There are situations in a person’s life when you need to get a new surname. After changing his last name, he needs to change his personal documents. If desired, the interested person can change his tax identification number (TIN).

The methods by which this tax document will be replaced will be discussed later in this article.

The need to replace a document

A taxpayer identification number (hereinafter referred to as TIN), which consists of 12 digits, is assigned to any citizen only once. This number is assigned to a specific person for his entire life.

The legislation of the Russian Federation does not have such a resolution where it is written that an individual who has changed his last name must necessarily change his TIN. After all, when a person receives a passport with a new last name, information about the change in personal data is immediately sent to the tax service.

Moreover, if a citizen received a new certificate for his current surname, then this action will not contradict the law.

Is it necessary to change the TIN due to a change of surname after marriage?

The registry office notifies the tax service about a change in the last name or first name, and the tax service changes the data in the archive, which means that the identification number data is consistent with the applicant’s last name according to the latest information.

The Tax Service does not oblige the owner of the TIN to receive a paper version of the document. But after your last name has changed, you will have to present your TIN every time you apply for a job, and you will constantly have to wait for checks from the employer and answer a whole bunch of additional questions. To avoid all this, it is still better to change the TIN. This is not such a complicated operation, especially free of charge.

TIN exchange deadlines

The law does not establish a time frame within which the certificate must be changed. Accordingly, there are no late fees. Obtaining a new document is in the interests of the taxpayer himself.

Video: in what cases it is necessary to replace the TIN certificate

On one's own

If an interested person wants to change his tax certificate on his own, he will need to follow the following algorithm:

- Collect a specific list of documents that will be needed to replace the tax document.

- Contact the tax office at your place of permanent registration.

- Obtain a special form from the tax inspector to obtain a new TIN.

- Fill out the form provided.

- Submit to an employee of the government organization all the documents collected in advance and the completed application.

According to the law, the applicant will be able to obtain a TIN for a new surname from the tax authority in 1 working week, counting from the day when the tax officer received all the important papers necessary for carrying out this operation.

What information about the entrepreneur may change

Most often, an individual entrepreneur changes his last name, usually as a result of marriage. But in addition to the surname, the name or patronymic of the entrepreneur can be changed. The procedure for changing any part of your full name will be the same.

In addition, an individual entrepreneur often changes his registration, but this fact does not always affect the need to change business documents. The same applies to adding or deleting OKVED codes - in this case, there is usually no need to change anything. As for the main registration codes (TIN or OGRN/OGRNIP), they do not change at all during business activities.

So, it is the change of the surname of an individual entrepreneur that entails the obligation to make changes to his documents, as well as to inform interested parties about this.

Submit reports online

Required documents

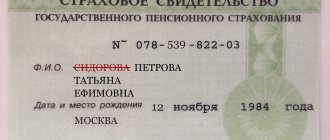

To replace the certificate after receiving a new name, the interested person needs to collect the following list of documents:

- Your passport , which is already registered in your new name.

- A document confirming the citizen’s permanent registration in the area where the tax authority is located. This certificate of permanent residence must be given to tax inspectors if such information is not contained in the document that confirms the identity of this citizen.

- Original and copy of marriage certificate.

- Previously received certificate. After the applicant receives a certificate under a new surname, the old document will be destroyed.

A citizen will be able to go through the procedure for obtaining a new certificate completely free of charge. It is worth noting that payment of a receipt for replacing a tax certificate may only be necessary if the tax document is re-issued.

If a citizen pays an unnecessary receipt, he will not be able to get the money back.

Conclusion

- The Taxpayer Identification Number (TIN) is assigned to everyone and is necessary to control the execution of tax payments.

- Changing the TIN is necessary in case of a change of name, loss or damage to the certificate. It implies a change of document, not a number.

- Submitting an application is possible by independently visiting the tax structure, the MFC, as well as through the State Services portal.

- You need to log into your personal account with a verified account, write an application and attach supporting documents (passport, copy of marriage certificate). Wait about five days for a response.

- Replacing a certificate as a result of loss or damage requires payment of a state fee.

Sources

- https://GosGo.ru/zamena-inn-cherez-gosuslugi-kak-izmenit-ili-pomenyat-cherez-sajt/

- https://intless.ru/startup/nalogi/zamena-inn-pri-smene-familii.html

- https://zakonguru.com/semejnoje/smena-familii/zamena-inn-gosuslugi.html

- https://gosuslugi-site.ru/zamena-inn-pri-smene-familii/

- https://prezident.org/info/kak-cherez-gosuslugi-pomenjat-inn-pri-smene-familii-11-10-2020.html

- https://gosuslugid.ru/pomenyat-inn-pri-smene-familii-cherez-gosuslugi

- https://mfc-list.info/zamena-inn-pri-smene-familii-gosuslugi.html

- https://InfoGosuslugi.ru/portal-gosuslugi/nalogi-i-finansy/zamena-inn-pri-smene-familii-cerez-gosuslugi.html

- https://gosuslugigid.ru/finansy/smena-inn.html

- https://gosuslugi-official.help/zamena-dokumentov/inn.html

- https://urist.club/administrative/oformlenie-dokumentov/inn/pomenyat-fiz-litsa.html

Through the Internet

If a citizen wants to issue this certificate for a new surname using the Internet, then the following web resources can help him in this matter:

- State services website.

