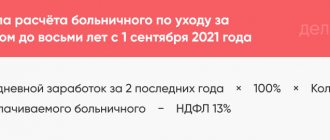

From September 1, 2021, it will be possible to receive 100% of average earnings for sick leave to care for a child. But this will not affect all working parents, but only those who have children under eight years old.

We talked about the new rules for calculating sick leave so that you can quickly understand how much you will receive from the state. Remind your accountant of the new rules.

If you don’t have time to read the entire material, go to the “Briefly” block - there is the main thing about changes in sick pay from September 1, 2021.

What does sick leave pay look like now?

The state will pay 100% of average earnings to workers who have children under eight years of age. The new rules are enshrined in Law No. 151-FZ dated May 26, 2021. In this case, the employee’s length of service and method of treatment will not be taken into account.

Tatyana Petukhova, accountant

From September 1, an employee who has worked for five years and an employee who has only a year of experience will receive the same payment. There is also no need to confirm work experience if the young parent has switched to an electronic work record book. In addition, the amount of sick leave for caring for a child under eight years of age is not affected by how the treatment took place - outpatient or inpatient.

To receive the payment, the employee does not need to fill out additional documents—the information on the certificate of incapacity for work is sufficient. Let us remind you that from January 1, 2021, sick leave is paid directly from the Social Insurance Fund, so the expenses of business owners will not increase from September 1.

An employer can provide incentive payments for its employees in local regulations that apply at the enterprise. However, in practice such stories are extremely rare.

Important. For working parents with children over eight years old, the rules will remain the same. The basis is Article 7 of the Law of December 29, 2006 No. 255-FZ.

To calculate the amount of sick leave for caring for a child under eight years old from September 1, 2021, use the step-by-step algorithm.

Calculation period for sick leave after maternity leave

According to paragraph 1 of Art. 14 of Law No. 255-FZ, periods for calculating sick leave can be replaced if the employee had no income during the calculation period due to maternity leave or child care leave. Social Insurance, in a letter dated November 30, 2015 No. 02-09-11/15-23247, explained that it is possible to replace the years for calculation only with the years immediately preceding maternity leave.

It should be borne in mind that this procedure for calculating sick leave is not the responsibility of the employer, but the right of the insured person. Therefore, it is important to receive a statement from the employee, which will indicate his will and an indication of those years that will relate to the new billing period. As a result, sick leave benefits in the current period should increase, otherwise this calculation procedure cannot be used.

The Social Insurance Fund also indicates the right to choose the year that was not fully worked (this could be the year of leaving maternity leave or the year in which maternity leave began). Non-consecutive years can also be used as a calculation period if, for example, the employee worked during the year between 2 maternity leave.

Example

The employee was on maternity leave from March 2021 to November 2020, after which she returned to work. In May 2021 she goes on sick leave. For previous years her income was as follows:

- 2016 - 115,000 rubles. (full year worked);

- 2017 - 379,000 rubles. (full year worked);

- 2018 (from January to March - 55 days) - 84,000 rubles;

- 2019 - no income;

- 2020 (after leaving maternity leave - 42 days) - 34,000 rubles.

Let’s compare the employee’s earnings for the years prior to going on maternity leave, combining them in different combinations.

| Period | Calculation of average earnings | Average earnings amount |

| 2016 and 2021 | (115 000 + 379 000) / 730 | RUB 676.71 |

| 2017 and 2021 | (379 000 + 84 000) / (365 + 55) | RUB 1,102.38 |

| 2019 and 2021 | (0 + 34 000) / (0 + 42) | RUR 809.52 |

| 2018 and 2021 | (84 000 + 34 000) / (55 + 42) | RUB 1,216.49 |

Having found out that the highest average earnings would be received if 2021 and 2021 were used as the calculation period, the employee wrote a statement indicating this particular period.

To learn about the nuances when calculating average earnings, read the article “Average daily earnings for calculating sick leave .

