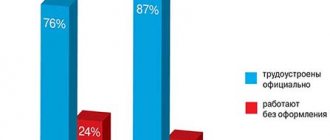

36% of Russians would agree to a “gray” or “black” salary, a study by the job search service Superjob, which was conducted in April 2021, showed. 1,600 people took part in it. 35% are not satisfied with such conditions, another 29% found it difficult to answer. At the height of the coronavirus pandemic (April 2021), 46% agreed to an envelope salary.

To combat “gray” wages, special departments will be created in the regions

Read more…

However, the number of people agreeing to an “envelope” salary turned out to be the minimum in 12 years. For comparison, in February 2009, after the economic crisis, 60% were ready to work under such conditions.

note

More people agree to a “black” or “gray” salary among men: 40% versus 33%. The willingness to receive money “in an envelope” does not depend much on age: the share of such workers among people under 24 years old is 34%, 25-34 - 34%, 35-44 - 39%, 45 and older - 37%. The dependence on income is also small: up to 29,999 rubles. — 38%, 30,000 — 49,999 rub. - 34%, 50,000 - 79,999 - 35%, from 80,000 - 38%.

Superjob believes that the activity of employers in the labor market is growing, and therefore the number of people willing to receive a salary “in an envelope” is decreasing: people have a choice between employers.

The study says:

Given a choice, job seekers give preference to companies that comply with the Labor Code of the Russian Federation, because the “white” salary means contributions to the pension fund, payment of sick leave, vacation pay and compensation upon dismissal in full.

Among those ready to agree to such conditions are those who are looking for personal gain, for example, they want to reduce payments under writs of execution. However, the majority call themselves hostages of circumstances: there are few vacancies, they urgently need to get a job, as follows from the survey.

According to official data from Rosstat, the share of unofficial salaries (which do not appear on the payroll) accounts for approximately 20%, and it remains virtually unchanged, noted Georgiy Ostapkovich, director of the Center for Market Research at the National Research University Higher School of Economics.

The tax office has a reason to withhold personal income tax from the company for salaries in envelopes

Read more…

These data are taken based on an analysis of expenses: it is immediately clear that the declared income does not coincide with the real one. According to the expert, there is no high “turbulence” in the labor market, although the share of hidden income is indeed falling.

Hidden salaries, as a rule, are offered by small enterprises in the small business sector, Ostapkovich explained. Large companies will not do this.

The Gazeta.Ru expert said:

Because no one wants to walk on the edge of a knife and end up under administrative or even criminal cases.

Mr. Ostapkovich added that there will always be a certain share of hidden income, and this applies not only to Russia, but also to other countries, for example, Great Britain and France.

The expert noted:

Where there is property, there is also a move away from white wages. So far, I don’t see any “crime”, if you look at the macro level.

The long-term budget forecast for the period until 2036, which was submitted in September 2021 by the government to the State Duma along with the draft budget for 2020–2022, stated that the volume of “gray” salaries in Russia is 10 trillion rubles. per year, noted Victoria Solovyova, leading lawyer of the civil law department of CLIFF. According to the Ministry of Finance, approximately 30-40% of Russians receive unofficial “gray” salaries.

Solovyova believes:

The reasons are different. There are workers who are forced to agree to the conditions offered by the employer due to high competition in the labor market. Some workers do this deliberately, hiding their actual income (for example, in order to reduce the amount of alimony), or agreeing with the employer on higher wages due to savings on insurance premiums.

note

The increase in the number of Russians who are not ready to work “in the gray” is associated with the unscrupulousness of some employers, says Olga Minchenkova, professor at the Department of Business Process Management at the Institute of Industry Management of the Russian Presidential Academy of National Economy and Public Administration. During a crisis, as a rule, the number of “thrifty” organizations increases.

She explained:

Workers naturally want to protect themselves, since the appeal procedure under the “gray” scheme is quite complicated.

It was more difficult for properly registered employees to be laid off or left without salary, for example, during a lockdown, noted Pavel Utkin, leading lawyer of the United Legal. At the same time, he emphasized that such surveys do not reflect the whole picture, and the situation with hidden salaries is changeable. In particular, some employees may make compromises with employers, for example, if they are offered an increase.

The essence of the scheme for using “gray” wages

“Gray” or “shadow” wages should be considered that part of an employee’s earnings that is given to him unofficially (in envelopes) and is not taken into account for tax purposes (Letter of the Federal Tax Service of Russia for Moscow dated 08.08.2007 No. 15-08/075418).

