Author

Sergey Ershov

Registration number in the register of lawyers of St. Petersburg – 78/5563

When a close relative dies, the heirs prepare to receive the property of the deceased. But not everyone knows that this procedure will require certain costs, sometimes very large ones. In this article I will tell you how much it costs to inherit with or without a will. Find out how you can avoid or reduce some expenses.

What is the procedure for entering into inheritance?

Entry into inheritance is a set of actions aimed at obtaining ownership of the property of the deceased. The general period for this is 6 months from the date of death of the testator - Art. 1154 of the Civil Code of the Russian Federation.

According to Art. 1111 of the Civil Code of the Russian Federation, inheritance is carried out:

- According to the will.

- In law.

- According to an inheritance agreement.

The successor's procedure is as follows:

- Appeal to the notary of the territorial district in which the deceased lived.

- Preparing a package of documents and submitting it to the notary.

- Payment of state duty.

- Obtaining a certificate of inheritance.

- Registration of ownership of property.

You can also register an inheritance through the MFC. The following must be taken into account:

- Before contacting the MFC, you will have to visit a notary and write an application.

- The MFC issues documents confirming the transfer of ownership of the testator's property.

- To obtain a certificate of inheritance rights, you will have to contact a notary.

See also:

How to enter into an inheritance legally in 2021 - step-by-step instructions

What is the deadline for entering into inheritance in 2021 according to the law of the Russian Federation - detailed answer

How much does it cost to open an inheritance case?

If, at the first visit to a notary, a person wants to designate this specialist for further work and immediately order some services in addition to the usual application for succession, then we can talk about more serious costs. If one application is drawn up, which serves as a basis along with the documentation provided, then the amount will be small.

People can make a decision about the ordered services in advance by clarifying the circle of heirs, the presence or absence of a will, and the list of registered property. Therefore, they can come to the office as prepared as possible to draw up contracts, order requests from a notary, etc. In any situation, it will not be possible to solve everything in one go. The notary will explain the additional steps and how much it all costs.

It is worth distinguishing between the concepts of opening the inheritance itself and the inheritance case by a notary. The inheritance opens at the time of the death of the primary owner, and then citizens turn to a notary. After the specialist takes into account the documents and issues application forms, the case is considered opened. The subsequent registration process takes a long time and usually takes at least six months.

What values is it made up of?

The notary charges a small amount for entering into an inheritance. This stage usually does not involve high expenses, since a person only applies for a certificate in the future. After a six-month delay, the situation with the circle of heirs and the inheritance due to them will become clearer. Therefore, when entering into an inheritance, the notary does not take any large percentage for his services.

What expenses will the heir face when entering into an inheritance from a notary?

Obtaining property rights to the inheritance may entail expenses for

- Notary Services.

- Property valuation.

- State duty for issuing a certificate of inheritance.

- State duty for registration of property rights.

What additional expenses are possible when entering into an inheritance?

In addition to the main expense items, there may be a need for additional expenses.

When entering into an inheritance, successors often encounter certain difficulties (missing a deadline, challenging a will, etc.). In such situations, additional costs may be incurred for:

- Payment for the services of an executor when he is named in the will.

- Protection of the hereditary mass.

- Sending requests to various authorities to obtain the necessary information.

- Preparation and execution of an agreement between successors on the division of inheritance.

- Litigation.

- Legal advice.

The cost of contacting a lawyer depends on the type of service that the heir wishes to receive. Prices for consultation start from 1 thousand rubles. For assistance in drawing up a claim and representing interests in court, you will have to pay about 5 thousand rubles.

You can contact lawyers who are willing to provide services free of charge, or get an online consultation.

The successor may be faced with a situation where the inherited land plot is not registered in the cadastral register. In this case, you will have to spend money on the services of a cadastral engineer, land surveying, and drawing up a technical plan.

When there are no documents confirming ownership of property transferred by inheritance, you will have to go to court.

How much do you have to pay for the examination?

Paying for the assessment procedure requires quite a lot of money. The price of the service starts from 5000 rubles. In some cities, the price tag can reach up to 100,000 rubles. If there is an overestimation of the cost according to the cadastre, it is worth contacting independent organizations. Registration of an inheritance is not always limited only to the payment of state fees and notary services. If the procedure is delayed and goes beyond the scope of notarial work, the costs will increase significantly. This is possible if a citizen untimely applied to the notary to enter into an inheritance. In this case, a trial is carried out. A person may need to hire an attorney. The cost of legal assistance depends on the complexity of the inheritance case. The total amount may vary greatly depending on the individual circumstances of the situation.

