Over the past 10 years, the level of debt among the population in Russia has increased significantly. Few people can boast of being debt-free. Most citizens receive loans from large well-known banks. But having allowed several months of delay, debtors are forced to communicate not with representatives of the bank where the agreement was drawn up, but with uncompromising collectors.

After many stories and news about the rude, and sometimes inhumane, behavior of debt collectors, in difficult economic times, all loan holders are worried about what to do if the bank has transferred the right to collect your debt to collectors.

Options for interaction between a bank and a collection agency

When issuing loans, banks expect to repay the borrowed amount and pay interest during the use of the borrowed funds. But not all borrowers fulfill their loan obligations on time and in full. Banks try to recover lost funds in several stages. When it is not possible to appeal to the conscience of defaulters with the help of its own employees, the bank turns to collection agencies. There are two scenarios in which the interaction between the bank and collectors occurs.

- The loan is not transferred anywhere, the debt remains on the bank’s balance sheet, and collectors only provide assistance in the process of returning borrowed funds.

- Assignment of rights of claim. This means that the bank sold the debt to a collection agency, and now it will search for an unscrupulous client and collect the debt on the loan.

Having received information about an old debt taken out from a bank from collectors, you must carefully read the letter and determine whether there is an assignment of claims, or whether the collector represents the interests of the same bank.

How can you turn off debt collectors over the phone forever?

There is no way to completely stop communication by saying a certain phrase to the collector. It is important to understand how such agencies generally work. Essentially, these are call centers, and collectors are simple operators working according to a given scenario.

The program issues calls to them. The collector first sees a note with the history of negotiations, and then he himself also puts some notes. Whatever the debtor says, soon the program will again call the specialist, and this may be a completely different operator. Therefore, it often happens that the debtor hears the same questions and tells the collector the same things in a circle. This is how the system is built.

You can send the caller as much as you want, telling him “Go to court!”, “I still won’t pay anything,” everything is useless. You will soon see an incoming call again. But there is still a way - write a statement of refusal to interact.

Debtor's first actions

If the information letter refers to the transfer of a debt, the citizen has the right to verify whether there was actually a transaction between the bank and the collection agency. Therefore, first you need to send a request to the organization specified in the letter to provide supporting official documents (a certified copy of the agreement and an extract directly from the loan). It is better to use mail as a means of communication, send a registered letter with notification of receipt.

If the bank really entered into an agreement on the assignment of claims under this loan, the agency will not have difficulty proving this. Until a written response, the debtor may not send funds to the collection account, and the accrued fines for the waiting period can be challenged, and the court will be on the side of the borrower.

It would also be a good idea to contact the bank where the loan was issued. There is always a possibility that the mailing is just another intimidation to activate debtors. Then it’s better not to tempt fate and start repaying the overdue loan immediately.

Challenging the loan agreement and assignment agreement

These options are used:

- when there are real grounds to recognize the agreement (agreements) in part or completely as invalid;

- when the debtor needs to initiate legal proceedings regarding the debt himself and does not want to wait for a claim from the creditor;

- when you want to delay the collection procedure - until a decision is made on the claim regarding the invalidity of the contract, there can be no talk of collection.

To choose the right model of behavior, you need to assess the prospects for the development of the situation. Consultation with a credit lawyer can effectively help with this, or even better, the latter’s study of the contract, the situation as a whole, and preparation of a specific action strategy.

If you have any questions, you can ask our duty lawyer online for free.

Is it legal to sell debts?

Before discussing the legality of a particular action on the part of an organization controlled by many services, in this case a bank, it is important to take into account that most Russian laws have such a line as “unless otherwise provided by the terms of the contract.” This means that almost any action of the bank in relation to a specific client is legal if it is specified in the loan agreement and the borrower has signed it.

Issues of consumer lending are regulated by the law on the protection of consumer rights. It does not explicitly prohibit the assignment of claims under a loan. There is only an obligation for banks to enter into such transactions only with organizations that have a license to conduct banking activities.

