Alimony legislation

The issues of alimony withholding are addressed:

- section V of the RF IC;

- Ch. 11 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”;

- Art. 138 Labor Code of the Russian Federation;

- Decree of the Government of the Russian Federation of July 18, 1996 No. 841.

What types of alimony are there?

Payers of alimony are not only parents living separately from a minor child, but also:

- adult brothers and sisters - for the maintenance of minor brothers and sisters;

- adult children - for the maintenance of disabled parents;

- one of the spouses - for the maintenance of the other;

- grandmothers, grandfathers - for the maintenance of grandchildren;

- grandchildren over 18 years old - for the maintenance of their grandparents;

- pupils - in favor of teachers;

- stepdaughters and stepsons - in favor of the stepfather and stepmother.

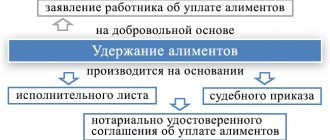

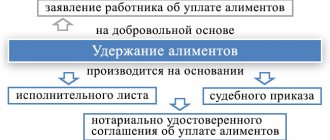

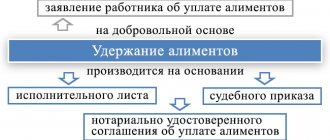

Options for paying alimony can be divided into three groups:

| ALIMONY | ||

| Voluntary | Forced | Agreed |

| The employee independently applies to his place of employment with an application to withhold part of his salary and transfer it to another person, indicating the amount of deductions. Often, voluntary alimony payers do this directly bypassing the employer, that is, they independently transfer (transfer) money to a relative | Alimony is collected through the court. A writ of execution, court order or resolution of a bailiff is received by the alimony payer, and the accountant, on the basis of this document, deducts the amount fixed by the court from the salary and transfers it to the recipient. | The two parties to the alimony relationship enter into a notarized agreement, which determines the amount of maintenance. Next, the payer independently pays alimony to the recipient. When the payer ignores the concluded agreement and refuses to pay, the recipient applies with the signed agreement to the FSSP, and then a bailiff takes over the work, and alimony is paid through the employer |

The list of income from which alimony for the maintenance of minor children can be withheld is determined by Decree of the Government of the Russian Federation dated July 18, 1996 No. 841. In other cases, all income except those specified in Art. 101 of Law No. 229-FZ. For example, you cannot deduct alimony from daily allowances, child care benefits, and compensation for business expenses.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Basic information about child support withholding

The legality of withholding alimony is prescribed in various legislative acts, in particular in Government Resolution No. 841. Collection of alimony can be made:

- from standard sources (salary, etc.);

- from bonus accruals;

- from sources of additional income;

- from salary advances, etc.

Article No. 101 of Federal Law No. 229 contains a list of payments from which alimony cannot be withheld:

- Cash accrued in connection with the loss of the main breadwinner.

- Funds issued in cases of death or injury, injury, trauma, or concussion during the performance of official duties (including to family members of the deceased person).

- Funds paid to care for disabled persons from different types of budgets.

- Payments of a monthly or annual nature, made in accordance with current legislation for certain categories of citizens (purchase of medicines, travel allowances, etc.).

- Money accrued as alimony during the period of search activities of the debtor parent.

- Compensatory payments provided for by the Russian labor law related to:

- business trips, transfer of an employee to work in other places;

- wear and tear of tools that allow the employee to carry out full-fledged professional activities;

- payments to an enterprise/organization for the birth of children, registration of marriages, death of close relatives.

- Payments regulated by insurance coverage under the terms of compulsory social insurance (with the exception of sick leave benefits and disability pension benefits).

- Amounts of money allocated from the federal budget for the payment of survivors' pensions.

- Funds accrued from the budget of the constituent entities of the Russian Federation for the payment of survivor benefits.

- Child benefits allocated from different budgets.

- Statutory payments in the form of maternity capital (in accordance with Federal Law No. 256).

- Amounts related to the category of one-time material assistance, allocated from various budgets, including funds from foreign states or companies in the following cases:

- occurrence of natural disasters, emergency circumstances;

- terrorist attacks;

- facts of death of family members and close relatives;

- receiving humanitarian assistance;

- payments of remunerations related to the provision of measures to assist in the processes of disclosure, prevention, suppression of crimes and terrorist acts.

- Full or partial compensation of the cost of trips to employees and members of their families from the employing companies. Compensation for travel packages for health purposes. The exception is tourist vouchers.

- Compensation for travel to the place of treatment (in two directions), if established by the Federal Law.

