1 comment

18 min. reading

Updated: 26/11/2020

Andrei lost the case to the bank - they collected the loan debt and interest from him. He did not file a complaint, so the court decision came into force after 30 days. While Andrei is trying to find money and pay off the debt, the bank received a writ of execution from the court. Now, if the bank hands over the documents for collection to the bailiffs, Andrey faces not only debt collection, but also an enforcement fee.

The Federal Bailiff Service (FSSP) is required to give time for voluntary repayment of debt. If Andrey misses this deadline, an enforcement fee will be added to the amount of the collected debt. Such a sanction can be imposed by the bailiff as a percentage of the debt, or in a fixed amount. In this material we will analyze what an enforcement fee is, what consequences it entails for the debtor, whether it is possible to appeal the decision of the bailiffs or avoid payment, reduce it or obtain a deferment.

Legal regulation of the issue

The basic Federal Law that regulates the activities of the FSSP is No. 229-FZ of October 2, 2007. The current edition was adopted on June 8, 2021.

The definition of enforcement fees from bailiffs, the grounds and reasons for collection, and other rules for practical use are described in Chapter 15 No. 229-FZ.

The provisions of the Federal Law are supplemented by legislative and regulatory acts at various levels - federal, departmental, regional. Their full list is here.

Deadline for payment

There is no specific deadline for paying the fee. It is forcibly collected from the debtor after repayment of the court debt and reimbursement of expenses incurred for carrying out enforcement actions. If the main IP is completed due to the withdrawal of the writ of execution by the collector or the impossibility of collecting the fee, the resolution on the application of a penalty measure is separated into a separate paperwork. Moreover, the issued resolution on the application of sanctions does not have a statute of limitations.

This you need to know: Complaint against bailiffs: who can help

Definition and amount of the fee in 2021

Art. 112 No. 229-FZ defines: enforcement collection means the collection of money from the debtor in case of failure to comply with a court order voluntarily and within a certain period.

Simply put, this is a fine for untimely fulfillment of financial obligations of various formats - from loan debt to an unpaid traffic police fine.

The fee amount is calculated using the following rules:

- when collecting a certain amount - 7% of the debt amount;

- when collecting property - 7% of the real value of the asset.

Important.

For both cases, the minimum fee is determined: 1,000 rubles. for individuals and 10,000 rub. for legal entities.

For decisions of a non-property legal nature, that is, not related to the collection of money or property - in a fixed amount of 5,000 for citizens and 50,000 rubles for a company.

An example of non-property enforcement proceedings: to provide the opportunity to see a child or to fulfill an obligation to demolish a building. That is, the debtor is obliged to perform certain actions.

Fee amount

The bailiff cannot arbitrarily determine the amount of the fee. In paragraph 3 of Art. 112 of Law No. 229-FZ provides for all possible options for calculation:

- if a certain amount is recovered by a court decision, the fee will be 7%;

- if the subject of recovery is property or rights to it, the fee is fixed at 7% of its value;

- the size of the sanction cannot be less than 1 thousand rubles. (for collection from citizens and individual entrepreneurs) or 10 thousand rubles. (when recovering from legal entities);

- if the performance is of a non-property nature, the fee is collected in a fixed amount of 5 thousand rubles. (from citizens and individual entrepreneurs) or 50 thousand rubles. (from legal entities).

Let's look at examples:

If the subject of collection is financial in nature, it is not difficult to calculate the amount of the fee. For example, if the amount of 100 thousand rubles is fixed in the writ of execution, and the debtor does not transfer it within the appointed time, the amount of the sanction will be 7 thousand rubles. The amount recovered by the court may include not only the satisfaction of the claimant's claims, but also court costs, legal costs and other financial obligations. For all amounts confirmed by the writ of execution, the fee will be calculated at a rate of 7%. If only part of the debt is paid within the period specified in the resolution, the fee will be calculated on the remaining amount.