Therefore, you need to re-read your loan agreement again and find out if there is a clause that talks about the possible transfer of debt and information about the client and information on the loan. If the client was warned at the stage of signing the contract, there can be no claims against the bank. During the first months of delay, the debtor is repeatedly reminded about it and the possible consequences. Not earlier than after 3-6 months of complete absence of payments, the bank transfers the right of claim to collectors.

Restructuring agreement

In most cases, collectors who have purchased a loan debt themselves, in their initial communication with the debtor, invite the latter to consider the option of restructuring. True, the schemes here often differ from what banks usually offer. They may, for example, offer to pay off some of the debt at once (before a certain date), and distribute the rest over months. Such offers usually come regularly, and often as the debtor refuses or ignores them, they become more and more loyal.

Whether or not to agree to restructuring is an individual question. The main thing is that there is a desire and financial opportunity for this. Collectors cannot impose restructuring. Moreover, you can prepare and officially present a restructuring plan yourself. This is done by sending a letter or in the form of a response to a received complaint.

Who to pay and how much

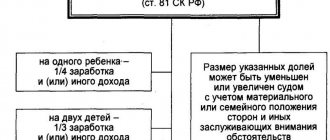

In cases where collection agencies act on the basis of a partnership agreement for the provision of services, that is, they perform collection work instead of the bank, but the debt remains with the original credit institution, all payments to repay the debt must be sent only to the bank to the previous account. For a long delay, the amount of the monthly payment increases due to accrued penalties and fines, which must be paid first.

When the right of claim is assigned, the borrower ceases to be indebted to the bank, and now the loan is repaid in the interests of the collectors. But this does not mean a multiple increase in the size of the debt. The law protects the rights of citizens. Regardless of who the loan debt is transferred to, no one can change the terms of the initial agreement with the bank without the consent of the borrower. This means the interest rate, the procedure for calculating fines, etc. should not be subject to adjustment by collectors.

How long does it take for the bank to transfer the debt to collectors?

There is no exact answer to this question; each financial organization solves this problem independently. But if we take into account that collection departments are also collectors, then problematic contracts come to their attention on the fifth day of delay.

Five calendar days is considered the norm for the banking sector. It is during this period that banks do not take any action against debtors. The exception is the fine, which is charged the next day as soon as the borrower forgets to pay.

If the delay lasts less than 5 days, this will not affect your credit history in any way.

It is necessary to understand that for the first two months the creditor will try to independently force the debtor to pay and put it back on schedule. Only after this can the debt be transferred to collectors on the basis of Art. 382 of the Civil Code of the Russian Federation.

Initially, debts are transferred for a time, and not sold. The average transfer period is three months.

Which contract can be transferred first:

- The debtor is not contactable. All phones are switched off.

- The debtor did not make a single payment.

- The debtor lives at a great distance from the bank's representative office.

In fact, these are all contracts that are difficult to collect on your own.

Delay is grounds for starting the collection process against the borrower (Article 393 of the Civil Code of the Russian Federation). Improper performance of their duties allows the creditor to sell debts.

Do's and don'ts for debt collectors

Collection agencies are organizations that have the appropriate license, are officially registered and carry out their main activity, namely debt collection, in accordance with current legislation. By definition, debt collectors are not bandits or criminals. But, unfortunately, in practice, in order to force unscrupulous payers to repay debts, collectors often use methods that go beyond their powers. Actions that violate the rights of citizens are illegal:

- Blackmail, threats and intimidation of the borrower and his relatives.

- Night calls (from 22.00 to 8.00).

- Calls to work and personal numbers more than 6 times a day.

- Public posting of information about the debt (social networks, inscriptions on the walls of the entrance, etc.)

- Penetration into the debtor's home.

- Attempts at any confiscation or simply inventory of property.

- Use of profanity, insults, humiliation and elevated tone of speech in dialogue.

- Demanding minute-by-minute payment directly to the collector.

- Inflating the amount of debt by adding additional penalties, fines and commissions not provided for in the original loan agreement.

