When the right to a deduction arises You cannot return tax for the years before receiving the right to a deduction Documents for a deduction can be submitted next year There is no statute of limitations for a property deduction You can receive a tax deduction for the last three years A declaration can be submitted throughout the year

In order to receive a property deduction when purchasing an apartment or other housing, you need to know not only the procedure for processing a return, but also the deadlines for applying for a deduction.

When should you contact the tax office? For what years can a 3-NDFL declaration be filed? Let's take a closer look.

Watch the video in which we talk in detail about what a tax deduction is when buying an apartment, who is entitled to the deduction, what documents need to be prepared and how they can be submitted to the tax office.

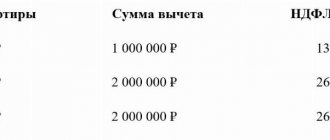

How to calculate the property deduction and how much personal income tax will be returned to the account - in examples and explanations from experts of the online service NDFLka.ru.

When does the right to a tax deduction arise when purchasing a home?

To receive a deduction, you must not just buy an apartment, house or land - you must officially register ownership of this housing. To do this, you need:

Receive a transfer and acceptance certificate if you bought an apartment in a new building under an equity participation agreement.

Obtain an extract from the Unified State Register of Real Estate (USRN) if you bought an apartment or other housing under a sales contract from another owner.

Thus, we have defined an important concept: the right to receive a property deduction arises after the legal registration of ownership of housing. This is stated in paragraphs. 6 tbsp. 220 Tax Code of the Russian Federation.

Receive a tax deduction within a week with the Quick Deduction service!

Get a service

Beware, scammers: how to save and return your apartment

Through threats and deception, a pensioner who owned an apartment on Derbenevskaya Embankment was forced to sell her home. As a result, the woman was left without living space and without money, like many before her. Read in the new Pravo.ru material about those who most often become victims of such scams, what schemes “black realtors” work under, how to avoid this and how great is the chance of returning stolen housing.

“Honest schemes” for taking away housing

Choice of victim

“Scammers are targeting single people, pensioners, disabled people, alcoholics, and children who grew up without parents. Such citizens are the easiest to deceive, which is why scammers first of all evaluate a person’s status. But many sane and intelligent people can fall for the bait of scammers, making a variety of transactions with apartments,” says David Melkonyan, general director of the Moscow Legal.

Collection of information

First, criminals try to make sure that the victim owns the property and there are no other applicants for it. Often, scammers gain the trust of owners by posing as compassionate neighbors, doctors, social service workers, or local police officers.

Taking over an apartment

Some owners do not even know that their apartment has been sold until new owners appear. In this case, criminals steal documents and draw up a contract of sale or donation of living space without the participation of the owners, signing documents on their behalf. “Under various pretexts, a fraudster can gain the trust of a legally illiterate pensioner and persuade him to donate or bequeath to him an apartment for some promises. And after that, he immediately legally discharges the donor from his own apartment,” says Melkonyan. If the pensioner does not give in to persuasion, “forceful methods of influence” are used. “There are known cases when lonely pensioners were kidnapped in order to take over their apartments, taken out of the city, forced to do backbreaking work, and hypnosis sessions were used on them. After several months of such “processing,” the victim agreed to everything,” the lawyer continues.

Registration of ownership

If the transaction was carried out “according to the rules”, when the victim was forced to sign all the necessary documents, even by deception or threats, and was notarized (the notary confirmed its legality, the legal capacity of all parties to the agreement and their rights to enter into an agreement), Rosreestr performs purely technical functions, formalizing housing for the new owner within one working day following the day of receipt of documents.

What about the owners?

In the “best” case, after concluding a deal, the owner of an expensive and fully equipped apartment ends up either on the street or in a dilapidated building somewhere on the outskirts, completely unsuitable for living. Sometimes scammers have “pocket” psychiatrists who can help hide the unwanted legal owner in a specialized hospital, from where he may never leave. Some act on the principle “no person, no problem,” preferring physical violence against victims. There are many such cases described in the press.

