We all know how important it is to prepare documentation correctly and how this can later affect the validity of the document. This issue does not bypass the payment of alimony. Very often, a negligent attitude to the execution of a money transfer or simply ignorance of how to correctly fill out a payment order for alimony can result in a lot of problems for us. Therefore, if you want payments to be made legally, then you must correctly indicate the purpose of the payment when transferring alimony.

How to correctly fill out a payment order for the transfer of alimony according to a writ of execution?

The document on the basis of which funds are transferred from one account to another current account is called a payment order. To transfer payments to minor children, certain rules must be taken into account.

Documentation that may be required to fill out a payment document must be prepared in advance; you may need:

- general passport;

- TIN;

- any documents on the basis of which alimony payments are assigned (court order, writ of execution, etc.);

- bank details of the recipient of the funds.

How to fill out a payment order?

The payment document is always filled out according to certain rules.

The order must include the following information:

Have you ever experienced delays in child support payments?

Not really

All of the above data is recorded in the payment order in specially designated fields, so there should not be any difficulties when filling out the document. If the payer is worried that he has filled out the document incorrectly, he can consult the responsible bank employee or request the form at work from accounting specialists.

Purpose of payment when transferring to a Sberbank card/passbook

In any payment order for the transfer of alimony, it is very important to correctly indicate the purpose of the payment; this column must contain the following information:

- the purpose of the funds transfer is payment of alimony;

- information about the recipient of funds - full name of the second parent;

- payment period – month and year;

- basis for payment (court order number, writ of execution number or details of a voluntary agreement);

- the amount of VAT (in the case of transfer of alimony, it is always stated without VAT, because such a payment is not taxed).

If all information is recorded correctly, the money will be credited the next day. It is better to keep receipts so that there is documentary evidence of payment in the future. It is convenient and easy to make alimony payments through Sberbank of Russia.

There are many ways to deposit funds:

- transfers from account to account through a mobile application, Internet banking;

- online transfers from your personal account;

- payment through self-service terminals;

- payment through bank employees in the transaction window.

To make payments through the Savings Bank, it is important to know some of the nuances associated with the procedure, namely:

- if money is transferred to the account of the second parent, then you should ask him for a receipt of payments;

- payment can be made by the payer independently, as well as through the accounting department of the enterprise where he works.

Options for transferring alimony

There are several ways to transfer alimony, you choose the most convenient one for yourself. There will not be much difference in the purpose of the payment, but it is worth familiarizing yourself with the rules below.

Payment in cash directly to the recipient

This type of money transfer is called “hand to hand”. As practice shows, this is one of the most common methods, as it is quite convenient. However, when we choose this option, we do not always think about the consequences. After all, if at one certain moment the transfer of money does not occur, then it will be almost impossible to prove this fact in court, since you will not have the relevant evidence.

Therefore, if you nevertheless choose this method of transferring funds for yourself, then at least give it legal force, namely, draw up a receipt each time. This will help avoid common mistakes and will serve as confirmation of receipt of alimony. In order not to write a receipt every time, you can prepare a ready-made template in advance or ask a lawyer about it, where the details of the recipient, the payer and the grounds for payment of funds will already be written down. You will only need to enter the date, the amount of alimony (in numbers and in words) and the purpose of payment - child support, full name and for what period. After this, the document is endorsed with the signatures of both parties. It does not need to be certified by a notary.

Lawyers have a negative attitude towards this type of transfers, since cash payments are associated with the largest number of disputes, which are quite difficult to resolve. Especially in the absence of evidence.

Transfer through an electronic system - mail, bank cash desk, client-bank, self-service terminals

If the alimony payer himself is engaged in transferring funds, then a reliable method is a bank transfer or transfer through a post office. Transfer of alimony in non-cash form can be carried out without even leaving home, for example, using a bank account. However, regardless of the chosen method of transferring money - through a cash register, terminal, banking or mail, it is very important to correctly indicate its purpose in the payment document. Otherwise, this payment may be classified as other expenses, but not as alimony. Therefore, in the “Purpose of payment” field, write down “Payment of child support, full name, for a certain month, on the basis of writ of execution No...”

