Often, alimony debts arise due to the fact that payers deliberately evade their obligations. If this is the case, then they can be held liable for various types of liability in order to recover funds. However, if the debtor did not pay alimony due to valid reasons, the court can not only reduce the amount of the debt, but also write it off completely.

- Is it possible to remove (write off) alimony debt? Grounds

- Arbitrage practice

The article also provides answers to questions about whether the court exempts from paying the debt if the alimony:

- declared bankrupt;

- served a sentence for failure to pay alimony;

- is on maternity leave.

What are the consequences of alimony debt?

Payment of child support is the responsibility of parents, the implementation of which is monitored especially strictly . Protecting the rights of minors is one of the priorities of family law.

If the payer has an outstanding alimony debt that arose through his fault , the bailiffs can bring him to various measures of responsibility:

- Blocking of a driver's license in the traffic police database for a debt of 10,000 rubles.

- Ban on traveling abroad of the Russian Federation.

- Executive search for the debtor.

- Seizure of property and funds of the defaulter.

- Bringing to administrative liability through:

- correctional or forced labor;

- administrative arrest;

- imposition of an administrative fine.

- Bringing the debtor to criminal liability under Art. 157 of the Criminal Code - this measure is an extreme measure and is applied only in case of malicious evasion of child support.

As you can see, bailiffs have various levers of influence over debtors. However, family law also protects the interests of persons liable for alimony . In exceptional cases, alimony debt can not only be reduced, but also canceled (written off).

Photo pixabay.com

Nuances

A problematic aspect in matters of writing off funds is the age of the child, if funds were paid for his maintenance. So, if a person has reached the age of 18 and there is a debt formed earlier, the applicant in the case is the recipient, and not the mother with whom he lived. This is due to the fact that the mother (father) with whom the minor lived is the manager of the money, but not the owner, so not all courts accept claims in this situation. Practice develops differently, so it is advisable to seek advice from bailiffs or a magistrate.

Additional Information

If, in accordance with the established procedure, the payer is declared missing or dead, all existing property is sold. At the same time, a manager from the guardianship authorities is appointed who controls this process. The debt to the recipient is repaid using the proceeds.

Is it possible to write off alimony debt, and how to do it?

The right of an alimony-obligated parent to partial or complete exemption from payment of arrears of alimony is described in Article 114 of the Family Code (FC).

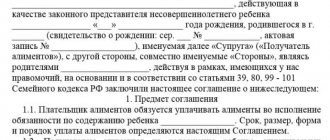

- If alimony was collected under a voluntary alimony agreement , then the parties can reduce the amount of the debt or not pay it by mutual agreement - such agreements can be concluded either orally or in writing, but preference is given to written form, which will serve as evidence in case of disputes.

- If alimony was assigned by a court decision or writ of execution , then regardless of who received it (children, parents, and so on), the debt can only be written off through the court.

However, it is impossible to voluntarily agree on release from alimony debts for minor children , even if the funds were collected under a notarial agreement (see Part 1 of Article 114 of the RF IC). To write off such debt, you must go to court.

Reasons for writing off debt

The rights of alimony recipients are especially protected by law, so the court can write off the debt only if there are truly compelling and valid reasons . They could be:

- Illness of the alimony payer himself, serious illness or death of his close relative.

- The influence of force majeure circumstances on the debtor: being in the zone of a natural or man-made disaster, loss of property due to a force majeure situation, and so on.

- A financial situation that does not allow repaying the entire amount of debt, for example, if, after collecting all alimony debts, the payer and his family do not have enough funds to meet priority needs. Most often this happens when paying off alimony debt for a minor; in this case, bailiffs can collect from the payer up to 70% of income (Part 3 of Article 99 of Federal Law No. 229-FZ of October 2, 2007).

- Changes in the financial situation of the debtor: the birth of a child, the appearance of disabled dependents and similar circumstances.

For a debt to be cancelled, two conditions must be met:

- A valid reason for the formation of debt.

- Family or financial difficulties of the payer that make repayment of the debt impossible.