When applying this scheme, the person hired is assigned a salary in the employment contract in an amount equal to the minimum wage, or slightly higher. The rest of the earnings (usually it turns out to be significantly more than indicated in the employment agreement) is paid unofficially.

The employer sees the following benefits in using “gray” payments:

- from the “gray” part, he does not need to fulfill the duties of a tax agent for paying personal income tax (amounting to 13% of income), nor pay insurance premiums (the total amount of which depends on the amount of payments for accident insurance, because of this it ranges from 30. 2% to 38.5% of income and may additionally increase by 2-14% due to charges for payments to persons working in harmful or dangerous conditions);

- the size of the “gray” part can be reduced by him for one reason or another, which is not officially stated anywhere, and the employee will not be able to challenge such a reduction;

- systematic delays in “gray” payments are possible, and it is difficult for the employee to influence this situation;

- the “gray” part may not be paid at all or paid at a reduced rate for periods of regular vacations and sick leave;

- upon dismissal in a conflict situation, the reality becomes the non-payment to the employee of the “gray” part of the earnings that turned out to be unpaid on the day of dismissal and the “gray” part of vacation pay corresponding to the unused number of days of the next vacation (if this additional payment was applied).

Thus, the amount of material benefit for the employer can be quite significant. And it also acquires a very effective tool for influencing employee behavior.

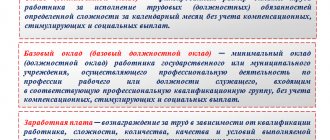

What are the salaries?

The employer is obliged to pay employees wages, from which income tax is withheld at the rate of 13%. But in addition to this, the employer pays:

- 22% of the income of each employee to the Pension Fund.

- 2.9% in the Social Insurance Fund.

- 5.1% in the Federal Compulsory Medical Insurance Fund.

- From 0.2 to 8.5% for other types of insurance.

The company contributes about 30% of employees' income to various funds, which some employers seem pointless or simply unprofitable. But deductions go only from official wages. Therefore, some companies, in order to reduce their own expenses in various funds and budgets, issue employees “gray” or “black” wages.

There are three options for monthly income for hired workers:

| Type of salary | Description |

| White | The official, net earnings of an employee, from the amount of which taxes and contributions are deducted to all funds provided for by law. |

| Gray | They legally pay only a minimal portion of the money earned. From this part income tax and other payments to the budget are deducted. The employee receives most of the salary in cash without deductions or accounting. |

| Black | A salary on which no taxes are paid and no money is transferred to funds. Typically, such calculations are carried out with employees without concluding an employment contract or official employment. The amount of payment for work is based only on verbal promises and decisions of the employer. |

Fraud with “gray” and “black” salaries is illegal. They can lead to big problems for the employee and his employer.

Signs of payment of “gray” wages for the Federal Tax Service

The fact that salaries are paid in envelopes rarely remains a secret to the tax authorities. Direct evidence of this is:

- complaints received from current or former employees;

- information about the amount of earnings reflected on the Internet in data about the employer’s vacancy;

- a certificate of a higher level of income of the employee, issued by the employer;

- statements for the payment of “gray” salaries discovered during the audit.

Reasons to doubt the reality of the officially shown salary arise when establishing earnings:

- in a volume below the industry average or the regional market average;

- without differentiation of incomes of managers and ordinary employees;

- in an amount significantly lower than at the previous place(s) of work.

Indirect evidence of the discrepancy between income and their real level is the purchase by an individual of property recorded in the Federal Tax Service (real estate, transport, land), the cost of which is not comparable with his official earnings.

What to do if you haven’t paid a gray or black salary

If you receive a gray or black salary, it will be very difficult to prove the employer’s dishonesty. Everything is based only on a verbal agreement, so scammers can profit from gullible employees. If you find yourself in a situation where you are underpaid, there is only one way out - to file a complaint against the employer and defend your rights.

If you are not paid the promised money:

- Collect all documents that can be used to prove that you receive an unofficial salary. After this, contact your employer and offer to resolve the issue peacefully.

- File a claim with the courts if your employer refuses to resolve your problem. Hire a professional lawyer. This can be quite expensive, but then the employer will have to reimburse all costs if the court finds him guilty as a defendant.

