It is generally accepted that the main thing is to win the trial. Indeed, without an appropriate court decision, it is often impossible to protect your rights and interests, but the issuance of a court decision does not mean that the process can be considered completed. Victory can only be celebrated when it is completed. In order to bring this moment closer, you need to obtain a writ of execution.

If you are not a lawyer or have no experience in litigation, we recommend that you always seek professional assistance. As practice shows, having competent legal support at all stages of the process - from preparing an application to executing a decision - significantly increases the chances of obtaining a positive result. For example, in consumer protection cases.

Why do you need a writ of execution?

A writ of execution (WW) is a special document that serves as the basis for enforcing a court decision. Such a sheet is made on a special form with watermarks and must be certified with seals. The document itself is important for the injured party: IL acts as a certain guarantee that the plaintiff will be able to receive what is due to him according to the law and the decision of the judicial authority. To obtain IL you must:

- wait for the court's decision in your favor (if you decide to enter into a settlement agreement with the defendant, then wait for its approval);

- make sure that the decision has entered into force (i.e. it has not been appealed by the second party);

- apply to court for IL in the prescribed manner.

The sheet must be obtained in order to initiate proceedings to enforce the decision (as a rule, after the decision is made, the plaintiff turns to the bailiffs, who must execute the acts of the courts). In addition to initiating enforcement proceedings, IL gives the collector access to information about the financial condition of the defendant.

Important! You can apply to the court for a writ of execution either the next day after the decision comes into force or a month later. There are no strict deadlines for obtaining IL.

What to do if lost?

A situation often occurs when a writ of execution is lost or the form becomes damaged and becomes unreadable even before the decision has been executed. In this case, the party must contact the authority that issued it with a corresponding application.

The judge schedules a hearing, during which the applicant provides explanations regarding the circumstances of the damage or loss of the sheet. This is done to avoid the possibility of re-execution. If the sheet was lost by employees of the authorized body, the judge, before making a decision to issue a duplicate, sends a request. If the fact is confirmed, then a decision is made to issue a duplicate.

How is a writ of execution obtained?

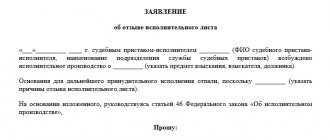

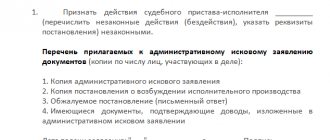

The process of obtaining a writ of execution cannot be called very complicated. The main thing that is required from the interested party is to correctly prepare and submit an application to the court office. It should contain:

- name of the judicial authority;

- information about the applicant;

- details of the court decision (order);

- an indication of the fact that the defendant does not want or cannot execute the decision voluntarily, therefore its forced execution is required;

- links to relevant legislation;

- a request to issue IL (required number of copies);

- method of obtaining IL (can be sent to the applicant or directly to the FSSP);

- date of application and signature of the applicant.

The application must be submitted in person or sent by registered mail with notification. If you have the opportunity to visit the court in person, then do not forget to prepare the application in two copies (on the second the employee will mark the acceptance and return it to you). If the application for the issuance of a sheet is sent by mail, be sure to send it with a notification (it will confirm the fact that the document was received by the court).

Important! If several plaintiffs or defendants are involved in the trial, then there must also be several enforcement documents. It is impossible to get one sheet for everyone.

Preparing a writ of execution usually takes a couple of weeks (sometimes more, it depends on the workload of the court). When receiving a document, it is very important to check its contents. The presence of an error in the sheet leads to its invalidity. If you submit the wrong document to the bailiffs, they will not consider it.

What to do if the court delays issuing a writ of execution?

Sometimes it happens that the court does not issue a document for some reason. Of course, the reason may be the workload of the judicial body, but if you are sure that there is a delay in the process of issuing a writ of execution, you should file a complaint.

The appeal is sent to the chairman of the court. The complaint must set out all the circumstances in detail and attach a copy of the application with an acceptance mark (or a copy of the postal notification). As a rule, filing a complaint is an effective measure that allows you to receive IL as soon as possible.

After receiving the IL, the document is transferred for execution. You can either send the writ of execution to the bailiffs (through the reception office of the authority or by mail), or contact the bank with it. You can collect funds through a bank if you know exactly which banking organization the debtor has an account with, received information about it and wrote a statement to the manager.

If there is enough money in the bank account, after the court issues the writ of execution and submits it to the bank, the banking organization will transfer you the required amount.

How is the writ of execution re-obtained?

Without IL, it is impossible to begin the collection procedure. If you lose a document (or damage it in any way), you will have to restore it. To do this, you will need to re-submit an application to the court (according to the same procedure as during the initial application), but the text must indicate the reasons why the document should be restored.

Please note that in order to re-issue a writ of execution, you must have valid reasons. If the IL is lost due to a frivolous attitude towards the document, refusal is possible.