- Social benefits related to burial.

How to calculate alimony

When the amount of alimony is set as a share of income, the calculation is made using the formula:

Where

- D - employee’s salary, taking into account all incentive and compensation payments (bonuses, vacation pay, night pay, etc.);

- Personal income tax;

- A% is the established amount of alimony as a percentage.

The amounts of alimony in favor of minor children are prescribed in paragraph 1 of Art. 81 RF IC:

- ¼ of income per child;

- 1/3 - for two children;

- ½ - for three or more.

Depending on the circumstances, these values may be changed by court decision.

For example, when a father pays alimony for the maintenance of two children from different marriages, the default payment amount is 25% for one child, that is, 50% in total for two. The father has the right to apply to the court for a reduction in the amount of alimony, and the court will reduce its amount to 1/6 in favor of each, that is, half of 1/3 (the established amount for maintenance of two children).

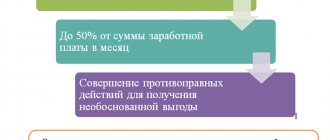

After calculating alimony for the month, it is necessary to check whether its value does not exceed the limits of possible deductions established by law (clause 3 of article 99 of Law No. 229-FZ, article 138 of the Labor Code of the Russian Federation):

- 70% in total - if alimony is paid for minor children;

- 50% in other cases.

Voluntarily paid and agreed upon by the parties, alimony is not limited by anything (Clause 1, Article 103 of the RF IC, Article 110 of the RF IC). But if we are talking about payments for the maintenance of a minor child, then the amount of alimony cannot be less than the established clause 1 of Art. 81 IC RF.

The legislation allows the payment of alimony in a fixed amount (for example, in the amount of the subsistence minimum for a child in the subject of residence). In this case, the withholding of alimony also follows the withholding of personal income tax. If the income of the current month does not allow alimony deduction in full, then the balance of the debt is paid off in the next month. If the employee is provided with a property deduction or others that cover the entire amount of tax, the deduction is made from the accrued wages.

The costs of transferring deductions are also borne by the debtor (clause 3 of Article 98 of Law No. 229-FZ). These could be bank commissions, postal services, etc. The costs of sending money to the alimony recipient are included in the deduction limit.

Salary deductions and permissible percentage

Often an accountant has to withhold a certain amount from an employee's salary for some purpose or in favor of some person.

There may be several types of deductions for one employee. The amount of deductions from wages is set as a percentage by law. There are different percentages for different types of deductions. It should be noted that personal income tax is withheld as a percentage of accrued wages, and the percentages of all other deductions are calculated from the amount that the employee receives in hand, that is, from accrued wages minus personal income tax. Limitations on the amount of deduction from wages are specified in Art. 138 Labor Code of the Russian Federation.

As can be seen from the above diagrams, alimony is a mandatory deduction and the percentage of such deduction can be quite high. Let's consider the nuances of withholding alimony: in what time frame it is necessary to do this, whether alimony is withheld from the advance payment, how alimony is distributed if the amount of withholding exceeds the amount of the salary upon full payment.

Calculation of alimony debt

Situations where the obligation to pay alimony arose before a court decision or the conclusion of an agreement and was not fulfilled by the payer often occur. But this does not mean that alimony will not be required during this period. Alimony is subject to collection for 3 years before the conclusion of the agreement or the entry into force of the court decision. In this case, it is necessary to calculate the alimony debt.

If alimony is paid for the maintenance of a young child, the debt is calculated based on:

- the amount of the debtor’s salary, confirmed by documents, for example, a 2-NDFL certificate;

- Rosstat data on the average salary at the time of alimony collection.

In other cases, the debt is determined by the bailiff, a court decision or an alimony agreement.

In case of disagreement with the amount of alimony, each party has the right to appeal the actions of the bailiff in accordance with paragraph 5 of Art. 113 RF IC.

From what income is alimony collected?

Alimony is divided into two categories. One of them is paid by parents (or siblings) in respect of minor children (or siblings). In this case, the payment is made from the income specified in the RF Regulation No. 841 dated July 18, 1996. Then the funds are calculated from the salary, including vacation pay, sick leave and business trips.

The second category is paid:

- parents in relation to their disabled adult children;

- on the contrary, by adult children in relation to parents who are disabled;

- one spouse in relation to another;

- by adults in relation to their brothers and sisters until they reach the age of 18;

- grandparents in relation to their grandchildren and vice versa;

- pupil in relation to educators;

- stepson and stepdaughter in relation to adoptive parents.

This type of alimony is withheld from all income, except in cases provided by law.