Make the transfer 2-3 days before the specified date in the writ of execution, since according to banking regulations, they can credit funds up to 3 days, thereby unintentionally triggering the formation of debt and the accrual of penalties. Thanks to the convenience and reliability of a bank payment order, you can check the status of your transfer, make statements for a certain period, and receive a certificate from the bank about the crediting of funds. All this helps to prove the fact of payment of alimony in the event of a controversial situation.

Transfer of alimony from wages at the place of work

When the alimony payer has an official place of work, alimony is usually collected automatically by the accounting department or the employer in accordance with the alimony agreement or writ of execution. From this moment, the parent’s responsibility for the timely payment of funds is removed and falls on the shoulders of the accountant. He also fills out a document where you need to correctly indicate the purpose of payment when transferring alimony.

The basis for regular payments can also be a personal statement written by the employee, if the parents did not go to court to collect alimony. This method is no less reliable, since the correctness and regularity of payments is controlled by a bailiff, and if necessary, an accountant can issue an appropriate certificate of the transferred amounts.

Sample of filling out a payment slip for the transfer of alimony payments

| 0401060 | |||||||||||||||

| Admission to the bank. plat. | Debited from account plat. | ||||||||||||||

| PAYMENT ORDER No. | 17 | 05.10.2018 | electr | ||||||||||||

| date | Payment type | ||||||||||||||

| Suma in cuirsive | Thirteen thousand rubles 00 kopecks | ||||||||||||||

| TIN 770000000 | Gearbox 111111111 | Sum | 13000-00 | ||||||||||||

| LLC "New Technologies Marfi" | |||||||||||||||

| Account No. | 40700000000000000000 | ||||||||||||||

| Payer | |||||||||||||||

| CB "Eastern UNI Kredprombank" | BIC | 044500000 | |||||||||||||

| Account No. | 30100000400000000000 | ||||||||||||||

| Payer's bank | |||||||||||||||

| Main Directorate of the Bank of Russia for the Central Federal District | BIC | 044000000 | |||||||||||||

| Account No. | |||||||||||||||

| payee's bank | |||||||||||||||

| TIN 770000000 | Gearbox 771000000 | Account No. | 40300000000000000000 | ||||||||||||

| UFK for the city of Kuibyshev (Interdistrict department of bailiffs for the collection of alimony payments No. 9 of the city of Kuibyshev, Moscow region, personal account 12000A00000) | |||||||||||||||

| Type op. | 01 | Payment deadline. | |||||||||||||

| Name pl. | Essay. plat. | 1 | |||||||||||||

| Recipient | Code | 0 | Res. field | ||||||||||||

| 0 | 45396000 | 0 | 0 | 001;770015578 | 08.03.2015 | ||||||||||

| Transfer of alimony withheld from the salary of the First-Called Grigory Nikolaevich (TIN 700000000000000) for October 2018 according to the writ of execution dated November 19, 2016 No. 786/21. Without VAT. | |||||||||||||||

| Purpose of payment | |||||||||||||||

| Signatures | Bank marks | ||||||||||||||

| M.P. | |||||||||||||||

To summarize, we note that each alimony payer can transfer money independently. According to writs of execution, transfers are made by authorized persons from the place of work.

This is usually the responsibility of the payroll specialist. When transferring funds to a Sberbank card, it is very important to indicate in the name of the payment the name of the payer, the payment period, and also that this is alimony for a minor.

Questions and answers

Q: Is it possible to transfer alimony to a Sberbank card? A: Yes, this is in no way limited by law and this method is very popular and convenient for both payers and recipients of alimony. You can pay both through ATMs and through the Internet bank Sberbank Online.

Q: How much does alimony go to a Sberbank card ? A: The transfer is carried out within three days, but in fact, if the correct details are indicated, within 2 hours.

Payment order to bailiffs

KBK for enforcement proceedings by bailiffs 2019-2020 Individuals and legal entities who owe money to organizations or third-party citizens are more likely to pay debts after a court decision. Such debts include: alimony, unpaid loans, loans from friends, relatives, banking organizations or damage. But some citizens sometimes do not pay fines assessed by the court. Then Art. 122 Federal Law No. 229 of October 2, 2007 (as amended on December 27, 2018). The article states that in such a situation, the citizen is obliged to pay the enforcement fee of the bailiffs in 2018, the BCC of which is entered in field 104 of the payment order. The budget classification code for paying fees assigned by bailiffs is in this article. After this procedure, the funds calculated for payment are debited from the employee’s salary and transferred to the budget.