How much does it cost to enter into an inheritance with a notary?

The costs of notary services when entering into an inheritance consist of:

- Cost of legal and technical services.

- State fees for performing notarial acts established by Art. 333.24 Tax Code of the Russian Federation.

The first step is to contact a notary with a corresponding application. In addition, the successor provides the following documents:

- Passport.

- Certificate or certificate of death of the testator.

- Will (if any).

- Documents indicating relationship with the deceased.

- Title documents for property.

The cost of an application for inheritance is 100 rubles. Based on the submitted application, the notary opens and conducts an inheritance case.

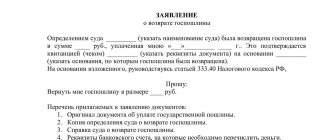

Sample application for inheritance

Sample application for inheritance (DOC, 16 KB)

See also:

What documents are needed to enter into an inheritance in 2021 - a complete list for all situations

How much does it cost to open an inheritance case with a notary?

An inheritance case is a package of documents that confirms that the heirs have rights to the property of the deceased, as well as the fact that it belongs to the testator.

Opening an inheritance case will cost approximately 1 thousand rubles, incl. 900 rub. — notary services and 100 rubles. duty.

What services does a notary provide when entering into an inheritance?

Notary when entering into inheritance:

- Accepts an application for inheritance.

- Announces the will.

- Explains the rights and responsibilities of heirs.

- Accepts an application to renounce the property of the testator.

- Calculates the amount of state duty.

- Prepares relevant documents and requests to clarify information.

- Issues a certificate of title to the property of the deceased.

How much does legal and technical work of a notary cost?

The Federal Tax Service annually sets the maximum fee for these services for each constituent entity of the Russian Federation in accordance with Art. 30 “Fundamentals of the legislation of the Russian Federation on notaries”.

In turn, the notary chambers of the constituent entities of the Russian Federation establish fees for services of a legal and technical nature (ULTS), not exceeding the maximum established values according to Art. 29 of the above law.

You can find out about the fees for such services on the FNP website.

For example, tariffs for UPTH for St. Petersburg in 2021 are:

- Certification of the accuracy of copies of documents and extracts from them (per page) with photocopying - 40 - 60 rubles.

- Sending a request - 50 rubles.

- Certification of the authenticity of a signature - 800 rubles.

- Certificate of power of attorney from an individual - 1300 rubles.

- Performing other notarial acts - 1600 rubles.

For comparison, prices for similar services in Moscow are 50 rubles, 50 rubles, 1 thousand rubles, 2 thousand rubles. and 1 thousand rubles respectively.

What is the cost of notary services when entering into an inheritance under a will?

When receiving the testator's property under a will, the following costs are possible:

| Name | Cost of UPTH, rub. | State duty, rub. | Total amount |

| Opening an envelope with a closed will and its announcement | 3 138 | 300 | 3 438 |

| Notarized certification of the accuracy of the translation per page (for example, when the heir’s birth certificate is drawn up in another language) | 1 255 | 100 | 1 355 |

| Certification of a power of attorney, when the heir delegates his powers to another person due to the impossibility of personal presence | 2 071 | 200 | 2 271 |

| Notarized authentication of the signature when the application for inheritance is sent by the successor by mail | 1 255 | 100 | 1 355 |

| Drawing up an inventory of property (for each hour), when it is necessary to take protective measures due to the value of the inheritance or the threat of its loss | up to 6,000 | 600 | 6 600 |

| Issuance of a duplicate when there are no original documents of title to the property | 3 000 | 100 | 3 100 |

| Performing other notarial acts | 2 500 | 100 | 2 600 |

The prices for UPTC presented in the table are the maximum values established by the Federal Tax Service for 2021.

Allocation of the spouse's share from the jointly acquired property in the inheritance estate will cost 200 rubles. in accordance with clause 11, part 1, art. 22.1 Fundamentals of the legislation of the Russian Federation on notaries.

If the will is drawn up in emergency circumstances in accordance with Art. 1129 of the Civil Code of the Russian Federation, it will need to be certified in court. The state duty will be 300 rubles.