Thus, in order to obtain a writ of execution in court, you need to submit an application to the judicial authority. After the court issues the IL, you will be able to begin forced collection. But, of course, in order for the court to issue you a document, you first need to achieve a decision in your favor. A lawyer will help you with this: it is no secret that without qualified legal support it is very difficult to count on victory.

Sources:

Code of Civil Procedure of the Russian Federation. Article 428. Issuance of a writ of execution by the court

Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings”. Article 13. Requirements for executive documents

Legislation on executive documents

According to Art. 137 of the Labor Code, deductions from wages may be made in cases regulated by the Labor Code or specific federal laws. The amount of such withholding should not be more than 20%, and in some situations (according to specific regulations) - no more than 50%.

There are also situations in which the amount of withholding will not exceed 70%, for example, the collection of alimony payments, compensation for harm or damage. With this option, deductions are made regardless of how the employee feels about it. The main thing is that an official document from government agencies must be drawn up.

If the employee himself expresses his will to withhold any amount or percentage from his wages, then in this case the norm of labor legislation does not apply. In other words, there is no restriction on how much an accountant has the right to withhold a specific amount of money from an employee's salary.

Important! An official withholding document received by an organization has more legal force than a statement from an employee. In this regard, deduction should initially be carried out according to an official document from government agencies, and then by decision of the individual himself.

Example of calculation of deductions

Let's consider an example of calculating deductions for two executive documents received by the employer in relation to one employee.

First Spanish sheet - on withholding child support payments in the amount of 25% of wages.

Second Spanish sheet - about withholding debt under a loan agreement in the amount of 50% of the salary, which is equal to 15,000 rubles.

For October 2021, the employee received a salary of 25,000 rubles. He has the right to receive a standard tax deduction - 1,400 rubles. for a minor child.

The accountant must make the following calculations:

- Personal income tax = (25,000 - 1,400) * 13% = 3,068 rubles.

- 1 sp. sheet = (25,000 - 3,068) * 25% = 5,483 rub.

- 2 Spanish sheet = (25,000 - 3,068) * 50% = 10,966 rub.

However, according to the second Spanish According to the document, the amount should be withheld in a smaller amount, since it is necessary to take into account the deduction under the first application. document:

- (25,000 - 3,068) * 50% - 5,483 = 5,483 rubles.

Residual debt under the second application. the document will need to be withheld in the following months in the same way, that is, after alimony is withheld.

Withholding limits

When calculating the amount of deduction, the accountant must focus on the limits regulated by law:

- up to 50% - in general cases;

- up to 70% - in exceptional cases.

Exceptional cases include alimony payments; compensation for harm caused to the health of another person; compensation for harm to individuals who suffered damage due to the premature death of their breadwinner; compensation for damage caused due to a criminal act.

However, in practice, questions often arise about exactly how much deduction should be made on a document. This is especially true in situations where one employee receives several enforcement documents at once. In this case, the payroll accountant must evaluate which of the documents received is more important, i.e. draws attention to the order of satisfaction of requirements under executive documents.

The first priority includes the exceptional situations listed above, as well as compensation for moral damage. Further, the requirements are distributed according to the degree of importance and, for example, the bank’s demand for collection of loan debt falls into the fourth stage.

As a result, it turns out that first it is necessary to satisfy the requirements related to the first stage. If possible, funds are withheld according to requirements from the following queues - second, third, etc.

Actions of bailiffs during enforcement proceedings

If the bailiffs take over the case, then the first thing they do is notify the debtor about this unfortunate fact for him and give him 5 days to voluntarily comply with the decision. Ignoring the requirement leads to the fact that now, in addition to the amount of the principal debt, he will have to pay an enforcement fee (a kind of state duty for the “services” of bailiffs), in accordance with paragraph 1 of Article 112 of the Federal Law on Industrial Regulations.

If the debtor does not understand the requirements, he can contact the court that issued the writ of execution for clarification. The court will consider it within ten days.

All actions of bailiffs and coercive measures are applied to the debtor at his place of residence or location. And since we’re talking about this, it would be nice to figure it out - what can bailiffs do?

- Call the parties to the enforcement proceedings.

- Request necessary information from citizens, organizations, government bodies.

- Conduct various checks - for example, check the debtor’s financial documents.

- Freely enter any premises occupied by the debtor. In residential areas - either with the written permission of the senior bailiff, or without any permission at all, if it is necessary to move in the debtor or evict the debtor.

- Arrest and confiscate property, money, securities.

- Appraise the debtor’s property independently or with the help of a professional appraiser.

- Search for the debtor and his property independently or with the help of internal affairs bodies.

- Restrict the debtor's right to travel outside the Russian Federation.

These are not all the powers of bailiffs; you can find out more about them in Article 64 of the Federal Law on Industrial Regulations. A very popular question is whether bailiffs can seize credit and salary cards.

