a purchase agreement with a reseller. But even here you will have to collect a bunch of papers in order to pay a tax deduction for the repair of secondary housing. It is worth enlisting the support of an intelligent lawyer in advance.

Please note that the contract of sale or assignment of claims must indicate that the object is being purchased with rough finishing.

Tax refund for apartment renovation

There are several ways to process tax payments for construction work on purchased property.

Papers are sent to NI in person and by mail (registered mail). The period for consideration of the application and processing of documentation is 3 months in both cases. It will take another month to transfer money to a current account (bank card), its number must be indicated in the application. The statement describes the desire to receive compensation for the purchase of an apartment and the improvement of living conditions carried out in it. In addition, a declaration is filled out in accordance with the law, all documents from the above list are attached. The funds will be transferred in a one-time payment or divided into parts (over several months or years depending on earnings). In practice, the waiting period is shorter.

The procedure for submitting documents and receiving benefits through the employer is slightly different. First of all, a citizen must submit an application to the Federal Tax Service and obtain permission for a subsidy. The application is considered for a month. After a positive decision and receipt of notification, the employee collects the same papers as the tax office, with the exception of the declaration and income certificate. The entire package is handed over to an accountant or employer, and after a thorough check, monthly payments are made (funds that were withheld to pay personal income tax).

Another way to get a refund for purchasing an apartment and construction work is through the State Services portal. The list of documents, the period for consideration and transfer of benefits is the same as in the Federal Tax Service. The main thing is to make high-quality scans of all papers, fill out the declaration correctly, and draw up an application. The entire path of the appeal can be tracked through the taxpayer’s account from submission to receipt of the refund.

In a new building

Living space purchased in a new house may be without renovation, with rough or fine finishing. The requirements for returning subsidies are slightly different. Let's take a closer look.

The apartment is unfinished, or “rough”. These cases are the most profitable, since receiving compensation will not be a problem, the main condition is that the papers are filled out correctly:

- The purchase and sale agreement states that the property was purchased without finishing.

- This information is attached to the declaration.

- A list of work carried out and materials purchased is attached, the data is supported by invoices.

- In case of shared ownership, one owner applies for a tax deduction, and the rest give their consent to this (in writing).

Partial finishing will bring a little more hassle during registration, since the inspector must see exactly what work was performed and whether it is included in the list of paid ones. You must provide the following information:

- Indicate what exactly was not produced by the developer.

- The transfer and acceptance certificate indicates the work to be performed by the owner.

- Funds spent on the purchase of furniture and plumbing cannot be returned.

Attention! An apartment with a fine finish is not included in the refund for repairs.

Secondary market

Resale is, as a rule, finished housing purchased from another owner. If a “custom” repair or simple transformation is carried out, then it will not be possible to return the money for it. But there is still a nuance that allows you to issue a refund.

When purchasing, the seller specifies in the contract the construction work that the buyer will have to carry out. If they are included in the legal list, then the return of benefits is possible.

There is no specific deadline for the return of compensation for the transformation, since the property deduction for the purchase and repair of property is issued together, no matter how long it takes.

For which houses can you get a deduction for repairs?

When it comes to private buildings, and not about living space in apartment buildings, there are certain nuances of obtaining compensation for alterations to housing. There are two situations worth considering.

- Purchasing a house from another owner.

If the documents indicate that you bought an unfinished residential building, then the costs for its completion are taken into account as part of the property compensation for personal income tax. When the agreement for the purchase of housing does not contain a clause that it is unfinished, then even with a complete renovation it will not be possible to return the tax deduction for repairs. - Building a new house on your own

. Having completed the registration steps, you continue to complete the construction of the property or decorate it - include the costs in the property coverage for personal income tax.

It turns out that you can compensate for the costs not only of finishing and repairing an old house. In the case of a new building, this is also allowed. The main thing is to properly prepare for receiving funds.

What does rough finishing mean and where should it be written down?

To apply for a tax deduction for apartment renovation, secondary housing must be properly registered. It is especially worth paying attention to such a nuance as rough finishing. Often, information about the presence or absence of such is indicated in the agreement on the purchase of living space or in the DDU.

Recommended article: How to buy a summer house with a mortgage

It is necessary to include information that the living space does not have interior decoration in a separate clause of the agreement. And it is advisable to list in detail the characteristics of the property. The rough finish itself suggests that:

- main entrance door installed;

- there are windows and a glazed balcony;

- sometimes there are partitions between rooms;

- there is a sewer system, but no plumbing;

- electricity is not supplied to the apartment;

- pipelines are blocked, etc.

