There are situations in a person’s life when you need to get a new surname. After changing his last name, he needs to change his personal documents. If desired, the interested person can change his tax identification number (TIN).

The methods by which this tax document will be replaced will be discussed later in this article.

The need to replace a document

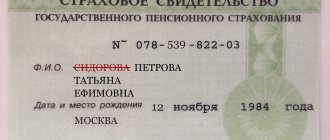

A taxpayer identification number (hereinafter referred to as TIN), which consists of 12 digits, is assigned to any citizen only once. This number is assigned to a specific person for his entire life.

The legislation of the Russian Federation does not have such a resolution where it is written that an individual who has changed his last name must necessarily change his TIN. After all, when a person receives a passport with a new last name, information about the change in personal data is immediately sent to the tax service.

Moreover, if a citizen received a new certificate for his current surname, then this action will not contradict the law.

On one's own

If an interested person wants to change his tax certificate on his own, he will need to follow the following algorithm:

- Collect a specific list of documents that will be needed to replace the tax document.

- Contact the tax office at your place of permanent registration.

- Obtain a special form from the tax inspector to obtain a new TIN.

- Fill out the form provided.

- Submit to an employee of the government organization all the documents collected in advance and the completed application.

According to the law, the applicant will be able to obtain a TIN for a new surname from the tax authority in 1 working week, counting from the day when the tax officer received all the important papers necessary for carrying out this operation.

Established procedure

Replacing the TIN when changing your last name in 2021 is carried out in several stages:

- Contact the Federal Tax Service, according to your place of registration or stay.

- Provide the employee with the required package of papers.

- The applicant will be asked to complete an application.

- Pick up a new document after receiving a notification on the tax website or come on the specified date. The date of document readiness is communicated when submitting the application. The maximum processing time is 2 weeks. As for practice, the procedure takes much less time (about 5 days).

Re-registration is very rarely denied. This may be due to the provision of insufficient papers. In this case, it is enough to convey the missing documents to the employees.

Required documents

To replace the certificate after receiving a new name, the interested person needs to collect the following list of documents:

- Your passport , which is already registered in your new name.

- A document confirming the citizen’s permanent registration in the area where the tax authority is located. This certificate of permanent residence must be given to tax inspectors if such information is not contained in the document that confirms the identity of this citizen.

- Original and copy of marriage certificate.

- Previously received certificate. After the applicant receives a certificate under a new surname, the old document will be destroyed.

A citizen will be able to go through the procedure for obtaining a new certificate completely free of charge. It is worth noting that payment of a receipt for replacing a tax certificate may only be necessary if the tax document is re-issued.

If a citizen pays an unnecessary receipt, he will not be able to get the money back.

Good reasons for changing your name, surname or patronymic

- A citizen wants to bear a premarital surname if the marriage was dissolved or if the spouse died.

- The applicant wants to have a common surname with the children if the spouse died and the surname was premarital.

- Last name, first name or patronymic sound dissonant or difficult to pronounce.

- A citizen wants to bear the surname or patronymic of the person who took part in the upbringing if the father or mother did not fulfill their duties. Or, on the contrary, he wants to take the surname of his biological parents if he was adopted and bore the surname of the adoptive parent.

This is an incomplete list of reasons on which you can change your name. But in general, everything else comes down to the above.

Through the Internet

If a citizen wants to issue this certificate for a new surname using the Internet, then the following web resources can help him in this matter:

- State services website.

- Website of the Federal Tax Service of the Russian Federation.

On the State website services

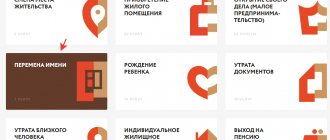

In order to replace the TIN on the Public Services portal, the applicant will need to complete the following steps:

- Go to the State Services website.

- Create your personal account on this website.

- After registration, the interested person will need to log into the created personal account.

- In the “Public Services” section that opens, you must click on the “Registration of an individual” item.

- After the “Registration of an individual” item has been selected, the citizen will need to click on the “Submit an application electronically” button.

- After completing the previous step, an application for issuing a TIN certificate in electronic form will appear on the website. This template must be completed by the applicant.

- Once all the necessary information has been entered into the form, you will need to click on the “Submit” button. And the application will be sent to the State Services website.

- Now the interested person will only need to wait for a response letter, which will indicate: the name of the state organization; the address where the citizen will need to go to receive a new tax certificate; time when the document will be issued.

- The citizen comes to the appointed place and time with his passport and receives his TIN for his new surname.

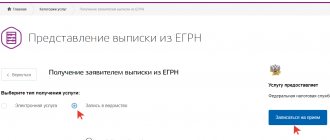

On the Federal Tax Service website

In addition to the State Services website, you can also apply for a TIN due to the fact that a citizen’s last name has changed on the official website of the Federal Tax Service of the Russian Federation.

