Free legal consultation over the Internet 24 hoursLawyer on housing issues in St. Petersburg. Free legal consultation on labor disputes.

5/5 (2)

Why is such a certificate needed?

A certificate of no debt, issued by the Bailiff Service, is required in various situations, for example, when a person intends to leave the country. Many points require certification of the fact that the citizen has no debts either to the state or to other people.

Some organizations require the preparation of the certificates in question in the following cases:

- the citizen’s intention to travel abroad;

- the need to clarify the fact of the presence or absence of debts to the state;

- participation of organizations in tenders, loans, license registration.

A certificate will also be required in case of participation in real estate transactions.

New changes in legislation regarding the debtor's salary card

Based on the negative consequences when applying certain articles of the law in practice, the President of the Russian Federation on July 29, 2021 signed Law No. 234 “On Amendments to the Civil Code of the Russian Federation and Federal Law No. 229,” which comes into force on February 1, 2022.

This law establishes the minimum income of a debtor citizen, protected from penalties.

The amount of the debtor's minimum income cannot be lower than one subsistence minimum for the working population, established by the region where the debtor lives.

The established restrictions are aimed at solving the following executive tasks:

- to ensure, within the framework of enforcement proceedings, the inviolability of the minimum income for the needs of the debtor;

- to ensure, within the framework of enforcement proceedings, the inviolability of the minimum income for the needs of persons dependent on the debtor (children, parents, wife, etc.).

After the law comes into force, it will be enough for a citizen-debtor to submit to the bailiff department an application “On maintaining wages and other income in the amount of one subsistence minimum.” In the application, he must indicate not only the account from which funds cannot be written off, but also the number of people who are dependent on him.

ATTENTION! Do not forget to attach documents that confirm that you have certain dependents.

As such documents, bailiffs may be presented with: a child’s birth certificate (for each child, if there is more than one), medical certificates stating that family members are incapacitated (disabled), a court decision that you are obliged to pay alimony to the elderly parents or other relatives, etc.

How to find out if you have debts

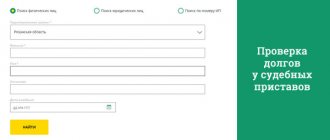

There are two main ways to determine the existence of debts, which include:

- Contacting the FSSP through the official website of the service. Next, you will need to go to the “Service” section, then select the first line and follow the link. A window will appear on the site that needs to be filled out, after which information about the person’s debts will be generated;

- Personal appeal to the FSSP. This option will allow you to receive an official document signed and stamped by a service employee. Only such a certificate will be considered confirmation of the absence of debts.

By law, the execution of the document should not take more than thirty days.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

How to protect your property from seizure

To prevent such radical actions on the part of bailiffs as arrest, seizure and sale of property, the debtor should get in touch in a timely manner and maintain contact with the IRS. It is necessary to convince the FSSP of your positive intentions and show your desire to implement the court’s decision with all your might.

For this, lawyers recommend:

- Find out whether it is possible to agree with the creditor on a deferment and partial repayment of the debt. Perhaps the person or organization you owe will agree to work out a schedule and collect the debt slowly but surely.

- Transfer at least small amounts, but regularly, so that the bailiff can see the seriousness of your intentions.

- If there is money in bank accounts, information about it can be transferred to the FSSP to write off debt from them.

A popular question is: what will happen if you pay 100 rubles a week (or a month) according to a writ of execution, and will it be possible to protect property in this way?

Property is seized if the amount recovered exceeds 3,000 rubles. If the debt is less than 3 thousand, then nothing will be seized. With larger debts, the bailiff has the right to seize the property, but is obliged to take into account the principle of proportionality - the object that he is going to sell must be cheaper or equal in value to the amount of the debt. He cannot sell, for example, a dacha worth a million for a microloan debt of 50 thousand rubles. If the amount is significant, for example, 600 thousand rubles, then the bailiff has the right to seize the car, and 100 ruble monthly payments will not help.

How and where to apply to obtain a document

The best option to obtain a certificate is to contact the FSSP. At the service, the person will be given advice and explained about the nature of the certificate and the procedure for obtaining it. In this case, you need to choose the department where the writ of execution was sent, and in the absence of one, to the FSSP department according to the citizen’s registration address.

If there is no information in the bailiff service, then to obtain information you need to contact the regional department, where a decision will be made to redirect the application to the appropriate department. After receiving the documents, the FSSP, which controls the debts of a particular person, will issue the certificate in question.

The application, if submitted, must be redirected to the regional authority no later than five days from the date of application. After the specified time, the relevant department of the service should already receive the application and begin processing the certificate within a thirty-day period.

Watch the video. How to find out debt from bailiffs, debt repayment:

Obligations of the debtor

When an individual is served with a resolution to initiate enforcement proceedings, or he receives a notice from State Services, he has only 5 working days to repay the debt on his own.

But not every person has the resources to pay off debts. Execution of a court decision is the job of a bailiff (Bailiff), this civil servant is endowed with broad powers to collect debts. For example, failure to pay according to the writ of execution will result in the SPI introducing restrictions for the debtor:

- for trips abroad;

- for transport management;

- for the use of money in bank accounts - deposits, deposits.