Take this into account when applying for a tax deduction for repair costs. This list can also include the lack of a finished floor, wallpaper, switches and sockets, lighting fixtures, etc.

For what work is personal income tax reimbursement paid?

Much in this matter depends not on actual expenses, but on the literacy of paperwork. The more receipts, checks and other evidence of expenses you collect, the more money you will be able to recover (the maximum amount of reimbursement is limited by law). And to understand what is included in the tax deduction for repairs, you need to start with building materials. The process takes into account:

- how much was spent on the total cost estimate;

- what funds were spent on materials for the attic, veranda, etc.;

- carrying out communications such as telephone, gas, heating, etc.;

- plastering surfaces, whitewashing, installing skirting boards and other finishing;

- wooden panels, components, nails, etc.

It is important to indicate in the documents what materials were required for certain types of work and how exactly they were used. If you ordered the design of a future remodel, then the costs should include contacting the design bureau. But you need to collect supporting documentation.

Clause 3 of Article 220 of the Tax Code of the Russian Federation on tax deductions

Even if you know how to get a tax deduction for apartment renovations, remember that such benefits are not provided automatically. They must be applied for, confirming the final amount of compensation with the relevant authorities. If you need to return funds for developing a project, provide an agreement with experts and receipts confirming payment for services. If you want to get money for building materials, collect evidence of their purchase and use. This is the only way to provide a tax deduction when purchasing an apartment and renovating premises.

What documents confirm expenses?

When purchasing finishing materials, checks, bills, receipts, contracts, etc. are suitable. It doesn’t matter whether the owners did the finishing themselves or ordered the service from specialists. The main thing is that the documents make it clear what was purchased and where.

Documents for payment for finishing work services - service agreements, acts, receipts. The main thing is that they indicate the name of the work as in the above-mentioned classifier of types of economic activity. Insist on it.

If the services are specified by an individual, his passport details must be included in the contract. This is a requirement of the tax office. It will be a problem if an individual does not declare his income. After all, the tax office may ask him for clarification. Therefore, he can raise the price for his work by the amount of the deduction for it or refuse to perform services. Here you need to decide according to the situation.

If, along with the purchase of, for example, windows or kitchen units, their installation was ordered, the contract must indicate a separate amount for production and a separate amount for installation.

The same applies to documents for the provision of services for drawing up a project for finishing an apartment and estimates. Service agreements, acts, receipts are suitable.

Compensation amount, calculation example

The total amount is determined based on actual expenses for finishing work, supported by documents. The law limits the maximum amount of compensation. It is 13% of the costs incurred, but not more than 260 thousand rubles per person (that’s thirteen percent of two million). When housing is purchased through mortgage lending, funds are calculated taking into account the interest on the loan.

It is important to make a note in the documents that the purchased property has not been finished. Then a tax deduction for apartment renovation will be paid.

If we are talking about new real estate, then in the act of transferring it to the owner, you need to indicate the percentage of readiness of the premises and a list of improvements necessary to complete construction work. It is better to consider the method of calculating a certain amount of coverage using an example.

A citizen purchases a one-room apartment for 1,700,000 rubles. Then repair and finishing work is carried out at a cost of 200,000 rubles, and furniture is purchased for another 150,000 rubles. It will not be possible to receive funds for pieces of furniture, and therefore it is better to eliminate these expenses immediately. As a result, the amount from which the property tax deduction for apartment renovation is calculated is 1,900,000 (1,700,000 + 200,000) rubles. Subtract 13% from it, and you get 247,000 rubles. This will be the final amount of compensation.

We generate expenses for deduction

When creating an application for a deduction, you can specify:

- the cost of finishing materials used;

- the cost of work performed by construction company specialists.

The ideal option is to order a repair service based on a design project. If you bought an apartment from a developer without finishing, then contact a specialized construction company. Select and agree on the design, wait until the specialists complete their work. Such companies will always help you correctly formulate an application to the tax office and carry out all the work efficiently. You will be able to move into an apartment that is convenient for living and at the same time save on compensation for repairs.

Complete turnkey apartment renovation

- Everything is included The cost of repairs includes everything: work, materials, documents.

- Without your participation After agreeing on the project, we only bother the owners when the repairs are completed.

- The price is known in advance. The cost of repairs is fixed in the contract.

- Fixed repair period Turnkey apartment renovation in 3.5 months. The term is fixed in the contract.

