What types of alimony are there and how does their type affect the collection procedure?

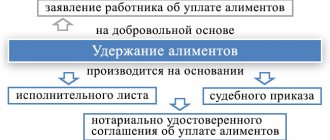

The procedure for deducting alimony from wages depends on whether it is:

1. Voluntary.

Such payments are made by the employer in accordance with the employee’s application. The main feature of voluntary alimony is that the person decides for himself how much percentage of his salary to pay.

2. Charged by force of law.

The grounds for such a charge may be:

- availability of a court decision (and writ of execution) to collect alimony;

- agreement between the parties to a family relationship regarding the payment of alimony.

Alimony can be divided into 2 categories:

1. Paid by parents (brothers, sisters) for the maintenance of children (brothers, sisters) under 18 years of age.

Alimony to minor citizens is paid from the income named in Decree of the Government of the Russian Federation dated July 18, 1996 No. 841. In particular, this list involves considering the average salary in various types (vacation pay, sick leave benefits, business trip salary) for calculating alimony.

In what cases alimony is withheld from sick leave, find out here.

2. Paid:

- parents for the maintenance of adult children who are recognized as disabled;

- adult children for the maintenance of parents recognized as disabled;

- one spouse in favor of the other;

- by adult citizens in favor of minor brothers and sisters;

- grandparents in favor of grandchildren (and vice versa);

- a pupil for the benefit of his teachers;

- a stepson or stepdaughter in favor of a stepfather or stepmother.

Such alimony is withheld from all income, unless otherwise provided by federal law. For example, Art. 101 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ contains a list of income from which alimony is not collected for the specified categories of persons.

Attention! Recommendation from ConsultantPlus: A payment order for the payment of alimony is sent to the bank within three days from the date of payment of wages to the employee. When transferring wages to the account of a debtor employee in a bank or other credit organization, the employer is obliged... (for recommendations on how to prepare a payment order, see K+).

Is alimony income?

Child support will be an expense for the parent who does not live with his child, but is obliged to provide financially for the child.

Cash payments for child support are recognized as the income of the family in which he lives. But their spending is regulated by Russian law, so a parent or guardian receiving alimony does not have the right to spend it on their personal needs.

The parent who pays this benefit has the right to control where and how much this money is spent.

The alimony holder may apply to the court with a request to transfer half of the alimony amount to the child’s account.

How is the maximum deduction from wages (average income) determined for calculating alimony?

Child support - what percentage of salary? If the legal basis for paying alimony is an agreement between the payer and the recipient, then the maximum deduction of alimony from wages, as in the case of voluntary payment, is not limited by anything (Clause 1 of Article 103 of the RF IC, Article 110 of the RF IC). Moreover, if the agreement is drawn up for alimony for a minor child, then the amount specified in it should not be less than that determined when alimony is assigned by the court (Clause 2 of Article 103 of the RF IC).

If alimony is prescribed by the court, then its maximum amount will be (clause 3 of article 99 of law 229-FZ, article 138 of the Labor Code of the Russian Federation):

1. When paying in favor of minor children - 70% of the employee’s salary.

In general, alimony for 1 child is 1/4 of the employee’s salary, for two - 1/3, for three or more - 1/2 (Clause 1 of Article 81 of the RF IC). However, these shares may be increased or decreased by the court, taking into account the considered circumstances characterizing the relations of the parties.

2. In other cases - 50%.

In cases provided for by law, alimony is awarded by the court in a fixed amount. If the payer’s income for the billing month is not enough to cover the corresponding amount, then the balance is collected from subsequent income.

In this case, alimony is collected only after personal income tax has been calculated and withheld from the income. If the tax is not withheld, for example, in the case of a property deduction, then alimony is calculated from the entire salary amount (clause 1 of article 210 of the Tax Code of the Russian Federation, clause 1 of article 99 of law 229-FZ).