The serious illness of the debtor, the appearance of a child in his new family and other circumstances cannot become the only reason for the cancellation of the debt, unless these circumstances affected the financial condition of the payer to such an extent that the payment of child support became impossible:

Example . Sergey S. is an entrepreneur and is obliged to pay alimony for a child from his first marriage in the amount of 7,000 rubles monthly. His income is unstable, but, as a rule, does not fall below 30 thousand rubles per month. He had a child from his second wife, as a result of which the family’s expenses increased, and Sergei stopped paying for the first child.

As a result, after 10 months of non-payment, a debt of 70,000 rubles arose. Sergei wanted to cancel the debt in court, but during the hearing it turned out that after the birth of his second child, the man bought a car and also took out a mortgage loan to buy a new home. His claim to write off his alimony debt was denied.

Exemption from payment of arrears of alimony: judicial practice

When deciding to write off a debt, courts first of all take into account whether the plaintiff has serious grounds and their documentary evidence. If the defaulter claims that the debt was caused by an inability to find work, the court will need evidence of good reasons why the plaintiff could not find work.

Often, those defaulters whose debt the bailiffs calculated based on the average wage in Russia insist on exemption from paying alimony debt. Many alimony payers mistakenly believe that if alimony is collected as a share of income, but there is no income as such, then debts are not accrued or written off.

As a rule, if the bailiffs did not have information about the official salary of the debtor, and the payer himself did not file claims to change the method of collection or to reduce the amount of alimony, and there are no valid reasons for non-payment, then the debt calculated from the average earnings is not canceled by the courts and is not decreases.

The court can also write off the child support debt for the period when the child lived with the payer and was dependent on him . As a rule, judges are of the opinion that such a reason for non-payment is valid, since the debtor actually supported the child, but everything depends on the specific circumstances of the case.

When it comes to writing off alimony debt in connection with challenging paternity, the courts, as a rule, adhere to the provisions of Art. 13 of the Code of Civil Procedure of the Russian Federation: if a court decision has entered into force, then it is binding. Thus, it is necessary to pay child support until paternity is challenged. Consequently, cancellation of alimony debt is impossible only on the basis that the man is not the biological father of the child.

However, judges take into account the family and financial situation of the alimony payer, the presence of dishonest behavior of the child’s mother (misleading a man about paternity, reporting false information, submitting false documents). If there are valid legally significant reasons, the court may exempt a man from paying alimony debt for a child whose father he is not.

Write-off cost

For the recipient of alimony, the withholding procedure is completely free, and the payer of alimony pays all bank and other fees associated with the employer’s transfer of alimony to the recipient’s accounts (Clause 3, Article 98 of Law No. 229).

In addition, if the debtor has evaded paying alimony and is in debt, then an enforcement fee in the amount of 7% of such amount is imposed on the amount of the debt. Upon receipt of the writ of execution, the accounting department breaks down the entire amount of the enforcement fee evenly over the entire payment period.

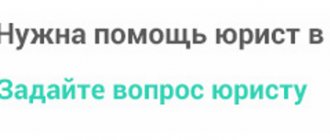

Statement of claim for relief from debt payment: sample

It is necessary to file a claim for exemption from payment of arrears of alimony in the magistrate’s court at the place of residence of the defendant, that is, the recipient of the payments. The plaintiff must pay the state fee: according to the rules of clause 3, part 11, art. 333.19 of the Tax Code of the Russian Federation, it is 300 rubles.

Click on the picture to open the document in a new window

The following documents are attached to the application (in 3 copies) and a copy of the plaintiff’s identity document (passport):

- A copy of the writ of execution (agreement) on the basis of which alimony is collected.

- A copy of the resolution on debt settlement.

- Copies of documents confirming the need to write off the debt: extracts from medical records, salary certificates, dismissal orders, acts indicating the loss of property by the debtor, and so on.

Documents are submitted in two copies : for the court and for the defendant.

Limit dimensions

According to paragraph 2 of Art. 99 of Law No. 229, the write-off amount cannot exceed half of the debtor’s total income at a given enterprise, including salary, bonus, advance payment and compensation for weekends.