- Website of the Federal Tax Service of the Russian Federation.

On the State website services

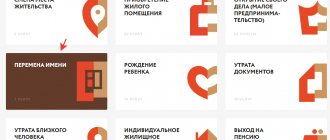

In order to replace the TIN on the Public Services portal, the applicant will need to complete the following steps:

- Go to the State Services website.

- Create your personal account on this website.

- After registration, the interested person will need to log into the created personal account.

- In the “Public Services” section that opens, you must click on the “Registration of an individual” item.

- After the “Registration of an individual” item has been selected, the citizen will need to click on the “Submit an application electronically” button.

- After completing the previous step, an application for issuing a TIN certificate in electronic form will appear on the website. This template must be completed by the applicant.

- Once all the necessary information has been entered into the form, you will need to click on the “Submit” button. And the application will be sent to the State Services website.

- Now the interested person will only need to wait for a response letter, which will indicate: the name of the state organization; the address where the citizen will need to go to receive a new tax certificate; time when the document will be issued.

- The citizen comes to the appointed place and time with his passport and receives his TIN for his new surname.

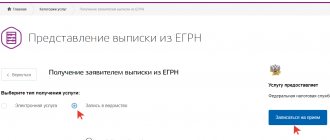

On the Federal Tax Service website

In addition to the State Services website, you can also apply for a TIN due to the fact that a citizen’s last name has changed on the official website of the Federal Tax Service of the Russian Federation.

In order to obtain a TIN on this website, a citizen will have to follow the following algorithm:

- Go to the website of this government organization.

- In the window that opens, create a personal account. In order to register, the interested person needs to enter the following personal data: his initials; your email address; password that will be used to log into the site.

- After registration, the user will need to perform the following actions: log in to his email; click on the letter that came from this Internet resource; By clicking on the link specified in the letter, the citizen will confirm the email address that was specified by him during the creation of his personal account.

- After the personal account is registered, the citizen needs to log in to this site.

- As soon as a citizen enters his personal account, he needs to go to the “Individuals” section.

- In this section, select the “Electronic Services” button.

- In the selected item, on the right side there will be a button “Submit an application for registration.”

- Clicking on this button will open an online application form that the applicant will need to fill out.

- When all the necessary data is written in the application, you will need to save your completed form by clicking on the “Save” button;

- After saving the application on this website, the citizen needs to click on the “Submit” button. If the sending occurred without technical failures, then a letter will be sent to the user’s email address, which will indicate information that his application has been sent.

- After some time, a letter from a government organization will be sent to the applicant’s email address, in which it will be written: the name of the organization; address of this unit; Time to obtain a new TIN.

In order for a citizen to receive his new tax certificate, he will need to present his passport to an employee of the tax organization.

Reasons for refusal

Let's summarize the question of whether it is necessary to change the TIN when changing your last name. There are no official reasons for this. But even without a code containing a real name, it is not possible to resolve serious issues. Therefore, citizens sometimes take the initiative by contacting the relevant structures to change their certificate. There should be no reason for refusing to issue the required certificate, but sometimes some misunderstandings arise in the form of:

- Providing false documents.

- An illegibly written statement.

- Copies not certified by a notary.

- Incomplete package of documents.

- Illiterate filling.

If, after resolving these problems, the issue remains open, then the applicant has the right to insist on a written refusal indicating the name of the person responsible, in order to be able to appeal this decision.

Via post office (required documents)

Those citizens who want to send documents to receive a new TIN by mail using a registered letter will need to prepare the following list of documents:

- Application in a special form. This form can be obtained directly from the tax office. Inspectors of this government organization will show the applicant a sample of the form. In addition to the basic information on the application form, you will also need to write the number of applications that need to be listed.

- A notarized photocopy of the passport with a changed surname. The interested person will first have to take a photocopy of the passport and have it certified by a notary office.

- Certificate of permanent residence registration , if this information is not indicated in the new passport.

- Original TIN certificate.

- A notarized copy of the marriage certificate.

Application form:

How can you change your TIN if you are not at your place of registration?