The enforcement action also involves the sale of the defaulter's property in order to cover the obligations.

About the issuance rules

Please note! Taking into account the type of debts and the type of debt certificates, the following general recommendations are provided for a citizen:

- If a citizen needs an exact indication of the amount of debt, for example, for court purposes, then this should be stated in advance. In addition, bailiffs can provide information about the amount of debt and the dates of repayment, which is also done at the request of the person;

- If a person has a question of alimony, then a special certificate will be required, which will reflect not all possible debts, but only the status of alimony payments. Such a certificate may be needed by the guardianship and trusteeship authorities, the court, the employer, and so on.

- If a citizen requires information about the beginning and progress of enforcement proceedings, then a corresponding certificate will also be required. Often such a document is required not by the debtor, but by the collector who controls the process of debt repayment.

Each of these certificates acts as an official document, and the information indicated in them has legal force.

Certificate of absence of alimony arrears

The executed document must strictly comply with the established templates, otherwise it is considered invalid. The certificate states:

- Full name of the person who fully repaid the debt.

- Number and date of the court decision.

- The amount of debt, including its current status.

- Information about the official who provided the document.

- If a certificate is taken for alimony, it indicates information about the recipient of such payments, for example, about a minor child.

Hotline for citizen consultations: 8-804-333-70-30

Issuing the document will not take much time; it will take the bailiff no more than five days to consider your application. After this you receive an official response. Please note that it is recommended to prepare the application in two copies, one remains with you, the second is transferred to the FSSP representative.

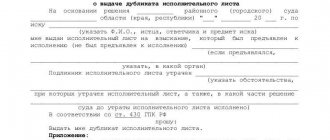

Sample application for a certificate from the FSSP

Important! In order for an application for a certificate to be accepted by bailiffs, it is necessary to follow the rules for drawing up such an application:

- Written form. This condition is mandatory. Oral appeals are not accepted; the only thing the bailiffs can do in this case is to provide advice on subsequent actions. Also, requests sent by email are not taken into account;

- A notary certification is not required; the application form must be simple in writing. Unified forms are also not used. It is enough to correctly state the request and indicate the type of certificate;

- The date of compilation and the personal signature of the applicant are required. You are also required to provide personal information. If there is no information about the applicant, then the application is considered anonymous, which is not allowed by law;

- The requirements in the application must be specified. If it is not clear from the application what needs to be done, the application will be returned.

What restrictions are established by law when collecting debt from the debtor’s salary card?

A debtor, like any other person, cannot exist without money, and even more so without it he cannot repay debts. Therefore, the legislator, while respecting the debtor’s right to life, has determined special conditions and lists of income that cannot be levied against.

For example, Article 99 of Federal Law No. 229 provides for the following restrictions on the deduction of funds from the debtor’s wages in favor of the claimant:

- during the execution of one or more enforcement documents, it is allowed to withhold no more than 50% of wages (and other income) until the enforcement requirements are fulfilled in full;

- When collecting alimony for minor children, compensation for harm to health or in connection with the death of the breadwinner, as well as damage from a crime, it is allowed to withhold from the wages and other income of the debtor in the amount of up to 70%.

This provision of the law is mandatory, therefore bailiffs and the bank must write off funds from the debtor’s salary card, taking into account these requirements.

What forms are there for certificates of receivables (and payables)?

Among the most common unified forms used to reflect receivables (and, if required, payables) debts is form No. INV-17, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. We are talking about an act of inventory of settlements of a business entity with its debtors and creditors.

This document can be used in strict accordance with the legally approved form or as a basis for drawing up a certificate.

You can learn more about the specifics of working with form No. INV-17 in the article: “Unified form No. INV-17 - form and sample.”

Another popular unified document is the form of a certificate of accounts receivable and payable, approved in Appendix No. 3 to the order of the Ministry of Justice dated July 30, 1999. The jurisdiction of this order is departmental, but the form of the certificate proposed in it allows any interested business entity to reflect in detail the structure of its receivables and payables.

What are the requirements for the application?

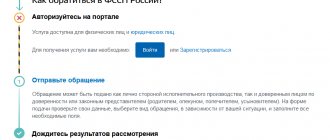

Through the State Services portal, an application is drawn up to provide information online or in a more detailed version, followed by printing of the document.

Fill out 2 items in the online application. Moreover, this can be done personally or through a trusted person (intermediary), if he has access to the page on the State Services service. If you have an account in your personal account, no additional information is provided. If desired, the user can correct the profile data.

When preparing an application in expanded form, you must:

- check personal data on your passport;

- specify the registration (residence) address;

- record an email address where you can send the generated document;

- in paragraph 2 indicate the type of appeal and the status of the applicant (claimor or debtor);

- In paragraph 3, enter information about enforcement proceedings in the boxes.

This form is used when there is actually a case being conducted by a bailiff. If there is none, a brief information certificate is issued online. The information it contains is checked by employees of regulatory authorities, for example, customs when traveling abroad.

The main requirement for writing an application is the accuracy and completeness of the information it contains. If discrepancies arise, the certificate will be refused, or the false entry will be asked to be corrected.

17 days are allotted for consideration of the application. After this, a document will appear in the citizen’s personal account, which can be downloaded and used electronically or printed.