Among recent high-profile cases, we can recall the story of documentary director Tamara Yakzhina, who was deprived of her life by criminals because of her housing. The seventy-year-old woman stopped answering calls from her loved ones on March 16 last year, and already on March 28, her relatives discovered that the apartment on Gabrichevsky Street, where the director lived, was put up for sale on a specialized website. In early April, a criminal case was opened regarding the disappearance of Yakzhina (part 1 of Article 105 of the Criminal Code) and attempted fraud (Article 30, part 4 of Article 159 of the Criminal Code). As a result, the investigation detained three suspects, one of whom, a 52-year-old neighbor of the director, confessed to her murder. He said that he met a neighbor on the street and offered to give her a ride; on the way, a quarrel broke out between them, which ended in murder. The apartment was put up for sale by two other detainees. Investigators believe that it was the attempt to take possession of the housing that became the motive for the crime. The defendants have not yet been sentenced.

Don’t trust the good “precinct officers” and the evil “employees to sort it out” and hung up.

Pankova dialed “02” and reported a suspicious call. Apparently, the scammers assumed such a development of events, because about half an hour later she received a call from someone who introduced himself as local police officer Alexei Surkov. Meanwhile, according to information posted on the official portal of the Danilovsky District Administration of the Southern Administrative District of Moscow, the victim’s house is located within the boundaries of administrative district No. 25, for which district police officers and police lieutenants Nikolai Neverov and Denis Belov are responsible.

Surkov assured the pensioner that he had the situation under control and advised her to follow his instructions. That same evening, an “employee from the Central Bank” called her back; the next day he called her again and said, “Now we’ll sell the apartment!”

After this, the panicking pensioner was called back by “precinct officer Surkov,” who said that he was tapping her phone and was aware of what was happening. He advised her to follow the instructions of the criminals and promised to assign her a man who should be called “grandson” in the presence of other people, and “his” realtor. They had to draw up documents to conclude a “fictitious agreement for the sale and purchase of an apartment,” which “will help solve the crime.” On the same day, that same “grandson” came to Pankova - a young man named Alexander, who clarified that he was “from Surkov,” and a girl named Daria, a realtor at the Armand Realty real estate agency. They took the woman to a real estate agency to draw up preliminary documents for the transaction. In the evening, she called the “precinct officer” again, saying that she was afraid. “Don’t worry, Dasha is our person!” – he assured. Pankova had no choice but to believe, and on June 18 she signed the purchase and sale agreement.

The buyers were a certain Alexander Sparyshkin and Dmitry Armand, the owner of the real estate agency through which the transaction was completed. Sparyshkin deposited 4.75 million rubles in the locker of the FORA Bank branch, and Armand – 750,000 rubles, although the purchase and sale agreement stated that they were purchasing an apartment for 8 million rubles. After this, according to Pankova and her defense, “grandson” Alexander took the money from the cell and disappeared with the funds received. As a result, the woman was left without money and without a roof over her head.

“Elderly people are like children...”

Pankova, unfortunately, is not the first and will not be the last victim of scammers who “specialize” in deceiving pensioners. “The number of crimes under Art. 159 of the Criminal Code (fraud), is growing,” says Grigory Marchenkov, head of the ODUUP and PDN of the Internal Affairs Directorate for the North-Eastern Administrative District of Moscow . “Moreover, in relation to older people who are at risk - single or living separately from relatives - in our district it increased by 12%.”

According to official statistics, over 5 months in the North-Eastern Administrative District the number of registered general criminal frauds increased by 39.4% (from 558 to 804). There were 27.6% more such crimes solved than in the same period last year. The number of identified fraudsters increased by 40% (from 45 to 63 people).

Among the registered frauds:

– 12 crimes were committed by persons who introduced themselves as social service employees and medical workers;

– 10 – imaginary employees of public utilities;

– 8 crimes are related to illegal occupation of housing;

– 427 were committed using mobile communications and the Internet.

No matter how much we warn our elderly relatives, this will not save them from scammers, Marchenkov believes. “Older people are like children, no matter how much you tell them, they will still do it their own way, especially if they are afraid for their loved ones,” he explains. Moreover, criminals often turn out to be good psychologists and have reliable sources of information - doctors and social service employees can share it, including for money. Fraudsters do not go door to door, choosing a victim, but hit with precision - they come to a specific address, knowing the name of the pensioner and his relatives, tracking movements, and so on.

