- Who is eligible for personal bankruptcy?

- What debts can be written off in bankruptcy proceedings?

- Participants in bankruptcy proceedings

- How the bankruptcy procedure for an individual works: step-by-step instructions 2021

- Lawyer in bankruptcy proceedings of an individual

- Is it possible to go through the bankruptcy procedure on your own?

- What is a turnkey bankruptcy procedure?

- Cost of bankruptcy procedure for an individual

The bankruptcy procedure for an individual in Russia has become possible since 2015, with the entry into force of the corresponding changes in Federal Law No. 127 “On Insolvency (Bankruptcy).”

If until 2015 only legal entities had the right to bankruptcy, then the changes made it possible to write off debts for all citizens of the Russian Federation.

Through the bankruptcy procedure, a citizen can write off almost any debts, the only exceptions being alimony, debts arising as a result of criminal liability, subsidiary liability, etc.

Who is eligible for personal bankruptcy?

According to the definition from Law 127-FZ “On Insolvency and Bankruptcy” , bankruptcy is the inability of the debtor to fully satisfy the demands of creditors. According to the letter of the law, this inability occurs when, after paying all obligations, the debtor is left with less than the subsistence level for each family member.

A paradoxical situation is emerging in Russia: many citizens are, in fact, bankrupt, but do not know about it, continuing to pay their debts in good faith.

In order to successfully complete the bankruptcy procedure, you must meet several criteria:

- Conscientiousness.

- Loan payments must be made in full for at least three months

- The amount of debt must be more than 500,000 rubles.

- You have not sold property for three years.

Good faith is a key concept in bankruptcy proceedings. It will not be possible to collect loans from different banks for millions of rubles, and then write them off in a legal way. During the procedure, you must show that having taken out a loan for certain purposes, you planned to repay it, and had such an opportunity, but as a result of the current circumstances, you are no longer able to service your obligations.

In fact, currently the courts accept smaller amounts for consideration, for example 300,000 rubles.

Here we are talking about property that can be described in the bankruptcy sale procedure: apartments, cars, land plots, etc. Such transactions can be challenged during the procedure only if the money from the sale was not distributed among creditors.

Get a free consultation

Why is the sale of property delayed?

The deadline for selling a bankrupt’s property varies from person to person and can end very quickly and take many months. The law sets a period of 6 months for bidding. If difficulties arise, the court may extend the implementation time. The process cannot be delayed indefinitely. As a result, the unrealized property is returned back to the owner.

Difficulties with selling arise for various reasons. They are always different and depend on the value of the property, its demand on the market, quality, and condition. The sale concerns only those types of property that are subject to foreclosure. The list of objects and items that cannot be put on sale is contained in the law. Citizens should not fear that they will be deprived of the most necessary things:

- The only apartment.

- Items that are used in professional activities, if their cost does not exceed 100 minimum wages. For example, a programmer’s computer will not be confiscated, but a taxi driver’s personal car will be taken away for sale.

- Food products.

- Fuel if the family lives in a private house.

- Awards, prizes.

- Cash in the amount of the subsistence level per family member.

- A car if its owner is disabled.

The sale of property at auction is announced only after a citizen has been officially assigned bankrupt status. A ruling on this is made at one of the court hearings after the restructuring procedure has been completed. Bidding is appointed as a stage for the final repayment of the bankrupt’s debts or their write-off if the individual has no property.

Important

Only liquid objects are put up for auction: jewelry, real estate, vehicles, luxury items. The speed of property sales depends not only on demand and prices, but also on the skills of the financial manager, in particular, on how he organizes the auction. The manager is a person interested in the speedy and successful sale of property, since he is entitled to 2% of the proceeds.

Participants in bankruptcy proceedings:

There are two main parties involved in bankruptcy proceedings: the debtor and the creditor.

. Their goals differ: the creditor wants to receive compensation for the issued loan and, preferably, with interest. The debtor wants to get rid of the credit burden and the accompanying “joys” of enforcement proceedings, pressure from collectors and banking services.

