Prepayment for an apartment is a kind of confirmation of the seriousness of the buyer’s intentions. The essence of prepayment is to fix the agreements between the parties to the transaction. After the Buyer transfers money to the Seller, the apartment is considered “reserved” for him. From this moment on, the Seller should not show the apartment to other applicants. Ideally, the advertisement for the sale of such an apartment should be removed.

You can agree on the “reserve” of an apartment either in writing or orally.

Prepayment for an apartment can be made as a deposit, advance payment or security deposit. Sometimes the Buyer is asked to make an advance payment to an agency acting on behalf and in the interests of the Seller. In the latter case, it is important to study in detail the document that the Buyer is offered to sign. There are often cases when an agency takes a so-called fee for its services, which consist only of assistance in concluding a purchase and sale agreement and does not bear any responsibility if the transaction does not take place.

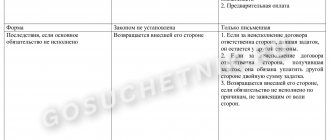

Making a deposit imposes certain obligations on the parties to the transaction. That is, in addition to the function of prepayment, this payment performs the function of securing the contract.

If a transaction for which a deposit was made is canceled due to the fault of the Buyer, the funds remain with the Seller. If the Seller is the reason for the failed contractual relationship, the deposit is returned to the Buyer in double amount. This means that the deposit is more beneficial to the Buyer.

The deposit agreement is made exclusively in writing. This norm is enshrined in Art. 380 Civil Code of the Russian Federation.

The advance is beneficial to the Seller. The buyer in this situation risks not only personal time, but also money. A clear example of such a risk: The buyer has made an advance payment and is already preparing the documents. At the same time, a new Buyer approaches the Seller, who outbids the price upward. The Owner agrees to a new transaction and returns the advance payment to the previous Buyer. As a result, the owner loses nothing (except for reputation).

A deposit is mutual control, which implies the financial responsibility of the parties to each other. That is why the Buyer should insist on this particular method of ensuring contractual relations. Property owners who cooperate with realtors, in most cases, want to receive an advance payment from the Buyer. In addition, in such situations, the advance payment is fixed in the form of a written agreement, which stipulates additional penalties for the buyer.

The essence of the penalties is that if the Buyer refuses the transaction, the funds that were paid as an advance will not be returned to him. That is, in this case, the amount of money transferred to the Seller is a security payment.

In practice, most often an advance payment is made as an advance payment. However, the agreement stipulates additional obligations for both parties.

What is an advance and the difference from a deposit?

Often these two terms are equated, despite having different legal statuses, with the following meanings:

- The advance payment is a partial payment for the purchased property after the DCT of the property has been approved.

- The deposit is the amount of payment made as an intention to issue a contract of ownership of the property before its approval.

Advance payment is rarely used in transactions and is not clearly regulated by the legislation of the Russian Federation, indicating that such payment of the amount is considered an advance payment when completing a purchase/sale transaction. In practice, “advance” often refers to funds given to the seller to confirm intent. The advance payment does not receive legal significance, and if the contract fails, it is returned to the buyer.

But the deposit is defined in Art. 380 of the Civil Code of the Russian Federation as the equivalent of confirmation of the intention to formalize an agreement. When making a deposit, both parties to the transaction agree on their intention to formalize the contract. Therefore, a deposit refers to one of the transaction methods and requires the execution of a deposit agreement. In most cases, the deposit agreement is of a fixed-term nature and is drawn up for a specific period. After execution of the contract, the deposit receives the status of an advance and is credited to the final payment account.

Thus, to summarize, it can be noted that if an advance payment agreement is drawn up between the parties, then such an advance payment is counted towards the full cost of the purchased object without any consequences in case of failure of the contract.

If a deposit agreement is drawn up between the parties, then in these circumstances the following regulatory rules come into force:

- If the buyer refuses the agreement, the potential seller will not return the deposit to the buyer.

- If the agreement is broken by the seller, then the deposit is returned to the buyer in double amount.

Note. If the deposit is not made in writing, then if a disagreement arises regarding the transaction, such an advance payment will be considered an advance without any penalties.