The best thing in such a situation is to organize constant monitoring: hire a nurse, ask neighbors to look after the lonely pensioner. And, of course, call your family as often as possible, ask how they are doing, and tell them that everything is fine with you. “Often, when they call such a grandfather or grandmother and say: your relative is in trouble, you need money, they don’t even call the relative back to find out if everything is okay,” says Marchenkov.

Any such visits, calls, threats must be reported to the police and no action taken until police officers contact you. If the criminals insist on a personal meeting, you can call the squad at the same time. It is easier for police to catch fraudsters on the spot than to look for them after the crime has already been committed. This is because it is very difficult to respond promptly to such cases of fraud: an elderly person does not immediately understand that he has been deceived; he usually reports to the police a day later, or even a few, by which time the criminals have managed to move far away, leaving almost no traces.

As you can see from the statistics, scammers often introduce themselves as employees of social services, which, by the way, is what they pretend to be. “Each elderly person who is at risk and who cannot take care of himself or herself is assigned a specific social security employee. Only he communicates with his ward, comes to him, calls. The pensioner knows him well, and most likely his neighbors do too. He has the appropriate ID. No one can come “from social security” anymore,” says Marchenkov. All payments, vouchers and other social guarantees are also not issued at home - for this, the pensioner or his representative must contact the social service themselves.

You can also check whether your local police officer called you. For example, through the website of the territorial body of the Ministry of Internal Affairs, where lists of strongholds are published, with the names of district representatives and work telephone numbers. “If the call did not come from this number, you do not need to agree to anything over the phone, make an appointment at the support point. When you arrive at the appointed time and see a local police officer there in uniform, with a badge, and a weapon, this will be a 100% guarantee that he is real,” advises Marchenkov.

The district police officer can conduct an investigation into any fact or appeal, take explanations, write requests to various authorities, and so on, but organizing and coordinating measures to detain criminals is the work of operational criminal investigation officers, to whom the district police officer does not belong. But, in any case, this event will be carried out by employees of the criminal investigation department or the economic security service, and not by “their realtors” or “fake grandchildren”.

Was there a receipt?

The story with Pankova is still not over. The pensioner realized quite quickly that she had been deceived. First, she contacted the police and on July 20 last year she was recognized as a victim in a case initiated against unknown persons under Part 1 of Art. 159 of the Criminal Code (fraud). The investigation is still not over, among the suspects is Alexander Alyapin - the same “grandson” who helped “catch the criminals.”

At the same time, on July 20 last year, Pankova filed a lawsuit in the Simonovsky District Court, demanding that the deal be declared invalid and the apartment returned to her (case No. 2-35/2016). In their response to the claim, buyers Sporyshkin and Armand indicated that they were bona fide purchasers. “When going to court to declare a transaction made under the influence of deception invalid, the burden of proving guilt falls on the plaintiff. The statement of claim does not present a single argument and does not present a single piece of evidence to support the fact that the defendant buyers committed any illegal actions that led to the conclusion of the apartment purchase and sale agreement,” the response to the claim stated. In addition, Pankova, in the presence of a notary, confirmed that she was entering into the agreement voluntarily and was fully aware of her actions and their consequences, which, according to the defendants, also spoke in favor of the validity of the transaction.

At the same time, the investigation conducted two psychophysiological examinations using a polygraph, during which Armand and Daria Ilyina, the realtor who accompanied the transaction, were interrogated. The results showed that both of them knew at the time of concluding the agreement that Alyapin was not Pankova’s grandson and was “stealing her apartment,” and also that Armand had deposited an amount significantly less than what was specified in the agreement into the bank safe deposit box. They also confirmed the information that Pankova, when drawing up documents from a notary, did not familiarize herself with their contents and signed them without looking. In addition, according to Matvey Revyakin, lawyer at Reznik, Gagarin and Partners,

, who represented the interests of the pensioner, responding to requests sent by him to law firms that handled similar cases involving Armand as a home buyer or realtor, he always used the services of the same notary to certify transactions.