Difficulties may arise when determining the value of property assets or rights. The bailiff cannot independently assess the value of the property. For this, the rules set out in the Letter of the FSSP dated 07/08/2014 No. 0001/16 apply:

- when collecting property from the defendant, the court is obliged to indicate its value in the decision and writ of execution;

- in the absence of such information in the writ of execution, the bailiff is obliged to send to the court a request for clarification of the act regarding the value of the property;

- if the court indicates that the property is not subject to assessment or refuses to provide an explanation, the enforcement fee is assigned in a fixed amount of 5 thousand rubles. (from citizens and individual entrepreneurs) or 50 thousand rubles. (from legal entities).

The bailiff does not have the right to involve appraisers in calculating the value, or to determine it based on information and documents provided by the claimant or debtor. Therefore, all controversial issues related to the valuation of property will have to be resolved by the parties in court.

Special rules are also provided for calculating the fee for periodic (regular) obligations. A typical example is the withholding of alimony from a debtor in favor of a child. The bailiff is given the right to collect a fee of 7% for each late periodic payment. Therefore, during ongoing proceedings, several decisions may be made against the debtor if he systematically violates payment deadlines.

Grounds for penalty and decision-making procedure

The decision to collect the fee is made in the process of enforcement proceedings. The proceedings are opened by an FSSP employee when the judicial act or resolution has entered into force.

The following are considered executive documents:

- court order;

- performance list;

- notarial agreements on the payment of alimony;

- acts of commissions on labor disputes, decisions of the labor inspectorate on the recovery of wages from the employer;

- a court verdict in a criminal case, if the liability of the offender is expressed in a fine or compensation for damage (material or moral) and legal costs;

- a court decision made as part of an administrative case;

- resolution of the arbitration court within its powers (writ of execution).

The full list is given in Article 12 of Law No. 229-FZ.

Performance list

- the most common executive document, it is a document of strict accountability, and therefore is drawn up on the state letterhead of Goznak with the official seal.

The deadline for providing enforcement documentation to initiate a case is three years from the date of issue by the court. The time allotted to the FSSP officer to open a case is three days. The information must be communicated to the collector and the debtor in the format of a resolution.

Its text contains detailed requirements of the executive document and the following mandatory information:

- number of the proceedings initiated with reference to the grounds for opening the case;

- Full name and position of the FSSP employee;

- within what time it is necessary to fulfill the requirements on a voluntary basis;

- a warning about the forced collection of not only the amount of the principal debt, but also the collection, as well as the costs of the work of the bailiffs, in the event of failure to comply with the legal requirements of the FSSP employee voluntarily and within the allotted time.

The period for voluntary execution is determined by Article 30 No. 229-FZ. Usually it is 5 days. For immediate execution cases – 1 day. For penalties in criminal cases - within 60 days. Court decisions issued in cases of payment of wages, alimony, reinstatement and inclusion in the voter list are subject to immediate execution.

After the decision is made, the document is sent to the parties in one of three possible ways:

- a call to the FSSP department for personal delivery;

- sending by courier;

- most often sent by Russian Post in the form of a registered letter.

Confirmation of delivery of the document is a prerequisite for subsequent collection of a fine. If the debtor refuses to receive the decree, the bailiff or courier draws up a report.

Sometimes bailiffs charge a fee for obstinacy

An enforcement fee is a fine for the fact that the debtor does not want to pay for those sins that the court has recognized. There is no point in resisting payment of the fee - it cannot be written off. As a result, the debt will only increase.

The postal notice does not say that the letter is from the bailiffs. This is done intentionally so that the recipient does not avoid “unpleasant” letters.

By the track number (under the barcode), the bailiffs look at the Russian Post website when the letter is delivered or not delivered to the addressee.

You can check these dates here.

If a letter arrives at the post office, about which a notice is delivered to the addressee, but the person receiving the letter does not show up, the correspondence is considered to have been received.

The period for voluntary execution starts from the moment the resolution is served, the act is drawn up, or from the moment a person receives a notice of a letter that is waiting at the post office in a person’s mailbox. That is, when he learned or should have known about the ruling.

