It is no secret that when changing your last name, and this mainly applies to girls and women after marriage, you have to change a whole package of documents from your passport to your driver’s license. Of course, the basic documents of a citizen include, among other things, the TIN - individual taxpayer number. An important question: does the TIN change after marriage when the last name is changed?

Next, we will analyze in detail how the TIN is replaced through State Services when changing your last name in 2021, and where this can be done.

Do I need to change the TIN when changing my last name?

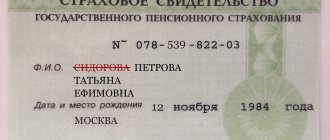

Do I need to change my TIN when changing my last name ? An individual taxpayer number (TIN) is assigned to a citizen of the Russian Federation once for life. Therefore, the TIN number itself does not change due to a change in surname, passport and personal data.

However, the TIN certificate itself on paper (as well as, for example, SNILS) contains the citizen’s full name, so after marriage it is better to change the document, while, as mentioned earlier, the individual taxpayer number itself will remain the same. In other words, it is necessary to replace the “piece of paper” itself - a certificate with a TIN number, which is kept by the citizen, while the TIN number is assigned to the citizen for life! Now you know whether you need to change your TIN when changing your last name after marriage.

Why do you need a TIN?

An individual code from a set of numbers is assigned to each taxpayer when registering a citizen with the tax authority at his place of residence. In an abbreviated version, the paper medium is called TIN; the presence of a code in it helps government agencies:

- control timely payment of taxes;

- conduct checks on employers regarding bona fide transfers

- funds to the state budget;

- monitor pension contributions.

Government agencies require individuals to present a taxpayer identification number at the time of:

- employment;

- submission and preparation of income declarations;

- registration of tax deductions;

- filling out financial documents;

- registration in State Services;

- opening individual enterprises;

- obtaining information about tax debts.

The document is issued not only for adults, but also for children if they have:

- taxable property;

- inheritance;

- tax and social deductions.

Important! Replacing the TIN when changing your last name is a personal matter for each taxpayer. The Civil Registry Office immediately sends information about citizens to the Federal Tax Service when their full name and basic details change.

For legal entities, a tax registration number is even more often required when:

- contracts are drawn up with partners;

- reports are submitted to the fiscal authorities;

- participate in financial transactions;

- enter into loan agreements.

Depending on the status, different numbers of digits are assigned. For ordinary citizens, the code consists of 12 characters, which contains information about the tax resident, region, and authority that issued the document. A ten-digit identification number with a verification code is created for entrepreneurs.

According to the law, such a measure is carried out solely at the request of the citizen himself. If you do not change the document, then no penalties or fines will follow. However, the federal service recommends issuing a new certificate after marriage to avoid confusion and possible troubles in the future.

Is it possible to change the TIN through State Services?

Is it possible to change the TIN through State Services?

? On the State Services portal, you can only make an appointment with the tax office (FTS), where you can submit an application and replace the TIN after marriage, or due to its loss/damage.

Where else can you change your TIN when changing your last name? It can be done:

- At the tax office at your place of residence (personal appeal);

- On the tax service website - more on this later in the article;

- In the multifunctional center (MFC) - moreover, by contacting the MFC, you can easily change your TIN and SNILS after changing your last name upon marriage.

Required documents

The list of documents is standard, however, it may vary depending on the circumstances of the certificate replacement. The entire package is attached electronically to the application.

Standard package:

- A completed application form;

- Identity document (passport);

- A copy of the marriage certificate;

- Document about the place of registration or temporary stay (sometimes);

- Receipt of payment of the state duty (required only in case of change due to loss or damage to the document).

Note. An individual taxpayer number is issued for life. When personal data changes, it cannot be changed and remains the same.

How to replace the TIN when changing your last name through State Services - step-by-step instructions

Below are step-by-step instructions on how to replace the TIN when changing your last name through State Services

:

- Go to the Gosuslugi.ru website in the subsection “Tax accounting for individuals”, select “Registration with the department”, and then click on the “Make an appointment” button;

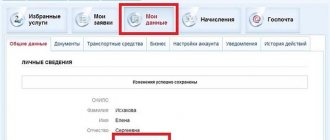

- After which you need to fill out an application - personal data will be downloaded from your personal account automatically;

- Next, you can select the region of circulation and the territorial tax office where you will change the TIN;

- Then all you have to do is choose a convenient appointment time.

Thus, on the State Services portal you can make an appointment with the tax office in order to change your TIN when changing your last name.

Cost and deadlines

Tax specialists have a 5-day period to consider the request and send a response. During this period, the applicant must be notified of the decision to replace the TIN with “Gosuslugi” when changing their last name.

In this situation, you will not have to pay the state tax. In the event that a duplicate is required due to the loss of a tax number, you will need to transfer 300 rubles to the state treasury.