Find out how to determine the billing period after parental leave in the Typical Situation from ConsultantPlus. Get trial access to the system and proceed to the calculation example for free.

Example. Sick leave to care for a three-year-old child

Anna has a son who is three years old. He fell ill with the flu, and Anna took sick leave to care for her son.

The duration of sick leave for a certificate of incapacity for work is 10 days. This is Anna's first sick leave this year.

Anna’s average daily earnings over the past two years are 2,145 rubles. Experience: eight years. Anna treated her son at home.

Since Anna’s son is three years old, from September 1, 2021, when calculating the mother’s sick leave, the mother’s length of stay and the method of treatment are not taken into account. Also, all sick days are paid equally if they do not exceed the limit.

Anna will receive from the state 2,145 x 100% x 10 - personal income tax 13% = 21,450 - 6,435 = 15,015 rubles.

How is sick leave calculated and paid after maternity leave?

According to the standards for paying sick leave, the average earnings for the previous 2 years are used. But young mothers who have recently returned from maternity leave may have no income during these periods. As stated above, the period can be replaced. But if for some reason replacement is impossible or earnings are below the minimum wage, or even non-existent, then payment must be made according to the minimum wage.

Check the current minimum wage in this material.

There are situations when, of all the possible periods that can be used to calculate before maternity leave, the employee only had income in one year. In this case, the average earnings indicator will still be calculated by dividing the amount of wages for one year worked by 730. And if the result turns out to be less than the average earnings calculated using the minimum wage, then the benefit will have to be paid based on the average earnings calculated using the minimum wage .

The legislation does not provide for the replacement of one year with zero earnings with payment according to the minimum wage.

Example

An employee got her first job in 2021 immediately after graduating from college. For 2021, her earnings amounted to 376,000 rubles. The employee worked for a full year and was not sick. On January 21, 2021, she went on maternity leave, after which she wrote an application for leave to care for a child up to 3 years old. In March 2021, the employee returned to work, ending her vacation early. But in July 2021, she was forced to go on sick leave. Since there was no income in 2021 and 2021 due to maternity leave, 2021 and 2021 can be taken as the calculation period. In this case, the average earnings will be:

(0 + 376,000) / (365 + 21) = 974.09 rubles.

It is necessary to compare this earnings with the minimum wage, which from 01/01/2021 is 12,792 rubles:

12,792 × 24 / 730 = 420.56 rubles.

Obviously, in the first case, the average earnings calculated from real income turn out to be significantly higher. It will be used to calculate temporary disability benefits, but taking into account the employee’s insurance experience.

If the employee does not exercise the right to postpone the calculation period at the time of accrual of benefits, then she can apply for recalculation later by writing an application.

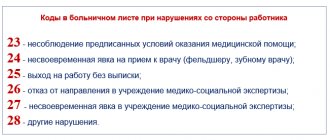

Errors when calculating sick leave

Let's consider situations related to errors in calculating payment for sick leave:

- The accountant made a mistake in the calculations and the employee received less credit. This is one of the less difficult mistakes to make. If the error is noticed on time, you simply need to accrue additional sick leave and pay the employee;

- The accountant made a mistake and the employee was paid more. In this case, you need to contact the employee and obtain consent to return the overpaid amount. If the employee agrees to do this, then you can either withhold this amount from his salary (but no more than 20% of one salary), or invite the employee to return the excess amount in cash to the cashier. If the employee refuses to return this amount, then the person responsible for the erroneous calculation is punished;

- Errors are often found on certificates of incapacity for work. In this case, you need to ask the medical institution that issued this sheet to issue a new one.

Other types of "children's" benefits

In addition to sick leave, maternity leave and child care benefits, the employee is entitled to so-called “children’s” benefits. They are provided for by Federal Law No. 81-FZ dated May 19, 1995. This is a benefit for registration in the early stages of pregnancy and a one-time benefit for the birth of a child.