Valid reasons for non-fulfillment of alimony obligations

The legislator has provided for circumstances that do not make it possible to fulfill the requirements specified in the executive document. Such circumstances are:

- extraordinary and unavoidable conditions (force majeure);

- deferment of fulfillment of obligations granted to a person in accordance with the established procedure.

If such conditions exist, the enforcement fee will not be charged.

If the debtor does not provide evidence of force majeure due to which he was unable to fulfill his obligations, the bailiff will regard this as a lack of valid reasons and will issue a decision to collect the fee.

An example of a debt collection procedure in the form of a traffic police fine

For clarity, let’s consider the order and duration of activities that are carried out to collect a debt from a traffic rule violator.

Sequence of executive actions:

- issuing a resolution to impose a fine on the initiative of a traffic police officer;

- 10 days to appeal a judicial act;

- 60 days to repay voluntarily without opening a FSSP case;

- sending a court order to the bailiff service;

- opening a case (within three days);

- 5 days for voluntary execution;

- forced collection of fees.

The total duration of the procedure is at least 78 days. Moreover, debt repayment interrupts the implementation of the next event at any stage.

On what basis are they charged?

The procedure in accordance with which all performers act is determined by Law No. 229-FZ. The paperwork begins in connection with the claimant's application. In administrative and criminal cases, opinions are sent by a court or other body. If you give an example of a fine that was issued to a motorist for violating traffic rules, they will not immediately begin to demand:

- The decision can be appealed within 10 days;

- if there is a complaint, then after its full consideration;

- for a person to have time to do everything voluntarily, there are 60 days;

- if at this time he did nothing, then the decision is sent to the bailiffs;

- an FSSP employee initiates a case, notifies the debtor about this, and gives him 5 days to pay the debts;

- if in this case he fails, then 7% will be added to his payment.

Is it necessary to pay a valid enforcement fee - if the violator manages to do as the law requires of him, then there will be no reason for his demand. The plaintiff can go to the FSSP only when the conclusion has already become legal. To submit documentation, he must have the following documents in his hands:

- court order;

- an order from the magistrate, if this is a penalty, there is no point in discussing (when the employer owes wages or the ex-spouse alimony);

- sentence, if the convicted person is obliged to pay a fine, compensate for moral or physical harm, or pay costs;

- results of the administrative case.

Read Can bailiffs seize child benefits for debts: what to do and how to remove it

You can obtain all these papers from the office. All documentation is issued with the seal of the relevant authority and signature. No differences are allowed between the decision and the writ of execution; both require the same list of requirements for the accused. It must be clear how much to pay the offender and why. For example, if a case was heard about reinstatement at work, then at the same time the following instructions may be presented:

- reinstate the employee in his previous position;

- pay him money for forced absences;

- demand compensation from him for possible moral damage;

- force you to pay for a lawyer.

Anything that does not involve money will need to be completed on the same day. 5 days are allotted for payment for voluntary compliance with the appointments.

When is the fee not collected?

The legislation establishes several situations in which the fee is not charged:

- actions based on the instructions of the bailiff in territories for which he does not have authority to work (for example, in a foreign country or in another entity);

- re-sending a document for which collection has already been made;

- when the FSSP collects the fee itself and related expenses;

- cases on interim measures during the trial;

- the subject of the case is the expulsion of a foreign citizen or stateless person from the country;

- execution of a court decision, the punishment for which is compulsory labor;

- execution of a request, the purpose of which is to search for a minor.

What is an enforcement fee from bailiffs?

Let's understand the basic terms and concepts that you will encounter in this article, so:

An enforcement fee is a monetary penalty imposed by bailiffs. The fee is analogous to a fine, which is imposed only for the debtor’s failure to comply with the deadline for the voluntary execution of a court decision.

Enforcement proceedings are the process of forced execution of judicial acts carried out by bailiffs. During this process, the bailiff can seize bank accounts and property, seize wages and other income, put the debtor on the wanted list, and take other enforcement measures. Proceedings begin after the bailiff receives the application and enforcement documents, and terminates after the debt is repaid or other court orders are fulfilled.