Consequently, legislators do not force taxpayers to change their TIN when changing their last name. But for personal peace of mind and to get rid of unnecessary questions, you can carry out the procedure. After all, you don’t need to leave your home to create and send a request, and when receiving it you won’t have to present a receipt for payment of the fee.

How long does it take to replace the TIN: state duty

How long does it take to replace a TIN ? The time frame for replacing the TIN when contacting the MFC or tax office is usually up to 5 working days .

It is necessary to remember:

- Changing the last name on the TIN certificate is not considered a reissue of the certificate, so you will not have to pay a state fee for this service;

- If the TIN is lost or damaged, then to restore it you need to pay a state fee of 300 rubles.

Now you know how much it costs to restore a TIN in case of loss and in connection with a change of surname, as well as how long it takes to obtain a TIN.

Make a complaint!

Re-obtaining a certificate

A new TIN may be needed not only if your last name is changed, but also if it is lost. In this case, repeated receipt can be ordered from the Federal Tax Service or the Multifunctional Center by providing the following documents:

- Application in form 2-2-Accounting for the issuance of a duplicate TIN certificate.

- Identity document of an individual.

- A document confirming registration at the place of residence.

- Receipt of payment of the state fee for re-issuance of the certificate.

You will be able to receive a new document after five working days.

Note. If you lose your TIN without changing your last name, an application for a new certificate must be submitted in person. A sample form will be provided by Federal Tax Service employees. In this case, the service will be provided for a fee. The cost of the state duty will be 300 rubles.

Sources: gosuslugi-site.ru, gosuslugi365.ru, infogosuslugi.ru, gosuslugigid.ru, smena-familii.ru, gosuslugi.net, gosuslugis.com, easyblank.ru, gosuslugipro.ru, gosgo.ru

Changing the TIN after marriage through the Tax Service website

Changing the TIN after marriage through the tax service website still implies a personal application by the citizen to the Federal Tax Service at the place of residence to receive the TIN in hand. However, it is possible to both make an appointment with the tax office and submit an application for a replacement TIN on the tax service website. There is no special form for submitting an application to change the TIN when changing your last name, but you can use the form for registering an individual for tax purposes. In other words, the user needs to apply for a TIN.

So, to change the TIN when changing your last name on the tax website you need to:

- Register on the website nalog.ru;

- Go to the section “Registration of an individual with a tax authority on the territory of the Russian Federation”;

- Next, you must carefully fill out the application form for a TIN and send it to the tax office;

- Once the certificate is ready, the user will be invited to the territorial authority to receive the TIN in hand.

These are the ways you can replace your TIN when changing your last name using the State Services portal, or through the website of the Tax Service (IFTS of Russia).

Possible problems and nuances

- Refusal to provide the service is possible if the full package of documents is not provided , the application is filled out incorrectly, or the information does not match.

- You can issue a TIN only at the place of registration . For this reason, if it is impossible to appear at the department, you can use a legal representative, if available. You can also send an application with all the necessary certified documents by registered mail with notification, it will be considered. And a duplicate of the certificate will be sent by letter.

- Changing the TIN is also possible through the Internet resource nalog.ru . Go to the section “Individuals”, “Electronic services”, “Submitting an application for registration”. Fill out the application and click submit.

- It is impossible to change a document without a passport.

How to change TIN in MFC

How to change the TIN in the MFC? You can simply contact the nearest MFC and submit an application there to change your TIN. You can also make an appointment at the MFC online. So, to register with the MFC to change your TIN after marriage, you will need:

- Go to the single MFC portal. Here, in the “Change of name” section, you can find a service for replacing the TIN in connection with a change of surname;

- Then you can make a preliminary appointment for an appointment at the MFC by logging into the e-mfc.ru portal through your State account class=»aligncenter» width=»900″ height=»663″[/img]

In this way, you can make an appointment at the MFC to replace your TIN after changing your last name.

What problems may arise if you change your TIN through the State Services portal

Registration of a new tax registration certificate is a simple procedure. The application contains a minimum amount of information. Therefore, there are no difficulties in obtaining this service. If you follow all the steps sequentially, the finished TIN will be issued the very next day after submitting the application.

The only difficulty that may arise is purely technical. The State Services website cannot be called stable. Sometimes it malfunctions, which prevents you from filing an application with a government agency. In such a situation, you just need to wait and order the document the next day.

Via post office (required documents)

Those citizens who want to send documents to receive a new TIN by mail using a registered letter will need to prepare the following list of documents:

- Application in a special form. This form can be obtained directly from the tax office. Inspectors of this government organization will show the applicant a sample of the form. In addition to the basic information on the application form, you will also need to write the number of applications that need to be listed.

- A notarized photocopy of the passport with a changed surname. The interested person will first have to take a photocopy of the passport and have it certified by a notary office.

- Certificate of permanent residence registration , if this information is not indicated in the new passport.

- Original TIN certificate.

- A notarized copy of the marriage certificate.

Application form: