The transfer of ownership of real estate must be registered with Rosreestr.

Only after this the buyer will become the official owner of the land plot.

Registration of property rights is a paid procedure, as it is accompanied by the issuance of documents with the name of the new owner.

Therefore, before submitting documents, you must pay a state fee in the amount of 350 or 2000 rubles. Details on how to calculate the amount are below.

Legal basis

The need to pay a fee for registering the transfer of ownership rights is specified in Federal Law No. 218 “On State Registration of Real Estate”. However, in Art.

17 of the law there are no specific amounts, but a link to the Tax Code of the Russian Federation is left, since the amount of payment may change. However, in addition to Art. 333.33 of the Tax Code, the formation of the state duty is also influenced by the Land Code and Order of the Ministry of Economic Development No. 44 “On approval of the classifier of types of permitted land use.”

These legislative acts establish the category of land, and therefore directly affect the amount of state duty.

Important! Some clauses of the Tax Code regarding the amount of state duty are controversial. Therefore, various authorities periodically issue clarification letters. For example, in an information letter dated July 26, 2017, Rosreestr explains the procedure for paying state fees.

Who pays: buyer or seller?

In the codes that regulate the payment of state fees, there is no indication of who exactly should contribute the funds. Therefore, to clarify this situation, a letter from the Department of Tax and Customs Tariff Policy of the Ministry of Finance was published. Although it was published back in 2011 and referred to some legislation that had already changed, the general principles remained unchanged.

In accordance with the explanatory letter, the buyer pays for the registration of the transfer of ownership, since he is the applicant regarding the change of ownership. If there are several buyers and each receives an allocated share, then the duty is divided among them in proportion to their rates.

For example, a plot of land is registered as the property of 2 individuals and 1 legal entity. face. Each buyer is required to pay ⅓ of the duty amount, i.e. for individuals - 670 rubles (⅓ of the rate of 2 thousand rubles), and for a company - 7350 rubles (⅓ of the rate of 22 thousand rubles).

The information letter also contains clauses stating that the seller and buyer pay the state duty in equal shares. However, this rule applied only to the registration of the purchase and sale agreement. And in accordance with Art. 551 of the Civil Code, the fee is paid only for registering the transfer of ownership rights.

How to pay state duty through the Sberbank terminal

Terminals are located in all Sberbank branches, so you can pay for the state fee at any of them. The operation requires a few simple steps. You need:

- insert the card into the terminal;

- enter PIN;

- select “Payment in our region”;

- click on the option “Taxes, fines and state duties”, go to “State duties and fees”;

- indicate the recipient's TIN;

- enter your passport details;

- select the type of state duty;

- indicate the price;

- press the “Pay” button;

- pick up two checks.

If you wish, you can use the terminal of another bank. Almost all branches across Russia provide the opportunity to pay state fees. However, it is better to choose the bank to which your card belongs. This will help you avoid charging additional fees.

Payment order

According to generally accepted standards, payment of the fee is made before submitting documents, since registration authorities require a receipt to confirm the fact of depositing funds.

However, Rosreestr explained the procedure for paying fees for real estate transactions:

Payment is made before or after submitting documents. The main thing is that the money is credited before the set of papers is reviewed by the registration authority.- In Rosreestr, the receipt of funds is checked using the GIS GMP system, so it is not necessary to present a receipt or bank payment.

- If the applicant has not paid the fee before submitting the documents, then after receiving the papers he must be given a payment direction with a unique identifier, details and the date by which the funds must be paid.

- From the moment of submitting the documents, the citizen has 5 days to pay the state fee. Otherwise, the documents are returned without consideration.

The deadline for paying state fees may be extended. For example, if the applicant deposited funds by bank transfer only on the 5th day after submitting a set of papers. Such a transfer takes about 3 days, so in the GIS GMP system, the stamp on payment of the state duty will appear only on the 8th day.

But the applicant can immediately provide a receipt to Rosreestr after payment , therefore, instead of returning documents without consideration, registration of the agreement and property rights will be delayed until a mark appears in the GIS GMP.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Jalil

07/27/2021 at 00:24 Good afternoon! I received this notification in the mail. Your application requires payment. You can do it on the portal using a bank card, mobile phone, or electronic wallet. Do this right now so that the department has time to receive payment information before your visit to the department.Service Issuance of a foreign passport

View application

And in public services there is only a notification about filing an application. How can I pay the state fee at a discount? Thank you

Reply ↓

Anna Popovich

07.28.2021 at 02:34Dear Jalil, contact a specialist of the State Services hotline by phone or short number for mobile phones - 115.