If you do not take the payment of the debt under the writ of execution seriously and do not pay the money, then a fine is imposed - an enforcement fee, which is 7% of the accrued amount calculated for payment. The BCC of the enforcement fee differs from the codes for other payments to the federal budget.

Deduction amount

If the parents have not agreed on the amount of child support, then it is collected in court in the amount of:

- quarters of income - per child;

- thirds of income - for two children;

- half of earnings - on three or more.

If a citizen does not comply with the court’s demand voluntarily, then the writ of execution is sent to his place of work. The employer is obliged to fulfill it unconditionally. How to draw up a payment order for alimony under a writ of execution and avoid mistakes?

According to the writ of execution, in addition to current payments for children, the resulting debt is collected. The maximum total percentage of such deduction is 70% of the employee's earnings.

Example

Semenov Andrey Petrovich pays, according to the writ of execution for his son, to his ex-wife, Semenova Inna Leonidovna, a payment in the amount of 25% of the income. In May 2021, he received a salary of 30,000 rubles. He did not submit an application for personal income tax deductions. Let's calculate the amount of deduction:

Which kbk to indicate in the payment order to bailiffs

Kbk alimony 2021 for bailiffs But with Failure to fulfill the obligation to index alimony threatens with a considerable fine from bailiffs under Part. The amount of deductions from income is limited by law. When withholding alimony, it is necessary to take into account the requirements established by Art. Namely, the amount of deductions from wages when collecting alimony for minor children cannot exceed 70 percent. Moreover, this refers to the total amount of all deductions, since in addition to alimony, the employee may have other grounds for collection. After the entry into force of Chapter 34 of the Tax Code of the Russian Federation, insurance premiums directed to:. The rules for processing payment orders for tax payments are established by the Order of the Ministry of Finance of All employers who hire employees pay contributions from the amount of wages paid. The transfer deadline is until the 15th day of the month following the billing month.

If extra-budgetary collections are carried out, there is no need to follow special rules when drawing up payments. That is why in this case you can use the format of a standard payment order.

: sample

Payment Order for Alimony from an Employee to the Bailiffs 2021 In order to ensure the collection of certain payments ordered by the court, the bailiffs send to the payer - the obligated person - a corresponding order, which contains the appropriate requirement and indicates the necessary details. The type of payment is indicated in the sample as 01. This means that the transfer is carried out by order (the client instructs the bank to debit from his account). And the order of payment is 1 (this will be described in more detail below).

The correct procedure for filling out a payment order for alimony - a sample for transfer The Family Code of the Russian Federation after a divorce obliges one of the parents who does not live with the minor to withhold funds for the maintenance of the child.

Payment order

If the employing organization is in charge of filling out a payment order for alimony, many questions arise regarding the order of payment. The fact is that enterprises not only pay money for the maintenance of their employees’ young children from their salaries, but also make other contributions: insurance, taxes, etc.

While government payments are important, alimony is a priority. If there is not enough money in the account for all contributions at once, they must be transferred in any case. This is explained by the fact that the main goal of the state is to protect the Constitutional rights and interests of people, especially children.

If the organization pays the fees first and has no money left for alimony, the child’s rights will be significantly violated, which should not be allowed.

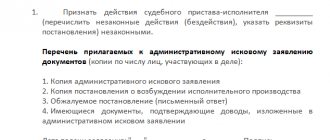

Termination of enforcement proceedings

How to submit a writ of execution to bailiffs in 2021 In addition to this document, an application for a writ of execution to bailiffs , also known as an application for the need to initiate enforcement proceedings. You can find out in what form it is filled out by looking at a sample at a stand in the advisory department of the Federal Bailiff Service of the Russian Federation or on government Internet resources. The standard form is presented as follows: 3 days are given to transfer documents to the bailiff. He has the same amount of time to consider and make a final decision. As a result, he issues a so-called resolution to initiate enforcement proceedings, or to refuse to implement the process. No later than 1 day after the decision is made, a copy of the document is sent to all participants in the process:

- 1 year - sheets containing a demand to return a child whose transportation to Russia was carried out in violation of current legislation, or the child is forcibly detained on the territory of the country;

- a period during which it is necessary to make periodic payments of a certain amount in favor of the creditor.