The main government body in bankruptcy proceedings is the Arbitration Court

. It is the judge who decides whether a citizen will become bankrupt or not. However, if a person honestly paid his debts, but due to force majeure circumstances was unable to service his obligations, the court will definitely take his side.

The definition of “good faith of the debtor” is a fundamental element of the bankruptcy procedure from the point of view of the court: if the debtor is acting out in the procedure, hiding income or property, has the ability to pay the loan, but does not want to do so, it will most likely not be possible to write off the debts.

The arbitration manager is responsible for determining the debtor’s income and property. This is a kind of intermediary between the creditor and the debtor, who must ensure that the rights of both participants in the procedure are not infringed.

How the bankruptcy procedure for an individual works: step-by-step instructions 2021

Depending on the specific situation, the bankruptcy procedure may vary slightly, but the basic steps that a citizen must take to write off his debts remain the same:

- Free consultation

with a lawyer from Bankrot-Service - Collection of documents

- Drawing up an application

- Filing an application to court

At this stage, we analyze your financial situation and determine whether, according to the law, you can apply for debt write-off through bankruptcy (not all debts can be written off, which was discussed a little higher)

In order for the bankruptcy procedure of an individual to be successful, documents are collected, which will then be attached to the application for filing with the court. We will publish the list of documents in a separate article. Documents can be collected both by the debtor himself and by Bankrupt Service specialists

A correctly drawn up application is the key to successful debt write-off during bankruptcy proceedings for an individual. The application must describe your financial situation and convincingly state the reasons why you were unable to service your obligations to creditors.

From this stage, the actual bankruptcy procedure for an individual begins. The court considers the application and documents that you provided. At the first meeting, the court makes a decision to declare you bankrupt and appoints an arbitration manager, who then manages the further procedure.

The most important thing is that already at this stage, even though the debts have not yet been written off, creditors and collectors should no longer bother you, enforcement proceedings are terminated. All further communication with the opposing party to the process takes place through the arbitration manager.

In the future, the bankruptcy procedure for an individual develops depending on the decision made by the court: this may be a debt restructuring procedure, or a procedure for the sale of property.

- 4.1 In the debt restructuring procedure, you will be able to repay your obligations on preferential terms.

- 4.2 In the property sale procedure, your large property will be sold, and the money will be used to repay the loan. You should not be afraid of the procedure for selling property: if it is assigned, you are protected by law. For example, it is impossible to take away your only housing, household or production assets by law!

Whether it makes financial sense for you to go bankrupt is quite easy to calculate, and we will definitely write about this on our blog.

Each of these procedures usually lasts six months. Some courts choose one option, but it happens that the bankrupt is transferred from one procedure to another.

- Decision to write off debts.

After the successful completion of the restructuring procedures or sale of property, the last court hearing takes place, at which a decision is made to write off all debts from you. After receiving this decision, you are officially freed from all debt obligations, and can continue to live a life free from calls from banks and threats from debt collectors.

Get a free consultation

Lawyer in bankruptcy proceedings of an individual

A lawyer in the bankruptcy procedure of an individual performs an important function: having experience in hundreds of bankruptcy procedures, he can analyze the current situation, make a forecast about whether your debts will be written off through the bankruptcy procedure, and whether there are any circumstances that may prevent a positive outcome of the procedure?

The lawyer will also help with collecting the necessary documents and competently draw up an application to submit to the court, select a good arbitration manager, accompany you during the bankruptcy procedure and provide legal support in case of violation of your rights by creditors.

Of course, hiring a lawyer to carry out the bankruptcy procedure is not at all necessary: the law allows you to go bankrupt on your own, but if you do not have the necessary legal knowledge, we still recommend turning to professionals.

How long does the procedure take?