- Contact your employer with a request to pay a penalty if it is calculated for months worked with delays. Interest for late payment is charged in the amount of 1/300 of the key rate established by the Bank of Russia for each overdue day.

Before going to court, collect as much evidence as possible that you worked honestly for the benefit of the organization. Otherwise, the court may consider you a fraudster too. To be guaranteed to receive protection, you can submit 2 applications. One to the territorial tax service, and the second to the prosecutor's office.

Be sure to indicate in the application that the employer is avoiding fulfilling its obligations. To confirm your honesty and express your reluctance to receive unofficial income, also submit an application to the labor inspectorate. After this, the organization where you work will begin thorough checks. Based on their results, a decision will be made on the payment of fines and penalties.

Tax consequences of “gray” payments for the employer

The employer's tax liability for “gray” payments is directly related to non-payment of personal income tax and insurance contributions on the unofficial part of earnings. Responsibility for these charges arises under various articles of the Tax Code of the Russian Federation:

- For insurance premiums, Art. 122, which specifies 2 fine rates calculated from the amount of the unpaid payment - 20% (clause 1) and 40% (clause 3). To apply a higher rate, intent to understate the tax base must be revealed. When using a “gray” payment scheme, there is intent, so accruals will be made precisely from it.

- For personal income tax, in respect of which the employer is a tax agent, Art. 123, which provides only 1 rate option for calculating a fine - 20%.

However, tax risks are not limited to this, since the fact of establishing a “gray” salary entails suspicions that the employer has systematically hidden income from which such payments are made. Accordingly, during tax control, data on revenue will be carefully checked, the underestimation of the volume of which leads to a reduction in the tax bases for VAT, income tax, simplified tax system or unified agricultural tax. Tax liability for these taxes, as well as for insurance premiums, will arise under Art. 122 of the Tax Code of the Russian Federation.

Sanctions applied under Art. 122 of the Tax Code of the Russian Federation, do not relieve the taxpayer from the need to pay additional unpaid taxes, as well as pay penalties for late payment (clause 5 of Article 108 of the Tax Code of the Russian Federation). Therefore, the total amount of additional payments can be quite significant.

Exactly the same payments (unpaid tax and related penalties) will have to be made for personal income tax, since clause 9 of Art. 226 of the Tax Code of the Russian Federation, which prohibits the payment of this tax at the expense of a tax agent, since 01/01/2020, additions have been made allowing the Federal Tax Service to demand payment of its amounts additionally accrued based on the results of a tax audit. The personal income tax paid in such a situation will not reduce the tax base for taxes depending on the volume of revenue received (Letter of the Federal Tax Service of Russia dated March 10, 2020 No. SD-4-3/4109).

Of course, the specific amount of additional tax assessments by the Federal Tax Service will have to be justified (clause 6 of Article 108 of the Tax Code of the Russian Federation). However, tax authorities can only collect part of the evidence on their own. They will be supported by facts and the collection of additional information will be carried out by the investigative authorities (Letter of the Federal Tax Service of Russia dated July 13, 2017 No. ED-4-2 / [email protected] ).

What may attract the attention of the Federal Tax Service

Schemes for transferring wages to the white segment have been used before. Many of them are well known to the tax authorities. In an attempt to catch employers who “whitewash” salaries, the Federal Tax Service tries to track the following transactions:

- Workers are transferred from part-time to full-time . It is important to arrange everything correctly here. First, an additional agreement is concluded with the employee, then an order is issued to transfer him to full-time work (the employee should be familiarized with it against his signature), then an entry is made in his work book and personal card.

- Gradual cost reduction . The black part of the salary was written off for certain expenses. With whitewashing, these costs should decrease. Therefore, employers gradually increased the share of white wages that are transferred to a bank account, while simultaneously reducing the above-mentioned expenses. But the Federal Tax Service has learned to track this too.

- Opening a new company . In small firms, the client base is often based on business connections between management and employees. Previously, they could close the old company without loss to their reputation, and then open a new one, where employees were paid completely white wages.

Attention! The fastest way to “whiten” employee wages is to sell the business to a new owner. But it carries risks. After all, the company can be checked and the former owner held accountable even after his change. Therefore, this option can be considered only if there are no tax debts .

Administrative and criminal liability of officials

For officials of an employer-legal entity, the consequence of paying “gray” wages may be bringing them to administrative as well as criminal liability.