All that collectors have the right to do is to remind by means of telephone calls and sending letters, notices of the existence of a debt and the need to repay it, to visit the debtor’s place of residence to personally communicate the requirements, without trying to break in by force and observing the rules of business communication.

To collect debt by selling property, collectors must collect the necessary documents and go to court. Only on the basis of a court decision is it possible to use funds in a citizen’s accounts or proceeds received from the sale of his property to pay off a debt. But this process is the work of a bailiff, not a collector.

Trial

Reducing a financial problem to a lawsuit is one of the main options for those:

- who has nothing to repay the debt with;

- who does not want or cannot solve the problem in another way;

- who wants to delay the collection procedure and thereby get additional time for themselves - a kind of deferment of debt repayment;

- who intends to achieve in court minimization of the amount of debt.

It must be said that collectors are in no hurry to sue. Sometimes the process of making phone calls, sending letters, claims, negotiating and other pre-trial activities drags on for years. Going to court means incurring additional costs, and the final result may be receiving 500-1000 rubles a month for decades. Sometimes enforcement proceedings even end with an offer to the creditor of an illiquid asset that he objectively does not need, such as the debtor’s receivables, which they themselves have to collect.

If you are considering litigation in advance as the only option for resolving a debt situation, you need to immediately inform the collector about this, and in the future simply ignore all requests and proposals or wait until the most acceptable one arrives. If the debt collectors approach the magistrate for an order, it can be quashed. The main thing is not to miss this moment, controlling the situation.

Where to go in case of unlawful behavior of debt collectors

The National Association of Professional Collection Agencies (NAPCA) is responsible for the work of all debt collectors. This is where you can file a complaint about the inappropriate behavior of debt collectors. But the reaction is rarely instantaneous. The organization will take a long time to find out what kind of employee he is, whether he was definitely wrong, etc., but as a result, a written response will be given about the measures taken.

You can get a quicker response if you contact the immediate supervisor of the reported collector. Only he is no less interested in repaying the debt and probably consciously turns a blind eye to some of the illegal actions of his employees. But a warning about further contact with law enforcement agencies can pacify a little.

If there are threats to life or health, you must immediately write a statement to the prosecutor's office. Such actions of debt collectors are classified as criminal offenses. There are already many precedents for convictions in cases of abuse of power by representatives of collection agencies.

But any complaint must be supported by evidence: audio and video recordings, photographs, links to social networks, expert opinions (for break-ins and other types of property damage), and witness testimony.

The presence of overdue loans does not deprive a citizen of his legal rights. Even if the bank has assigned rights to your debt to debt collectors, you can protect yourself. Today, the services of anti-collectors are popular, who, for a fee, undertake communication with annoying debt collectors and decide how to resolve the relationship between the borrower and the lender within the framework of the law. But it is safer and smarter to avoid such situations altogether. If a difficult financial situation arises, you should not hide and avoid paying off the debt; it is better to immediately contact the bank with a request for a deferment or restructuring. Banks are interested in repaying the debt in any case and are ready to make concessions privately.

When do debt collectors stop calling during bankruptcy?

According to legislative acts, no third-party organizations or persons have the right to interfere in the processes conducted by the judicial authority. Therefore, as soon as the Arbitration Court approved the application to initiate the procedure for assigning a citizen the status of financially insolvent, and set the date for the first court hearing, collectors, banks, and private creditors must stop all calls, visits and written notifications.

Before submitting an application to the Arbitration Court, one of the mandatory activities is sending notifications to creditors of the intention to initiate the procedure. Copies of notifications and notices of their receipt by the addressees are attached to the application, so the creditor will no longer be able to say in court that they did not know about the start of the bankruptcy case.

If debt collectors continue to call or come, you need to file a complaint and send it to the Federal Bailiff Service. They will react immediately and begin proceedings.

The Caucasus is a delicate matter

And this is not a story at all, but I really don’t know what it is... I listen to three telephone conversations in a row between collectors and debtors from Nalchik, Makhachkala and Vladikavkaz. On the other end of the line –

untranslatable play on words.

What barely reaches my consciousness is

only monstrously distorted Russian profanity.