On May 19 this year, Judge Pavel Vershinin rejected the claim. In the decision (the text is available to the editors), he indicated that Pankova did not provide a single piece of evidence that Armand or Sporyshkin committed any illegal actions that led to the conclusion of an agreement for the sale and purchase of an apartment by deceiving the plaintiff or misleading her, and also that she actually received threats. Here the judge referred to clause 14 of the agreement, which, among other things, states that all its parties, in the presence of a notary, confirmed that they understand the essence of the agreement that they are concluding, they do not have circumstances forcing them to conclude it on extremely unfavorable terms, the agreement is not is under the influence of a combination of difficult circumstances for the parties.

According to the applicant and her representative, the conspiracy between the buyers of the apartment and the persons who contributed to its sale was obvious - after all, the realtor Daria worked in a real estate agency owned by one of the new owners. However, the court indicated that “the very fact of the performance of certain official or labor duties of these persons does not confirm the fact of the plaintiff’s deception when concluding the purchase and sale agreement.”

Meanwhile, Alyapin, interrogated during the meeting, said that he was hired to play the role of “grandson”, paying 500,000 rubles. The actions of all participants in the transaction (including buyers and realtor) were supervised by a certain “Volodya” - an acquaintance of his acquaintance, who suggested this way of “earning money” to Alyapin. However, the court was critical of his testimony, since it “contradicts the actual circumstances of the concluded agreement.”

Lawyer Revyakin insists that the defendants did not present a receipt from the plaintiff, which would indicate that she received money for the apartment. Alyapin said that Pankova gave such a receipt (a copy of the interrogation protocol is at the disposal of the editorial office), moreover, she rewrote it twice: first when preparing the transaction at Armand Realty, and then at FORA Bank on June 18 at the time of transfer of money .

Revyakin considered it proven that his trustee was misled, but the court did not apply the provisions of Art. 178 Civil Code. Clause 1 states that a transaction made under the influence of a mistake may be declared invalid by the court at the claim of the party acting under the influence of the mistake, if the mistake was so significant that this party, having reasonably and objectively assessed the situation, would not have completed the transaction if would have known about the actual state of affairs.

The situation was commented on by the lawyer of the Law Office “Reznik, Gagarin and Partners” Konstantin Gagarin (his law office is handling this case on a pro bono basis) –

The judge took it upon himself to deprive the pensioner of her only home in the presence of irrefutable evidence of deception in the case. Moreover, the judge devalued the work of law enforcement agencies by pre-determining the question of the innocence of the so-called “buyers”, whose involvement in fraud is being verified by the investigation, before the investigation into the criminal case was completed. It seems that the judge ignored the obvious facts of deception under the influence of the charm of realtors in crimson jackets. In fact, the present solution is an indulgence for scammers who cynically threw a lonely pensioner onto the street

There is a chance to win the case

Revyakin has already filed an appeal in the case, and his colleagues believe that Pankova has every chance of returning her housing. True, Lada Gorelik, managing partner of Gorelik and Partners , believes that since the pensioner is recognized as a victim in a fraud case, the court should not apply Art. 178, and art. 179 of the Civil Code, which deals with the possibility of invalidating a transaction made by the victim under the influence of violence, threat or deception.

Mikhail Voronin, senior partner at Yukov and Partners, says that the apartment will in any case be returned to the owner if a conviction is made in a criminal case of fraud. “This case should definitely be qualified under Part 4 of Art. 159 of the Criminal Code, all those involved must be brought to justice, and when the court determines the culprits and the verdict comes into force, the apartment will be returned to the woman who suffered from fraudulent actions, even if the current purchasers are bona fide,” he says. “Perhaps it would be advisable to file a claim in a criminal case, when it is brought to court, to compensate the victim for property damage by returning the apartment,” adds Gorelik.

