A registration certificate issued by the tax office is as important a document as a passport or SNILS. It is required when applying for a job, concluding contracts or obtaining loans. Replacing the TIN when changing your last name is not a mandatory process, but it is recommended to go through it, since a discrepancy between passport data and information in the document will raise unnecessary questions. Let's look at the ways in which you can change your TIN, how to apply online, and whether there is a fee for this.

Why is it needed?

TIN is a taxpayer identification number. There are millions of citizens living in our country, some of them have the same first and last names and even dates of birth. This unique digital code exists to identify a person. It is assigned to a person once for the rest of his life. Even if a citizen has not applied to the tax office to issue the original, his TIN is still in the database.

From the twelve-digit TIN code you can obtain information about where the person was registered for tax purposes, in which particular inspection. The first two digits indicate the subject of the Federation, the second two indicate the Federal Tax Service number at the place of residence. The number code does not change, even if a person moves to another region or changes his last name. The registration certificate itself is most often required during employment, so that accountants can withhold income tax from employees in favor of the budget.

Since the beginning of 2021, tax inspectorates have been issuing all originals on simple A4 sheets without using a stamp form, which have now been canceled by order of the Federal Tax Service of Russia dated September 12, 2016 No. MMV-7-14 / [email protected] Citizens should not be surprised at what they receive in their hands a document with all the details and a signature, but not on the usual yellowish form with a hologram.

First step

First, an entrepreneur needs to contact the registry office and request a certificate to change his last name. To do this, you need to go to the authority at the place of residence/registration of the individual entrepreneur. An application to change the surname is sent to the registry office. Before submitting an application, a fee is paid, and all the necessary documents are collected.

Question: An individual entrepreneur changed his last name. Is it necessary to make changes to the employment contracts concluded with its employees? View answer

Change of surname is carried out on the basis of an application. The corresponding instruction is in Government Decree No. 1274 of October 30, 1998. The application records this information:

- Basic data (full name, date of birth).

- Children under 14 years old, if any (you must indicate their full name).

- Details of documents (number, date, name of the registry office) about marriage.

- Selected last name.

- Reasons why the surname changes (personal desire, marriage).

- List of attached papers.

Question: The individual entrepreneur changed his last name. In this regard, is it necessary to conclude additional agreements to employment contracts with employees? View answer

The following documents are attached to the application:

- Birth certificate.

- Old passport.

- Marriage or divorce certificate if the surname changes due to these circumstances.

- Authorization of official representation if the surname of minors changes.

The package of documents in question, the application and the receipt for payment of the state fee must be sent to the registry office.

The application is reviewed by the registry office within 30 days. Under exceptional circumstances, it is possible to extend the period to 60 days. As a result, the person receives a certificate. Based on this, you can change your passport. It must be changed within 30 days from the date of receipt of the certificate. A passport with current data will be ready 10 days after it is ordered.

In what cases is the TIN changed?

Replacing a TIN usually occurs as a result of a change in passport data. Here are the most common cases requiring a TIN change:

- the woman got married and took her husband’s surname;

- the person has changed his name or patronymic;

- the person changed his place of birth in his passport;

- errors and inconsistencies were discovered in the current certificate.

When getting married, not only women, but also men can change their surname, so this applies to them too. The opposite situation also applies: if, during a divorce, a woman returns her maiden name, she will also need to take a new original. Those who have received a new birth certificate also change their TIN when changing their last name, for example, when establishing paternity in themselves.

How to change TIN in MFC

How to change the TIN in the MFC? You can simply contact the nearest MFC and submit an application there to change your TIN. You can also make an appointment at the MFC online. So, to register with the MFC to change your TIN after marriage, you will need:

- Go to the single MFC portal. Here, in the “Change of name” section, you can find a service for replacing the TIN in connection with a change of surname;

- Then you can make a preliminary appointment for an appointment at the MFC by logging into the e-mfc.ru portal through your State account class=»aligncenter» width=»900″ height=»663″[/img]

In this way, you can make an appointment at the MFC to replace your TIN after changing your last name.

Fine, state duty, deadlines

Replacing the TIN is not at all necessary if a person does not consider it necessary to do so. This document is not included in the list of mandatory replacements, unlike, for example, SNILS, a medical policy or an international passport. Therefore, there are no penalties for the fact that a person lately applied for a new original. You can apply for a replacement TIN either immediately after receiving a new passport or later, at least 5 years after that.