Many people may be faced with a situation where they need to make a payment to the state budget, but they have no idea about it, or, on the contrary, they deliberately do not make this payment, delaying it in all possible ways. Such situations occur mainly when some administrative offense has been committed, but the offender does not want to pay the fine for it. How is KBK 3220000000000000180 used in such situations according to the writ of execution, and also where does this document come from? Let's look at it in this article.

Payment to bailiffs under a writ of execution in 2021

BCC 2021 Regarding non-budgetary collections, there are no special rules, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field. So, it indicates the type of deduction (for example, alimony for such and such a period), details of the writ of execution, alimony case, you can provide information about the recipient of the amount withheld from the employee. The specific composition of the information can be clarified with the bailiffs.

What are the consequences of an error in the KBK?

Fine as a criminal punishment (read more...)

If the payment purpose code is specified incorrectly, the payment will be transferred to the budget, but it will not be distributed correctly there, which means that the state will not actually receive it. The result may be the same as if the money had not been transferred at all: the tax office will count the arrears under a certain item. At the same time, if the BCC is simply mixed up, there may be an overpayment under another item.

If, according to a writ of execution, you transfer an employee’s personal taxes to the account of the FSSP department, the payment order is issued according to the rules provided for payments to the budget.

Let's start with the fact that the procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, judicial penalties).

Details for Payment of Alimony Through Bailiffs in 2021

Sample of filling out a payment order to bailiffs

Details for Payment of Alimony Through Bailiffs in 2021 This code is separated from the identifier by a semicolon. The signs “No” and “–” are not indicated in field 108. When an individual's TIN is filled in, the value 0 is allowed in this field. PAYMENT ORDER TO BAILIFFS - SAMPLE 2021

(read more…)

— 01 — passport of a Russian citizen; — 04 — military personnel identification card; — 14 — SNILS; — 22 — driver’s license; — 24 — vehicle registration certificate.

There are no special rules regarding non-budgetary collections, as well as official instructions on the procedure for processing payments. Therefore, we believe that a regular payment order is issued for them, without filling out the “tax” fields, including payer status, BCC, etc. In this case, all information identifying the payment is provided in the “Purpose of payment” field.

Results

Payments to the FSSP are a transfer there of funds withheld by the employer from the employee’s salary under a writ of execution. Non-tax and tax debts can be paid in this way. In the second case, the payment document will be drawn up according to the rules applied for budget payments, but taking into account some of the features of entering data into certain fields.

Sources

- https://clubtk.ru/forms/bukhgalteriya-v-kadrakh/alimenty-kak-zapolnit-platezhnoe-poruchenie

- https://raszp.ru/spravochn/platezhnoe-poruchenie-na-alimenty-v-2021-godu-obrazets.html

- https://allo.tochka.com/zapolnyat-platyozhku

- https://AlimentOff.ru/alimenty/platezhnoe-poruchenie-na-vyplatu-alimentov

- https://bankigid.net/obrazec-zapolneniya-platezhki-na-alimenty-v-sberbanke-v-2021-godu/

- https://aliment24.ru/raschet/sposoby-vyplat/perevod-alimentov-cherez-sberbank.html

- https://prozakon.guru/semejnoe-pravo/alimenty/platezhnoe-poruchenie-na-perechislenie-obrazets.html

- https://alimentypro.ru/naznachenie-platezha-pri-perechislenii-alimentov/

- https://nalog-nalog.ru/bank/platezhnoe_poruchenie_sudebnym_pristavam_-_obrazec/

How do bailiffs work?

The first three digits of the code (322) indicate the payment administrator (Federal Bailiff Service). If we are talking about carrying out extra-budgetary collections, there are no special requirements for drawing up a payment order. All information identifying the payment is indicated in the “Purpose of payment” field. But the KBK, taxpayer status and tax information are not reflected in the document.

When filling out a payment order for the transfer of tax debts to the bailiff (for example, when transferring deductions from an employee’s salary), you should be guided by the rules governing budget payments. In this case, “0” should be indicated in the “104” field.