( Video : “MONEY TO THE WASTE WHEN THE DEPOSIT AGREEMENT IS NOT NOTARIAL...”)

When is it concluded?

In practice, when drawing up a contract of ownership of property, circumstances may arise when one of the parties to the agreement is not ready to immediately formalize the agreement for various reasons. For example, in case of temporary financial difficulties on the part of the buyer or problems with the preparation of documents by the seller. In this option, the parties can enter into an advance agreement, which is a type of preliminary agreement for partial payment, but is not a guarantee of the execution of the main agreement.

Advance payment for the purchase of real estate can be arranged in the following ways:

- By displaying all the terms of the future agreement in the preliminary contract, where a separate paragraph shows the transfer by the buyer to the seller of part of the cost of the property as an advance payment.

- By drawing up a separate advance payment agreement (DA), reflecting in it the terms of advance payment and the obligations of the parties. At the same time, the legislative norms do not provide for special requirements for the execution of such an agreement. However, the structure of the document must reflect all the information about the parties and the terms of the agreement in order for the contract to be recognized as legal.

Useful video

Concluding an advance agreement for the purchase of an apartment between individuals is a very correct decision to provide guarantees to both parties to the transaction. The seller can be sure that there is already a buyer for his property, and the latter, in turn, does not have to worry that the property that he likes will not be sold to anyone else. The video below will help you clearly understand what an advance agreement is and how to draw it up.

Procedure for drawing up an advance payment agreement when purchasing an apartment

The advance agreement is drawn up in writing and does not require mandatory certification by a notary. The document will need to outline the rights and obligations of the parties to the transaction, as well as specify the following requirements:

- The seller, upon receiving an advance payment under the contract, guarantees not to search for another buyer and not to sell the property to a third party before the date specified in the agreement.

- The buyer, when transferring an advance payment to the seller, receives a guarantee for the purchase of the object and promises to pay the buyer in full on the due date, according to the signed contract.

- The responsibility of the parties is set out in the DA by mutual agreement, indicating penalties in case of failure of the contract. At the same time, according to the legislation of the Russian Federation:

- The amount of the prepayment cannot be higher than (1-2)% of the price of the DCT item.

- The form of transfer of the advance payment is established by the parties by mutual agreement.

- When paying in cash, receipt of prepayment is documented with a receipt, which provides protection against fraud.

- The subject of the DA must be displayed similarly to the DCP with identification parameters, for possible consideration of the dispute by the court.

( Video : “Deposit agreement when buying an apartment, car in 2021”)

What should I do before making an advance payment?

As noted above, an advance payment provides evidence of the seriousness of the buyer’s desire to issue a DCT in the near future, after eliminating the obstacles to its immediate signing.

It would seem that there are no difficulties in such a transaction: a receipt is issued and the money is transferred. However, here you will need to observe some subtleties, if neglected you can part with not only money, but also waste nerves and time on both sides of the transaction. Therefore, before handing over the advance payment, it is recommended to do the following:

- Make sure the seller actually owns the property. To do this, you will need to require an extract from the Unified State Register.

- Make sure there are no encumbrances on the DCP and no claims from third parties. To do this, it is recommended to contact the court website at the location of the item, checking the absence/presence of claims on the property being sold.

- To avoid problems in the future, it is not recommended to pay the advance amount above 1-2% of the selling price of the property.

Note : Information about the property being sold can be obtained by contacting a notary, who will check the legal “purity” of the property.

The main reason for problems with advance repayment

The presence of an advance payment, which constitutes some part of the cost of the purchased housing, is stipulated in the preliminary agreement or a special receipt confirming receipt of money by the seller. The vast majority of such documents contain a clause on non-refund of funds if the buyer refuses the transaction, as well as his other actions that led to its failure. It would seem that everything is extremely clear. But if you dig deeper, it turns out that all this is contrary to current legislation.

Making an advance, in accordance with the norms established by law, is just a kind of protocol of intent, and not an obligation to buy an apartment at any cost.

The money transferred to the seller is simply an addendum to the contract, which should be returned, regardless of the reasons why the transaction did not take place.