One thing is clear: the hot guys are not going to give any loans, and if they are “harrassed”, there will be no problems. I’m asking the collectors what it was? They explain: “And this is the most problematic region. It is very difficult to convey the information that they owe something to someone. They live in their own world, and, of necessity, completely forget the Russian language, except for those words that you understood. They prefer to solve all problems not legally - with us or through the courts - but to “resolve” them through friends. By the way, all our conversations are recorded, and this recording can be attached to the case in court, if it comes to it.” - “And how many such clients does your bank have?” -

"Very! Every day we “discuss” like this. In this case, the negotiations clearly did not work out. Now, apparently, regional representatives of the bank from among former law enforcement officers will go to visit the debtors. Maybe they can do something? After all, it’s easier to explain the situation face to face.

The Moscow Arbitration Court rejected the claim of the Collection Development Center against Rospotrebnadzor for the protection of business reputation and the recovery of compensation of 1 ruble. The plaintiff considers the statements of the head of Rospotrebnadzor Gennady Onishchenko about the activities of collection agencies in Russia to discredit his reputation, explained Dmitry Zhdanukhin, general director of the Collection Development Center LLC.

Onishchenko said at a press conference on March 14 that these organizations intimidate people, engage in “telephone terrorism,” threaten with “black lists” and the fact that the consumer of financial services will not be able to obtain a foreign passport or travel abroad. Onishchenko stated that in this case, collection organizations are acting completely unlawfully.

The plaintiff demanded that a refutation be published on the Rospotrebnadzor website, in which it should be clarified that all the actions described by Onishchenko are taken by “some, but not all” organizations, and the phrase should also be added: “Collection Development Center LLC does not apply to such organizations.”

The profession that chose the person

So, now he is 26. An intelligent-looking guy with glasses –

not a strongman and not a former security officer (the most common stereotype).

He started from scratch, and is

the head of a collection agency department at one of the reputable metropolitan banks with an extensive regional network. I ended up in the collectors not entirely by accident, but certainly not at the behest of my soul. It’s just that, while studying at law school, I was tired of surviving on a student scholarship; I wanted to earn extra money. Working for pennies as a legal assistant somehow didn’t appeal; there wasn’t enough experience and connections for the legal profession. So a “position” has turned up, giving the opportunity, with a certain diligence and fulfillment of the plan, in addition to the salary, to also earn a substantial bonus. The option turned out to be optimal. I got involved.

Debt conveyor

The collection approach to debt collection must be distinguished from other methods of solving the debt problem: legal, economic, illegal. At the same time, the collection approach (from the English collect –

collect, collect, collect) can be defined as a conveyor belt, i.e., the most formalized and technologically advanced, collection of a large volume of the same type, mostly undisputed, debt.

Bottom line

It can take a long time to sue a bank. As a rule, banks need to return their money and in most cases, such debts are simply sold, regardless of the court decision.

Sometimes the human factor plays a major role. Contracts are sold by mistake, they are put into a portfolio without checking, and handed over to collectors.

If you have any questions or require free consultation from a specialist, leave a request in the comments or to the lawyer on duty in the form of a pop-up window. You can also call the numbers provided. We will definitely help.

In the lair of the “scavengers”

This is exactly what their “wards” call collectors behind their backs, or even to their faces. The third day I learned the subtleties of craftsmanship in Oleg’s office. There is absolutely no desire to make him an angel, or a kind of modern Robin Hood, taking money from dishonest borrowers and returning it to cunning but law-abiding bankers, or an inhuman monster tormenting poor debtors misled by the “sharks of capitalism”, –

I just want to take a look at the profession, about which there are a lot of rumors, from the inside.

The most reasonable thing is

to tell several stories, and then judge for yourself who is better and who is worse. Everyone has their own truth, and every stick has two ends.

Regulations on the sale of rights of claim to a third party

Selling debt is not an easy process. It is much easier for large credit institutions in this regard. As a rule, they already have well-established partnerships with professional debt collectors. A civilian will have to independently find a suitable collection agency, convince employees to take up his case, offering interesting financial conditions or interest in the personality of the borrower.