Reply ↓

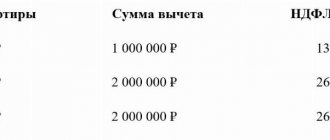

Size when registering land ownership

The specific amount of state duty for land is indicated in Art. 333.33 Tax Code. The table below outlines mandatory payments in various situations.

| Amount of state duty for an individual, in rubles | Amount of duty for a legal entity, in rubles | |

Registration of land for:

| 350 | 22000 |

| Registration of a plot of agricultural land | 350 | 350 |

| Registration of a land plot for other purposes | 2000 | 22000 |

| Registration of the share of the land plot listed in the first row of the table (proportionally for all buyers) | 350 | 22000 |

| Registration of a share on the right of common ownership for agricultural land | 100 | |

| Registration of a share of land for other purposes (proportionally for each participant in the transaction) | 2000 | 22000 |

| Purchase of joint property on the right of common use without allocating shares among the lands indicated in the first line of the table (from each) | 350 | 22000 |

| Purchase of joint property on the right of common use without allocating shares among lands for other purposes (from each) | 2000 | 22000 |

If there is a house on the site, including an unfinished one, then the buyer will need to pay a fee for the transfer of ownership of the building . The fee is 2000 rubles. Some sources mention that the state duty for a house is only 350 rubles. However, this rule only works when the house is registered as a property and for initial registration. Therefore, it is not valid during the sale.

How to pay state duty through Sberbank Online

To make a payment through Sberbank Online, you must be a user of a Sberbank card. First you need to open the bank page. What to do next?

- log into your personal account, enter your username and password;

- Confirm your login with a password sent to your phone number;

- open the “Payments and Transfers” tab;

- enter the recipient's details in the columns;

- check the information entered;

- indicate the price;

- click on the “Pay” button;

- receive the code in the form of SMS from the bank, fill it in the payment confirmation line.

The operation is completed. After this, the system will offer to print a receipt. In the future, only he will confirm the fact of payment. The same procedure can be carried out through the personal account of other banks.

The amount of state duty when purchasing land together with a private house or dacha

The house and the land on which it is built are considered inseparable.

Therefore, when purchasing a dacha, the new owner will be given rights to a plot for personal farming. The fee for registering ownership of a house is 2,000 rubles and another 350 for registering land.

If the plot is not privatized, then the buyer will have the same restrictions as the previous owner. For example, if a long-term land lease was issued.

But in this case, the new owner must pay a fee not for transferring ownership of the land, but for registering an additional agreement to the lease agreement - 350 rubles for individuals or 1000 for legal entities.

Note! The Ministry of Finance information letter No. 03-05-06-03/42109 mentions the term “blocked residential development”. This is a single-family home that is adjacent to adjacent buildings by one or more walls and has access to land designated for common use. Therefore, a fee of 350 rubles is levied on each owner of adjacent houses.

If all the above methods do not work

If you do not have a card, an electronic wallet and a mobile phone with a sufficient balance, then there is only one option left - to pay the state fee in cash. What can be done at the cash desk of any bank.

To do this, in the list of payment options, you must select the “Download receipt for payment” option. Download it to your device. The form looks like this, all the necessary information has already been entered into it:

Now you need to print it. Next, go to the cash desk of any bank and deposit money in cash. But please note that banks may charge a commission for making such a payment according to their tariffs. Please check this information in advance.

Payment details

Details for paying the fee can be found on the Rosreestr website:

- You must select the region of registration of the object;

- Select the tab with the name of the area next to the “Central Office” section.

On the same page you can print a payment form. Details are also issued at the MFC and Rosreestr branches after submitting a set of documents.

Privileges

The fee for registering land ownership rights is not paid:

- veterans and disabled people of the Great Patriotic War;

- former concentration camp prisoners;

- Muscovites who fell under the housing renovation program;

- budgetary organizations.

There is also no requirement to pay a fee for registering transactions in the Republic of Crimea if they were concluded before the region was admitted to the Russian Federation.

Reference! In case of payment of the fee through the State Services website or other regional portals connected by authentication with the ESIA system, a 30% discount is provided.

Services of our real estate lawyers

Legal support for the purchase of real estate

Legal support for the sale of real estate

Registration of property rights and transactions in Rosreestr

Recognition of ownership of real estate in court Registration of inheritance in Russia

Need a real estate lawyer? To calculate the cost of services, call us at 8 (495) 223-48-91 or submit a request.

Order