The commission for the transfer of funds to the alimony recipient is paid at the expense of the debtor (Clause 3, Article 98 of Law 229-FZ). However, it is taken into account when calculating the maximum withholding amount.

That is, the formula for calculating alimony as a percentage of salary is as follows:

Al = (D × personal income tax) × Pr, where

D - the sum of all income, including incentive payments and payments calculated on average earnings, such as vacation pay or travel pay;

Pr – amount of interest to be withheld.

Next, you should compare the amount of alimony with the employee’s income to see if it exceeds the limits approved by law (50–70% of the employee’s income).

A separate scenario is establishing the amount of alimony based on the average salary in the state. Let's study it.

Is alimony the income of the mother or the child?

Most people believe that child support is income for a mother who is raising a child alone.

However, this is a misconception. In fact, child support payments are the property of the child to whom they are allocated. Thus, alimony is the child’s income.

The parent only undertakes to dispose of them in good faith, observing the interests of the child and the relevant provisions of the Civil Code.

After the child turns 14 years old, he can manage these payments independently. For some purchases and transactions, permission from legal representatives, that is, a parent or guardian, is required. According to regulations, alimony payments are the official income of the person to whom they are intended.

If funds are transferred to a child, then this is his income. The ex-wife has the right to apply directly to the ex-spouse or through the court to obtain the right to financial support from the ex-husband while caring for a minor child. In this case, the funds received will be the mother’s income.

It is important to remember that child support is formal income for the parent.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

How to apply the average salary in the country for arrears of alimony in 2020-2021?

It happens that before the alimony agreement was drawn up or the writ of execution was formed, the payer already had obligations to pay alimony (and they were not fulfilled). Alimony for the period between the moment such an obligation arises and the moment of its legal collection is subject to collection, but no more than 3 years before the possibility of its legal collection arises. And if the debtor evaded paying alimony intentionally, then for a period of any duration, starting from the moment the obligation to pay alimony arose.

The amount of payments for the period preceding the assignment of alimony is determined:

1. If the recipient of alimony is a minor child:

- based on the payer’s documented earnings;

- in the absence of such earnings - based on the average salary in Russia at the time of collection of alimony.

The average salary for calculating alimony in 2020-2021 and other periods is taken according to Rosstat.

2. In other cases - in accordance with a court decision or alimony agreement.

The payer and recipient of alimony in any case have the right to challenge the method of calculating it in court (Clause 5 of Article 113 of the RF IC).

Is income tax taken from alimony from the recipient?

In accordance with Art. 217 of the Tax Code of the Russian Federation, a person who is the recipient of alimony does not have to pay income tax on it. This applies to both payments collected on the basis of a voluntary agreement and those imposed in court.

As for the consequences arising from untimely repayment of obligations, in the case of receiving interest for the use of funds from the employer company, a tax base arises. That is, personal income tax must be paid for alimony.

This follows from letters from the Russian Ministry of Finance with reference to Art. 41 of the Tax Code of the Russian Federation, which indicates the signs of the emergence of economic benefits. Since a person has the right, when receiving interest, to dispose of it at his own discretion, it must be subject to income tax at a rate of 13%.

Download a sample claim for the collection of alimony for the past period.

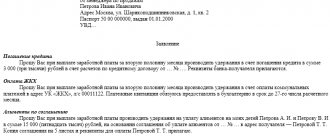

Is alimony withheld from the advance payment and other nuances in enforcement proceedings?

An employer who is involved in enforcement proceedings related to the assignment of alimony must keep in mind that:

1. Deductions cannot be made, in particular:

- from daily allowances paid to the posted worker;

- from amounts to reimburse the employee’s business expenses;

- from child care benefits.

A complete list of income from which alimony cannot be withheld in court is given in Art. 101 of Law 229-FZ.

See also “Is alimony withheld from financial assistance?”

2. The question of whether alimony is withheld from the advance payment is within the full competence of the employer.

The main thing is that upon payment of the second (main) part of the salary, alimony is deducted in the established amount and subject to the restrictions determined by law. If alimony amounts to the maximum 70% of the salary, then when the salary is divided into 2 equal parts, one of them will go towards alimony in full, and another 20% will have to be taken from the other part of the salary.

2. Any alimony collected by the court must be the first in line among all payments by the employer - along with writs of execution to satisfy claims related to compensation for harm (clause 2 of Article 855 of the Civil Code of the Russian Federation). Only after making such payments are other deductions made from wages, for example, for unpaid advances.

3. If the alimony payer quits, then the company must report this (and the new place of work of the debtor, if it has such information) to the bailiff within 3 days after the occurrence of this event (clause 1 of Article 111 of the RF IC).

If this order is not followed, the bailiff has the right to apply sanctions to the company under Art. 17.14 of the Code of Administrative Offenses of the Russian Federation, or impose a fine under Art. 19.7 of the Code of Administrative Offenses of the Russian Federation in the amount of 300–500 rubles. (per official), 3000–5000 rubles. (for a legal entity).

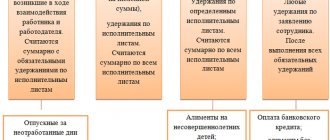

On what incomes are alimony payments not made?

The legislation provides for an extensive list of income from which alimony is not deducted. The legislator makes it clear that certain amounts received by the payer relate exclusively to his personal life.

For which incomes alimony is not collected:

- benefits for women during pregnancy and childbirth (with the exception of sick leave payments);

- compensation for injury to health received during the performance of official duties;

- insurance payments;

- amounts allocated for the care of incapacitated persons;

- amounts that the employer allocates as travel allowances for business trips;

- amounts allocated to compensate for special meals in various medical institutions;

- compensation related to transfer to service in another region of the Russian Federation;

- maternal capital;

- survivor's pension;

- amounts allocated by the employer for the repair or replacement of work tools (it is assumed that such a tool is the personal property of the payer and, therefore, his means of subsistence);

- financial assistance allocated in connection with the birth of children, weddings, funerals of relatives, damage from natural disasters;

- alimony that the payer receives from another person.

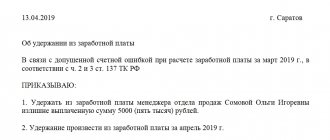

Documenting alimony payments: nuances

In order to effectively record obligations within the framework of enforcement proceedings, it makes sense for the employer to use separate accounting documents.

For the purposes under consideration, the employer may use:

1. Book of registration of writs of execution.

The fact is that for the loss of a writ of execution, an official of the employing company can be fined up to 2,500 rubles. (Article 431 of the Code of Civil Procedure of the Russian Federation). Therefore, the employer needs to appoint someone responsible for storing such documents and oblige him to use a special accounting book.

Writs of execution must be kept for 5 years, but not less than the period during which alimony payments are made, as well as another 3 years after the expiration of this period (Clause 1, Article 29 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, Clause 4 of Article 21 of Law 229-FZ).

2. Journal of alimony payments.

It makes sense to use such a document in order to generally improve the efficiency of accounting for transfers to an employee. The journal can classify such payments in various ways (for example, by the recipient’s marital status, by the method of calculating alimony - in a flat amount or as a percentage of earnings).

3. A form for notifying bailiffs about the fact of the debtor’s dismissal (and about his new place of work - if information about him is available).

The procedure for applying the first 2 documents should be fixed in the company’s accounting policy (clause 4 of PBU 1/2008).

Results

The deduction of alimony from wages can be voluntary or carried out by force of law (based on an agreement of the parties or with the involvement of bailiffs). Alimony should not exceed the maximum standards established by the Labor Code of the Russian Federation and legislation on enforcement proceedings.

You can learn more about calculating alimony in the following articles:

- “Withholding alimony under the simplified tax system “income minus expenses””;

- “How to correctly reflect alimony in 6-NDFL (nuances)?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.