Acceptance of an application to renounce the property of the deceased will cost 500 rubles.

What is the cost of services when entering into an inheritance without a will?

When the deceased did not leave a will, the property belonging to him is distributed among the heirs of the corresponding order.

The costs of legal heirs are similar to those of inheritance under a will. Except for payment of costs for:

- Opening and reading of a closed will.

- Certification by court of last will drawn up in emergency circumstances.

A feature of receiving the testator's property by law is the possibility of actually accepting the testator's property.

What expenses are paid upon actual acceptance of the inheritance?

The actual acceptance of an inheritance is a set of actions by the heir that indicate the intention to acquire property. In this case, the heir will have to spend money on:

- Payment of expenses for maintaining the property of the deceased.

- Repayment of utility bills.

- Taking measures to protect property from attacks by third parties.

The actual acceptance of the inheritance must also be carried out within 6 months. The heir who actually accepted the property provides the notary with the relevant evidence (payment receipts, testimony of neighbors, certificate of residence).

The notary evaluates the documents provided and makes a decision on issuing or refusing to issue a certificate of inheritance.

In addition to the above costs, there may be costs for:

- State duty for issuing a certificate.

- Property valuation.

- Re-registration of property.

When a citizen does not have supporting documents, he has the right to go to court with a claim to establish the fact of acceptance of the inheritance Ch. 28 Code of Civil Procedure of the Russian Federation. When considering disputes in such cases, a state fee in the amount of 300 rubles is subject to payment.

How much does it cost to inherit without a will after 6 months?

Applying to a notary after the six-month period established by law is regarded as missing the established deadline.

However, the claimant has the opportunity to receive the property of the deceased. In addition to the above costs, there may be costs associated with restoring the time limit for entering into an inheritance in court.

Read more about this in the section “How much does it cost to enter into an inheritance through the court”.

See also:

How to enter into an inheritance after 6 months in 2021 - step-by-step procedure

How to restore the inheritance deadline in 2021 - step-by-step instructions

How much do public notary services cost?

There are very few budget (state) notaries now. But even specialists engaged in private practice, in fact, work not only in their own interests and satisfy all the needs of clients. Each notary is approved for this position by the highest judicial body and the notary chamber, and therefore is obliged to act in compliance with its legal standards.

The question of how much notary services cost is debatable. All remuneration for specialist services can be divided into two parts. In Russia, a control system has been established that approves identical tariffs throughout the country for one part of the payment, as well as maximum figures for the second. The controversy in this case relates specifically to the second part, since the limit value implies variability in prices up to this level.

What causes the amounts that need to be paid to the notary:

- unified values when paying state fees for notarial acts (part 1);

- legal and technical support, fluctuating within acceptable limits (part 2).

In this situation, a request appears about the admissibility of competition among notaries. In the Russian Federation there is indeed freedom of entrepreneurship, but this does not apply to these specialists, since they do not fall under this category. Competition is minimized by the need for the same notaries to deduct taxes from their earnings, as well as payment for rent and other office expenses.

It is worth clarifying that a slight individual reduction in prices is possible at the initial stage of the office’s work or in the process of further activity, but in general, in most regions, the cost of services is approximately at the same level. Moreover, in individual entities, at general meetings of chamber representatives, the cost of services related to the second part of the price list may be established.

How much will it cost to enter into an inheritance if there is an inheritance agreement?

According to Art. 1118 of the Civil Code of the Russian Federation, the rules of the Civil Code of the Russian Federation on wills are applied to an inheritance agreement, unless otherwise follows from the essence of the agreement.

An inheritance contract is an agreement between the testator and the successor on the transfer into ownership of the latter's property belonging to the alienator.

An inheritance agreement is the basis for a notary to issue a certificate of inheritance after the death of the owner.

The costs of entering into an inheritance are similar to the costs of legal heirs or heirs under a will. They depend on the scope of services provided by the notary, the amount of state duty payable upon receipt of a certificate of inheritance and for registering property rights.

Payment for the service of issuing a certificate for the share of the spouse’s property

If one of the spouses survives the other, then the remaining spouse has the right to claim a share in the common property. So, for example, after the death of her husband, the wife has the opportunity to transfer his share to herself if material wealth was acquired jointly. A mandatory condition is to notify all other applicants for the inheritance (Article 75 “Fundamentals of Notaries”).