“A common mistake in such cases is that the injured party places its main hopes on officials of the internal affairs bodies, ignoring the possibility of conducting a lawyer’s investigation. At the same time, the results of a high-quality lawyer’s investigation greatly simplify the work of both law enforcement agencies and the court,” says lawyer Anton Pulyaev, deputy chairman of the DE-JURE Bar Association .

lawyer Alexey Mikhalchik agrees with him , who suggests that lawyers representing victims of fraud in such cases should more actively use materials from criminal cases or pre-investigation checks as arguments. “In my practice, there was a case when an apartment was returned to the owner on the stated grounds after how a technical examination of the documents established that the signature on the receipt for receipt of funds for the apartment was made earlier than the text of the receipt, that is, on a blank sheet of paper. The court recognized these actions as fraud and terminated the apartment purchase and sale agreement,” the defense lawyer shares his experience.

In the meantime, according to lawyers, it is necessary to ensure that interim measures are taken so that “the apartment does not go further.” Gorelik, for example, proposes to do this as part of a criminal investigation: recognize the housing as material evidence, seize it and transfer it to the custody of the victim. And lawyer Pulyaev believes that the petition for seizure should have been submitted along with the statement of claim.

Lawyer Oksana Filacheva also reminded about prevention, noting that elderly single people first of all find themselves in such situations, and primarily because they do not consult with relatives, friends, and neighbors in a timely manner. “I am convinced that such fraud will not work, if the victim seeks advice from lawyers in time. Both people suffering from mental disorders and completely healthy people fall for fraudulent housing schemes; the only question is how convincing the scammers are, the lawyer is sure. – In my practice there is a huge number of such cases. They need to be dealt with, but each case requires a lot of work, so it is better to prevent such situations rather than resolve their consequences.”

What about the buyer?

Legal General Director David Melkonyan recalled the other side of the apartment fraud coin . According to him, if, upon termination of a transaction concluded by deception, it is not difficult to return the apartment itself and other real estate, then, as a rule, a bona fide purchaser has to fight for the return of the money paid to the scammers. “The most serious problem from the point of view of judicial practice that a real estate buyer can run into is the recognition of the transaction as invalid by a court decision,” says Melkonyan.

This is due to the fact that the plaintiff must prove the reasons why the transaction should be classified as unconcluded and provide compelling evidence. To cope with the collection of evidence, he should have a good understanding of the law and be able to correctly draw up all the papers submitted to the court. “If there are usually no difficulties with the return of ownership of the apartment, at least according to the documents, since changes to the register about the change of owner are made automatically after the court decision is provided, then difficulties may arise with the return of funds. If voluntary return does not occur, the party to the agreement will have to begin enforcement proceedings, and this will take time, says the lawyer. – Of course, the buyer has the opportunity to protect himself from such a situation and minimize financial risks - to conclude an insurance contract for the purchased property, provide for the risks of invalidating the transaction and do this simultaneously with the conclusion of the contract. But these are certain expenses that the parties to the transaction are unlikely to bear.”

The main thing is to remember that it is unlawful to bring claims against bona fide purchasers under Article 167 of the Civil Code of the Russian Federation. This rule was approved by the Constitutional Court in Resolution No. 6-P of April 21, 2003. The owner can demand the return of property on the basis of Article 167 of the Civil Code only from an unscrupulous purchaser. Since a bona fide acquisition in the sense of Article 302 of the Civil Code is possible only when the property is acquired not directly from the owner, but from a person who did not have the right to alienate it, the consequence of a transaction made with such a violation is not bilateral restitution, but the return of property from illegal possession (vindication).

When bringing such claims, plaintiffs must know which category to classify the last owners of property into: bona fide or dishonest purchasers. And depending on this, make a decision on the subject and basis of the claim. If the transaction is declared invalid, then the rules of bilateral restitution must apply. This means that each party to an invalid transaction returns everything received under it to the other party. That is, in relation to residential space, one party must return this area, but the other party returns the money received for this area. Otherwise, the court decision is subject to cancellation as it violated the rights of the participants in the invalid transaction.

- Fraud, Real Estate, Courts and Judges

- Civil Code of the Russian Federation

- Theft

It is not possible to refund taxes for years preceding the year in which the right to deduction was granted.

Tax refunds can be made only from the moment the right to deduction arises. This means that you cannot receive money for previous years.

To find out detailed information about all the nuances of property deductions, read the article “Tax deductions when purchasing an apartment, house, or plot of land.”