Required documents

In order for the YES to be recognized as valid, certain documents must be attached to it, both from the buyer and the seller:

1) From the buyer:

- Passport or other identification document. If a representative acts on his behalf, then a power of attorney certified by a notary.

2) From the seller:

- A passport or other identification document, or a power of attorney, if a representative acts on his behalf, certified by a notary.

- An extract from the Unified State Register of Real Estate, indicating that the property being sold belongs to the seller.

- Title materials (DCP, information about inheritance, etc.).

- For non-cash payment, you will need to provide a document with bank details.

- When transferring an advance in cash, the seller will be required to write a receipt to the buyer confirming receipt of the advance payment. In this case, the receipt will need to be written manually in the presence of the buyer, indicating that it was written precisely by the seller, and it is advisable to invite witnesses when transferring the advance payment.

As an additional guarantee, the buyer is recommended to demand from the seller (if the registration concerns the apartment’s DCP):

- Technical passport - to ensure that there is no illegal redevelopment.

- The house register or an excerpt from this document - to ensure that there are no registered persons in the living space, including minors, since in these circumstances permission to sell the apartment from trustee structures will be required.

- A certificate of full settlement with housing and communal services, issued by a utility company or management company. This document is submitted before issuing the DCT, since it usually has a limited validity period.

Deadlines

The advance payment period lasts until the conclusion of the main contract for the object and full settlement with the Seller.

This period is provided to the parties to the agreement to prepare the necessary documents and carry out formalities for the acquisition of the property. For ordinary transactions, this period is 3-4 weeks, for transactions involving the preliminary sale of another object (to raise money) - 6-8 weeks. By agreement of the parties, the terms may vary, up to 12 months.

If, at the time specified in the agreement, the main DPA is not concluded, two options are allowed:

- Sign a re-agreement with different terms.

- Terminate the agreement and return the advance to the buyer (unless the agreement specifies penalties for the parties).

How to draw up an advance payment agreement when buying an apartment?

It is recommended that the transfer of the advance payment when purchasing an apartment be formalized in a separate agreement on the advance payment, or displayed as a separate clause about this fact in the preliminary or main DCP of the apartment.

Considering that there is no standard template for an advance agreement approved by the legislation of the Russian Federation, when drawing up a separate DA, you must follow the generally accepted rules for drawing up contracts in office work. In such a document it is recommended to follow the following scheme:

- Display the details of the parties, outlining the passport information and residence addresses of the parties.

- Write down the subject of the contract, reflecting the parameters of the apartment in it, to identify the object.

- Note the procedure for delivering the advance payment, indicating the amount of the advance payment transferred. In this case, after transferring the advance payment, the seller is obliged to write a receipt in the presence of the buyer regarding receipt of funds.

- Confirm that all information about the living space being sold is reliable, listing all documents confirming that the apartment belongs to the seller, the absence of encumbrances, claims of third parties, absence of debts to housing and communal services, etc.

- Indicate the deadline for drawing up the main contract with the extent of responsibility for failure to comply with this agreement.

- Both parties must sign this agreement, indicating their names.

When preparing this document, the following requirements must be met:

- The agreement must be drawn up in writing, either manually or in printed form.

- The document must be formed correctly, without errors or deletions, otherwise it will not be recognized as valid.

- The number of copies of the agreement must be equal to the number of parties to the agreement with the personal signatures of the parties in each copy.

( Video : “Deposit when buying an apartment. Preliminary Agreement sample. Deposit and Advance, what’s the difference”)

Contents of the agreement

Considering that there is no legally approved template for the DA, the document is filled out in a free style. However, to recognize such an agreement as valid, it will need to include the following points:

1) Details of counterparties with reflection:

- FULL NAME. parties to the agreement.

- Their passport details.

- Residence addresses.

2) Subject of the agreement, which displays:

- Advance payment amount.

- The cost of real estate sold.

- Characteristics of the apartment being sold.

- Her accommodation address.

3) Rights and obligations of the parties, indicating:

- Rights of the parties to the agreement.

- Accepted promises to implement the main policy.

- Responsibility of the parties in case of failure of the main transaction.

- Conditions for repayment of advance payment.

