In what cases are you entitled to a deduction What can be included in the deduction What cannot be included in the deduction If payment documents are lost When can you apply for a deduction Documents for deduction when building a house Amount of deduction when building a house Did you take out a loan to build a house? House finishing costs

If you built a house, you can get back some of the money spent on construction. It doesn’t matter whether it was your personal savings or borrowed ones. This is stated in paragraphs. 3 and 4 clauses 1 art. 220 Tax Code of the Russian Federation. In the first case, you receive a tax deduction for the construction itself, in the second, you also receive a tax deduction for the interest you paid to the bank for the loan.

In order to receive a property deduction for a built house, a number of conditions must be taken into account.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

In what cases are you entitled to a deduction?

1. You purchased a plot of land and built a residential building on it

We are talking specifically about a residential building, and not about a residential building. The Letter of the Federal Tax Service of the Russian Federation dated 02/15/2018 N GD-4-11/ [email protected] “On the procedure for applying the property tax deduction for personal income tax” and the Letter of the Ministry of Finance of Russia dated 02/08/2018 N 03-04-07/7700 states :

“In accordance with the current legislation of the Russian Federation, the terms “residential building” and “residential building” are not identical.”

Thus, from paragraphs. 3 and 4 clauses 1 art. 220 of the Tax Code of the Russian Federation follows:

“...there are no grounds for applying property tax deductions provided for in Article 220 of the Code during the construction or acquisition of a residential building that is not recognized as a residential building.”

It should be taken into account that, according to Letter of the Ministry of Finance of Russia No. 03-04-05/27085 dated 05/03/2017:

“If a residential building is recognized as a residential building, a property tax deduction, the taxpayer has the right to receive the specified tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of Article 220 of the Code, taking into account the established requirements.”

So, one thing is important for us - you can return the tax if you built a residential building with the right to register in it, registered it with Rosreestr and received an extract about it.

Place your order and we will fill out the 3-NDFL declaration for you!

Order a declaration

Example:

In 2021, you bought a plot of land for personal subsidiary plots (personal subsidiary plot) and built a house on it. According to the documents, it is registered as a residential building without the right of registration. In this case, you are not entitled to a tax deduction. But if the house is recognized as a residential building with the right to register in it, you can receive a property tax deduction for it.

2. You bought a house under construction and completed it

Attention! If you plan to receive a refund not only for the purchase of the house, but also for its construction, carefully draw up the purchase and sale agreement. It must indicate that you are purchasing an unfinished construction project.

Example:

In a cottage village, a plot of land with an unfinished house was for sale. You have correctly drawn up the purchase and sale agreement and stated that you are buying an unfinished construction project.

After you finish building the house and receive an extract from the Unified State Register of Property Rights, you can submit documents to the tax office. The deduction will include both the costs of purchasing an unfinished house and construction costs.

Example:

You found a house you liked and rebuilt it as you saw fit: you carried out various types of reconstruction, expansion and improvement. Since you purchased a finished house and not an unfinished construction project, you will not be able to include construction costs in your tax deduction.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Purpose of the site for obtaining a deduction

Land plots vary depending on their intended use. For example, land for individual housing construction (IHC) is intended for the construction of residential buildings on it, but the intended use of a site intended for gardening does not provide for this possibility.

However, for the purposes of obtaining a tax deduction, the key condition is not the purpose of the land plot, but the presence of an individual residential building on this plot (Letter of the Federal Tax Service of Russia No. ED-4-3 / [email protected] dated December 10, 2012).

Thus, the possibility of obtaining a deduction when purchasing a land plot directly depends only on the possibility of obtaining a deduction for a residential building located (built) on this plot.

Example: Krasilnikov V.V. bought a plot of land and built a country house on it (not a residential building). Krasilnikov will not be able to receive a property deduction, since the deduction is provided only for a residential building. However, if a country house is recognized as a residential building, in addition to the deduction for the house, it will have the right to include in the deduction the costs of purchasing a land plot.