Example:

In 2021, you bought an apartment in a building under construction under an equity participation agreement. The fact that the contract has been signed does not give you the right to a tax deduction.

In January 2021, the house was handed over, and you received a Transfer and Acceptance Certificate with the right to register the property. From this moment you have the right to deduct. In 2021, you can contact the Federal Tax Service and receive a tax refund for 2021.

If you don't have enough income tax paid during 2020 to receive a full refund, your right will carry over to the next year. And so on until complete exhaustion. But you cannot get the money back for 2021, 2021 and 2019, since you were not yet eligible for the deduction in those years.

Example:

In 2021, you purchased a home under a sales contract. In the same year we received an extract from the Unified State Register of Real Estate. This means that your right to receive a property deduction arose in 2021.

Since you decided to contact the inspectorate in 2021, you can receive a tax refund and file 3-NDFL declarations for 2020 and 2021.

If the income taxes you paid during those years do not cover the tax deduction you are entitled to, your entitlement carries over to subsequent years. In this case, in 2022 you need to contact the Federal Tax Service minus 2021, in 2023 - 2022, and so on every year until completely exhausted. Returns cannot be filed for 2021, 2021 or earlier.

Attention! The ban on transferring property deductions to previous years does not apply to pensioners. According to paragraph 10 of Art. 220 Tax Code of the Russian Federation:

“For taxpayers receiving pensions in accordance with the legislation of the Russian Federation, property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of this article may be transferred to previous tax periods, but not more than three, immediately preceding the tax period in which the carried forward balance was formed property tax deductions."

Example:

Your mother became a pensioner in 2021. In 2021, she bought an apartment. Since documents for deduction are submitted at the end of the tax period, your mother can apply to the Federal Tax Service in 2021.

She will not receive a deduction for 2021, since she no longer worked and did not receive taxable income. But she will receive a property deduction for 2021, 2021 and 2021. When calculating the deduction for 2021, the months when your mother was still working will be taken into account.

Have a question or need to fill out 3-NDFL - we will help you!

To get a consultation

Return of a sold apartment

Return the purchased apartment through legal proceedings

Legal experts will help you resolve these and other serious issues. Contact us for help.

Yes, there are options for returning a purchased or sold apartment (namely, returning an apartment after purchase in the sense of registration), for example:

- the seller or buyer is declared incompetent, and the transaction was made without the consent of guardians and guardianship authorities;

- one of the parties was forced to carry out such a purchase and sale (this will also have to be proven in court);

— the apartment was sold twice, the second time using duplicate documents;

- fraudulent actions were carried out when showing or selling an apartment (falsified documents, a hung street sign on the house, a number on the apartment, other deliberate misrepresentation regarding the characteristics of the object or deception, etc.);

— criminal acts of various nature;

- there are facts proving the invalidity of the transaction, etc.

In order to return a sold or purchased apartment, it is necessary to collect a serious evidence base even before going to court. It may be necessary to conduct a series of examinations and collect the necessary documents and evidence. When filing a claim, a clear, specific position must already be developed. The judge must understand the meaning of the dispute and the grounds for returning the apartment from the text of the statement of claim.

Documents for property deduction for the current year can only be submitted next year

As stated in paragraph 7. Art. 220 Tax Code of the Russian Federation:

“Property tax deductions are provided when the taxpayer submits a tax return to the tax authorities at the end of the tax period, unless otherwise provided by this article.”

The tax period is considered to be the calendar year from January 1 to December 31. This means that the 3-NDFL declaration for a specific year can only be submitted after its end, that is, next year. It does not matter in what month you purchased the property and for what months you paid income taxes.

Example:

You bought a room in March 2021, received an extract from the Unified State Register of Real Estate and decided to immediately receive a property deduction. The tax office will not accept your documents, since the tax period during which you received the right to deduction has not yet ended. You can submit your 3-NDFL declaration no earlier than 2022.

In order not to wait for next year and receive a property deduction immediately, contact the inspectorate at your place of residence. After a 30-day verification of your documents, the Federal Tax Service will issue a Notification, which you will submit to the accounting department of your enterprise.