Many citizens know that re-issuance of any documents is subject to state duty. The same applies to the preparation of a secondary certificate. Only here is another reason taken into account:

- if a citizen has lost it or damaged it, the state duty is 300 rubles;

- if a TIN is issued when changing your last name - free of charge;

- if errors were found in the old original due to the fault of a Federal Tax Service employee, the state duty is also not paid.

The standard period for consideration of citizens' applications by tax inspectorates is 5 working days after the application. This means that a person will need to come again in a few days to get a new TIN. This procedure does not provide for an expedited response for double payment, unlike, for example, receiving extracts from the Unified State Register of Individual Entrepreneurs.

Registration on the portal

First of all, you need to register. To do this, enter the following data:

- Surname.

- Name.

- Mobile phone).

- Email.

All you have to do is click the registration button. A code will be sent to the specified number as an SMS message. It must be entered on the page that opens. Then click the continue button and fill out the form that opens.

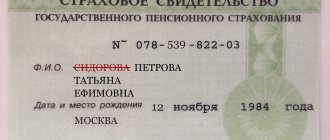

It states:

- FULL NAME.

- Floor.

- Place (as indicated in the passport) and date of birth.

- Passport data.

- SNILS number.

During the initial registration, you will need to visit the MFC and submit documents: passport, SNILS, TIN and others that the registering person has. You can find the nearest branch by searching on the State Services service. You only have to visit the branch once, and then you can fully use the services of the service.

Obtaining a Certificate

After registration, to receive a Certificate you need:

- On the main page of the service, select “Taxes and Finance”.

- Select the subsection “Tax accounting for individuals”.

- Click the receive button and fill out the application form.

Cost and terms

The service for replacing the Certificate is provided free of charge. The period for producing new documents is not regulated by law. However, when replacing through State Services, the deadline is 5 working days.

You can track the progress of obtaining a certificate in your personal account of the State Services service.

Issuance of a certificate is possible only upon a personal visit to the tax authority or by a third party with a notarized power of attorney.

If the Certificate is changed after damage or loss, you will have to pay a fee of 300 rubles.

Replacement options

Most often, taxpayers know the answer to the question of where to change the TIN. For all questions that arise, citizens are accustomed to contacting tax officials personally. What other options are there for this? Is it possible to save time and submit an application remotely? Here are the ways available to everyone:

- Go to an appointment at any Federal Tax Service, even outside your place of registration.

- Apply for a replacement TIN through any Multifunctional Center.

- Fill out an online request on the Federal Tax Service website.

Contrary to popular belief, this procedure cannot be completed on the State Services website. The service that operates on this resource only allows you to find out your exact TIN in real time. So, you can first get information about your taxpayer number from State Services, because in any case it will be useful when replacing the TIN in any other way. Let's look at them.

Personal reception

Many people work in other cities other than their place of registration, so they are interested in whether it is possible to contact someone else’s inspectorate to obtain a TIN? You can get a new certificate from the beginning of 2021 at any Federal Tax Service agency in accordance with Federal Law No. 243-FZ dated July 3, 2016, which amended Art. 83 Tax Code of the Russian Federation. This does not require any special conditions; the citizen will be accepted in any case with the same package of documents that was presented above. It is also possible to send your application by mail or send an official representative.

Is it possible to change the TIN through State Services?

Is it possible to change the TIN through State Services?

? On the State Services portal, you can only make an appointment with the tax office (FTS), where you can submit an application and replace the TIN after marriage, or due to its loss/damage.

Where else can you change your TIN when changing your last name? It can be done:

- At the tax office at your place of residence (personal appeal);

- On the tax service website - more on this later in the article;

- In the multifunctional center (MFC) - moreover, by contacting the MFC, you can easily change your TIN and SNILS after changing your last name upon marriage.

Step-by-step instructions for changing your TIN

- On the main page of the Federal Tax Service website you need to select the section for individuals.

- From the section of popular queries “I am interested”, select the “TIN” link.

- At the bottom of the page, after general information about the taxpayer number, there is “Life Situations”, where there are links to the most common queries.

