Reasons for replacing a passport after a last name change

There are circumstances when it is necessary to change the name and documents, and sometimes a citizen is simply given such an opportunity, but the final decision remains with the employees of the competent authority.

| Mandatory grounds |

|

| Optional grounds (may be regarded by employees of the competent authority as sufficient/weighty) | The law does not formulate a clear list, however, based on the practice of registry offices, these include:

|

The table above lists the actual grounds for issuing a new passport. But in order for the competent authority to “believe” you that there really are grounds, you must provide a supporting document.

For different cases these will be different documents:

- in case of marriage – marriage certificate;

- in case of divorce - divorce certificate;

- in case of adoption - a certificate or certificate of adoption issued by the registry office;

- if the change is caused not by registration/divorce/adoption, but by personal desire - a certificate from the registry office of a change of surname.

On one's own

If an interested person wants to change his tax certificate on his own, he will need to follow the following algorithm:

- Collect a specific list of documents that will be needed to replace the tax document.

- Contact the tax office at your place of permanent registration.

- Obtain a special form from the tax inspector to obtain a new TIN.

- Fill out the form provided.

- Submit to an employee of the government organization all the documents collected in advance and the completed application.

According to the law, the applicant will be able to obtain a TIN for a new surname from the tax authority in 1 working week, counting from the day when the tax officer received all the important papers necessary for carrying out this operation.

Where to contact

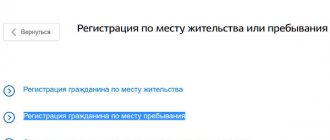

There are several options where you can apply for a passport in connection with a last name change:

- the nearest territorial body of the Ministry of Internal Affairs (formerly the FMS) - now continue to operate in the same buildings where the FMS used to be located;

- MFC at your registered address;

- State Services website.

In the latter case, you will not submit all documents online, but only the completed Form of the established form and scanned photos. After a decision has been made on your issue, a notification will be sent to your email address stating that you need to come with a complete package and a receipt for payment of the state duty to the territorial body of the Ministry of Internal Affairs.

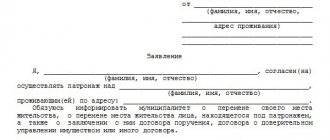

If you cannot appear in person, then you have the opportunity to use the services of a legal representative who will do everything for you. Usually his role is performed by a lawyer, with whom the corresponding agreement is concluded.

If you changed your last name, do you need to change your license?

Yes. This is required by law. Thus, Government Decree No. 1097 says the following:

35. A Russian national or international driver's license is considered invalid and subject to cancellation in the following cases:

- ….

- b) if the personal data of its owner contained in the driver’s license has changed;

Thus, if the surname is changed, the driver’s license becomes invalid, and it is necessary to change it - regardless of whether it happened after marriage, at the request of the owner of the license, or for other reasons.

Deadlines for passport replacement

The government in the “Regulations on the Passport of a Citizen of the Russian Federation” established an obligation - with a change of surname (for any reason) to exchange the passport for one in which the correct personal data will be entered. It must be completed within 30 days from the date of “acquisition” of a new surname .

So, for girls who have changed to their husband’s surname, 30 days are counted from the wedding day, and for those who decided to “change their name” of their own free will, from the day indicated in the certificate of change of surname.

The deadlines for issuing a passport are also regulated, and they depend on through which authority you decide to issue a new identification document:

- if through the Ministry of Internal Affairs, then the period is:

- 10 days – for those who applied to the authority at the place of registration;

- 2 months – at the place of application (but you will have to prove the impossibility of submitting an application at the place of registration).

- if through MFC:

- 10 days – at the place of registration;

- 30 days - in any other Multifunctional Center.

- the period for providing the service through the State Services website is 10 days

Where to change TIN

Contact one of the authorities:

- in the tax service;

- in the Multifunctional Center;

- through the State Services portal;

- through your personal account on the Federal Tax Service website (relevant if the document is needed urgently).