From this moment on, the employer will suspend transferring 13% of personal income tax from your salary to the budget. This is stated in paragraph 8 of Art. 220 Tax Code of the Russian Federation. For a detailed description of the process, see our article “Obtaining a property deduction from an employer.”

Tax concierge - consultations with a tax expert for only 83 rubles per month!

Order service

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Natalya Kolbasina

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Margarita

10.20.2020 at 15:40 Hello, I made a ban on transactions without personal participation, but on the Internet they still write about fake passports. How realistic is it to make such a transaction using a fake passport? I called the Rosreestra hotline and the operator said that all documents are being checked and my friends convince me that it’s difficult, I recently left a photocopy of my passport and didn’t sign the passport, I didn’t lose the photocopy, they made it and I didn’t see how it took two minutes, they returned the passport, now I’m worried

Reply ↓

There is no statute of limitations for property deductions

Whenever you purchase an apartment or other housing, after receiving ownership rights, you can return the tax even after five or ten years.

It doesn’t matter why you didn’t immediately exercise your right - you didn’t know about such an opportunity or didn’t have taxable income - the property deduction has no statute of limitations .

Don’t forget - you can submit documents to the Federal Tax Service at the end of the year for which you want to receive a deduction. For example, a refund for 2020 is issued in 2021 or later.

Example:

You bought an apartment in 2009, and in 2021 you decided to receive a tax deduction. After contacting the inspectorate, you will receive your money back.

Attention! There is a restriction that you are only entitled to a tax refund for the last three years. This is stated in paragraph 7 of Art. 78 Tax Code of the Russian Federation.

Example:

You bought an apartment in 2010, and in 2021 you decided to receive a tax deduction. You can safely contact the Federal Tax Service and receive the money due to you. If you want to return tax for previous years, then 2021, 2021 and 2018 will be included in the calculation.

Quick registration and help from a tax expert!

Register

What to do if they refuse

If the seller refuses to return the money or pay a penalty, you must try to resolve the situation peacefully: contact the developer or seller in writing indicating the requirements. If there is no response, the complaint is forwarded to the court with all necessary documentation attached.

During the proceedings, the court will definitely find out whether there were attempts to resolve the conflict on its own. If you document that you tried to negotiate with the seller, the advantage will be on your side.

Dear readers! To solve your problem right now, get a free consultation

— contact the lawyer on duty in the online chat on the right or call: +7 (499) 938 6124 — Moscow and region.

+7 (812) 425 6761 — St. Petersburg and region. 8 (800) 350 8362 - Other regions of the Russian Federation You will not need to waste your time and nerves - an experienced lawyer will solve all your problems! Or describe the situation in the form below:

You can only receive a tax deduction for the last three years.

Despite the fact that the property tax deduction has no statute of limitations, clause 7 of Art. 78 of the Tax Code of the Russian Federation imposes restrictions on tax refunds for previous years:

“An application for a credit or refund of the amount of overpaid tax may be submitted within three years from the date of payment of the specified amount, unless otherwise provided by the legislation of the Russian Federation on taxes and fees.”

Example:

You bought a house in 2015, but decided to apply for an inspection only in 2021. You can return the tax for 2021, 2021 and 2018.

If the income tax you paid during these years is not enough to cover the entire amount of the tax deduction, then you will have to file a 3-NDFL return in 2022 and receive a deduction for 2021. And so on, until the overpaid tax is completely exhausted. You will not be able to receive a deduction for 2021 or 2021.

For pensioners, the deadline for tax refunds for previous years has been extended. According to Letter of the Ministry of Finance of the Russian Federation No. 03-04-05/40681 dated July 12, 2016, a pensioner may not wait for the next year and file a declaration for the four previous years in the year of retirement.

Example:

In 2021, you purchased a home. In 2021 we received a tax deduction for 2021, in 2021 - for 2021. After that, you retire in 2021.

Now you can take advantage of the legislative benefit and return tax for previous periods: 2021, 2021, 2021 and 2021. You have already received a deduction for 2021 and 2021 when you were not yet a pensioner, which means there remains a deduction for 2021 and 2021.

In 2022, you are entitled to a refund for 2021 for the months you were still working.