The price for preparing such a document may vary slightly, since this is not a standard certificate of inheritance. This document indicates ownership, so the notary is placed in more stringent conditions for notifying government agencies about the accomplished act. As a result, the operation may cost more.

How much does it cost to register an inheritance with a notary?

The cost of registering inherited property with a notary is formed from two components:

- Notary fee.

- The amount of state duty is for issuing a certificate of inheritance.

The cost of notary services also depends on the type of inheritance:

- Pensions - no more than 100 rubles.

- Money - no more than 3 thousand rubles.

- Each item of property (except for real estate) - up to 3 thousand rubles.

- Each property - up to 5 thousand rubles.

If it is necessary to conclude an agreement between the successors on determining the shares due, drawing up an agreement and certifying it will cost 5 thousand rubles.

The same amount will have to be paid for the services of a notary for the division of property transferred to the successors as common property. If there are more than two such objects, for each object starting from the third, an additional 1 thousand rubles are paid, but not more than 11 thousand rubles.

If notarial acts are performed outside the premises of a notary's office, the state fee is paid at one and a half times the amount.

How much does an inheritance certificate cost from a notary?

A document confirming the right of an heir to the property of the deceased is a certificate of inheritance. It performs the following important functions:

- Confirms the heir's right to the property of the deceased.

- Establishes specific property that passes to a specific successor.

The certificate is issued by a notary and is subject to a state fee.

What is the amount of state duty for issuing a certificate of inheritance?

The state duty rate for issuing a certificate is established by paragraphs. 22 clause 1 art. 333.24 Tax Code of the Russian Federation. The amount depends on two factors:

- Degree of relationship between the testator and successor.

- Estimated value.

When there are several certificates of the right to inheritance, the state duty is paid for each of them. If the heirs want to minimize their expenses, they can ask the notary to issue one general certificate for all types of property.

What percentage does a notary charge for registering an inheritance?

The amount of the state duty is set as a percentage of the value of the deceased’s property and is:

- 0.3% - when the successors are children, spouses, parents, full and half brothers and sisters of the testator. In this case, the amount of the state duty cannot exceed 100 thousand rubles.

- 0.6% - for successors who are not the above-mentioned relatives, but not more than 1 million rubles.

The state duty is withheld from each heir and for each object of inheritance, in proportion to the share received.

Who has benefits when paying state duty for inheritance?

In accordance with Art. 333.38 of the Tax Code of the Russian Federation, the following categories of citizens have the right to count on exemption from paying state duty:

- Heirs, when inheriting property in which they lived together with the testator at the time of death and continue to live there after that.

- Successors of a person whose death occurred as a result of the performance of state or public duties. Those killed for this reason also include citizens who died within a year after receiving injuries and wounds under the above circumstances.

- Heirs who have not reached the age of majority, as well as persons suffering from mental disorders, over whom guardianship has been established in accordance with the law.

- Recipients of deposits in banks, funds in accounts, insurance amounts under insurance contracts, wages, copyrights, pensions.

Disabled people of groups 1 and 2 pay for notary services in the amount of 50% of the total amount.

Important! To receive a tax exemption, the successor must provide the notary with documents confirming the right to receive it.

Amount of state duty

The heir will need to pay a state fee. It is charged for the registration procedure. The amount of state duty is determined as a percentage of the value of the estate. Close relatives of the first and second priority must pay 0.3% of the value of the property.

| Kinship | Payment amount (%) | No more than (rubles) |

| Children, spouse, siblings, parents. | 0,3 | 100000 |

| Other. | 0,6 | 1000000 |

The law fixes the maximum amount that can be charged to the heir. Today the indicator is 100,000 rubles.

Close relatives are:

- parents;

- children;

- spouses;

- brothers and sisters;

- Grandmothers and grandfathers.

If a person does not fall into the above category, the amount of the state duty will increase and amount to 0.6% of the amount. The maximum allowable payment amount is also increased. It can reach up to 1,000,000 rubles.

Video

Additionally, you will have to pay for material, labor and technical measures. The size of the payment depends on the complexity of the inheritance. There are also limits set here.

You may be required to pay the following amounts:

- 100 rubles if pension contributions are inherited;

- 1000 rubles if financial savings are inherited;

- 5000 rubles, if the amount is charged for each immovable property;

- 3000 rubles if the heir receives other property of the citizen.