General procedure for replacing TIN:

- Submitting an application.

- Providing original documents.

- Obtaining a new certificate.

You can pick up a new certificate:

- in person, by arriving at the Federal Tax Service office;

- by sending a representative by proxy.

Public services

Figure 3. Main page of the State Services portal

Replacing a tax certificate through the state portal requires the existence of a created account. If it is not available, you must go through the registration procedure.

Procedure

To send a request to change a certificate, you must complete the following procedure:

- Through the search bar or on the main page of the site, find the “Taxes and Finance” section.

- In the window that appears, select .

- Proceed according to further instructions on the site.

Figure 4. Section “Services and Finance” on the state portal

Note : Only a request to replace a certificate is sent through the state portal. To receive the completed document, you must personally visit the Federal Tax Service on the appointed date. But if you have an electronic signature, you can order an electronic version of the document.

Documentation

When registering on the portal, the user specifies the details of all necessary documents. Therefore, to obtain a completed certificate, you only need a passport with a new name and the previous TIN.

Payment of state duty is not required.

MFC

You can change your tax certificate in Multifunctional.

The difference from the Federal Tax Service is that the MFC does not independently issue a certificate. The center's employees send the information to the tax authority, and then receive a ready-made document for its subsequent issuance to the citizen.

Procedure

To replace a certificate at the MFC you need:

- Collect the necessary package of documents.

- Contact the Multifunctional Center.

- Write an application on the provided form.

- Receive the completed document on the due date. The maximum production time is the same as when applying to the Federal Tax Service - 5 working days.

Documentation

Table 1. List of documents for replacing the TIN certificate

| View | Note |

| Basic documents | |

| Identity card with registration or temporary registration | Original and photocopy are provided. Important: the passport must be new, with the last name already changed |

| Previous TIN | MFC employees confiscate the original document for disposal. A new certificate is issued in exchange |

| Additional (used in exceptional cases) | |

| Power of attorney | It is necessary if another citizen will receive a ready-made TIN for the taxpayer. The power of attorney must be notarized |

| Certificate of residence | Provided if a citizen lives without registration, and there is no note in the passport indicating the place of registration |

Note : If the completed certificate will be received by an authorized person, he must have with him not only the specified list of documents, but also his own passport confirming his identity.

Federal Tax Service

Changing a tax document with the Federal Tax Service is not difficult. The civil service allows the taxpayer to independently choose the method of filing an application that is convenient for him:

- Personally. By visiting the tax office.

- By post. The written application is sent by registered mail.

- Remotely. Through the Federal Tax Service website.

At the same time, you can receive a completed certificate in both paper and electronic versions.

Procedure

The procedure depends on:

- the chosen application method;

- availability of an electronic digital signature from a citizen.

To submit an application in person you must:

- Collect a package of documents.

- Visit the tax office.

- To write an application. The form will be issued by the institution's staff.

- Receive a completed certificate in a few days (maximum period – 5 working days).

To send by mail, citizen:

- Fills out an application on Form No. 2-2-Accounting independently. It is necessary to additionally indicate the method of obtaining a new TIN: in person or by mail.

- Makes photocopies of documents (identity card, TIN). A copy of the passport must be notarized.

- Sent by registered mail to the address of the tax service.

It is important to take into account that the five-day period for preparing the document begins not from the moment the letter is sent, but after it is received and accepted by tax officials.

.

You can change your TIN online on the tax office website in one of two ways:

- Without using an electronic signature.

- Using digital signature.

The first method is the most common. In order to use it, you need:

- Log in to your personal account. If you don't have an account, register. This can be done using a registration card, to obtain which you need to contact the Federal Tax Service at your place of residence. The second way: go to the site through the State Services portal. For this purpose, the tax office website has a special button “Login/registration using a public services portal account.” But this option is only available if you have a verified account.

- Find using the search bar “Submission of an individual’s application for registration.” A form for the initial receipt of a TIN will open. It is important to choose this particular service.