The benefit for early registration is paid on the basis of a certificate issued by a doctor. Such certificates are issued to women who register before 12 weeks of pregnancy.

Until July 1, 2021, this benefit was paid one-time by the FSS. The amount was fixed, and from February 1, 2021 it was 708.23 rubles.

Starting from July 1, 2021, benefits for registration in the early stages of pregnancy are paid by the Pension Fund at the request of the employee. The benefit became monthly. Its value is equal to 50% of the regional subsistence level for the working population in a constituent entity of the Russian Federation. From January 1, the benefit amount is subject to recalculation. The payment period is from the month of registration with a medical organization (but not earlier than six weeks of pregnancy), until the month of childbirth or termination of pregnancy.

The benefit is not always due, but only if the following conditions are simultaneously met:

- the pregnancy is six weeks or more, and the woman registered with a medical organization before twelve weeks of pregnancy;

- the size of the average per capita family income does not exceed the subsistence minimum per capita in the constituent entity of the Russian Federation on the date of application for the benefit (see “Benefits for registration in the early stages of pregnancy will be paid according to the new rules”).

The size of the lump sum benefit for the birth of a child is a fixed amount that does not depend on the employee’s length of service or earnings. It is indexed annually. To calculate the benefit for the current calendar year, you need to take last year’s value and multiply by the coefficient approved by the Social Insurance Fund for the current year (read more about this in the article “How to calculate “child benefits” in 2015: new amounts and “transitional” situations”) .

From February 2021, the amount of the benefit for the birth of a child is 18,886.32 rubles.

These types of benefits are not subject to income tax or insurance premiums.

Switch to direct payments

Since 2021, all regions of the Russian Federation have switched to direct payments of social benefits from the Social Insurance Fund. This means that the employer only pays for the first three days of the period of incapacity. Payment for the remaining days is transferred by the Social Fund directly to the sick person. The employer provides the Fund with information for assigning payment for a certificate of incapacity for work, including which years are taken to calculate sick leave if the employee was on maternity leave, and about replacing the calculation period. The procedure for calculating the payment amount has not changed, but the employee now receives it in two tranches:

- for the first three days - from the employer;

- for the remaining days - from the FSS.

Learn more about direct payments

Read more about filling out sick leave during the pilot project

Rules of law

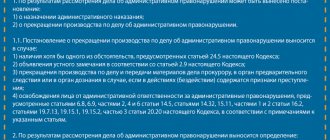

In order to receive the payment required by law, the procedure must be coordinated with the current legislation - the Labor Code and federal legislative acts:

- No. 255-FZ, adopted on December 29, 2006 (regulates the procedure for applying compulsory insurance when calculating benefits for disability (illness or care);

- The procedure for issuing sick leave approved by the Ministry of Health and Social Development in 2011;

- By Order of the Ministry of Health and Social Development No. 347 of June 29, 2011. (acceptance of the form for sick leave).

The above documents establish the basic provisions for how they receive, transfer and accrue in the event of going on sick leave to care for a child, including cases with the calculation of the amount due after maternity leave.

Registration procedure

The woman herself does not take part in the registration of sick leave - this is done by the doctor. It is important to check that the document is fully completed before submitting it to the accounting department: the document must bear the seal of the medical institution where the treatment was provided, and the records must be endorsed by the doctor’s signature.

- Reduction during maternity leave: when it is possible and not

After the sick leave is closed, the employee goes to work and hands over a form for processing accruals. Often, doctors' notes are illegible and it is difficult to understand the diagnosis indicated on the sick leave. Meanwhile, complaints about a doctor’s handwriting are not grounds for refusal of compensation due to complaints about the execution of the form. Notes on sick leave are made with a gel or fountain pen. Typewritten filling is allowed. Other requirements for the document are established in the provisions of Order No. 347, issued by the Ministry of Health and Social Development in 2011.