- Select the request “I want to register (get a TIN).” If the applicant chooses another link to re-issue the document, he will have to pay a fee, which is not suitable in case of a change of surname.

- Go to the electronic service “Submission of an individual’s application for registration.”

- Fill out the form, select the place where the certificate is issued, send a request.

- Receive a TIN within the specified period by visiting the inspection in person.

The advantage of working with the service is that you will not need to collect a package of documents. If a citizen does not have free time to pick up the completed certificate from the inspection, it is better for him to send the application by registered mail with notification. In this case, the inspection will send a response to the sender's postal address. The letter will contain the original certificate.

As a result, it turns out that anyone can find a suitable way for themselves to change their TIN when changing their last name, even in the absence of free time or Internet access. A document with updated information will be issued free of charge, and no one will fine a citizen if he does not replace the certificate on time.

4 / 5 ( 12 votes)

Legislation

In order to understand this discrepancy, let us clarify the information about the concepts themselves:

- TIN is a taxpayer number that is assigned once and remains unchanged for the rest of your life.

- A certificate is a document reflecting information about the ownership of the TIN (number) to a specific person.

Accordingly, when changing the surname, the citizen needs to replace the certificate in which the surname is indicated, but the number itself will remain the same. Therefore, when faced with information about replacing the TIN, you need to understand that what is meant is not the number, but the document attributing it to this person.

As stated in paragraph 1 of Article 83 of the Tax Code (Tax Code) of Russia, all individuals must be registered with the tax authority at their place of residence. The registration procedure is controlled by an appendix to the Order of the Ministry of Finance dated November 5, 2009 No.-114n. In accordance with paragraphs 36 and 37 of this document, when the surname is changed, the old certificate becomes invalid and requires replacement.

Methods for obtaining a document

There are several ways to create a certificate with an individual number:

- When contacting the territorial office of the Federal Tax Service. To do this, you can make a preliminary appointment for an appointment through the online service on the State Services portal. If you submit an application on the website, you can receive a completed document in one visit to the tax office.

- Contact the territorial multifunctional office. You can register a TIN at the MFC either personally or through an authorized representative.

- Send the required package of documents to the Federal Tax Service by mail on a territorial basis. The letter should be issued by registered mail with notification of receipt and a list of attachments. The completed document will be sent to the applicant’s postal address. In this case, the certificate can be obtained without a personal visit to the tax office.

Significantly simplifies the procedure for obtaining details if you order a TIN through the MFC. In this case, the individual has the following advantages:

- widespread location of offices and the ability to contact a nearby one;

- convenient work schedule of the centers;

- absence of long queues as a result of process optimization and one-stop service;

- the ability to pre-register at a convenient time;

- preliminary consultation with a center employee;

- checking prepared documentation before submitting it.

- providing information about the readiness of the document.

Registration of a TIN at the MFC has an undeniable advantage compared to other methods - it is the qualified assistance of the center’s employees, which, as a result, avoids many mistakes when filling out an application and saves the client’s personal time.

Is it possible to change the individual taxpayer number through the website?

You can order and receive a TIN through the State Services portal. In addition, the site provides the opportunity to restore a lost or damaged document.

Every user of the State Services website should know about some rules:

- If there has been a change of name, the document itself needs to be replaced, not the number.

- Only those users who have registered on this Internet resource and confirmed their account can change their TIN using the State Services service.

- If site users have an electronic signature, then they can receive a TIN in electronic form. The second option is that a paper version of the TIN can be sent by mail to the recipient’s address.

- If there is no electronic signature, then to obtain a paper TIN you will need to visit the tax office in person.

Obtaining an extract from the Unified State Register of Individual Entrepreneurs (USRIP)

An entrepreneur does not need to contact an individual entrepreneur to change information. The passport office itself will send all the necessary information on the basis of which changes are made. An entrepreneur can receive an extract from the Unified State Register of Entrepreneurs about the change of data. Providing an extract is a free service. The document will be ready within 5 days.

Sometimes information in the Unified State Register of Individual Entrepreneurs does not change in a timely manner. The entrepreneur can speed up the procedure. To do this, you need to send a corresponding application formed according to form P24001. The application is sent to the tax office. This can be done either in person or by mail. There is no need to pay a fee.