Seizure of a bank card

In accordance with the provisions of subparagraph 7 of paragraph 1 of Article 64 of the Federal Law on Legal Regulations, bailiffs can seize the debtor’s funds: deposits, debit bank card accounts, including salary cards. This is done after the expiration of the five-day period for voluntary execution established by paragraph 12 of Article 30 of the Federal Law on the Federal Law.

To do this, the bailiffs send to the bank where your account is opened an order to seize the account and collect funds. The credit institution cannot refuse. The arrest is lifted some time after the debt is repaid - the legislator does not indicate the exact period, but in practice it is 1-3 days.

One, several or all of the debtor's accounts may be seized, depending on the circumstances. Online banking users are usually notified of the seizure by a message.

To resolve the issue, you need to contact the bailiff himself, and not the bank, since lifting the arrest is beyond the competence of the latter. If you disagree with the fact of imposing a penalty, you can write a complaint to the FSSP.

Please note that blocking a card is unlawful if you, as a debtor, have not received a resolution to initiate enforcement proceedings! This is explained by the fact that, due to your actions (or rather, inactions), you have lost the period for voluntary execution of the decision, without sanctions.

As for credit accounts, the Federal Law on Personal Welfare does not contain a ban on blocking them. But, in fact, the money in such an account does not belong to the debtor-borrower, but to the bank. Therefore, the bank may well refuse due to the fact that it is not in its interests.

Accountant's responsibility for someone else's executive document

If an accountant makes mistakes when processing a writ of execution, he risks receiving a fine from the bailiffs. There was information on the FSSP website that the accountant was issued a fine of 30 thousand rubles

. for not complying with the bailiffs' request to withhold alimony.

To eliminate the risk of non-processing of the writ of execution, it is advisable to timely enter it into the 1C:ZUP program, which will independently calculate the amount of withholding according to the specified conditions. In this way, the accountant will protect himself and the company from possible administrative liability and comply with all the requirements of the legislation of the Russian Federation.

Still have questions? Order a free consultation with our specialists!

Time limits for enforcement proceedings

When performing actions within their powers, bailiffs must be guided by the deadlines specified in Article 36 of the Federal Law on Legal Regulations: this is 2 months from the date of initiation of enforcement proceedings. In this case, the period for initiating the case in the period specified above is not included. The rule applies when a court decision, order or other act of a court or federal law does not establish another deadline for its enforcement. Thus, tax and customs legislation may provide for their own deadlines for mandatory payments.

The deadline for execution is established primarily to protect the rights of the claimant, since expiration does not mean that the bailiff does not have the right to carry out enforcement actions and apply enforcement measures. In other words, this period is not a statute of limitations, because its end does not entail the termination of enforcement proceedings. In fact, there is simply no statute of limitations.

Therefore, there are often cases when the claimant appeals not only the action, but also the inaction of the bailiffs. The complaint is submitted to management and the prosecutor's office. Or it may not be filed at all - the claimant always has the right to appeal against the actions or inactions of FSSP employees in court (of general jurisdiction or arbitration if the plaintiff is an entrepreneur).

The only exception to the described rule is the provision of Article 47 of the Federal Law on Legal Regulations, according to which such proceedings may be terminated by the expiration of the statute of limitations provided for in Article 31.9 of the Code of Administrative Offences. In accordance with the latter, the decision to impose an administrative penalty must be executed within 2 years. Otherwise, it loses binding force.

But the rule ceases to work if the one against whom the decision was made evades its execution. The countdown resumes from the moment when the location of the violator or his property, which can be subject to administrative penalties, was discovered.

End of enforcement proceedings

Article 47 of the FZIP contains an exhaustive list of grounds for ending enforcement proceedings. These include:

- fulfillment by the debtor of all requirements as provided in the writ of execution;

- return, after the bailiffs have initiated the process, of a writ of execution or an order to the claimant: if he asked, if it is not possible to find the debtor, if the claimant himself interferes with the conduct of the case, there is nothing to collect from the debtor and for other reasons listed in Article 46 of the Federal Law on Compensatory Laws;

- return of the writ of execution at the request of the court;

- liquidation of an organization that is a debtor - a sheet or order is sent to the liquidation commission, the liquidator;

- the debtor obtains bankruptcy status - the writ of execution is transferred to the insolvency administrator;

- sending a copy of the sheet or order to the organization to withhold periodic payments;

- expiration of the statute of limitations of the decision - concerns administrative proceedings.

Thus, enforcement proceedings, ideally, should relieve the claimant from the headache associated with the debtor’s failure to comply with the court decision. However, the system does not always work effectively - you can encounter both the inaction of the bailiffs and the debtor’s cunning schemes to hide himself and his property from the FSSP.

However, submitting an application to the bailiffs to initiate proceedings still remains the only way to get at least something from the debtor.

Sources:

Initiation of enforcement proceedings

Complete list of actions and measures taken by bailiffs

List of reasons for returning the writ of execution to the claimant