Read more about Done

When compiling a list of work that was carried out during the renovation of an apartment, you cannot include the costs of purchasing furniture. But you have the right to indicate in the list of works the installation of furniture or the installation of a wardrobe.

The cost of materials and work performed during the redevelopment of an apartment cannot also be included in the list for deduction. The tax office takes into account those materials and work that can prepare the apartment for use, and not to improve its functionality.

Important!

Formation of an application to the Federal Tax Service is a one-time process. You cannot first declare some works and then add others. The application is submitted after the repair is completed.

To receive the amount of compensation for repairs, it is necessary to pay great attention to the wording that will be indicated in the application. Any contractor will go to great lengths to please the client. Therefore, ask the specialists of the company that will carry out the finishing to write the work in the estimate as you indicate.

You won’t be able to get a deduction for a design project, so you can’t include it in the tax document. But you can get a deduction for developing estimate documentation.

Another nuance is related to the air conditioning system. If the wording is exactly this (“air conditioning system”), then this gives the right to receive compensation. But if you suddenly write “installation of a split system,” then the tax office will not allow you to receive a deduction for this.

The situation is similar with windows. Installing windows in premises gives grounds for receiving a deduction. But if you want to install glass structures on the balcony and receive compensation from the tax office for this, you will be disappointed. Tax refunds are not available for such work. As in other matters, when replacing windows that have already been supplied by the developer as part of the cost of the property. If windows were not included in this cost, then you can include them in the list of repair expenses.

What documentation is required to apply for benefits?

You need to start the procedure for receiving funds by collecting a minimum package of papers. When they are ready, go to the authorized authorities. In a standard situation, you need to collect the following documents for a tax deduction for repairs:

- confirmation of income (form 2NDFL);

- 3NDFL declaration and a copy of the housing purchase agreement;

- all acts and certificates proving rights to real estate;

- checks and other similar papers;

- application, TIN and passport of the applicant.

When submitting repair receipts for tax deduction, be sure to include specific materials. If there are invoices or an agreement with the construction company, attach them too. The certificate confirming the applicant's income will have to be marked with the seal of the employing company. This document must bear the signature of the manager.

The certificate and declaration are provided only in originals. And all contracts must be copied. Moreover, the agreement confirming the purchase of the object must contain information that it was transferred to the new owner without finishing. The application must indicate the details of the account to which the funds will be credited. One of the shareholders is a minor; a birth certificate of such an owner will be required.

Recommended article: What is more profitable: a new building or a secondary mortgage?

In order to easily receive a tax deduction for home renovation, you need to pay special attention to filling out the 3-NDFL declaration (Instructions for filling out 3NDFL). It will take approximately three months to check the package of documents and application. The Federal Tax Service found inaccuracies or the necessary paper is missing - they will refuse compensation. The payments themselves are made in stages.

Extracts from the Unified State Register, certificates, acts of transfer of an object, etc. are used as documents confirming ownership rights. If you have taken out a mortgage loan with a bank, you will have to attach the corresponding agreement. It is advisable to take with you not only copies, but also originals. Although a lot depends on through which authority you submit the package of papers.

List of documents

To receive benefits for finishing work when purchasing real estate in a new building, you need to collect a package of documents:

- passport of a citizen of the Russian Federation;

- TIN;

- declaration;

- statement;

- income certificate (2-NDFL);

- contract of sale;

- act of acceptance and transfer of ownership of housing;

- payment papers (checks, receipts, etc.);

- birth certificate (if there are minor children among the owners).

One of the most important documents is Form 3-NDFL. It is filled out according to all the necessary data and without errors. Copies of documents are submitted to the Federal Tax Service, but take the originals with you.

For reference! Accrued funds are returned in parts, over several months or years. This depends on the applicant's earnings.

Where to apply for tax benefits

Knowing how to return a tax deduction for apartment renovation, you also need to understand which department to apply for such a payment. The only authority is the Federal Tax Service, but there are different options for receiving funds.

- You can submit your application and papers directly to the tax authorities. Then you will need proof of income (2NDFL) and a declaration (3NDFL). The application must indicate the account details where the specific amount will be transferred.

- The second option is to apply through your employer. Then you won’t have to confirm your income and fill out a declaration. Along with the rest of the papers, you should come to the Federal Tax Service. After consideration of the application (within a month), a notification will be provided here. It is sent to the accounting department of the company where the applicant works. In this case, obtaining a tax deduction for apartment renovation is possible by refusing to pay 13% income tax.