What can be included in the deduction

When applying for a property deduction for building a house, keep in mind that not all of your expenses will be taken into account when returning your personal income tax.

What expenses are deductible:

- acquisition of land for construction;

- purchase of an unfinished construction project (residential building);

- ordering and payment of design and estimate documents;

- connection to general engineering networks and communications: electricity supply, water supply, sewerage, gas supply;

- construction of autonomous networks and communications: electricity supply, water supply, sewerage, gas supply;

- construction/finishing materials;

- construction work and finishing.

Do not forget to save all payment documents for purchasing materials and placing paid orders. It is on the basis of these documents that you will claim your right to a tax refund.

Quick deduction service: personal income tax refund in 7 days, not 4 months!

Order service

Conditions of receipt

The conditions for obtaining a deduction are described in Article 220 of the Tax Code

, as well as in

Federal Law No. 202-FZ of July 19, 2009

, which introduced certain amendments to this article.

Main conditions:

- the plot must be purchased after January 1, 2010, if it was purchased earlier, then it will not be possible to issue a deduction;

- the plot must be intended for the construction of a residential building, that is, it will not be possible to receive a deduction for garden or dacha plots, or it will be necessary to prove that the garden house complies with the standards of residential premises enshrined in Article 15 of the Housing Code;

- a residential building must be built on the site that complies with all urban planning standards, and ownership must also be registered.

There are certain requirements for the recipient of the deduction:

- he must be a tax resident of the Russian Federation;

- during the reporting period for which the deduction is requested, they had to pay taxes to the country's budget (that is, the unemployed, pensioners, dependents and other citizens who do not have taxable income will not be able to issue a deduction);

- the purchase and sale transaction should not be concluded between interdependent persons, which, according to Article 105 of the Tax Code,

include close relatives, as well as step-grandparents (that is, the grandparents of the spouse); - the property must be paid for from the buyer’s personal funds, and not at the expense of the employer or the state (that is, a tax deduction is not provided for that part of the property that was paid for with maternity capital, a military certificate or other housing subsidy).

In addition to the deduction for the plot itself, you can apply for a deduction for interest paid on a loan or mortgage.

However, it should be taken into account that in reality this is not always possible, since citizens usually file for tax refunds for the past period in full, and there are simply no “reserves” left to receive other deductions.

For example, in 2014, a citizen paid taxes for 14,000 rubles.

If he returns this entire amount, using his right to receive a deduction for the purchase of a land plot, then he will not be able to formalize deductions for the mortgage due to the fact that all withheld taxes will already be returned to him.

What cannot be included in the deduction

According to letters from the Ministry of Finance of Russia dated January 20, 2011 No. 03-04-05/9-15; dated August 24, 2010 N 03-04-05/9-492; dated January 20, 2011 N 03-04-05/9-15; dated September 15, 2010 No. 03-04-05/9-545 the tax deduction does not include:

- redevelopment of premises in a built house;

- redevelopment and reconstruction of a built house, including the construction of floors or extensions;

- installation of plumbing, gas and other equipment;

- construction of adjacent buildings: swimming pool, bathhouse, garage, barn, fence, etc.

- a gas boiler;

- air conditioning systems;

- any plumbing equipment: shower, bath, toilet, faucets, water meters;

- production and installation of loggia glazing;

- cost of purchasing plastic windows;

- warm floor;

- sound insulation;

- installation of electrical wiring, telecommunications, computer network and cable television wiring.

Example:

You bought a plot of land with an unfinished house, completed construction and decided to build a swimming pool on the plot. Costs for the pool will not be included in the tax deduction. You will receive a tax refund only for the purchase of land, purchase of a house, construction and decoration.

Information support from a tax expert of the online service NDFLka.ru means a correctly completed 3-NDFL declaration and receiving the maximum possible tax deduction when building a house!

Legislation

The conditions for the return and registration of tax deductions are established by the Tax Code and are associated with other rules for collecting duties on the income of individuals:

- Article 207 specifies who the taxpayer is:

- residents of the Russian Federation;

- non-residents of the Russian Federation.