Administrative liability when identifying “gray” payments arises in connection with gross distortion of accounting and accounting data, leading to an understatement of taxes by more than 10% or a distortion of any of the financial reporting indicators by more than 10% (Note 1 to Article 15.11 of the Code of Administrative Offenses of the Russian Federation) . With systematically carried out “gray” payments, both of these indicators in relation to the period under review can reach a value sufficient to apply an administrative fine. Its size will be (Article 15.11 of the Code of Administrative Offenses of the Russian Federation):

- from 5 thousand rubles. up to 10 thousand rubles when a violation is detected for the first time (clause 1);

- from 10 thousand rubles. up to 20 thousand rubles. in case of repeated offense (clause 2).

In case of repeated violation, the fine may be replaced by disqualification for a period of 1 to 2 years.

Criminal liability due to “gray” payments arises under Art. 199 of the Criminal Code of the Russian Federation. To apply this liability, the volume of violations committed must be large (over 15 million rubles) or especially large (more than 45 million rubles) for 3 consecutive financial years (Note 1 to Article 199 of the Criminal Code of the Russian Federation).

In case of major violations, the punishment is (Clause 1 of Article 199 of the Criminal Code of the Russian Federation):

- a fine of 100 thousand rubles. up to 300 thousand rubles. or in the amount of salary or other income of the convicted person for a period from 1 to 2 years;

- forced labor for up to 2 years with deprivation of the right to hold certain positions or carry out certain activities for up to 3 years or without specifying a period;

- arrest for up to six months or restriction of freedom for up to 2 years with deprivation of the right to hold certain positions or carry out certain activities for up to 3 years or without specifying a period.

For especially major violations or acts committed by a group of persons by prior conspiracy, the punishment will be (Clause 2 of Article 199 of the Criminal Code of the Russian Federation):

- a fine of 200 thousand rubles. up to 500 thousand rubles. or in the amount of salary or other income of the convicted person for a period from 1 to 3 years;

- forced labor for up to 5 years with deprivation of the right to hold certain positions or carry out certain activities for up to 3 years or without specifying a period;

- restriction of freedom for up to 6 years with deprivation of the right to hold certain positions or carry out certain activities for up to 3 years or without specifying a period.

A person who has committed a crime for the first time may be released from criminal liability if he or the legal entity in relation to which this crime took place fully pays all amounts of missing taxes, as well as related penalties and fines accrued in accordance with the Tax Code of the Russian Federation (Note 2 to Article 199 of the Criminal Code of the Russian Federation).

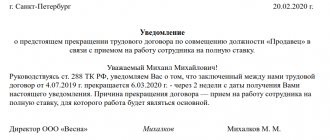

Suspension of work

If the company's management pursues a policy of “no money, but you hold on,” you have the right not to work. Argument - Article 142 Article 142. Responsibility of the employer for violation of the terms of payment of wages and other amounts due to the employee of the Labor Code of the Russian Federation.

Write a notice of suspension of work due to non-payment of wages. And then be sure to register it with the secretariat or accounting department. This is proof that management received it and you are exercising your legal right and not skipping work.

During the suspension of work, the employee retains his average earnings.

You cannot suspend work if:

- The country is in a state of emergency or martial law has been introduced.

- You are a civil servant.

- You work in a particularly dangerous workplace.

- You work as an ambulance, rescue worker, firefighter, police officer, or your work is in some other way related to the life and safety of the public.

If the employer comes to his senses and notifies you in writing of his readiness to pay your salary, you must appear at your workplace on the next working day. If not, complain to the Labor Dispute Commission (LCC) or the labor inspectorate.

Consequences of “gray” payments for an employee

Despite the fact that a taxpayer for personal income tax is considered to be an employee who receives income from an employer (clause 1 of Article 207 of the Tax Code of the Russian Federation), he does not have tax liability for “gray” payments made to him. This is due to the fact that the obligation to calculate, withhold and pay wage tax is assigned to the tax agent (clause 1 of Article 226 of the Tax Code of the Russian Federation), that is, to the employer. If the tax agent does not have the opportunity to withhold tax, then he must notify both the employee and the INFS (clause 5 of Article 226 of the Tax Code of the Russian Federation).

With “gray” payments, the employer does not fulfill any of these obligations. But this is not the employee’s fault. Therefore, filing tax claims against him is unfounded. Additions made from 01/01/2020 to clause 9 of Art. 226 of the Tax Code of the Russian Federation, confirm the validity of this conclusion, since they secure the right of the tax authority to receive additional tax accrued during a tax audit (and along with it penalties) from the employer.

