Home » Repayment

- 1 What can bailiffs do and what are their powers?

- 2 What types of debts do bailiffs have?

- 3 Rights and obligations

- 4 Priority of debt collection

- 5 Deadlines for debt collection

- 6 How debt collection by bailiffs occurs - instructions

- 7 What property can be taken to pay off the debt?

- 8 What happens if the bailiff fails to collect the debt?

- 9 Collection of movable objects

- 10 Special cases of debt collection

- 11 Debt reset

- 12 What happens after the debt is paid?

- 13 Errors and nuances

- 14 Results

According to statistics, only one out of five borrowers independently copes with their obligations and repays the money within 30 days from the date of the court decision. Every third person does this with the help of bailiffs, and half of the creditors completely refuse to repay their debts. The success of debt collection largely depends on judicial officers (executors). Below we will consider the rights and responsibilities of bailiffs, methods and principles of their work.

What can bailiffs do and what are their powers?

The main task of such employees is to do everything possible to ensure that the court’s decision is implemented. For this purpose, bailiffs are vested with specific powers. They have the right:

- Seize property.

- Suspend the right to drive a car.

- Prohibit traveling abroad.

In addition, by court decision, bailiffs have the right to seize the debtor’s material assets for subsequent sale, as well as to conduct a search for him. In the latter case, judicial officers make a request to the relevant authorities regarding the following information:

- Places of employment.

- Availability of cards and accounts, as well as property (car, apartment, house).

Bailiffs work with debtors as soon as they receive a court decision, taking into account the restrictions established by law. The starting point is the provision of a writ of execution to the applicant, as well as the acceptance of the document by the bailiffs department.

Tasks

Defined in the official regulations on the activities of the federal service.

Central tasks:

- resolving issues of ensuring order in courts of all levels - from Constitutional to arbitration;

- measures for the enforcement of decisions of arbitration courts and common law.

Also, the tasks of the federal service include managing territorial divisions and carrying out necessary actions through them, functioning within the framework of the Constitution and Russian legislation, coordinating work with other federal, regional, local executive authorities, and public organizations.

What types of debts do bailiffs have?

The executive body deals with various types of debts that require coverage by a court decision. This category includes debts on microloans and bank loans, alimony and mortgages. Taxes, contributions to the Pension Fund of the Russian Federation, the Pension Fund of the Russian Federation and the state budget are collected, as well as fines, debts under receipts and contracts. In addition, bailiffs deal with housing and communal services and wage debts.

Work is carried out with all categories of citizens, as well as government agencies. The instructions of the court bailiff must be followed by everyone - state authorities, municipal representatives, ordinary citizens and companies. Federal Law No. 229 states that after a court decision is made, the plaintiff has the right to turn to bailiffs to collect the debt.

Who are they

Depending on their responsibilities, these officials are divided into several categories:

- working with debtors and collecting money from them to repay the debt;

- armed guards guarding judges and other participants in the hearing;

- leaders.

Their activities are regulated by the relevant Federal Law, which we will try to understand in this article.

Functions of the Federal Bailiff Service

The roles of these bodies include:

- search for the defendant's property;

- arrest and confiscation of found items;

- valuation of seized property;

- its implementation.

Video on the topic:

Bankruptcy of individuals

from 5000 rub/month

Read more

Services of a credit lawyer

from 3000 rubles

Read more

Legal assistance to debtors

from 3000 rubles

more

Write-off of loan debts

from 5000 rub/month

More details

Rights and obligations

Bailiffs have rights and responsibilities that are prescribed by law and specified in their job description.

Liabilities:

- Conducting activities taking into account the legislation of the Russian Federation.

- Working with personal information of participants in proceedings, if required to receive money.

- Providing the plaintiff and defendant with the required papers (copies, extracts, etc.).

- Putting the debtor or property on the wanted list. In some cases, a search is organized for the child if, by court decision, he must be transferred to the legal guardian (parent).

- Acceptance and study of the petition of the participants in the process, clarification of issues relating to the period and methods of appeal.

- Registration and submission of information about the crime to the head of the inquiry, taking into account current legislation.

- Recusal in a situation where the bailiff has a personal interest in the case.

Rights:

- Issuing instructions to participants in the trial regarding the implementation of certain actions specified in the court decision.

- Obtaining the information required to fulfill obligations - clarifications, corrections, personal information.

- Access to storage facilities or facilities occupied by the debtor. If required, the bailiff has the right to open them, study the documentation and inspect the property. If necessary, a representative of the executive body opens the premises occupied by the defendant and inspects it.

- Verification of the fact of deductions from wages, control of the maintenance of financial papers relating to the execution of a court order.

- Summoning citizens and company representatives on writs of execution.

- Seizure, seizure, transfer for storage and sale of seized material assets.

- Checking personal documents (passports) of the plaintiff and defendant.

- The use of transport by one of the parties to the proceedings to transport property. The obligation to pay the costs falls on the debtor.

- Appeal to the court if there are any ambiguities in the procedure and method of implementing the decision.

- Conducting a search for the debtor and obtaining information about him.