Alimony from advance

The employer’s obligation to make deductions from the employee’s salary and other income on the basis of a writ of execution or an agreement certified by a notary is enshrined in Art. 109 RF IC. And the obligation to pay wages at least twice a month is in Part 6 of Art. 136 Labor Code of the Russian Federation.

The Labor Code of the Russian Federation does not contain the concept of “advance”: when we talk about an advance, we mean the salary for the first half of the month. As for withholding alimony from wages for the first half of the month, there is no specific rule in this matter.

The calculation of alimony is based on the amount of salary minus income tax (Part 1, Article 99 of Law No. 229-FZ). For personal income tax accounting purposes, the date of receipt of income in the form of wages is the last day of the month (Clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, the employer withholds and transfers personal income tax to the budget from wages once at the end of each month (letter from the Ministry of Finance of Russia dated July 10, 2014 No. 03-04-06/33737, dated July 3, 2013 No. 03-04-05/25494). Therefore, the calculation and deduction of alimony must be made at the end of the month during the final settlement with the employee.

But withholding alimony and personal income tax, calculated from the amount of accrued wages at the end of the month, from payments for the second part of the month is risky because:

- the employee may not have income from which to withhold funds for maintenance, which is unacceptable;

- There may also be no amount to pay, thereby violating the requirement of Part 6 of Art. 136 Labor Code of the Russian Federation.

It is recommended to withhold alimony when calculating wages for both the first and second parts of the month, taking into account the requirements of executive documents and established restrictions, and transfer them to the recipient once a month.

An example of calculating alimony with withholding upon full payment

Having studied the regulatory framework, we will consider whether alimony is withheld from the advance payment.

There is no concept of “advance” in the Labor Code of the Russian Federation. But since salaries are paid twice a month, the first payment is usually called an advance. The advance is paid, as a rule, before the end of the billing month, so personal income tax on this date has not yet been calculated and is not withheld from the advance. We conclude that there is no obligation to withhold alimony from the advance payment.

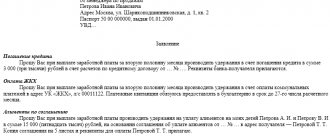

Example 1

Fomin A.V. submitted to the accounting department a writ of execution, according to which he must pay alimony to G.V. Fomina for the maintenance of their minor child in the amount of ¼ of their earnings.

Fomin A.V.’s salary is RUB 30,000.00. per month. He is entitled to a standard tax deduction in the amount of RUB 1,400.00. Personal income tax is: (30,000.00 – 1,400.00) × 0.13 = 3,718.00 rubles.

Let's make a calculation for July 2021.

The advance payment at the enterprise is paid in proportion to the time worked. Thus, it is equal to: 30,000.00 / 23 (number of working days in July) × 11 (number of working days in the first half of the month) = 14,347.85 rubles. Fomin A.V. will receive this amount in his hands on July 23, 2019 in accordance with the salary payment rules adopted by the enterprise.

The full calculation is as follows: 30,000.00 – 3,718.00 (personal income tax) – 14,347.85 (advance) = 11,934.15 rubles. And from this amount we withhold alimony, which amounts to: (30,000.00 – 3,718.00 (personal income tax)) × 1/4 = 6,570.50 rubles. This amount does not exceed 70% of the salary.

Fomin A.V. 08/10/2019 will receive: 11,934.15 – 6570.50 (alimony) = 5363.65 rubles.

Other nuances of working with alimony

When generating a payment order for the transfer of compulsorily collected alimony, in field 21 “Payment order”, indicate the symbol “1” - similar to compensation for harm caused to life and health (clause 2 of Article 855 of the Civil Code of the Russian Federation). When alimony is paid voluntarily at the request of the employee, put the order of payment “3” - the same as when transferring wages, since the statement is not a writ of execution.

It is necessary to transfer alimony to the recipient within 3 days from the date of deduction (Article 109 of the RF IC).

Clause 1 Art. 111 of the RF IC imposes on the employer the obligation to inform the bailiff about the dismissal of the employee, as well as about the new place of work (if such information exists).

The employer is obliged to store executive documents for 5 years, but not less than the period for making payments under the document, as well as another 3 years after the end of the payment period (Clause 1, Article 29 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, p. 4 Article 21 of Law No. 229-FZ).

What types of alimony are there, and how their type affects the collection procedure

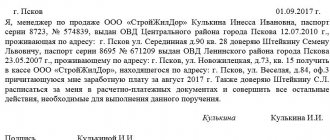

Alimony from wages is withheld voluntarily or by force of law. In the first case, payments are made based on the employee’s application. The document confirming the payment of alimony is an agreement between the alimony payer (employee) and the recipient (in most cases, the ex-wife).