However, the negative consequences of “gray” wages for the employee still occur. They are expressed in underestimation:

- the amount of income taken into account when calculating average earnings, which affects the amount of payments for vacation and sick pay;

- severance pay paid upon dismissal of personnel due to reduction;

- insurance premiums affecting the size of the future insurance pension;

- income reflected in the Form 2-NDFL certificates provided by the employer;

- the amount of personal income tax that can be returned from the budget when applying tax deductions.

How to collect wages from an employer: instructions for employees

An employee who has not been paid his salary can go to collect it through Rostrud or directly to court. You can contact the local branch of Rostrud throughout the year in person or electronically through the official website. Adopted in December last year, Art. 360.1 of the Labor Code obliges the state labor inspector to collect accrued but unpaid wages.

But lawyers advise going straight to court. This is the most popular way. “If a person applies to Rostrud, the statute of limitations may expire, they will have to be restored and explained that the citizen tried to protect his right in another way,” explains Evgeniy Korchago from Korchago and Partners. The period remains the same - one year.

The State Duma adopted amendments on the collection of wage debts without court

A copy of the employment contract must be attached to the lawsuit. Korchago advises including other local acts: job description, regulations on the procedure for remuneration and a certificate of income paid to the employee by the employer.

During the trial, the employee can also be helped by witness testimony, copies of the work log, schedules and other documents that will confirm the fact of the employment relationship and the actual time worked.

Art. 236 of the Labor Code allows an employee to recover wages with interest for each day of delay. The countdown begins after the payment date and ends on the day of actual settlement. The interest rate is not lower than 1/150 of the Central Bank key rate in force at that time. Now it is 4.25%.

Lawyer Artem Chertilov from KA Kovalev, Tugushi and partners Kovalev, Tugushi and partners Federal rating. group Arbitration proceedings (major disputes - high market) group Dispute resolution in courts of general jurisdiction group Insurance law group Bankruptcy (including disputes) group Labor and migration law (including disputes) group Pharmaceuticals and healthcare group Criminal law group Corporate law/Mergers and acquisitions 9th place By revenue per lawyer (more than 30 lawyers) 23rd place By number of lawyers 25th place By revenue reminds that even in case of defeat the employee will not be forced to reimburse procedural costs.

How money is transferred

If the court satisfied the applicant’s claim and issued a decree to begin enforcement proceedings, then the bailiffs immediately request information about movements in the debtor’s accounts. The decision of the labor inspector also has the force of an executive document. He himself transfers it directly to the bailiffs at the bank.

If the employer refuses to compensate the debt to the employee voluntarily, the bailiff issues a resolution, on the basis of which the bank must immediately transfer the salary from the debtor’s account to the employee’s account.

Lawyers note that if the employer has money in his account, then there should be no problems with collection.

The Supreme Court decided whether the bank would be liable for the violation of the order of write-offs

“If there are insufficient funds, then collection takes place as funds are received in the organization’s current accounts and taking into account the order in which funds are written off from the account, including the calendar order,” clarifies the managing partner of FTL Advisers FTL Advisers Federal Rating. Group Family and Inheritance Law Group Compliance Group Private Wealth Management Group Corporate Law/Mergers and Acquisitions Group Tax Consulting and Disputes (Tax Consulting) Maria Chumanova. For example, if a company goes through bankruptcy proceedings, the demands of employees, in accordance with clause 2 of Art. 134 of the bankruptcy law are satisfied in the second priority - before the demands of the main part of creditors, who occupy the third priority. Wage debts are collected in advance of tax debts. If the bank violated the order of write-offs, then it must compensate for the losses.

Is it possible to recover a premium?

The bonus is part of the salary, but with its payments, things are not so clear.

- Bonus - the right or obligation of the employer: the position of the Supreme Court

January 10, 13:49

Evgeniy Korchago believes that if the company’s regulations provide for a bonus, then “the employer is obliged to pay it regardless of desire.” Internal regulations, as a rule, must establish certain target indicators, and their achievement gives the right to additional payments.

But often the bonus is simply an incentive on the part of the employer and is paid at his discretion. According to lawyer Andrei Nemov from Law Office "A2" Law Office "A2" Federal rating. group Land law/Commercial real estate/Construction group Arbitration proceedings (major disputes - high market) group Corporate law/Mergers and acquisitions Company profile, in such cases “it is almost impossible to prove that you should be paid a premium.”