The exception is cases when alimony is paid according to a certified agreement, or when the debtor-employee is a willful defaulter - in such cases, the amount written off can reach 70% of the salary.

It is important to remember that the above restrictions do not apply to the debtor’s savings stored on his salary bank card in excess of his monthly income - these savings can be written off in full at a time to cover part of the debt

within 3 days after the accounting department receives the writ of execution.

How to avoid paying child support debt after turning 18

Both recipients and payers of alimony are concerned about the question of whether debts are written off after the child turns 18. Many are sure that after reaching adulthood, the debt is removed, but this is not so.

According to family law, parents are obliged to support their children until they reach adulthood. If the assigned funds were paid in good faith, then with the onset of the child’s 18th birthday, the child support obligations of the father or mother cease. However, this is only true if there is no debt .

If the payer has a child support debt and the child is already 18 years old, then the bailiff does not have the right to close the enforcement proceedings. He must continue to influence the person obligated for alimony until the debt is repaid.

In addition, the alimony debt is not subject to a statute of limitations : even if the father (or mother) has not paid alimony since the child turned 12 years old, he will still be in debt for all 6 years of non-payment and even after adulthood child, and the amount can be canceled only if there are good reasons.

You can find out more in the article “Arrears of child support after 18 years.”

What is salary deduction?

Withholding alimony from wages means a monthly deduction of a part of the salary equal to the alimony payment in favor of the parent raising the child. The deduction is made by the company's accounting department employees. Legislative regulation of the withholding of alimony payments is carried out:

- Family Code;

- Law No. 229 “On Enforcement Proceedings”;

- Resolution No. 841.

In Art. 109 of the RF IC indicates the obligation of accounting to withhold payments from an employee’s salary, Chapter 11 of Law No. 229 describes the procedure for writing off alimony and debts on it from wages, and Resolution No. 841 lists all types of income from which alimony can be written off.

Is it possible to cancel an alimony penalty?

Not only the bailiff, but also the collector of funds can hold the alimony debtor accountable. He can go to court with a claim to collect a penalty in the amount of 0.1% for each overdue day, according to the rules of Art. 115 of the RF IC, in this case:

- the longer the period of non-payment and the larger the amount of debt, the higher the amount of the penalty, since it is calculated in direct proportion to the accumulated amount of debt;

- the need to pay the penalty does not cancel the obligation of the alimony provider to repay the amount of the debt itself, as well as to continue to pay funds for the child.

The Family Code provides for the possibility of releasing the debtor from paying a penalty if its amount is clearly too high and does not correspond to the consequences caused to the claimant by non-payment of alimony. In this case, the court will take into account the financial and marital status of the debtor.

It should be noted that reducing or writing off the amount of the penalty is a right, not an obligation of the court, therefore the debtor needs to document his difficult financial situation using:

- certificates of low income;

- documents confirming the presence of dependents on his support: a pregnant wife, disabled parents, a disabled child, and so on;

- receipts for payment of utilities and other services;

- certificates of retirement or disability;

- extracts from medical records and others.

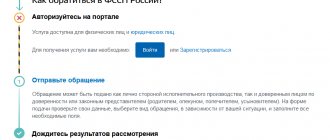

Click on the picture to open the document in a new window

The absolute basis for writing off a penalty is the failure to transfer alimony through no fault of the debtor : if the funds did not arrive due to an error by an accountant or bank employee, then the penalty is not collected from the debtor.

Procedure for deducting alimony

According to Art. 99 of Law No. 229, alimony is subject to withholding from any type of income only after the personal income tax has been written off.

If the debtor has issued a tax deduction for the purchase of real estate and receives annual compensation through the employer, he is obliged to pay alimony from the deductions received after recalculation.

To control this process, the employer sends a corresponding request to the tax service if the debtor is listed in the accounting department as the person who issued the tax deduction.

In some cases, a criminal record certificate is very important when applying for a job. How will the pension of working pensioners be indexed after dismissal in 2021? Find out about it here.

When quitting, check if you have any unused vacation days - the employer is obliged to compensate for them. You can read more in this article.