A writ of execution is a document confirming the list of obligations and amounts specified in the court decision. The claimant may receive a writ of execution after the decision enters into force. The document is signed by the judge and the seal of the court, and it is drawn up on a strict reporting form.

Cancellation of the resolution

The easiest way not to pay the enforcement fee is to voluntarily comply with the court order within the time limit provided by the bailiff. Confirmation of the fulfillment of obligations is a document confirming the payment.

Article 112 No. 229-FZ provides for several more situations when you don’t have to pay money in excess of the principal debt:

- delay is due to force majeure circumstances. Their list is not clearly regulated; you can refer to quarantine, illness, business trip;

- the court granted the right to installment/deferment of payment;

- the court order or ruling has been revoked. How to quickly cancel a court order, read here;

- the debtor status is the person who is restructuring the mortgage as part of the state program to support certain categories of borrowers;

- the absence of intent or guilt of the debtor in the delay in fulfilling financial obligations has been proven.

In case of disagreement with the actions and decisions of the FSSP employee, the decision is appealed in the manner prescribed by law. Filing a complaint automatically means suspension of the imposed sanctions until the court considers the circumstances of the case. Legal grounds for appealing against actions taken by the bailiff:

- adoption of a resolution before the end of the period allotted for voluntary execution;

- failure to comply with the procedure for opening or conducting a case;

- imposition of sanctions in cases that do not involve the collection of a fee;

- the bailiff's decision was made after fulfillment of obligations on a voluntary basis;

- errors in calculating the amount of collection;

- refusal to extend the time for voluntary repayment of debts due to force majeure circumstances.

In addition to those listed, any other violations of the law that were committed within the framework of enforcement proceedings become grounds for filing a complaint.

In what situations can the court not request an additional amount?

Each situation involving a prohibition for legal proceedings on the imposition of an enforcement fee on a debtor is reflected in the fifth paragraph of Article 112 of the Federal Law. Let's list these cases:

- If there are orders for bailiffs from other departments.

- If the writ of execution is additionally presented for execution, but earlier, as part of the legal proceedings, it was already decided to apply a fee, and there was no cancellation of the decision.

- For legal proceedings for the recovery of the 7 percent amount, as well as the costs of any enforcement operations.

- As part of writs of execution for interim measures, including seizure of the debtor's property.

- If citizens of other countries or stateless persons are forcibly expelled from the territory of the Russian Federation.

- When serving forced labor.

- Based on child search requests.

Step-by-step instructions for reducing the fee or obtaining a deferment/installment plan for payment

Alternative options to appealing include reducing the financial burden on the debtor - reducing the amount of the fee or obtaining a deferment/installment plan for payment. This requires a court decision.

How to get a deferment or reduce the enforcement fee.

No. 1. Obtaining a resolution

You can go to court with a request to reduce the amount or defer payment only after the service officer has issued a decision on collection. It is possible to receive a document during a personal visit to the regional branch of the FSSP, by mail or after sending a request using the Internet reception, which is posted on the official website of the service.

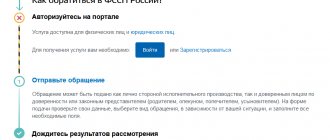

Another way to get the information you need is the State Services Internet portal. Its functionality allows you to file a complaint against the actions of bailiffs or obtain information about the existence and progress of specific enforcement proceedings.

No. 2. Collect evidence

The debtor needs to confirm his position with written evidence that explains the reasons for the delay in payment.

For example, the judge will consider there is a serious reason and will grant a deferment for delays in wages. You can get an installment plan if your income is only slightly above the subsistence level.

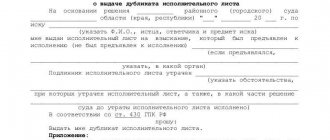

No. 3. Application to court

(35.5 KB)

An application to reduce the amount of payment is submitted to the court, whose decision became the basis for opening the case. The text must include the following information:

- information about the judicial authority, debtor and bailiff;

- details of the writ of execution;

- grounds for reducing the fine;

- documents confirming the validity of the debtor’s position;

- petition to reduce the amount of payment;

- a list of related documents;

- signature with transcript and date.