In case No. 2-98/33-1143, the judicial panel for civil cases of the Novgorod Regional Court refused to satisfy the appeal of the plaintiff, who tried to win the award. The court indicated that the employment contract allows, but does not oblige the employer to provide incentive payments. Therefore, the appeal upheld the decision of the first instance.

And in case No. 33-4161/2020, the Arkhangelsk Regional Court upheld the plaintiff’s complaint and referred to the fact that bonuses to employees in the company are not paid arbitrarily, but in accordance with the bonus regulations. As a result, the appeal ordered FSUE Rosmorport, the defendant, to pay the employee 23,941 rubles.

According to Chumanova, “what matters is what procedure is established in the company for paying bonuses to resigning employees.” This is due to the fact that often the bonus for past periods is accrued after one or two billing periods (one or two years), and by the time of dismissal the employer may not accrue it. If the bonus is not accrued, the employer does not pay it.

What to do with “gray” salaries?

Very often, employers verbally promise to pay part of the employee’s wages, but the employment contract only states a salary equal to the minimum wage. It is more difficult to collect this “gray” salary than what is indicated on paper.

- How it works: we collect “gray” wages from the employer

July 21, 14:34

To prove the fact of such payments, Chumanova offers the following evidence: witness statements of employees or former employees, envelopes on which the employee’s full name and payment amount will be written, facts of additional assessment of personal income tax by the tax authorities to the employer in previous periods, work-related correspondence , including by email. Nemov also reminds that email messages from the employer about the accrual of such salaries will be useful, and if the “gray” part was credited to the card, bank statements.

Korchago believes that “if an employee receives part of his salary in an envelope, then he assumes all the risks of non-payment.” According to him, it is possible to prove the fact of “gray” additional payments, but “the position of the courts, as a rule, is that the employer is released from the obligation to pay wages not stipulated by the official employment contract.”

What if you worked unofficially?

The Supreme Court explained how to establish the existence of an employment relationship between an employee and an employer when there is no agreement between them. For example, in the decision in case No. 8-КГ18-9 it was stated that “an employment contract is considered concluded if the employee began to perform his labor function and performed it with the knowledge and on behalf of the employer.” The existence of labor relations in such a situation is presumed.

- The Supreme Court helped workers establish labor relations

April 15, 10:19

In this case, the employee must prove the amount of wages. According to Chertilov, “due to the specifics of unofficial relationships, a variety of methods of proof are used - from electronic messages with a job offer, SMS correspondence, witness testimony, information about the receipt of money on the card from an unofficial employer, and ending with employer advertisements containing websites information about similar vacancies. It is more common, in his opinion, to obtain information from the employer’s staffing table.

Moral damage

Art. 237 of the Labor Code provides for compensation for moral damage to an employee for unlawful actions or inaction of the employer. In the resolution of March 17, 2004 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation,” the Plenum of the Supreme Court indicated that violation of the property rights of an employee also falls under the scope of this article. “For example, when payment of wages is delayed.”

Expectations and reality: compensation for moral damage in Russian courts

The decision on the amount of compensation must be made by the court and at the same time “based on the specific circumstances of each case, taking into account the volume and nature of moral or physical suffering caused to the employee, the degree of guilt of the employer, other circumstances, as well as the requirements of reasonableness and fairness.”

In fact, according to Chertilov, the compensation sought is very different. But there are some patterns.

Cynical violations of employee rights entail more significant amounts of compensation for moral damage.

Artyom Chertilov, lawyer KA Kovalev, Tugushi and partners Kovalev, Tugushi and partners Federal rating. group Arbitration proceedings (major disputes - high market) group Dispute resolution in courts of general jurisdiction group Insurance law group Bankruptcy (including disputes) group Labor and migration law (including disputes) group Pharmaceuticals and healthcare group Criminal law group Corporate law/Mergers and acquisitions 9th place By revenue per lawyer (more than 30 lawyers) 23rd place By number of lawyers 25th place By revenue

The Sverdlovsk Regional Court in case No. 33-10613/2020 confirmed the decision of the Tavdinsky District Court of the Sverdlovsk Region to recover 10,000 rubles. compensation for moral damages for non-payment of full wages to a firefighter. The first instance was guided by the fact that the employee who had been deprived of his salary had to work overtime in hazardous conditions, as well as without additional vacations for seven years.