Figure 5. Service page for supplies for tax registration on the Federal Tax Service website

- Fill out the application fields.

- On the specified date, personally visit the Federal Tax Service with original documents to obtain a certificate.

Note : You should not use the page on which you order the re-issuance of a TIN. This service is subject to a state fee, unlike changing the surname on a document.

The second method is more convenient and faster. When using it, you can receive a free electronic version of the certificate. However, you do not need to visit a government agency.

Procedure:

- The user must have an electronic signature. You can obtain it from a Certification Center accredited by the Ministry of Telecom and Mass Communications of Russia.

- On the Federal Tax Service website, download the Taxpayer Legal Entity program.

Figure 6. Legal Entity Taxpayer Program

- Fill out the application for TIN No. 2-2-Accounting and request No. 3-Accounting in the program.

- The finished document can be received by registered mail or email.

.

Note : The Legal Entity Taxpayer program is most relevant for entrepreneurs and is mainly used by legal entities. Its functionality allows you to use an electronic signature for submitting reporting documents. But individuals can also work with the program.

Documentation

When applying to the Federal Tax Service, you need the same documents as when writing an application at the Multifunctional Center:

- new passport;

- previous TIN;

- statement.

Bottom line : you can get a new tax certificate after changing your last name for free. To do this, you need to contact the Federal Tax Service or the MFC. It is also possible to submit an application via the Internet.

The TIN is reissued quickly. The document will be ready within five working days.

Video on the topic:

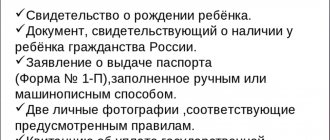

Documentation

There are not so many documents that will be required from you. Moreover, all of them are usually available to the person, that is, they do not need to be “taken” somewhere, standing in queues for many hours, which means that collecting them will take a minimum of time.

Here is their list:

- Old passport.

- Completed application form.

- 2 frontal photographs without headgear, 35x45 mm (the face should occupy 70% of the area).

- Birth certificate.

- Certificate reflecting the basis for changing the passport:

- about marriage;

- about divorce;

- about adoption;

- about a name change.

- A receipt or a copy thereof confirming payment of the state duty.

- Documents for making mandatory notes in the passport:

- military ID;

- marriage/divorce certificate;

- birth certificate of children (up to 14 years);

- death certificate (husband or child).

Usually original documents are required. For example, when the surname changes due to marriage, the marriage certificate is taken away while the passport is being prepared. But in essence, it is enough to provide copies, and when submitting documents, present the original to confirm the photocopier version. If you don’t want the original to be taken away (after all, no one is insured against loss), tell the employee that you may need it - at work, study or somewhere else.

Replacing personal data with a man

In the context of the fact that the most common reason for changing a name is the conclusion or dissolution of a marriage, especially on the part of Russian citizens, many are quite rightly interested in whether it is possible for a man to change his surname in Russia? When understanding this issue, it is necessary to take into account that the legislation gives the right to change personal data to all citizens over 14 years of age, without the use of a gender component. Thus, men, like women, have the right to change their name in the general manner - they will not have any problems related to gender.

Legal assistance in the procedure (cost and timing)

In the case where a citizen does not have the opportunity to replace the certificate of replacement of his TIN himself, he can turn to lawyers for help. Lawyers will help him resolve this issue within a few days.

The services of a lawyer in this situation include the following:

- Correctly filling out the application for a new TIN.

- Submitting a list of documents to a specific tax service for an individual.

- Obtaining a new TIN from a special tax organization. This will be possible only if the applicant issues a power of attorney to a lawyer to carry out this operation.

Legal assistance in the procedure for replacing the TIN will cost the interested citizen approximately 1 thousand rubles.

As can be seen from what is written above, issuing a TIN certificate for a new surname is not so difficult. If the interested person knows the methods and algorithm of actions in this situation, then this procedure for replacing a tax document will not take much time and effort.