What types of alimony are there and how does their type affect the collection procedure?

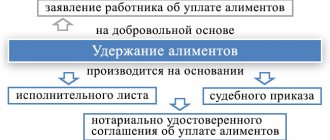

The procedure for deducting alimony from wages depends on whether it is:

1. Voluntary.

Such payments are made by the employer in accordance with the employee’s application. The main feature of voluntary alimony is that the person decides for himself how much percentage of his salary to pay.

2. Charged by force of law.

The grounds for such a charge may be:

- availability of a court decision (and writ of execution) to collect alimony;

- agreement between the parties to a family relationship regarding the payment of alimony.

Alimony can be divided into 2 categories:

1. Paid by parents (brothers, sisters) for the maintenance of children (brothers, sisters) under 18 years of age.

Alimony to minor citizens is paid from the income named in Decree of the Government of the Russian Federation dated July 18, 1996 No. 841. In particular, this list involves considering the average salary in various types (vacation pay, sick leave benefits, business trip salary) for calculating alimony.

2. Paid:

- parents for the maintenance of adult children who are recognized as disabled;

- adult children for the maintenance of parents recognized as disabled;

- one spouse in favor of the other;

- by adult citizens in favor of minor brothers and sisters;

- grandparents in favor of grandchildren (and vice versa);

- a pupil for the benefit of his teachers;

- a stepson or stepdaughter in favor of a stepfather or stepmother.

Such alimony is withheld from all income, unless otherwise provided by federal law. For example, Art. 101 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ contains a list of income from which alimony is not collected for the specified categories of persons.

How is the maximum deduction from wages (average income) determined for calculating alimony?

Child support - what percentage of salary? If the legal basis for paying alimony is an agreement between the payer and the recipient, then the maximum deduction of alimony from wages, as in the case of voluntary payment, is not limited by anything (Clause 1 of Article 103 of the RF IC, Article 110 of the RF IC). Moreover, if the agreement is drawn up for alimony for a minor child, then the amount specified in it should not be less than that determined when alimony is assigned by the court (Clause 2 of Article 103 of the RF IC).

If alimony is prescribed by the court, then its maximum amount will be (clause 3 of article 99 of law 229-FZ, article 138 of the Labor Code of the Russian Federation):

1. When paying in favor of minor children - 70% of the employee’s salary.

In general, alimony for 1 child is 1/4 of the employee’s salary, for two - 1/3, for three or more - 1/2 (Clause 1 of Article 81 of the RF IC). However, these shares may be increased or decreased by the court, taking into account the considered circumstances characterizing the relations of the parties.

2. In other cases - 50%.

In cases provided for by law, alimony is awarded by the court in a fixed amount. If the payer’s income for the billing month is not enough to cover the corresponding amount, then the balance is collected from subsequent income.

In this case, alimony is collected only after personal income tax has been calculated and withheld from the income. If the tax is not withheld, for example, in the case of a property deduction, then alimony is calculated from the entire salary amount (clause 1 of article 210 of the Tax Code of the Russian Federation, clause 1 of article 99 of law 229-FZ).

The commission for the transfer of funds to the alimony recipient is paid at the expense of the debtor (Clause 3, Article 98 of Law 229-FZ). However, it is taken into account when calculating the maximum withholding amount.

That is, the formula for calculating alimony as a percentage of salary is as follows:

Al = (D × personal income tax) × Pr , where

D - the sum of all income, including incentive payments and payments calculated on average earnings, for example, vacation pay or travel pay;

Pr - amount of interest to be withheld.

Next, you should compare the amount of alimony with the employee’s income to see if it exceeds the limits approved by law (50–70% of the employee’s income).

A separate scenario is establishing the amount of alimony based on the average salary in the state. Let's study it.

Grounds for reducing alimony and stopping payments

The amount of child support depends on many factors - for example, the health status of the parents and children. If any of the minors has a disability, the amount of funds for this child may be increased. If the alimony provider is diagnosed with disability, he has the right to apply to the court with a request to reduce the amount of payments.

If the alimony holder has registered a new marriage and has a fourth child, his financial situation worsens, and this also serves as a basis for revising the amount of alimony.

The grounds for termination of financial obligations include the following:

- the alimony or recipient of funds has died;

- the child has reached the age of 18 or has become legally competent until adulthood;

- the child was officially adopted by another person.

If any of the three children no longer needs financial support, then the amounts of payments for the remaining minors are subject to revision.

How to apply the average salary in the country for arrears of alimony in 2020-2021?

It happens that before the alimony agreement was drawn up or the writ of execution was formed, the payer already had obligations to pay alimony (and they were not fulfilled). Alimony for the period between the moment such an obligation arises and the moment of its legal collection is subject to collection, but no more than 3 years before the possibility of its legal collection arises. And if the debtor evaded paying alimony intentionally, then for a period of any duration, starting from the moment the obligation to pay alimony arose.