4) Other conditions, where noted:

- Who bears the costs of completing the contract?

- The number of copies that have the same strength.

- Other conditions, including guarantees for fulfillment of the terms of the main agreement with the attachment of title documents.

5) Signatures of the parties.

- Here, each participant in the transaction is required to personally sign and display his last name and initials.

- If the agreement is notarized, then the signature of the notary is also required.

The advance agreement is considered an appendix to the main DCP of the apartment, which displays:

- Guarantees to the buyer that at the time of registration of the apartment contract, it is not encumbered or seized, and is not mortgaged.

- The details of the attached documents are marked.

- The procedure for considering controversial issues is outlined.

- Deadline for issuing the main policy.

- Period of validity of the advance agreement. If there is no such clause, it will be valid for one year.

Implementation of the deal in stages

Signing the contract

One of the central documents when applying for a mortgage is the purchase and sale agreement concluded between the borrower-buyer and the seller-owner. The purchase and sale agreement may be preceded by a preliminary agreement .

First of all, the parties must sign a preliminary contract and a deposit agreement, which will impose financial obligations and guarantees on the parties to complete the transaction.

When agreeing on a mortgage loan, the client must immediately protect himself financially and be one hundred percent sure that the chosen transaction will be completed in accordance with all the rules.

It is not necessary to notarize the preliminary agreement . After drawing up the document, the seller and the buyer sign with a transcript (the first and middle names are indicated in initials, the last name in full).

Receiving a receipt

The form of the receipt must be in writing; otherwise, the law does not regulate its preparation. However, this is a legally competent document - in the interests of both parties.

The receipt must include the following mandatory items::

- Passport details of both parties.

- Date of receipt.

- Amount received from the buyer.

- Date of conclusion of the main contract.

- Signature of the person who received the money.

Transfer of money

The deposit is transferred through the channels used to transfer money under the purchase and sale agreement. You can use the cash method and give the funds to the seller from hand to hand.

For those who want to play it safe, renting a safe deposit box is suitable . In the case of a deposit, it is possible to transfer money both upon the fact and after registration of the transaction using banking services. However, you should not refuse to draw up a receipt - an additional document confirming that the money was transferred - in any case, it increases the security of the transaction.

Advance or deposit? // What and when to transfer.

Certification by a notary

The legislation of the Russian Federation does not provide a clear definition of the concept of “advance”. There is only a note in Art. 380 of the Civil Code of the Russian Federation, which explains the concept of a deposit, and that an advance payment is an advance payment to the Seller, if the executed agreement does not indicate that this payment is considered a deposit.

The need to make an advance payment arises in such circumstances when it is not possible to draw up a property contract immediately, since the parties need time to prepare:

- For the buyer - the required amount to pay for the purchased object.

- For the seller - the required documents confirming the right to sell the property.

At the same time, the legislation of the Russian Federation does not provide for mandatory certification of the agreement for the transfer of an advance payment by a notary. However, the parties have the right, by mutual agreement, in order to ensure the security of the transaction, to carry out this procedure. This is especially true if the advance amount is large. In this case, the notary will help to correctly draw up such an agreement and will witness the payment of the advance to the Seller.

For such a service, the notary will have to pay from 1000-2500 rubles. The amount depends on the complexity of the contract, as well as tariffs, which are different in different regions.

Advance amount

The parties determine the amount of the advance independently. Advance payment for an apartment can be paid in the form of:

- percent of the total cost of housing (on average they take about 5%);

- a fixed amount (as a rule, it is also affected by the total cost of the object).

There are no regulations regarding what exactly the advance payment should be. This point remains for the parties to the transaction to independently resolve.

In what situations is the advance not returned to the buyer?

When is the advance not returned?

Despite all of the above, sometimes situations still arise when the advance payment remains with the seller even after a court decision. And the reason for this is that real estate buyers are not very attentive to the process of drawing up, filling out and signing documents.

Most often, the advance payment is not returned for the simple reason that the addendum to the preliminary agreement states that if the buyer refuses to complete the transaction, the funds received from him remain with the seller as a fine for moral and other damage. In this situation, the court will quite rightly take the side of the latter and rule in his favor.