- Or you can submit an appeal through the State Services portal. You only need to register, prepare the above documents (the declaration is filled out online), and fill out the application through your personal account.

In the first case, you can send an application to the Federal Tax Service in person, by mail or through a representative. But you will have to obtain a certificate from your place of work yourself. To eliminate the risk of refusal, you should first consult with a lawyer.

How to apply

The application and the required package of documents can be submitted to the Federal Tax Service in several ways:

- in person;

- with the help of a representative by proxy;

- by mail with notification and a list of the contents;

- remotely using your personal account on the tax service website or through the government service portal.

The application must be completed correctly. Contact the Federal Tax Service to obtain the correct form. You can also entrust filling out the application to specialized organizations. For a small fee, they will do all the work for you. If you still decide to cope on your own, consider a few nuances:

- correctly fill out the “header” of the application - the name of the authorized body and your personal data with a contact phone number;

- be sure to indicate the period for which you are making a return;

- write down all the costs incurred (in accordance with OKVED);

- Put a date and signature on each sheet of the application.

You can submit a return application for each stage of work without waiting for it to be completely completed. For example, this year you plan to only plaster, and next year you plan to wallpaper the walls and lay the floors. After each period of work, you can send documents to the tax authorities.

When will a deduction for repairs be denied?

If you already understand how to get a tax deduction for home renovations, you need to find out in what cases this will not be possible.

- Most often, they are denied when the applicant cannot confirm the right to such compensation, or the documents are incorrectly drawn up or one of them is missing.

- When purchasing residential space on the secondary market with renovation, it will not be possible to obtain a 13% personal income tax refund, even if the existing finishing does not suit the new owner.

- When housing was purchased from close relatives of the first and second stages, you cannot count on compensation either.

- If the contract for the purchase of a private house does not indicate that you purchased an unfinished property, then a refund of the tax deduction for repairs is impossible.

- Additional problems will arise for unemployed citizens, pensioners, or parents on maternity leave. Although some of them are resolved within the framework of the law.

- Other situations where there are discrepancies with the law or the requirements for an applicant to receive coverage.

In other cases, you can safely count on the successful consideration of the application by the Federal Tax Service.

How quickly are funds transferred and where?

If you were able to obtain a tax deduction for the renovation of a new apartment or other home, you will have to wait until the entire amount is in your account. Sometimes the procedure lasts for years, but much here depends on the salary of the person applying - the higher the salary, the greater the lump sum compensation. The amount paid cannot exceed the applicant's monthly income.

When calculating the timing and frequency of payments, the citizen’s annual income is taken into account:

- the official salary for the year is 2,000,000 - the entire amount is paid at once in one payment;

- the official salary is slightly more than a million rubles - payments are divided over two years (the exact terms depend on the base amount);

- income not exceeding 1,000,000 rubles - the tax deduction for the renovation of a purchased apartment is divided into three years or a longer period.

For example, if a citizen’s salary is 60 thousand rubles per month, the maximum possible compensation (260 thousand rubles) is paid for five years. For four years the applicant will receive 60,000, and in the last year he will be paid the balance - 20,000 rubles.

Funds are transferred to the bank account specified in the application. Or it is possible to abolish income tax (13%) for a certain period. For all years included in it, the citizen will not pay this fee to the Federal Tax Service.

Recommended article: How to get a tax deduction for a co-borrower on a mortgage

The procedure for registering a property deduction including finishing

In order to receive money for finishing the apartment purchased in a new building, you need to go through several steps:

- Collect a package of documents.

- Submit them to the tax office within the prescribed period.

- Wait for the result of the desk audit and receive the money.

Let's look at everything in order and in more detail.

Collecting papers

The most important document, without which it is impossible to obtain any type of tax deduction, is the 3-NDFL declaration. It contains information about all the taxpayer’s income, income tax deductions and expenses incurred as a result of the purchase of housing and finishing work in it. You can fill it out manually yourself or hire a specialist for this purpose. However, it is much easier to use a special program that can be downloaded from the tax service website.

Certificate 3-NDFL consists of several sheets of A4 format with information about the taxpayer (including passport data and TIN), his place of residence and place of work. The first sheet also contains the name of the tax department to which the package of documents will be sent. All sources of income from which personal income tax is paid are indicated on a separate sheet. Another sheet is devoted to the costs of purchasing and finishing housing. Each page indicates the date of application and the taxpayer's signature. Don't forget to indicate for which tax period you want to receive the deduction.