Only these entities have the right to receive a deduction from personal income tax. Legal entities cannot issue a refund on this basis, because don't pay this tax.

Dear readers! To solve your problem right now, get a free consultation

— contact the lawyer on duty in the online chat on the right or call: +7 (499) 938 6124 — Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will solve all your problems!

- In Art. 216, the tax period is established - a calendar year. This is important to remember, since the amount of the refund within this period is limited to a certain amount.

- The list of existing deductions is established in Articles 218–221. The return of tax for the purchase of land relates to property (Article 220).

When can you apply for a deduction?

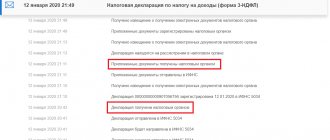

In order to receive a personal income tax refund, you need to contact the tax office. According to paragraphs. 6 clause 3 art. 220 of the Tax Code of the Russian Federation, among other documents, it is necessary to provide an extract from the Unified State Register of Real Estate.

This means that until you have registered title to the house and received a statement, you cannot claim the property deduction.

So, first you need to complete the house, then register it as a residential building (not as a residential building!) and receive a document of ownership. Only after this should you contact the Federal Tax Service at your place of residence.

You can submit a 3-NDFL declaration and an application for a deduction for building a house the next year after receiving an extract from the Unified State Register of Real Estate. In order not to wait for next year, and start receiving a deduction this year, contact the tax office for a notification and apply for a property deduction from your employer.

Example:

In 2021, you bought a plot of land and began building a residential building. In 2021, construction was completed, in the same year you registered your property rights, about which you received an extract from the Unified State Register of Real Estate. You can send documents to the tax office no earlier than 2022. The month of submission of documents does not matter.

It is not necessary to go to the Federal Tax Service next year. Since the property deduction works without a statute of limitations, you can do it in a year or two. But remember: if you want a refund for past periods, this refund will only apply to the last three years.

Example:

You received title to the house in 2015. They decided to contact the Federal Tax Service in 2021. You have the right to get a tax refund for 2021, 2019, 2021.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

Features of the return of overcharged amounts

Excessively collected amounts are a consequence of additional tax charges, which subsequently turn out to be illegal. For example, you were checked, additional taxes and penalties were assessed, and possibly a fine. You paid it all, and then successfully appealed the additional charges in court. You have every reason to return what was collected illegally.

To refund taxes in such a situation, the rules of Art. 79 of the Tax Code of the Russian Federation, which differ from the return of overpayments in the following:

- You can submit an application for a tax refund not only to the inspectorate, but also directly to the court.

- To receive a tax refund, the taxpayer submits an application to the tax authority - the period for filing it has been increased from 1 month to 3 years.

- Tax authorities have 10 days from the date of receipt of the application to make a decision on the refund of the overcharged tax.

- Amounts are returned with interest in any case, and not only if the repayment deadline is violated.

The application form for the return of overcharged amounts is the same as for the return of overpayments.

The procedure for a citizen to obtain a tax deduction when purchasing a land plot

- Check if you are eligible for a tax deduction

- If you are married, then you need to distribute the tax deduction between the spouses

- Prepare the necessary documents for tax deduction

- Calculate the amount of deduction and tax to be refunded

- Select the appropriate option for personal income tax refund

- Submit documents to the tax office

- Get a deduction and get a tax refund

List of documents for tax refund

To receive a personal income tax refund when purchasing a land plot, the following documents are submitted through the tax office:

- tax return in form 3-NDFL (original),

- application for refund of overpaid tax (original),

- certificate 2-NDFL (original),

- agreement for the acquisition of a land plot/land plot and a residential building with annexes and additional agreements thereto (if concluded) (copy),

- documents confirming the taxpayer's ownership of a land plot or share(s) in it, and documents confirming ownership of a residential building or share(s) in it (copy),

- documents confirming payment (copy).