Many users are interested in how long the bankruptcy procedure can last. The only thing we can say for sure is that it is quite long, but the specific timing depends on the specifics of the situation. For example, the following factors may affect the duration:

- whether the debtor has property that can be sold;

- whether the debtor has suspicious transactions that have been concluded over the past three years, and whether they can be cancelled;

- the amount of debt and the number of loans that formed it;

- other circumstances that may affect the case.

Under normal circumstances, the procedure will take no more than 6-8 months. It takes about 2 months to approve a restructuring plan. It will take up to six months to complete all activities.

What is a turnkey bankruptcy procedure?

Turnkey bankruptcy is a comprehensive service that is provided. It includes full support of the bankruptcy procedure:

It is also worth noting that we provide a guarantee of successful completion of the bankruptcy procedure for an individual and complete write-off of all debts.

Get a free consultation

The necessary conditions

Before going through bankruptcy proceedings, you need to make sure that there are rational grounds for this. First of all, an applicant for bankruptcy status must meet certain requirements. They are listed in No. 127-FZ. In particular, all applicants must have signs indicating their insolvency:

- the presence of debt in an amount exceeding 500 thousand rubles (it makes no difference to whom - a bank or another individual);

- the period of delay in loan payments exceeds 90 days from the date of the last installment;

- the presence of circumstances that may further impede the restoration of financial solvency.

Regarding the first two points, everything is very clear, but the third point about a citizen’s bankruptcy is worth considering in more detail, because if it is possible to repay the debt, even if it is overdue, there is no need to urgently submit documents to the Arbitration Court. So, circumstances that can be interpreted as an obstacle to debt repayment include:

- dismissal from work;

- long-term illness that prevents work;

- loss of a family breadwinner;

- force majeure such as a burned house, etc.;

- loss of business.

In other words, a crisis has come in the life of the alleged bankrupt, and it will not be possible to get out of it soon. In such circumstances, it is not necessary to wait until the debt grows to 500 thousand rubles, but to submit an application as quickly as possible.

Cost of bankruptcy procedure for an individual

The cost of bankruptcy, first of all, depends on the costs that will have to be incurred for the procedure itself:

- Arbitration court deposit, which is paid for each procedure, and there may be several during bankruptcy

- Mandatory publications about the procedure

- Publication of entries in the bankruptcy register

- Postage.

We have listed only the main cost items for the bankruptcy procedure, the total amount is from 40 to 80 thousand rubles, excluding the assistance of a lawyer.

The bankruptcy procedure for an individual is a well-developed and understandable legal procedure, the course of which is quite easy for a person with experience to predict. If you have problems with debts, have nothing to pay on the loan, or have insoluble financial difficulties, contact our company, and during a free consultation, we will answer all your questions about the bankruptcy procedure and help you solve all your problems with debts.

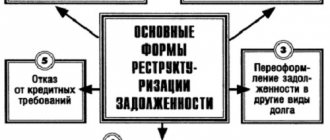

Introduction of debt restructuring

Typically, restructuring is assigned “by default”, and can be avoided by filing an appropriate petition. The point of the procedure is to assess whether the debtor can pay off in 3 years if the debt payment process is extended and the interest accrued on the debt is reduced to a minimum.

Over three years, the debtor must pay 75-80% of the total debt. The court will reduce the rate on loans and other borrowed funds to the Central Bank discount rate at the time of the decision. At the end of July 2021, this is 6.5% per annum.

The period for making a decision on the appointment of a procedure is about six months, during which the manager analyzes the debtor’s finances, his property, and tries to develop a debt repayment schedule, and reports the results to the court.

But most citizens decide to file for bankruptcy precisely because they cannot pay off their debts, so it is advisable to immediately introduce the sale of property, bypassing restructuring.

And in addition to delaying the deadlines, restructuring significantly increases the cost of bankruptcy of individuals - after all, for this procedure, regardless of its results, you will have to pay the insolvency administrator 25 thousand rubles, plus the costs of publications, mail, etc.

The bankruptcy procedure can last from six months to 3 years. Much depends on the financial situation of the debtor and on the skill of the lawyers taking part in the process.