In addition to this declaration, you must provide the following documents:

- certificate 2-NDFL, which must be taken from the accounting department at work, signed by the director and stamped;

- a copy of the purchase and sale agreement, which must clearly state that the apartment was purchased without finishing;

- certificate of ownership of housing or an extract from the Unified State Register of Real Estate (in case of purchasing a new building after the introduction of the new law);

- documents confirming the costs of finishing: checks, contract agreements, certificates of completed work, invoices;

- an application to the tax office for a deduction indicating the details of the bank account to which the money will be transferred to you if the application is approved;

- owner’s passport and TIN (copy);

- birth certificates of children, if they are also owners of this apartment on the basis of shared ownership.

All documents provided should not raise doubts about the authenticity of the tax authorities. Otherwise, you will be denied a deduction.

When all the documents are ready, you can submit them to the tax office. How and when to do this, read on.

Ways to apply for a tax deduction

Today you can use one of 4 ways to apply for a deduction when purchasing an apartment in a new building. For those who are used to doing everything the old fashioned way and have enough time, there is a classic way - a personal visit to the tax inspector. The advantage of this method is that all documents will be immediately inspected, and if there is any misunderstanding on the part of the inspector, they will be returned to you for revision.

The second method is transfer through a proxy. Most often, this role is played by a private trader who makes money from such intermediary actions. Its services are still in demand, since it is quite difficult to fill out the 3-NDFL declaration on your own without the help of the program. This person not only helps you submit a package of documents to the tax office, but also prepares it himself. At the same time, the probability of refusal due to incorrect registration tends to zero.

The third method is to send documents by mail with notification. However, here you need to take into account the likelihood of a return due to incorrect registration, which can occur after a certain period of time. Although, if you are sure that there are no shortcomings, there is nothing to worry about. This method is used in remote settlements where there is no Federal Tax Service division.

The easiest and most convenient way to submit an application is through the website of the Federal Tax Service or State Services. We fill out the 3-NDFL declaration using the program downloaded there and attach the file in the required location. We also upload scanned copies of other documents there. We send the application and wait for the result. If everything is fine, the application status will change to “accepted”. From this moment, a desk audit of all documents begins, the period of which is 90 days.

When do you need to apply for a deduction and how to get it?

Applications for any deduction are submitted after the end of the tax period. That is, when buying a home, you can only submit an application for the next year. Unlike filing a declaration for the sale of housing, which is submitted before April 30, there are no such restrictions here. However, you will only be able to receive deductions for the 3 years that preceded the filing of the application. That is, if you purchased an apartment 5 years ago, but have not yet exercised your right, you can do it now by submitting 3 applications at once. Pensioners have the right to receive a deduction for the last 4 years in which they worked if they purchased housing before retirement.

Since the average employee is able to pay personal income tax per year no more than 40 - 80 thousand rubles, you are unlikely to be able to get all 260 thousand rubles at once (unless, of course, your salary is more than 166 thousand rubles per month). Therefore, be prepared that it will take several years to write applications. You can get money in two ways:

- One-time payment of the entire amount due for the year to the account specified in the application. Every year you need to write a new application until the entire deduction amount is paid. The period depends on the transferred personal income tax, that is, on the size of the taxpayer’s salary. For example, with a salary of 30 thousand rubles, the pleasure will last for 6 years.

- Don't pay personal income tax. Upon notification from the tax office, your accountant simply will not withhold personal income tax from your salary. This is also good, but most people prefer the first method, since receiving a large amount at once is somehow more pleasant than receiving a little every month.

Each person has the right to choose the method of tax refund. The main thing is to collect the documents correctly and submit them on time. If all the requirements described above are met, it is not very difficult to include the costs of finishing it in the property tax deduction for the purchase of a new building.

How to compensate for 13% personal income tax if maternity capital was used during the purchase

In any case, you need to take into account the costs of renovating your apartment for tax deductions. But in the situation with maternity capital, everything turns out differently. The Tax Code of the Russian Federation states that material assistance from the state is not subject to a 13 percent tax, which means there is simply nothing to return if you spent maternity capital on finishing.

But sometimes it is possible to cover the costs. It is transferred to the family’s account, taking into account the previously paid personal income tax on the purchase of real estate. To apply for a tax deduction refund for the renovation of an apartment and its purchase, you will have to meet standard conditions (availability of an official salary, Russian citizenship, etc.).