When receiving a tax deduction for the purchase of a land plot (its share), the child’s birth certificate is additionally submitted to the child’s ownership.

When purchasing a plot of land, spouses may need the following documents:

- marriage certificate (copy),

- agreement on the distribution of expenses for the purchase of a land plot (application for the distribution of deductions) between spouses (original).

Tax Refund Options

There are two ways to receive a deduction when buying an apartment.

With the employer this year. In this case, you do not need to submit a declaration in Form 3-NDFL. The deduction will be provided based on notification. The tax office issues such a document upon application. This method of providing a deduction is that the employer reduces taxable income for the year by the deduction amount and ceases to withhold personal income tax. You receive it along with your salary.

According to the declaration next year. This option is suitable for returning personal income tax for previous periods or in the absence of an employment contract. You can file your return at any time during the next year or even later. The April 30 deadline for deductions does not apply: it must only be observed when declaring income.

Documents for tax refund when building a house

In most cases, the right to a property deduction applies not only to the purchase and construction of a house, but also to the purchase of a land plot.

All these expenses can be entered into one 3-NDFL declaration. Below we provide a complete list of documents for tax refunds for the purchase of land, houses and construction.

You will need copies of:

- Passport. To check with the Federal Tax Service, you must present the original.

- Extract from the Unified State Register of Real Estate to your home.

- Extract from the Unified State Register of Real Estate for land.

- House purchase and sale agreement.

- Contract of purchase and sale of land.

- Payment documents for the land plot (bank statements, checks, receipts, receipts, etc.).

- Payment documents for the purchase of a home (bank statements, checks, receipts, receipts, etc.).

- Register of construction costs.

- Design and estimate documentation, contract agreements, certificates of completed work.

- Payment documents for all construction and finishing materials (checks, bank statements, receipts, payment receipts).

You will need the originals:

- Declaration 3-NDFL.

- Help 2-NDFL. Obtain from your employer. Required condition: the certificate must be for the year the deduction was issued. If in 2021 you submit a declaration for 2021, the 2-NDFL certificate must be for 2021.

- Application to the tax office for personal income tax refund. Among other data, it indicates the account for transferring money.

If you include mortgage interest in your tax deduction, then attach an agreement with the bank and a certificate from the bank about the interest paid.

Quick registration and help from a tax expert!

Register

conclusions

- Please note that the tax deduction is calculated from the amount specified in the purchase and sale agreement. Therefore, if the seller owns the plot for less than 3 years, then he will have to pay sales tax and, most likely, the seller will want to reduce the amount specified in the agreement.

- It is worth noting that the total amount of real estate transactions exceeding 1 million rubles per year is subject to a 13% sales tax.

- Since 2015, for the “tax-free” sale of a single residence, it is still required to own real estate for more than 3 years, but for each subsequent property owned, the ownership period has been increased to 5 years.

Amount of deduction for building a house

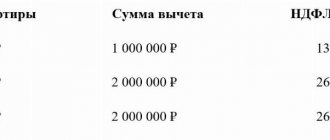

The total amount of property deduction cannot exceed 2 million rubles . This amount includes the purchase of land, the purchase of a house and the construction/repair of an unfinished construction project. The maximum refund is 13% of the tax deduction: 260 thousand rubles = 13% x 2 million rubles.

The tax deduction cannot be greater than the amount of your expenses . If you spent 1.5 million rubles when buying and building a house, then the tax deduction will be 1.5, not 2 million rubles.

The annual refund cannot exceed the amount of income tax you paid . If during the year you did not receive the entire amount, the balance does not expire and is transferred to subsequent years until the allotted amount is completely exhausted.

Example:

You bought a plot and built a house. The total cost was 8 million rubles. Since the maximum amount of property tax deduction is set by law at 2 million rubles, you can receive a refund based on this amount. This means that you will receive 260 thousand rubles into your account.

Important addition! If you are officially married, then your husband/wife can also claim a deduction. As a result, each of you will receive 260 thousand rubles, that is, 520 thousand rubles per family.