A citizen has the right to receive preliminary consultation. To do this, you need to contact a notary or lawyer. There is a separate fee for consultation. Its size depends on the tariffs in force in a particular organization.

Why is a property valuation needed and how much does it cost when entering into an inheritance?

Valuation of the testator's property is a mandatory step when entering into an inheritance. Carrying out this procedure is necessary to calculate the amount of state duty for issuing a certificate of inheritance.

Real estate, vehicles, shares in a business, etc. are subject to assessment. The deceased's savings and funds in bank accounts, on the contrary, do not need to be assessed.

The assessment is made on the day the inheritance is opened in accordance with clause 6, clause 1, art. 333.25 Tax Code of the Russian Federation.

To calculate the state duty, a document may be presented indicating:

- Estimated value.

- Cadastral value.

The estimated value is determined by independent appraisal companies that are licensed to provide such services and are active members of the SRO. The document confirming the assessment is a report on market value.

The cadastral value is determined according to a certificate from Rosreestr. The supporting document is an extract from the Unified State Register of Real Estate. However, the value of the property may not always be reflected in this document. In its absence, you will have to use the services of independent appraisers.

Determine the value of vehicles, shares in companies, etc. The appraiser will also help.

On average, the services of an independent property valuation company will be:

- Apartment - from 4 thousand rubles.

- House with land - from 5 thousand rubles.

- Vehicle - from 1,500 rub.

Obtaining a certificate of cadastral value will cost 350 rubles.

The cadastral value is usually lower than the market value, so it is more profitable to use it to calculate the state duty. When submitting several valuation documents to the notary, the lowest value is accepted for calculation.

Costs for assessing inherited property

An important step in registering inheritance rights is the assessment of the value of the property that the successor can legally receive.

It will not be possible to avoid these costs, since without them it is impossible to determine the amount of the mandatory state duty. They are also necessary when property is inherited.

The list includes:

- real estate (regardless of whether it is residential or non-residential);

- vehicles (1.5 – 2 thousand rubles);

- land;

- Appliances;

- inventory.

In relation to funds, such state duty is not paid. In addition, there is no need for evaluation.

To determine the value of inherited property, the following types of assessment are used:

- cadastral - established by the state authorized body, which is the local administration;

- market - carried out by an expert commission, cost about 5 thousand rubles (depending on the region);

- inventory - installed by the Technical Inventory Bureau (BTI), will cost 540 rubles.

Since the BTI certificate includes only basic valuation conditions (for example, location), the inventory value is significantly higher than the first two options. However, the certificate issued by this body is a confirmation of the price of the presented property. According to the current legislation, the notary undertakes to accept it (Tax Code of the Russian Federation, Art. 333.25).

There are situations when an authorized person refuses to accept the BTI assessment. In this case, he must present a document in accordance with the established procedure, which will confirm the fact of refusal. The successor has the right to appeal it in court.

How much does it cost to register an inheritance with a notary for a house and land?

You can estimate the approximate amount of costs for registering an inheritance, when its object is a house and land, by imagining the following situation.

The father left his only son a house (7 million rubles) and a plot of land (2 million rubles). For each of the objects there are title documents, and data on the cadastral value has been obtained. The son's expenses will be:

- The state fee for obtaining a certificate is 0.3% * 9 million = 27 thousand rubles.

- UPTH - 6 thousand * 2 = 12 thousand rubles.

- Registration of a house and land plot in Rosreestr - 2 thousand and 350 rubles. respectively.

In total, the total amount of expenses will be 41,350 rubles.

If there are no title documents for the house and land plot, the total amount of expenses may increase to 50 thousand.

The costs of notary services depend on the circumstances and conditions of inheritance. Their cost is influenced by the following factors:

- Is there a will or is inheritance carried out by law?

- Does the heir participate personally or through a representative.

- Do you have title documents for the property or do they need to be restored?

How much does it cost to inherit a house after your mother's death?

The costs in such a situation will be similar to the costs listed above, with the exception of the costs of issuing a certificate for a land plot and its re-registration.

If the heir lived with his mother, he is exempt from paying state duty.

Taking the above example as a basis, provided that the son and mother lived together, the costs will amount to 8 thousand rubles. (6,000 UPTH + 2,000 registration of property rights).

How much does it cost to inherit an apartment?

Let's look at the cost of inheriting an apartment using an example.