Korchago calls the compensation ridiculous.

Our courts proceed from the fact that the amount of compensation for moral damage is more symbolic in nature.

Evgeniy Korchago, Korchago and Partners

At the same time, he advises the workers themselves to approach this issue more seriously. “The easiest way to prove moral suffering is to prove the fact of contacting a specialist doctor. For example, to a psychologist or psychotherapist. He arranges an appointment, issues a confirmation document, where he records various symptoms. For example, loss of sleep, loss of appetite, psychological reactions associated precisely with the fact that a citizen’s labor rights were violated.”

This way you can increase your chance of receiving at least some compensation.

- Supreme Court of the Russian Federation

- Opinion

Let's sum it up

- “Gray” is considered to be the part of the salary paid to the employee unofficially (in excess of the amount specified in the employment contract). This scheme allows the employer not only to reduce taxes paid on wages, but also to influence the behavior of the employee, as well as, at his discretion, reduce the amount of “gray” payments or delay their issuance.

- There are a number of signs that make the use of “gray” wages obvious to regulatory authorities. However, the very facts of such payments and their volumes require proof. They are obtained during tax audits. Investigative authorities may be involved in obtaining evidence.

- The consequence of identifying a system of “gray” payments for employers is additional payment of taxes (contributions), penalties and fines. Moreover, not only those payments that are related to wages (personal income tax and insurance premiums), but also taxes related to revenue (VAT, profit, ONS, Unified Agricultural Tax), are additionally charged, since the source of “gray” payments, as a rule, are hidden from taxation income. The opportunity to demand additional personal income tax payment from the employer appeared with the introduction of amendments to clause 9 of Art. from 01/01/2020. 226 Tax Code of the Russian Federation.

- The fines applied to additional taxes are established by two articles of the Tax Code of the Russian Federation - 122 (for insurance premiums and taxes related to revenue) and 123 (for personal income tax). Art. 122 establishes 2 rates for the fine - 20% and 40%. A larger amount is used when the tax base is deliberately understated. In Art. 123 only one rate is indicated - 20%.

- Officials of an employer-legal entity may be subject to administrative and criminal liability. The emergence of administrative liability is associated with gross (comprising at least 10%) distortion of accounting and accounting data, and criminal liability is associated with the volume (large or especially large) of unpaid taxes.

- Bringing tax liability to an employee who receives a “gray” salary is unlawful, since the obligation to calculate, withhold and pay personal income tax from salary is assigned to the employer, who is the tax agent. Additionally, this is evidenced as of 01/01/2020 by what is enshrined in clause 9 of Art. 226 of the Tax Code of the Russian Federation the right to demand payment of additional tax accrued during a tax audit from the employer.

- The negative consequences of receiving a “gray” salary for an employee are expressed in the underestimation of those amounts that affect the calculation of vacation pay, sick leave, severance pay, pensions, the amount of personal income tax returned from the budget and are shown in income certificates.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Salary "astronomy"

The essence of the claims.

This refers to promises of astronomically high salaries in job advertisements that will attract not only candidates, but also inspectors. The inspectorates have special employees for such checks. They will track and compare what was promised with objective reality (by comparison with reporting). Read reviews from former and current company employees. They can also show up for an interview - under the guise of an applicant, with a voice recorder. They find out that out of the promised 50,000 rubles, only the minimum wage will be “thrown” onto their card, and the rest will be handed over to them. They will nod their heads in understanding and leave. If the amount of remuneration in the offer to applicants differs from the actual one, tax authorities may accuse the organization of wage fraud. They will pass on their conclusions to the cameras or directly to the Federal Tax Service. They can initiate an on-site inspection and share information with labor inspectors.

How to avoid.

The security measures here are as follows: the salary in vacancies should not differ greatly from the reporting that the company submits to the tax office. Inspectors may come under suspicion based on their salaries. For example, if they decided to offer a new candidate more money than their predecessor. Then the tax authorities will decide that the salary in the advertisement is a real one, but the salary in the reporting is underestimated. In this case, it is safer not to name a specific amount in the advertisement, but to disclose it based on the results of the interview.

It is also safe to write in the vacancy a range from the lowest to the highest salary that you are willing to pay an employee. For example, if you promise an employee to pay from 30 to 100 thousand rubles depending on the result of their work, the inspectors most likely will not have any complaints.