Under what conditions can a tax deduction be returned when purchasing a land plot?

Firstly, the law does not provide for a separate deduction for the purchase of one plot of land. A deduction is provided for the acquisition of a land plot or a share in it with the type of permitted use of individual housing construction (for individual housing construction) with the subsequent construction of a residential building. Or a deduction is provided for the purchase of a land plot with an already built residential building or a share in it.

Secondly, if you want to return the tax deduction, then you must be a resident of the Russian Federation and officially receive wages, on which the employer pays 13% personal income tax.

Property deduction can be used only if you receive an official salary and pay income tax at a rate of 13%. The actual income tax paid or accrued is subject to a refund.

If the owner of a land plot with a house or a share in it does not work or pays taxes as an individual entrepreneur using a simplified taxation system, it is impossible to return the tax using a property deduction, because it is not paid to the budget.

Thirdly, when purchasing land plots or a share(s) in them provided for individual housing construction, a property tax deduction is provided only after the taxpayer receives a certificate of ownership of a residential building.

The tax deduction may include actual expenses for new construction or the acquisition of a residential building or share(s) in it on the territory of the Russian Federation.

Namely:

- costs for the development of design and estimate documentation;

- expenses for the purchase of construction and finishing materials;

- expenses for the acquisition of a residential building or share(s) in it, including those not completed construction;

- expenses associated with construction work or services (completion of a residential building or share(s) in it that has not been completed) and finishing;

- costs of connecting to electricity, water and gas supply and sewerage networks or creating autonomous sources of electricity, water and gas supply and sewerage.

Acceptance for deduction of expenses for the completion and finishing of an acquired residential building or share(s) in them or the finishing of an acquired apartment, room or share(s) in them is possible if the agreement on the basis of which such acquisition was made provides for the acquisition of unfinished construction of a residential building, apartment, room (rights to an apartment, room) without finishing or share(s) in them.

Individual construction or ready-made object?

Development land without a building or with an unfinished house

In this case, the deduction amount is calculated based on the total costs of building a house and purchasing a plot of land. These costs include:

- incurred on the project;

- to connect communications;

- estimate documentation and construction cost calculations;

- purchase of necessary building materials;

- Carrying out external and internal finishing works.

Land plot with ready-made real estate

In order to receive a deduction in the case of purchasing a finished house with a plot, it is important when making a transaction to check whether the seller has ownership rights not only to the building, but also to the land. Many people put up for sale cottages that were built on lands taken on a long-term lease or in the status of use from local governments.

Example: Russian legislation does not oblige the buyer to enter into separate agreements for the purchase of a house plot and a residential building on it. Consequently, many miss the point associated with the privatization of such land. It is assumed that the land underneath is also acquired along with the estate, but in fact this is not always the case.

Conclusion: You can receive an individual deduction only when purchasing legal land and a house on it. At the same time, the contract specifies the total amount of the transaction with the allocated cost of the land plot.

How much tax deduction will be returned when purchasing land?

The tax deduction is calculated from the actual costs incurred for the purchase of a land plot of individual housing construction and the construction of a dwelling or for the purchase of a land plot together with a built house. But there is a condition:

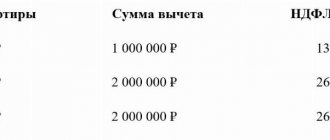

The tax deduction cannot exceed 2 million rubles. for one person. That is, the tax refund will be 260 tr. (2,000,000 – 13%).

But it is necessary to take into account that a tax refund for a calendar year can be made only in part of the personal income tax paid in that particular calendar year.

For example, in 2021 you purchased a plot of individual housing construction worth 550,000 rubles. Let's calculate that the amount to be refunded will be 71,500 rubles. But you earned 300,000 rubles in 2021 and the employer withheld only 39,000 rubles (personal income tax).

Therefore, in 2021, when you file a tax return, you can only return 39,000 rubles. The remaining amount of 32,500 (71,500 – 39,000 = 32,500) will be transferred to the next year 2021 if you work under the same conditions in 2021.

A pleasant fact is that if both family members (husband and wife) cost 4 million rubles to build or purchase a house along with a plot of land, then the tax deduction will be 520,000 rubles per family.

In addition, if you took out a mortgage loan to build or buy a house, you can return 13% of the interest paid. The maximum tax deduction will be 390,000 for each family member.

How do payment schemes affect?

One of the important conditions for obtaining a deduction is the purchase of land or real estate using a bank loan or your own savings. It is not allowed to purchase objects using money received from preferential programs by the state or employer. For example, the program for providing housing to military personnel or mothers of large families does not provide for a tax deduction.

The restrictions apply to cases, including when the buyer enters into a transaction with one of his immediate relatives. However, there are concessions in the system. For example, if you prove that personal savings or a loan were used to pay for part of a large purchase, you can get benefits. There are also nuances associated with transactions at the expense of the employer. An individual approach and consultation with a specialist are important.

Important! The tax deduction is provided to an individual only once. If a person is married, the amount of compensation is divided into two and is not summed up.

List of documents for tax refund

To receive a personal income tax refund when purchasing a land plot, the following documents are submitted through the tax office:

- tax return in form 3-NDFL (original),

- application for refund of overpaid tax (original),

- certificate 2-NDFL (original),

- agreement for the acquisition of a land plot/land plot and a residential building with annexes and additional agreements thereto (if concluded) (copy),

- documents confirming the taxpayer's ownership of a land plot or share(s) in it, and documents confirming ownership of a residential building or share(s) in it (copy),

- documents confirming payment (copy).