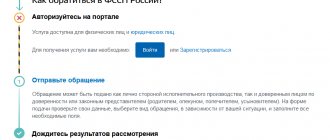

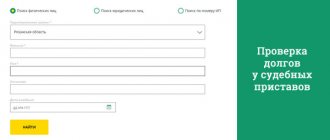

If the official place of work of the debtor is unknown, or problems constantly arise with the correctness and timeliness of deductions, it is advisable to send enforcement documents to the FSSP service. To do this, you need to consider the following nuances:

How deductions are made

Withholding of alimony from an employee is carried out either by writ of execution or by personal application of the employee.

If the organization receives a writ of execution, then child support is withheld regardless of the employee’s wishes. It specifies the amounts and procedure for withholding, and the details of the recipient.

If the transfer to the recipient is made by bank transfer, then it is necessary to fill out a payment order when transferring alimony, taking into account the latest changes in the processing of transfers to individuals.

Maintenance for a minor is ceased to be withheld according to a writ of execution only when the child reaches the age of majority or upon the dismissal of an employee.

From what income is alimony withheld?

Maintenance for minors is paid from all employee income not only during work, but also during absence from work:

- wages;

- bonuses, allowances, and other remuneration for performing job duties;

- vacation pay;

- temporary disability benefits.

The full list is given in Government Decree No. 841 of July 18, 1996.

The types of payments from which child support is not withheld include (Article 101 229-FZ):

- travel expenses and other accountable amounts;

- compensation payments in connection with the use of the employee’s personal property in the interests of the organization. The government list clarifies that we are talking about the use of tools, transport, equipment, other technical means and materials, reimbursement of expenses associated with their use (RF Government Decree No. 388 of 04/01/2021);

- compulsory social insurance benefits, with the exception of sick leave payments;

- financial assistance in connection with an emergency or the death of a family member.

Who is affected by the new rules for filling out payment slips?

The adoption of Bank of Russia Instructions No. 5286-U was due to amendments to Law No. 229-FZ of October 2, 2007. The changes are aimed at limiting penalties for enforcement proceedings in terms of social payments. The codes approved in the Directions allow bailiffs and bank employees to find out from which income of individuals debts can be withheld and from which they cannot.

Thus, the new rules for filling out payment documents apply to all employers who pay money to citizens, including those working under employment contracts and those hired on the basis of civil contracts.

Note! According to stat. 99 No. 229-FZ, in general cases, the amount of deductions in the presence of executive documents cannot be more than 50% of the amount of income. However, when calculating alimony, the amount of deductions is no more than 70%.

What changed

From June 1, 2021, everyone who pays individuals will have two new responsibilities when transferring and completing payments.

The amount of collection in the purpose of payment. If your employee is a debtor, and you, as an employer, have received a writ of execution for deduction from his wages, you must make a note about this on the payment slip. In the “Purpose of payment” field, indicate the amount of the collected amount in the following format: symbol “//”, “VZS” (amount collected), symbol “//”, amount in numbers, symbol “//” .

When indicating the amount, rubles are separated from kopecks by a dash. If the amount is a whole amount, without kopecks, then “00” is indicated after the dash sign. For example, if you withheld 500 rubles from an employee according to a writ of execution, write in the payment slip: //VZS//500−00//.

New field 20. If you pay wages to employees, pay remuneration under a contract, or make any other transfer to an individual, you must indicate the type of income code in the payment order. The payment order itself has not changed, so the code is indicated in field 20 “Payment purpose code”.

Why was coding introduced?

There is a list of income of individuals from whom debts cannot be withheld. Before June 1, banks could not always understand exactly what income the debtor received, so they incorrectly wrote off money according to the writ of execution. For example, they could write off utility bills from child support. From June 1, 2021, the Bank of Russia introduced coding of payments to individuals, which should solve this problem.

At the place of work

Writ of execution for alimony: sample 2021 At the moment, no new standards for the execution of this document have been adopted. An approximate sample application for alimony to bailiffs (2020):

- performance list. Issued after the court decision has entered into legal force;

- court order. Issued upon application by magistrates;

- notarized agreement. Contains the terms of payments: amount, frequency, possible circumstances of termination of obligations, etc. Such an agreement, not notarized, has no legal force.

Procedure

In what cases should I contact the bailiffs (read more...)

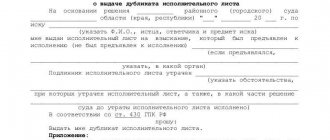

Note! If the writ of execution is lost, only the claimant will be able to obtain a duplicate of it. To do this, you need to contact the court with an application, a sample of which can be found on the court information stands. Also note that the deduction is not suspended during the period of production of the duplicate.