The total amount is calculated minus funds invested from maternity capital. It turns out that if housing cost 2,000,000 rubles, approximately half a million in state aid must be subtracted from this amount, and 13% must be calculated from the remaining 1.5 million.

Works and materials that you purchase at your own expense

- plumbing installation;

- purchase of interior items, furniture;

- payment for notary services;

- purchasing the tools needed to carry out repairs;

- installation and dismantling of existing windows;

- redevelopment;

- delivery of building materials to the repair site.

Is it possible to get money if the apartment is registered to a spouse who is on maternity leave?

One of the conditions for obtaining a tax deduction for materials for apartment renovation is the presence of an official salary and work. But while on maternity leave, the young mother has no income. Therefore, if real estate was acquired during marriage, the following have the right to apply for compensation:

- father of the family, if there are sufficient grounds;

- spouse, at the end of maternity leave.

At the same time, it is worth taking into account the clarifications of the Ministry of Finance, which states that in this case it will not be possible to receive a double standard deduction. All due to one parent being on maternity leave and lack of regular income.

To receive a tax deduction for building materials in a new building, you need to submit the documentation listed above. The final package includes: confirmation of the purchase of materials, a housing purchase agreement, papers for the applicant, etc. If a marriage contract is concluded between the spouses, which provides for other rules for the division of property, then a copy of it must be added to the list of documents. The procedure for paying compensation will be regulated by this agreement.

Types of finishing for which tax deduction will be carried out

Not all types of work and not all finishing costs can be reimbursed. We want the reader to have a complete understanding of how the work and materials to be paid are selected. To do this, let’s look at the basis on which the Federal Tax Service operates.

In their work, all services and government bodies rely on the regulatory framework. Not a single setting is taken out of thin air and is not determined at the discretion of the specialist accepting the documents. So it is with home renovation in a new building. The list of partially paid jobs is taken from the All-Russian Classifier of Types of Economic Activities (OKVED). Any types of activities that are legal in our country are listed in the OKVED directory. Therefore, the work carried out in your apartment must correspond to the officially established name in the directory. Before accepting a receipt for purchasing materials or performing work, check them for compliance with OKVED. Do not hesitate to ask work crews to enter the required wording into payment documents.

In new buildings the following are paid:

- the actual work performed;

- purchase of building materials;

Let's look at this list in expanded form. So, the types of work that are included in the directory, and which can be the tax base for the return of part of the funds:

- drawing up cost estimates;

- conducting gas, electricity, water consumption and wastewater disposal;

- plaster;

- decoration of walls and floors;

- Carpentry and carpentry work;

- surface painting work;

- wallpapering walls;

- ceiling finishing;

- any other finishing work.

As with everything related to interaction with officials, this list has a number of nuances. There are works and purchases that will not be taken into account to form the tax base.

Is it possible to receive personal income tax compensation for a pensioner or an officially unemployed person?

Considering that the deduction for repairs and decoration of an apartment is a refund of taxes paid by a citizen, usually no payment is made to the unemployed. Work experience does not affect the provision of compensation. Even if a person got a job for the first time a month ago, he will be refunded personal income tax in the amount paid. In the case of the unemployed and pensioners, the situation must be considered individually.

- You can return 13% for repairs in a new building when it comes to persons carrying out activities under a contract.

- When a citizen regularly pays personal income tax (from the sale of property, renting out an apartment, etc.), even without being officially employed, he has the right to count on compensation.

- If in the future a pensioner or unemployed person receives a position in a company, he will be able to count on this benefit (13% return).

- Pensioners return personal income tax for the past three years, while other categories do not have similar rights.

None of the options suits you - it is permissible to apply for such coverage for an employed relative. But here we are talking about common property.

What to do if the apartment was purchased with a military mortgage

According to the law, when using someone else's funds (sponsor, employer, etc.) to purchase housing, a refund of personal income tax paid is impossible. Military mortgage involves the use of funds allocated from the savings-mortgage program (NIP). This means that when purchasing real estate, a serviceman does not spend his own money, which means he should not expect a return.

However, there are cases when you can count on such payments.

- Provide a package of documents containing a list of finishing materials for tax deduction, proving that your own funds were spent on their payment.

- The cost of housing in the mortgage agreement is greater than the amount of compensation under the NIP - 13% of personal income tax is returned from the difference between the two amounts.

Having in hand documents proving one of the above facts, you can count on tax benefits in the form of a 13% refund. Otherwise the procedure remains standard.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateJuly 17, 2019October 25, 2019