When receiving a tax deduction for the purchase of a land plot (its share), the child’s birth certificate is additionally submitted to the child’s ownership.

When purchasing a plot of land, spouses may need the following documents:

- marriage certificate (copy),

- agreement on the distribution of expenses for the purchase of a land plot (application for the distribution of deductions) between spouses (original).

Features of filling out an application

It is necessary to carefully fill out the application and submit the appropriate documents on expenses (checks, receipts, contracts), otherwise a reduction or refusal of personal income tax compensation may be possible.

The application must be submitted both in writing and electronically. When registering it, the following general rules are observed:

- Name of the organization (Federal Tax Service, its address).

- Full name, address of the applicant.

- A request for a deduction indicating the funds spent, account details for crediting money.

- List of applications.

- Date and signature of the applicant.

When purchasing land for individual housing construction without a house

The Tax Code does not provide for separate exemptions for land plots. In accordance with the letter of the Federal Tax Service dated December 10, 2012, the partial return of personal income tax is not associated with the purchase of land, but with the acquisition or construction of housing on it.

Therefore, the right to return when purchasing land for individual housing construction will arise from the moment of registration of the constructed residential building.

Tax Refund Options

There are two ways to receive a deduction when buying an apartment.

With the employer this year. In this case, you do not need to submit a declaration in Form 3-NDFL. The deduction will be provided based on notification. The tax office issues such a document upon application. This method of providing a deduction is that the employer reduces taxable income for the year by the deduction amount and ceases to withhold personal income tax. You receive it along with your salary. clause 8 art. 220 NK

According to the declaration next year. This option is suitable for returning personal income tax for previous periods or in the absence of an employment contract. You can file your return at any time during the next year or even later. The April 30 deadline for deductions does not apply: it must only be observed when declaring income. clause 7 art. 220 NK

Grounds for receiving a deduction

A property deduction will be provided only when purchasing a plot of land intended for the construction of an individual house. This fact will be confirmed by the permitted type of use of the site - this criterion is indicated in the contract for the purchase of real estate and the Unified State Register of Real Estate extract. If the land plot is purchased at the same time as the house, such difficulties will not arise.

Thus, you can claim a deduction in two cases:

- if a plot intended for individual construction has been purchased;

- if there is already a residential building on the acquired plot.

The right to receive a deduction will arise immediately if a finished property is located on the purchased site. If a plot of land is purchased for future construction, it will be possible to reimburse part of the acquisition costs only after the actual construction of the facility.

The essence of the property deduction is to reimburse the costs of purchasing a land property by returning the personal income tax withheld from the citizen in the previous calendar year. Withholding income tax is the responsibility of the management of the enterprise where the citizen works. For self-employed citizens (individual entrepreneurs, notaries, lawyers, etc.), the tax is calculated and paid independently at the end of the calendar year.

How to submit documents to the tax office for a tax deduction

If the deduction is claimed for previous years, you need to submit a tax return in Form 3-NDFL. For each year there is a separate declaration. If two spouses claim a deduction for one apartment, then each submits a declaration for himself. A complete package of documents must be attached to the declaration: copies of them are sufficient. In addition to the declaration and supporting documents, you must attach an application for a tax refund with details of where to transfer the overpaid amount of personal income tax.

A certificate of income must be attached to the declaration. It can be taken at work or downloaded from the taxpayer’s personal account. Certificates for the previous year appear in your personal account around April of the following year or later, when employers submit reports.

To receive a deduction this year from your employer, you need to submit an application to confirm your right to deduction. It is convenient to fill out and send it in the taxpayer’s personal account on the website nalog.ru. In this case, there is no need to fill out a declaration.

conclusions

An increase in the tax burden on citizens can be direct or indirect. The transition to cadastral calculation is an example of a direct increase. The indirect nature of the increase in burden includes a change in the taxation system for the sale of housing.

It is quite possible that an indirect tax increase will have a much stronger impact on the financial well-being of citizens than a direct one. In any case, the exercise of your right to housing, which, according to Art. 40 of the Constitution of the Russian Federation, the state guarantees to its citizens is becoming more and more complex.

How to get a tax deduction for the purchase of land and return the tax

The declaration is verified within three months. Another month is allocated by law for the transfer of personal income tax to the taxpayer’s account. In total, it may take about four months from the moment the declaration is submitted until the money is returned to the account.

The application for the right to deduction is checked for about a month. Within 30 days, the tax office issues a notice of the right to deduction. It must be taken to the employer. If there is such a notification, then the accounting department will stop withholding personal income tax from the salary until the accrued income from the beginning of the year does not exceed the deduction amount specified in the notification. If it was not possible to use the entire deduction in a year, the balance is carried over to the next year, but the notification must be received again.

The declaration and application can be sent to the tax office every year, taking into account the balance of the deduction and the tax already returned. Until the entire personal income tax amount is returned.

Procedure for payment of compensation

If you plan to receive a refund at your place of work, you can submit documents and for a certain period not pay taxes in the amount of a deduction of 13% from wages.

However, you need to understand that a tax deduction is the amount of a refund from the state. This means that the government agency cannot reimburse you for more than the amount of income taxes you previously paid. You can submit documents for compensation through your employer at any time, without being tied to the reporting period.

Another option is a full refund to your bank account or payment card. To implement this payment option, you must submit documents before the end of the current tax period or tax year (from January 1 of the following year). For example, if you purchased a plot of land with a house in 2021, you will be able to receive payment starting from January 1, 2021.