In order to obtain a TIN on this website, a citizen will have to follow the following algorithm:

- Go to the website of this government organization.

- In the window that opens, create a personal account. In order to register, the interested person needs to enter the following personal data: his initials; your email address; password that will be used to log into the site.

- After registration, the user will need to perform the following actions: log in to his email; click on the letter that came from this Internet resource; By clicking on the link specified in the letter, the citizen will confirm the email address that was specified by him during the creation of his personal account.

- After the personal account is registered, the citizen needs to log in to this site.

- As soon as a citizen enters his personal account, he needs to go to the “Individuals” section.

- In this section, select the “Electronic Services” button.

- In the selected item, on the right side there will be a button “Submit an application for registration.”

- Clicking on this button will open an online application form that the applicant will need to fill out.

- When all the necessary data is written in the application, you will need to save your completed form by clicking on the “Save” button;

- After saving the application on this website, the citizen needs to click on the “Submit” button. If the sending occurred without technical failures, then a letter will be sent to the user’s email address, which will indicate information that his application has been sent.

- After some time, a letter from a government organization will be sent to the applicant’s email address, in which it will be written: the name of the organization; address of this unit; Time to obtain a new TIN.

In order for a citizen to receive his new tax certificate, he will need to present his passport to an employee of the tax organization.

Via post office (required documents)

Those citizens who want to send documents to receive a new TIN by mail using a registered letter will need to prepare the following list of documents:

- Application in a special form. This form can be obtained directly from the tax office. Inspectors of this government organization will show the applicant a sample of the form. In addition to the basic information on the application form, you will also need to write the number of applications that need to be listed.

- A notarized photocopy of the passport with a changed surname. The interested person will first have to take a photocopy of the passport and have it certified by a notary office.

- Certificate of permanent residence registration , if this information is not indicated in the new passport.

- Original TIN certificate.

- A notarized copy of the marriage certificate.

Application form:

How to change the last name of a company director

If the director has changed his last name, the procedure is similar. The only difference is that instead of sheet “D” you need to fill out sheet “K”:

- put “3” in line “1. Reason for entering information";

- fill out block “2. Information contained in the Unified State Register of Legal Entities” according to old passport data;

- fill out block “3. Information to be entered into the Unified State Register of Legal Entities for the new passport.

Fill out Sheet “P” using your new passport data.

After changing the surname of the director of the LLC

all corrections must be made to his work book. If the book is paper, simply cross out the old name on the first spread and write a new one. Corrections are certified by the director’s signature and seal. If the book is electronic, then make changes to the labor record through the account of the PFR policyholder.

Legal assistance in the procedure (cost and timing)

In the case where a citizen does not have the opportunity to replace the certificate of replacement of his TIN himself, he can turn to lawyers for help. Lawyers will help him resolve this issue within a few days.

The services of a lawyer in this situation include the following:

- Correctly filling out the application for a new TIN.

- Submitting a list of documents to a specific tax service for an individual.

- Obtaining a new TIN from a special tax organization. This will be possible only if the applicant issues a power of attorney to a lawyer to carry out this operation.

Legal assistance in the procedure for replacing the TIN will cost the interested citizen approximately 1 thousand rubles.

As can be seen from what is written above, issuing a TIN certificate for a new surname is not so difficult. If the interested person knows the methods and algorithm of actions in this situation, then this procedure for replacing a tax document will not take much time and effort.

What is a TIN and how to find it out

TIN is a kind of code, which is a sequence of twelve digits for individuals. persons and out of ten for legal entities. persons It is necessary in order to ensure control of taxes on a citizen’s income. You can obtain such a document from the Federal Tax Service, according to the place of registration.

At the moment, there are several types of digital codes:

- For physical faces. The code consists of twelve digits:

- the two digits in front indicate the region code;

- the next two are the Federal Tax Service number;

- the next 6 digits are considered the tax record number;

- the remaining value is a digit for input control.

- For individual entrepreneurs. Its assignment is carried out after an individual registers himself as an individual entrepreneur.

- For a legal entity.

- For a foreign legal entity.

How to find out your TIN and assigned digital code:

- Contact the Federal Tax Service.

- Use the unified portal of State Services or other online service.

The first method has a significant drawback - the need to pay a state fee. If you use the online service, you just need to enter your passport data in the fields provided for this purpose.

Interesting! In addition, any citizen of the Russian Federation can contact the Federal Tax Service to have a mark with a digital code put in their passport. Thanks to this, you don’t have to present a certificate when carrying out any transactions. This is done solely at will.

The presence of this document is necessary for official employment, for civil servants, as well as individual entrepreneurs. Also, without it you cannot purchase real estate. This number is used for any and all taxes or fees.