After the death of her father, the daughter received a two-room apartment. The cadastral value of the property is 5 million rubles. Since the daughter lived separately (she was not entitled to benefits), the state duty will be: 5,000,000 * 0.3% = 15 thousand rubles. Registration of ownership of an apartment will cost 2 thousand rubles.

In total, the total amount of expenses is 20,350 rubles, where 3 thousand (notary services), 350 (certificate of cadastral value), 15 thousand (state duty) and 2 thousand (re-registration of the apartment).

If the apartment has not been privatized, then it will not be included in the inheritance mass. So, in accordance with Art. 1112 of the Civil Code of the Russian Federation, it includes property that belonged to the testator at the time of death. A non-privatized apartment is not the property of the deceased.

However, if the testator began the process of re-registering it as property during his lifetime, it may be included in the inheritance.

What is the cost of inheriting after the death of a husband?

In addition to the expenses mentioned, spouses may be faced with the need to allocate a marital share.

Let's consider an approximate algorithm for calculating expenses.

After the death of her husband, mother and daughter inherited a two-room apartment. The cadastral value of the property is 5 million rubles. The apartment was jointly acquired property, respectively, 50% belongs to the wife and another ¼ is due to her by inheritance. The spouse is exempt from paying state duty because she lived together with the testator.

The cost of notary services will be approximately 3 thousand and 200 rubles. for the allocation of the marital share. Obtaining a certificate of cadastral value 350 rubles. In total, the wife will have to pay 3,550 rubles.

What is the cost of registering an inheritance with a notary after the death of one of the parents?

When registering an inheritance after the death of a mother or father, you should take into account the above recommendations. The cost of expenses is calculated similarly to the examples discussed.

The total cost is affected by:

- Living together with a deceased parent.

- The need to evaluate objects of inheritance.

- Availability of title documents.

- Whether the successor participates personally or through a representative.

Is tax due paid?

Until 2005, citizens paid tax on inherited property. But this norm was abolished. In accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, income received as a result of inheritance is exempt from taxation.

However, you will still have to pay a fee when inheriting:

- Rewards for creating an original work of science and literature.

- An object of art, if it is sold.

- Rewards for invention, creation of an industrial design or utility model.

How much does it cost to register property rights?

After receiving a certificate of inheritance, the successor must contact the appropriate government agency to re-register ownership.

Registration of a private house or apartment is carried out in Rosreestr according to the tariffs established by Art. 333.33 Tax Code of the Russian Federation.

The cost of re-issuing documents for these objects will be 2 thousand rubles. For re-registration of a share in the right of common shared ownership, you will also have to pay 2 thousand rubles. State registration of ownership of a land plot will cost 350 rubles.

The list of tariffs for performing registration actions in relation to real estate can also be found on the Rosreestr website.

The registration of a vehicle is carried out by the territorial division of the traffic police. The costs will be 850 rubles. For changing license plates, the fee will be 2,850 rubles. You must register your car within 10 days. Violation of the established deadline is punishable by a fine.

When the successor received funds in a bank account as an inheritance, nothing needs to be paid. The heir must contact the bank with an application to withdraw funds from the account and provide a certificate of title to the property of the deceased.

When does the right to benefits arise?

Some categories of property are recognized as preferential. This means that no fees are charged when inheriting them. The list of categories is enshrined in Article 333.38 of the Tax Code of the Russian Federation.

The list includes the following property:

- pension contributions;

- insurance and royalties;

- bank deposits;

- compensation that was provided for the accident that caused the death of the testator;

- the property belonged to citizens who were subjected to political persecution or died in the performance of civic duty;

- state insurance payments.

The list is not exhaustive. You can study the full list by reading the current legislation. Certain categories of citizens are also entitled to a reduction in registration fees.

The list includes:

- minor children of the testator;

- persons with mental disabilities;

- persons with first and second disability groups.

Disabled people of groups 1 and 2 have the right to receive a 50% discount. The assignee is obliged to pay the state fee personally, depending on the volume of property received. The rule is enshrined in the Tax Code of the Russian Federation.

Video

How much does it cost to inherit through court?

Resolution of disputes between claimants to the property of the deceased is possible in court.

The grounds for going to court may include:

- Missing the deadline for filing an application for inheritance.

- Disputes regarding the division of property.

- Infringement of the interests of heirs entitled to an obligatory share.

- Preemptive right to an indivisible thing.