- Involvement of assistance from employees of the FSB, the migration service of the Ministry of Internal Affairs, as well as other bodies (including state power, local government and the National Guard of the Russian Federation).

Unlawful actions in bankruptcy proceedings

What actions of citizens are considered unlawful when going through bankruptcy proceedings?

According to Russian legislation, unlawful actions of a citizen during bankruptcy include:

- Commitment of illegal transactions by a citizen. The purpose of their commission by a bankrupt is to conceal property and leave it safe, bypassing the legislation on conducting bankruptcy proceedings for an individual.

This group includes the following actions:

- concealment of the debtor's property, as well as information about him;

transfer of property to third parties (for example, relatives) for the purpose of its preservation;

- destruction of property or other forms of alienation of material assets.

- Commitment by a citizen of actions aimed at illegally satisfying property claims (Part 2 of Article 14.13 of the Code of Administrative Offenses of the Russian Federation and Part 2 of Article 195 of the Criminal Code of the Russian Federation).

This group of illegal actions includes the commission of such actions by the guilty person (bankrupt) that are aimed at illegally satisfying the claims of the creditor (or creditors) to the detriment of others. In other words, creditors are on equal terms and it is impossible to satisfy the demands of only one to the detriment of the others.

- Creation by a citizen (debtor) of obstacles to the financial manager in the performance of his official duties (Part 4 of Article 14.13 of the Code of Administrative Offenses of the Russian Federation and Part 3 of Article 195 of the Criminal Code of the Russian Federation).

This may include: failure to provide the necessary information to the financial manager about the financial position and solvency, as well as providing knowingly false information

The commission of such actions entails administrative-legal (Part 1 of Article 14.13 of the Code of Administrative Offenses of the Russian Federation) and criminal liability (Part 1 of Article 195 of the Criminal Code of the Russian Federation).

The onset of administrative or criminal liability for a citizen if he commits unlawful actions depends on the level of damage caused. If the amount of damage is assessed as large, namely over 2 million 250 thousand rubles, then the debtor is subject to criminal liability. Less than the specified amount is administrative.

To hold a citizen accountable for committing illegal actions during bankruptcy, it is necessary to prove that the culprit acted intentionally.

Get a free consultation

Sequence of debt collection

The procedure for debt collection by bailiffs deserves special attention. So, if the debtor does not have enough money to fulfill his obligations, payments are made in the following sequence:

- Collection of alimony and coverage of damage caused to health. Payment of moral and material damage caused during the commission of a crime. Compensation for the death of a family breadwinner.

- Payment of severance pay and salary, taking into account the requirements of the employment contract, as well as payment of bonuses to authors based on the results of their intellectual work.

- Repayment of debts to the state budget and extra-budgetary funds.

- Other obligations.

It is worth noting that issues that concern the interests of children are considered priority.

How debts are collected by bailiffs - instructions

Debt collection by a bailiff takes place in several stages:

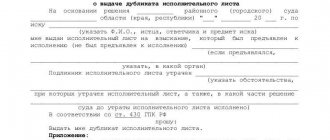

- Enforcement proceedings are initiated, the result of which is a decision. The bailiff receives the plaintiff’s application and the writ of execution, after which he begins to perform his duties. It must take up to six days for the decision to be issued from the moment the papers are received.

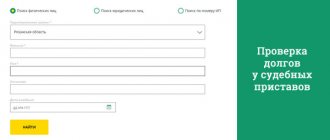

- Determining the availability of property. Bailiffs perform a set of actions to identify material assets from the defendant. To do this, they forward requests to Rosttekhnadzor, traffic police, cadastral and other authorities. We are talking about various real estate - cars, apartments, houses, and so on.

- Carrying out measures to preserve property until foreclosure. We are talking about a seizure that prevents the sale of an object.

- A ban on the defendant leaving the country. If the debtor does not comply with the demands of the judicial authority, and the debt exceeds 10,000 rubles, the bailiff has the right to initiate the process of banning departure from Russia.

- Debt collection. Money to pay off the debt is forcibly debited from a bank account, taken from the company’s cash register, or deducted from wages.

- Collection of enforcement fees. If the defendant does not comply with the requirements of the writs of execution, he is obliged to pay an enforcement fee of 7% of the amount of debt - from 1000 rubles. (for an ordinary citizen) or from 10,000 rubles. (for individual entrepreneurs).

- End of enforcement proceedings. Once the above steps are completed, the process is completed.

What property can be taken to pay off the debt?

We discussed above how bailiffs collect debts. Against this background, the question arises of what exactly they have the right to take, taking into account the Civil Code of the Russian Federation. By law, any property not included in the list of untouchables is seized:

- An apartment or a share in it.

- A plot of land or a house that is built on this plot.

- Household items and personal items (shoes, clothing).

- Pets (provided they are used to cover personal needs and not business).

- Property that is used for professional activities.

- Seeds for sowing.

- Food.

- Cash (a person must have an amount not lower than the subsistence level for each family member).

- Car for disabled people.

- Fuel used for heating homes or cooking food.