Can an individual buy and sell debts?

The law does not establish any personal restrictions in this regard. The sale of debts is available to every lender, regardless of his social status and position in society. The main thing is to have a well-drafted agreement in your hands confirming the fact of borrowing money.

It is necessary to take into account that the smaller the amount of debt, the less willingly professionals will take on the process of collecting it. Some collection agencies generally work only with debts whose amount exceeds 300 thousand rubles. Therefore, if you want to sell your neighbor’s debt of 50 thousand rubles, you will still have to look for people willing to buy it back.

Buyers can be individuals and legal entities, institutions conducting financial activities.

Main nuances of debt sale

To sell a debt to a third party, you must have documents confirming the existence of the debt and the right to collect it. This could be an agreement, a receipt, preferably certified by a notary, with signatures of all parties involved. Otherwise, the lender does not have any legal rights to demand the collection of financial resources from a person whom he considers his debtor.

Before redeeming the debt, the collection agency carefully studies the identity of the borrower, assesses the chances of successful collection, and calculates the amount of possible profit. If the debtor does not have a job, does not have property, and its exact location is not known, the chances of successful collection are extremely low. Collectors are not interested in such a debtor.

It’s another matter if the borrower has real estate, vehicles, is engaged in entrepreneurial activities, or is a well-known person in the city.

You can quickly assess the debtor’s solvency, whether he has property, etc., using integration with the FSSP service, more details in our other article.

The following circumstances increase the chances of debt repurchase by debt collectors:

- significant amount of liabilities;

- low debt redemption price;

- there is a high probability that the borrower will return the money, even after a long time and in parts;

- the debtor has a business, money, jewelry, antiques.

When making a debt transfer transaction, it is worth considering that only the principal amount of the debt is subject to sale. All previously accrued fines and penalties for late payments are cancelled.

Documentary evidence of the sale of debt

The transfer of the creditor's rights to third parties is carried out upon the conclusion of the assignment agreement. This document is regulated by Article 382 of the Civil Code. After the parties have executed an assignment agreement, the original lender is deprived of all rights to the loan issued by him, and in return receives an agreed amount of remuneration from the collector.

The signed assignment agreement is supported by all related documents and certificates for the current loan.

Why does a creditor transfer debt to collectors?

The quick sale of debts allows the lender to receive a certain amount of money, partially covering the loss from non-repayment of the loan issued by him, in a short time.

Typically, a civilian entity transfers debt collection obligations to a third party when:

- all means available to them to collect the loan from the client have already been used, but they have not brought results;

- the lender urgently needs money;

- there is no desire to waste energy, time, and money on numerous lawsuits.

Collectors are looking for benefits for themselves. As a rule, they buy back debts for about 1/3 of the amount of the principal debt. When professional debt collectors manage to collect the entire amount from the borrower (even if it takes a long time), they will make a net profit of around 200-300%.

Commodity – money – commodity

A good fellow came to Eldorado, took out goods on credit, and when asked by the bankers to repay the debt, without blinking an eye, he stated that it was not they who gave him the loan, but the store. “Such is the legal culture!” –

Oleg laughs.

Two friends decided to buy goods on credit. One took a vacuum cleaner, a plasma TV and a washing machine. Another –

5 identical “plasmas”. The first one is expired, but the goods are used in everyday life. The second one is also overdue, but the TVs have disappeared. Conclusion: I bought it either for an organization, which is illegal, or for retail sale.

A man with a salary of 20 thousand rubles a month took out a TV for 50 thousand on credit and, according to his assurances, gave the expensive TV to a friend, but was unable to repay the debt. Where can he be with such a salary!

Borrower’s complaint: “I lent a large amount to a friend, but he doesn’t repay, and that’s why and only that’s why I can’t pay you back. Help!” “You have no right to put pressure on a friend, but we can talk,” –

Oleg gives the go-ahead.

The conversation with a friend had an effect -

he promised that he would return everything.