- Challenging the last will of the testator.

- Refusal of a notary to issue a certificate of title to the property of the deceased.

- Establishing the fact of acceptance of inheritance.

The presented list of grounds is not exhaustive.

An obligatory step when applying to the judicial authorities is the payment of state fees. A document confirming compliance with this condition is attached to the statement of claim.

In addition, the successor has the right to seek the help of a lawyer to obtain advice or represent his interests in court. These costs can be recovered from the defendant if the plaintiff's demands are satisfied.

See also:

How to challenge an inheritance without a will in 2021 - step-by-step instructions

How to legally enter into an inheritance through the court in 2021 - step-by-step instructions

What is the amount of state duty when going to court?

The amount of the state fee depends on the type of legal proceedings and the subject of the dispute. The fee for property claims is calculated in accordance with Art. 333.19 of the Tax Code of the Russian Federation and consists of a fixed amount and a percentage of the value of the property:

- For claims from 20,001 to 100 thousand - 800 rubles. and 3% of the amount over 20 thousand.

- For claims from 100,001 to 200 thousand - 3,200 rubles. and 2% of the amount over 100 thousand.

- For claims from 200,001 to a million - 5,200 rubles. and 1% of the amount over 200 thousand.

- For claims over a million - 13,200 rubles. and 0.5% of the amount exceeding 1 million.

If the value of the claim is up to 20 thousand, the state duty is 4%. However, it cannot be less than 400 rubles. and exceed 60 thousand rubles.

When the subject of the dispute is a share in the property of the deceased, its value is taken as the basis.

When considering cases to establish a legal fact (dependency, acceptance of inheritance, restoration of a term), the state duty rate is 300 rubles. The successor will have to pay a similar amount if the will is contested.

Who is exempt from paying state duty

For disputes arising from inheritance legal relations, disabled people of groups 1 or 2 are exempt from paying state duty in accordance with Art. 333.36 Tax Code of the Russian Federation. In this case, the cost of the claim should not exceed 1 million.

Remember

- Entering into an inheritance involves certain costs on the part of the heir.

- You will have to pay for notary services, property valuation, state duty for issuing a certificate of inheritance and for registering property rights.

- The more objects of inheritance, the higher the cost of entering into inheritance.

- Some categories of citizens are exempt from paying state duty.

- The total amount of expenses depends on the degree of relationship with the deceased, the value of the inherited property, the presence or absence of the necessary documents and personal participation in the inheritance procedure.

- If it is necessary to resolve disputes in court, you will have to pay a state fee.

What will you do? Will you prepare the necessary package of documents yourself in order to avoid paying some expenses when entering into an inheritance? Will you provide the notary with data on the cadastral value of the property or contact an appraisal company?

Cost of obtaining a certificate of ownership

The main cost is associated with providing the certificate. On its basis, a person will be able to dispose of the property of the testator. The document can be obtained 6 months from the date of death of the owner of the inheritance. The certificate is provided only after the value of the property has been assessed. Information about the price of property must be formalized. The examination report must be ordered from the BTI or another specialized government organization.

Current prices are available on the website of the Federal Notary Chamber

In order for the document to be provided, it is necessary to prepare a number of papers, the list of which includes:

- title documents for property;

- cadastral passport;

- papers for land plot.

Depending on the amount indicated in the assessment documents, the amount of payment for the services of a notary representative will be established. If a person cannot carry out the procedure independently, he has the right to issue a power of attorney.

Approximate prices for Moscow:

| Service | Description | Price, rub |

| property valuation | is mandatory for accurate calculation of state duty; the assessment can only be done by a licensed company; the cost depends greatly on the specific type of property | 5-10 thousand and above |

| state fee for issuing a certificate of inheritance | inherited by a person who belongs to the 1* or 2** line of heirs | 0.3% of property value, maximum 100 thousand |

| any other person inherits | 0.6% of property value, maximum 1 million | |

| notary technical services | certification of a will | 100 |

| certification of the will of the testator to revoke his will | 500 | |

| opening an envelope containing a will | 300 | |

| certification of an application for inheritance | 100 | |

| certification of refusal to join | 500 | |

| issuing a copy of any document | 100 | |

| any notary request | 50 | |

| state fee for registration of property | depends on the specific type of property | for apartment decoration – 2000 |

Detailed prices on the official website notariat.ru