- State awards, prizes and other gifts.

Despite the large list of exceptions, there are nuances for each of them. For example, a debtor may be left without an apartment if it was purchased with a mortgage and is used as collateral. As for personal belongings, the category of “untouchables” does not include jewelry and other luxury items.

There are also nuances regarding equipment used for work activities. We are talking about things that cost no more than 100 minimum wages. For example, if a musician’s piano costs more than 100 minimum wages, it is taken away to cover losses. If the family is engaged in farming, they will not be able to take the seeds, but expensive flowers can be classified as luxury items. In addition, wheelchairs made with precious metals are also confiscated.

What happens if the bailiff fails to collect the debt?

If the bailiff fails to fulfill his obligations, the enforcement proceedings are subject to closure. This situation is possible if the debtor does not have money and material assets to repay, or the bailiff approached the work irresponsibly.

If the debtor cannot pay the debt, the writ of execution is handed over to the plaintiff, who waits for the debtor to receive the money. As soon as this happens, the creditor again turns to the bailiffs. It is worth noting that repeated application is possible within three years.

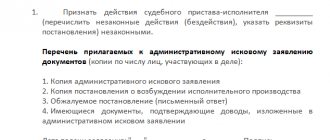

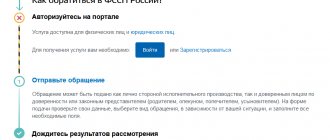

If the cause is poor quality work of a representative of the executive body, the following must be done:

- File a complaint addressed to the head of the executive service department. During the transfer, you must take a certified copy from the office.

- Write a letter addressed to the director of the FSSP department. A similar principle applies here. The only difference is in the “header”, where other information will be indicated. When sending or transferring paper, you must endorse and attach a copy of the previous complaint (if it did not produce results).

- Contact the prosecutor. This action is required if the appeal to the FSSP did not have an effect within 30 days from the date of submission. The application to the prosecutor's office is completed independently without a sample. If the prosecutor discovers shortcomings in the activities of the bailiff, he demands their elimination.

How to complain

The main rule is that all applications must be submitted in writing.

Telephone conversations and personal meetings with the head of the territorial branch of the FSSP, as a rule, turn out to be ineffective. The bailiffs themselves are also in no hurry to correct mistakes, citing a court decision or personal workload. As soon as you become aware of a violation of rights, you must immediately file complaints with the leadership of the FSSP, the main Directorate of the service, the court and the prosecutor's office. The more channels you use, the greater the chance of objective consideration of the issue and the speedy satisfaction of your requirements.

Collection of movable objects

If, by a court decision, movable property is subject to recovery, the bailiff must send a notice no later than 10 days before the auction day. The property is sold to the highest bidder. The auction did not take place if there were less than 2 people participating, only one participant came, there was no increase in the original cost, or the winner did not pay the required amount. A re-tender will be held a month later. If the funds are insufficient to cover the debt, the bailiff has the right to seize other property.

Basic principles of the state civil service

In accordance with the Federal Law on enforcement proceedings, the basic principles that should guide the bailiff are:

- Honesty;

- Openness;

- Legality;

- Deadlines.

Only by observing all the rules and not abusing his powers can a bailiff be considered a professional in the field of execution of punishment. After all, every executed court decision is a big step in resolving civil and administrative disputes.

Special cases of debt collection

In the work of bailiffs, situations often arise that involve difficulties in collecting debt. Let's look at the main ones:

- The person is in MLS. The bailiff can only wait until the debtor is released from prison, and then demand the recovery of half the wages.

- The person is registered in an apartment with other relatives. In such a situation, collection firms and bailiffs may visit the apartment. The latter can be let in. In this case, it is important to show documentation confirming that the valuables in the apartment were purchased by relatives and not by the defendant. If bailiffs seize property illegally, they can be sued.

- The debtor is under eighteen years of age. Such a person may receive a debt after entering into an inheritance with an encumbrance. In such a situation, until the child turns 18, bailiffs work with parents or legal guardians.

- The debtor is a person of retirement age. Many banks provide loans to pensioners, which has led to an increase in the number of elderly people with debt. In such a situation, bailiffs withdraw up to 50% of the pension or describe the property (if any).

- The man died. Here the debt is inherited by relatives. When a small amount is involved, it is divided among all beneficiaries with an obligation to repay. In other cases, the decision is made on an individual basis with the assistance of a qualified lawyer. Many, if they have an “unaffordable” debt, simply refuse the inheritance.

Errors and nuances

In Russian legislation, even minor oversights in the issue of enforcement proceedings can affect the course of the case. For example, a mistake in a bank account number often results in money being directed to another person. Correcting an error takes valuable time, which is worth its weight in gold in enforcement proceedings.

In practice, there are known techniques that debtors specifically resort to. For example, a person learns about a creditor’s desire to collect a debt. In such a situation, he transfers papers confirming the fact of debt to 3 parties. In this case, the amount may be higher than the amount of debt. Here you have to wait until the defendant pays off debts to 3rd parties. Another way is to transfer property to relatives and friends using “fake” papers.