In order for the payments to be considered alimony, the agreement must be certified by a notary. In the second case, money is collected forcibly. The legal basis for this is the relevant court decision, as well as a writ of execution.

Document flow for alimony

To work with executive documents, their effective and timely recording, as well as fulfillment of obligations under them, the employer can use:

- A book of registration of writs of execution, in which all decisions, orders and writs of execution received for execution are recorded. It would be useful to appoint someone responsible for storing writs of execution and maintaining an account book.

- A log of payments for deductions will help to structure payments made and will facilitate quick search for information.

- A self-developed form for notifying bailiffs of the alimony worker’s dismissal and new place of work.

The procedure for using the first two documents in work must be reflected in the company’s accounting policy (clause 4 of PBU 1/2008)

List of documents under which deductions from premiums are made

Payment of alimony from the premium can be made if:

- employment contract;

- collective agreement enshrined in the charter of the enterprise;

- wage regulations;

- bonus provisions;

- company bonus fund.

If you doubt that alimony is deducted from the premium correctly, you can go to court. You will have to bring the entire set of documents above to the court hearing. Otherwise, the case will not be considered.

If the alimony payer is trying to avoid payments, it is necessary to contact the bailiffs. Representatives of the law will not only help collect the required amount, but will also be able to exercise proper control over the payer’s income. To do this, the claimant must submit a corresponding application. You can write a request at any time.

In order to identify an additional source of income, the bailiff can:

- check the applicant's information;

- identify the amount of debt;

- issue a decree on the collection of alimony;

- familiarize the alimony payer with the measures taken.

Based on the claims identified by the FSSP, the accounting department will withhold money in favor of the child.

Responsibility for violations when working with alimony

| Offense | Who will be fined | Punishment | Base |

| Loss (damage) of the writ of execution | Executive | Fine up to 30 thousand rubles. | Art. 431 Code of Civil Procedure of the Russian Federation |

| Ignoring the demands of the bailiff | Individual | Fine 2 – 2.5 thousand rubles. | Part 3 Art. 17.14 Code of Administrative Offenses of the Russian Federation |

| Executive | Fine 15 – 20 thousand rubles. | ||

| Entity | Fine 50 – 100 thousand rubles. | ||

| Failure to provide information | Individual | Warning or fine 300 - 500 rubles. | Art. 19.7 Code of Administrative Offenses of the Russian Federation |

| Executive | Fine 300 – 500 rubles. | ||

| Entity | Fine 3 – 5 thousand rubles. |

Let's sum it up

- Alimony is money paid to support a disabled relative.

- The amount of forced alimony is determined by the court.

- The amount of alimony withheld per month is a maximum of 70% for deductions in favor of minor children and 50% in other cases.

- The alimony debt is calculated based on official data on the income of the alimony provider or Rosstat data on the average salary.

- Compulsorily collected alimony must be transferred to the recipient first.

- The employing company has 3 days to transfer the withheld alimony.

Example of withholding significant amounts of alimony

From the considered example it is clear that if the amount of deduction is significantly greater, which often happens in the situations listed below, then when acting according to the considered algorithm (that is, if alimony is not withheld from the advance payment), the norms of the Labor Code of the Russian Federation on paying wages every half month are violated:

- Child support is paid for several children, and their share is up to 50% of the salary;

- alimony is set at a fixed amount, which eats up most of the earnings;

- in addition to the established alimony, there is an obligation to pay alimony debts;

- other when the amount of deductions is significant.

Example 2

In the previous example, let’s say that alimony is paid for three children, that is, it amounts to ½ salary. The standard tax deduction is: 1400.00 + 1400.00 + 3000.00 = 5800.00 rubles.

Let's calculate:

- Personal income tax: (30,000.00 – 5800.00) × 0.13 = 3146.00 rub.

- Alimony: (30,000.00 – 3146.00) × 1/2 = 13,427.00 rub.

- Full settlement amount: 30,000 – 3146 – 14,347.85 = 12,506.15 rubles.

We find that the amount of alimony is greater than the amount payable.

If in example 2 we withhold alimony only upon full payment, we get:

- arrears of alimony, since the amount to be paid is not enough to fully cover it;

- violation of the Labor Code of the Russian Federation, since the second half of the salary will not be paid.

How to proceed in this case? Is alimony withheld from the advance payment or not?