You can obtain a writ of execution from the office of a judicial institution - in person or through a representative by proxy.

Alimony in favor of bailiffs

Sample payment order for the transfer of alimony to bailiffs in 2021. We also note that if the address of the person in whose favor alimony is being collected is unknown, the FSSP of Russia recommends transferring alimony by payment order to the settlement account of a structural unit of the relevant territorial body of this service (subp. 9 clause II of Appendix No. 1 to the Methodological Recommendations of the FSSP of Russia dated June 19, 2012 No. 01-16). The employer may receive a writ of execution from a bailiff or from the claimant himself (for example, from the employee’s ex-wife). It is imperative to inform the employee about the receipt of the writ of execution and obtain his signature stating that he knows about the receipt of such an order (letter of Rostrud dated December 19, 2007 No. 5204-6-0).

After the employer has received a writ of execution from the claimant or a copy thereof from the bailiff, in which his employee is indicated as a debtor, the amounts specified in the writ of execution should be withheld from wages (including advance payments) and other income paid to the employee, regardless of his desire (Part 3 of Article 98 of the Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”).

Normative base

Decree of the Government of the Russian Federation No. 841 of July 18, 1996 “On the List of types of wages and other income from which alimony for minor children is withheld”

Federal Law No. 229-FZ of October 2, 2007 “On enforcement proceedings”

Directive of the Bank of Russia No. 5286-U dated October 14, 2021 “On the procedure for indicating the type of income code in orders for the transfer of funds”

Information letter of the Bank of Russia dated February 27, 2021 N IN-05-45/10 “On indicating the amount collected in the settlement document”

If the claimant submitted documents directly to the bank

New rules for withholding debt from accounts and cards

In simple words, now the bank itself will check the purpose and type of each payment received into the citizen’s account. If this account was previously seized, the bank is obliged to calculate the amount of deductions itself, transfer the money to the FSSP deposit or directly to the creditor. It is also the bank’s responsibility to determine the income that is prohibited from foreclosure.

We’ll tell you separately about the last item on this list. The 50% withholding limit applies only to the last amount received from the employer. If the money is not withdrawn and left on the card, after the next part of the salary is credited, it may be completely written off to pay off the debt. The balance on the card automatically ceases to be considered a salary as soon as the next payment from the employer is received on it. It will be impossible to return the money after debiting in such a situation.

- immediately after initiating enforcement proceedings, take a certificate from your place of employment and a bank statement to confirm which account your salary is being transferred to (the same can be done for pensions, social benefits and other support measures);

- if the documents are sent for work to withhold periodic payments, ask the bailiff to remove the seizure from bank accounts and cards (this will avoid double withholding);

- After receiving each part of your salary on the card, immediately withdraw the money, because the next payment from your employer can legally write off the entire balance from you.

§ Transfer of Alimony to Bailiffs Payment Order 2021 Procedure for withholding from bank accounts and cards in 2021

Short

- From June 1, 2021, new rules for filling out payment orders when transferring money to an individual will come into force.

- If you withhold money from an employee’s salary under a writ of execution, in the “Purpose of payment” field you need to make a note with the amount of the collected amount in the format “//VZS//500−00//”.

- When transferring salaries, vacation pay and other payments to employees, when paying remuneration to a contractor and other transfers to individuals, you must indicate one of three codes for the type of income or leave the field blank.

- The code is indicated in the payment in field 20 “Payment purpose code”.

- The income type code “1” is set in case of transfer of salary, advance payment, bonus, payment under a civil contract and other payments for which there are restrictions on withholding.

- The income type code “2” is set if you are transferring child benefits, daily allowances, maternity allowances, alimony and other payments, from which deductions cannot be made by law.

- The type of income code “3” is indicated only in two cases: when compensating for harm to health or when transferring compensation payments from budget funds.

- In other cases, the field remains empty and there is no need to assign a code. These may be cases where an entrepreneur transfers money to himself as business income.

- If you transfer money using different codes, for example, salary and travel allowances, you need to fill out a separate payment order for each type.

- Please be careful when choosing a code - the payer is responsible for filling out field 20 correctly.