The application is sent by mail or submitted to the court office for registration.

Once the application is accepted, any collection activities are automatically suspended.

No. 4. Participation in legal proceedings

The applicant takes part in court hearings independently or sends a representative. The purpose of the trial is to consider the merits of your claim and make a decision.

No. 5. Obtaining a court decision

The court has the right to reduce the amount of the fee or approve a deferment. The maximum reduction is 25% of the legal fine.

Another possible scenario is complete exemption from the need to pay. It is accepted in the event of an illegal decision or the absence of grounds for such actions on the part of the bailiff.

What the law says

Cancellation and return of the collected enforcement fee is a complex procedure that can only be carried out if the enforcement document is canceled or following a judicial review. The fact is that Federal Law No. 229 does not give the bailiff the authority to change or cancel a resolution previously adopted by him on the application of a sanctionary measure of influence on the debtor. On the other hand, the Presidium of the Supreme Court emphasizes the right of the bailiff to correct his own mistakes during the IP and allows the cancellation or modification of an unreasonable decision.

In practice, the bailiff insists on considering the issue in court, since the instructions of the Presidium do not contain a list of enforcement actions, including the collection of an enforcement fee, subject to adjustment within the powers of the FSSP. Thus, in order to be exempt from paying the fee, you will have to apply not only to the bailiff, but also to the court.

Refund of money paid

The legislation establishes several grounds for returning money after payment:

- cancellation of a writ of execution or a judge’s decision;

- recognition of the debtor's complaint against the bailiff's actions as justified;

- judicial exemption from payment;

- reduction of the amount of payment by the court;

- a technical error when calculating the amount of sanctions or when collecting a fine forcibly.

The refund procedure is regulated by PP No. 550, which was adopted by the Government of the Russian Federation on July 21, 2008. You need to submit an application for a refund of the fee to the FSSP unit. It is accompanied by a documentary basis, for example, in the form of a court decision. The application shall indicate the details by which the funds are transferred.

How to return the performance fee - grounds for cancellation

If the fee has already been collected, it can be returned in the following situations:

- when a judicial act or executive document is canceled (for example, if the result of a challenge is positive);

- upon cancellation of the bailiff's act upon the debtor's complaint;

- when exempt from paying the fee by court decision;

- when the amount of the sanction is reduced.

Naturally, the amount of the fee excessively collected by FSSP officials (for example, in the event of a technical error) is also subject to refund.

The refund procedure is determined by Government Decree No. 550 dated July 21, 2008. To return the money, you need to submit an application to the FSSP department where the fee was collected. The application must be accompanied by a document confirming the grounds for the return (for example, a court decision).

The maximum return period cannot exceed 30 days from the date of acceptance of the application. The money will be transferred according to the details specified by the applicant. Refunds are made from funds on deposit with the FSSP unit, or through the Federal Treasury Department.

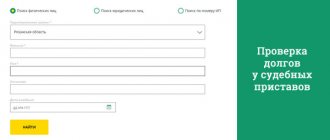

Payment methods

Several payment options for the execution fee are allowed. The first and simplest is through the SPI receipt book directly from the bailiff

.

The receipt is issued in two copies. The money is accepted by the bailiff, then the document is handed over to the debtor as confirmation of payment.

A prerequisite is the presence of the “blue” seal of the FSSP unit. Keep your receipt.

If you do not want to visit the FSSP branch, you can pay the tax collection online through State Services or at the bank. Just choose a convenient payment method on the bailiffs website.

Rules for drawing up an application

The procedure for canceling the decision and returning the paid enforcement fee does not strictly contain a sample application. According to generally accepted standards of office work, a document must meet several requirements:

- written form (preferably printed version);

- indication of the addressee - a specific division of the FSSP;

- content – justified demands for cancellation of the decision and return of funds;

- indication of bank details for return;

- in the attachment - a copy of the court decision to cancel the decision or other documentary basis for the procedure;

- when submitting an application by a third party - a power of attorney regarding the powers of the representative;

- date and signature of the applicant (or representative).