The amount of payments for the period preceding the assignment of alimony is determined:

1. If the recipient of alimony is a minor child:

- based on the payer’s documented earnings;

- in the absence of such earnings - based on the average salary in Russia at the time of collection of alimony.

The average salary for calculating alimony in 2020-2021 and other periods is taken according to Rosstat.

2. In other cases - in accordance with a court decision or alimony agreement.

The payer and recipient of alimony in any case have the right to challenge the method of calculating it in court (Clause 5 of Article 113 of the RF IC).

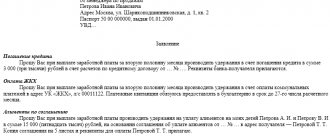

Is alimony withheld from the advance payment and other nuances in enforcement proceedings?

An employer who is involved in enforcement proceedings related to the assignment of alimony must keep in mind that:

1. Deductions cannot be made, in particular:

- from daily allowances paid to the posted worker;

- from amounts to reimburse the employee’s business expenses;

- from child care benefits.

A complete list of income from which alimony cannot be withheld in court is given in Art. 101 of Law 229-FZ.

2. The question of whether alimony is withheld from the advance payment is within the full competence of the employer.

The main thing is that upon payment of the second (main) part of the salary, alimony is deducted in the established amount and subject to the restrictions determined by law. If alimony amounts to the maximum 70% of the salary, then when the salary is divided into 2 equal parts, one of them will go towards alimony in full, and another 20% will have to be taken from the other part of the salary.

2. Any alimony collected by the court must be the first in line among all payments by the employer - along with writs of execution to satisfy claims related to compensation for harm (clause 2 of Article 855 of the Civil Code of the Russian Federation). Only after making such payments are other deductions made from wages, for example, for unpaid advances.

3. If the alimony payer quits, then the company must report this (and the new place of work of the debtor, if it has such information) to the bailiff within 3 days after the occurrence of this event (clause 1 of Article 111 of the RF IC).

If this order is not followed, the bailiff has the right to apply sanctions to the company under Art. 17.14 of the Code of Administrative Offenses of the Russian Federation, or impose a fine under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation in the amount of 300–500 rubles. (per official), 3000–5000 rubles. (for a legal entity).

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Sergey

05/11/2020 at 16:47 how to unsubscribe from all paid services

Reply ↓ Anna Popovich

05/12/2020 at 16:31Dear Sergey, which paid services do you want to unsubscribe from?

Reply ↓

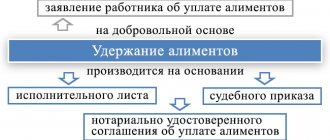

Documenting alimony payments: nuances

In order to effectively record obligations within the framework of enforcement proceedings, it makes sense for the employer to use separate accounting documents.

For the purposes under consideration, the employer may use:

1. Book of registration of writs of execution.

The fact is that for the loss of a writ of execution, an official of the employing company can be fined up to 2,500 rubles. (Article 431 of the Code of Civil Procedure of the Russian Federation). Therefore, the employer needs to appoint someone responsible for storing such documents and oblige him to use a special accounting book.

Writs of execution must be kept for 5 years, but not less than the period during which alimony payments are made, as well as another 3 years after the expiration of this period (Clause 1, Article 29 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, Clause 4 of Article 21 of Law 229-FZ).

2. Journal of alimony payments.

It makes sense to use such a document in order to generally improve the efficiency of accounting for transfers to an employee. The journal can classify such payments in various ways (for example, by the recipient’s marital status, by the method of calculating alimony - in a flat amount or as a percentage of earnings).

3. A form for notifying bailiffs about the fact of the debtor’s dismissal (and about his new place of work - if information about him is available).

The procedure for applying the first 2 documents should be fixed in the company’s accounting policy (clause 4 of PBU 1/2008).

When is it impossible to prove that the alimony provider is hiding his real income?

Often, collecting evidence that the alimony provider is hiding his real income comes down to the human factor.

Those. when the persons involved in the issuance, preparation and collection of documents do not perform their tasks very responsibly or simply refuse to issue the requested documents. What to do in such a situation? Seek help from the court from a bailiff - a person who is competent enough and has sufficient authority to contact the tax service, pension fund and other services to obtain documents on salary and deductions.

Hire a lawyer. A lawyer has the same powers as a bailiff and legally has the right to demand the above documents.

Results

The deduction of alimony from wages can be voluntary or carried out by force of law (based on an agreement of the parties or with the involvement of bailiffs). Alimony should not exceed the maximum standards established by the Labor Code of the Russian Federation and legislation on enforcement proceedings.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.