Replacing the TIN certificate form in person is only possible at the place of registration. If an individual is in another city and does not have the opportunity to personally come to the tax authority, then a new form can be issued by mail.

To do this, you must send an application in the prescribed form by registered mail with acknowledgment of receipt and attach to it a notarized copy of your passport, a copy of the document confirming registration and a receipt for payment of the fee (only if the TIN is issued due to damage or loss of the old one).

After receiving the letter by the tax authority, a completed duplicate of the TIN certificate is also sent to the individual by registered mail with acknowledgment of receipt.

If an individual has his own legal representative, who has the opportunity to contact the tax service (at the place of registration of the individual), then he can submit all the necessary documents in his place. A representative of an individual also has the right to pick up a new TIN certificate.

To do this, the legal representative must contact the tax office with a written application for registration, a document confirming registration and a passport of the individual being registered.

The legal representative must have a document with him that confirms his authority.

Legal assistance in the procedure (cost and timing)

In the case where a citizen does not have the opportunity to replace the certificate of replacement of his TIN himself, he can turn to lawyers for help. Lawyers will help him resolve this issue within a few days.

The services of a lawyer in this situation include the following:

- Correctly filling out the application for a new TIN.

- Submitting a list of documents to a specific tax service for an individual.

- Obtaining a new TIN from a special tax organization. This will be possible only if the applicant issues a power of attorney to a lawyer to carry out this operation.

Legal assistance in the procedure for replacing the TIN will cost the interested citizen approximately 1 thousand rubles.

As can be seen from what is written above, issuing a TIN certificate for a new surname is not so difficult. If the interested person knows the methods and algorithm of actions in this situation, then this procedure for replacing a tax document will not take much time and effort.

How to write an application?

The application form for changing the TIN Certificate consists of 3 sheets.

applications can be found here.

366.54 Kb

The speed of obtaining a new Certificate depends on the correct completion of the form for obtaining a TIN. When filling out you must adhere to certain rules:

- Filling should be done with a ballpoint pen with black or blue ink;

- write dates in numbers;

- write the text in capital block letters, starting from the first square;

- enter the applicant's initials at the top of each page;

- Place your personal signature in the lower corner of the form;

- blots, corrections, damage to sheets (even with a stapler) are unacceptable;

- Each of the three sheets of the application is printed separately.

The sheets of the form are filled out as follows (an example of a completed application can be found

on the first sheet.

Initials should be written in full, and not abbreviated, in strict accordance with the entries in the passport. The code of the tax office where the application is being written will be provided by its employees. It is necessary to indicate the number of copies of the attached documents and their accuracy. Blank fields of the form must be completed by the inspection staff themselves.

Second sheet.

Passport details are entered and the applicant’s place of residence is indicated. The previous surname must be indicated in a special line of the form. If a passport is presented, code 21 is indicated in the corresponding field. In the field where you need to enter the country code, for the Russian Federation, 643 is written.

Third sheet.

On this sheet of the form, registration information is indicated according to the documents that confirm it. This is a mandatory item for stateless persons, non-residents and Russian citizens who do not provide their passport. It is necessary to indicate the actual place of residence or stay.

basic information

Changing the surname of an individual entrepreneur is practically no different from changing the surname of a sole proprietor. The only difference is the need to change not only “physical” but also “legal” documents. Changes must also be entered into the Unified State Register of Individual Entrepreneurs. The entrepreneur will need to change the OGRNIP certificate. The procedure for changing an individual entrepreneur's surname is regulated by Federal Law No. 143 “On Acts of Civil Status” dated November 15, 1997.

Is it necessary to submit a SZV-TD in relation to hired workers if the individual entrepreneur has changed his last name?

The surname changes in several stages. The entrepreneur will have to send relevant applications to various authorities. And this must be done within a certain time frame. It is not enough for an entrepreneur to simply change his passport. If the information in business documents does not correspond to reality, the individual entrepreneur will not be able to carry out activities.

FOR YOUR INFORMATION! If an individual changes his last name, he only needs to change his passport and civil papers. If an individual entrepreneur changes his last name, he needs to change all papers related to entrepreneurial work.

Sending notifications to partners

The first step is to send the changed information to the servicing bank. The client's current account will remain the same, but the name of the individual entrepreneur will be updated. A notification must be sent to the bank before the next payment from the counterparty so that the money goes through the correct details.

It is also recommended to contact counterparties. Free-form letters are sent to partners. They must indicate that the details of the individual entrepreneur, and in particular the last name, have changed.

If the entrepreneur has a seal, it also changes. This is due to the fact that the surname of the individual entrepreneur usually appears in it. If you do not update anything, the seal will no longer be relevant.

An entrepreneur may have loans. In this case, you need to contact the credit institution.