Quick deduction service: personal income tax refund in 7 days, not 4 months!

Order service

Required documents

The fiscal department does not simply return funds. It is necessary to collect documents confirming the costs:

- extract from the Unified State Register of Real Estate,

- purchase and sale agreement,

- salary certificate in a standard form,

- receipts confirming expenses,

- identification document,

- individual taxpayer code.

There are several options for transferring documents. You can personally come to the appointment at the Federal Tax Service. If this is not possible, then the application can be sent by post. However, in this case, the processing may be delayed (it will take time to send an email message). To submit an application through a proxy, you will need to issue a power of attorney.

Did you take out a loan to build a house? Get a tax deduction on interest

If you used a mortgage loan to buy and build a house, you have the right to return income tax on the interest paid to the bank.

The amount of interest accepted for deduction is 3 million rubles. The calculation includes interest actually paid to the bank.

Keep in mind: Before January 1, 2014, the mortgage interest tax deduction was unlimited. For a house built before this time, you will receive a full deduction for the entire amount of interest paid to the bank.

Important addition! If you are officially married, then your husband/wife can also claim an interest deduction. As a result, each of you can receive up to 390 thousand rubles, that is, up to 720 thousand rubles per family.

Example:

In 2012, you took out a targeted mortgage loan in the amount of 15 million rubles and bought an unfinished house. In November 2014, you completed construction and received a title deed. They decided to apply for the deduction in 2021.

To date, you have paid 4 million rubles in interest to the bank. Since the house was registered before January 1, 2014, you are entitled to a deduction for the entire amount of interest.

Namely: 13% x 4 million rubles. = 520 thousand rubles. If you continue to pay principal and interest, you can take an annual deduction for the interest actually paid during the past year.

Detailed information in the article “Tax deduction when purchasing with a mortgage.”

Tax concierge - consultations with a tax expert for only 83 rubles per month!

Order service

Common mistakes

Error: The taxpayer claims to receive a tax deduction when purchasing a plot of land for a personal subsidiary plot (LPH).

Comment: The purchased land must have the status of a site for individual housing construction, otherwise the tax benefit will not be issued.

Error: The taxpayer submits an application for a tax deduction after purchasing a plot for individual housing construction, whereas the land was purchased with subsidies provided by the regional authorities.

Comment: To receive tax compensation when purchasing a building plot, you must pay for it with your own money. Subsidies, subsidies, and assistance from an employer make it impossible to receive a tax deduction.

List of documents for registration

When filing a return through the Federal Tax Service you will need:

- Declaration of income.

- An extract from the unified state register of real estate, which should contain a record of ownership of the acquired plot.

- Land purchase and sale agreement.

- Documents confirming payment of the cost of the allotment (both full and partial), as well as expenses for the purchase or construction of housing.

If a loan agreement was concluded with a bank for the purchase, then this is also provided.

When contacting an employer, the package of documents includes:

- Application for a deduction.

- Extract from the Unified State Register of Real Estate.

- Contract of sale.

- Documents confirming payment for the plot, expenses for building a house.

- Papers confirming the payment of personal income tax.

- Notification indicating the right to receive a deduction (from the Federal Tax Service).

Features of filling out an application

It is necessary to carefully fill out the application and submit the appropriate documents on expenses (checks, receipts, contracts), otherwise a reduction or refusal of personal income tax compensation may be possible.

The application must be submitted both in writing and electronically. When registering it, the following general rules are observed:

- Name of the organization (Federal Tax Service, its address).

- Full name, address of the applicant.

- A request for a deduction indicating the funds spent, account details for crediting money.

- List of applications.

- Date and signature of the applicant.

When purchasing land for individual housing construction without a house

The Tax Code does not provide for separate exemptions for land plots. In accordance with the letter of the Federal Tax Service dated December 10, 2012, the partial return of personal income tax is not associated with the purchase of land, but with the acquisition or construction of housing on it.

Therefore, the right to return when purchasing land for individual housing construction will arise from the moment of registration of the constructed residential building.