The term "duty" is used to refer to a special type of government tax levy. This payment has been used in trade, transport, and legal proceedings at least since the Middle Ages. Most state duties and their amounts are specified in the Tax Code of the Russian Federation, but may also be reflected in other regulations.

Today we will talk about how the state duty for the division of property is calculated in 2021.

We will talk mainly about divorces, since most often property is divided upon divorce. Less common are hereditary disputes.

For example, when several heirs of the same line cannot independently divide the inheritance mass so that “no one is offended.” The cost of the state duty for the division of property in 2021 by inheritance in this case will be calculated similarly to the “divorce” fee.

Amounts of state duty for division of property in 2021

The division of the common property of the spouses is carried out according to the rules established by Articles 38, 39 of the RF IC, Article 254 of the RF Civil Code.

Property acquired by spouses during marriage can be divided by agreement between them. The agreement on the division of property must be certified by a notary. For performing notarial acts, a state fee is paid in the amount established by Article 333.24 of the Tax Code of the Russian Federation

If a dispute arises, the division of property, as well as the determination of the shares of the spouses, are carried out in court. When filing a claim of a property nature in accordance with Article 333.19 of the Tax Code of the Russian Federation, a state fee is paid.

The amount of state duty is regulated by the Tax Code of the Russian Federation.

What property is not divided

According to the law, property acquired before marriage cannot be divided. The following is also not shared:

- things received as a result of donation or inheritance during family relationships;

- clothing, footwear, personal hygiene items and personal use;

- copyright.

Expert commentary

Kamensky Yuri

Lawyer

If the property was acquired after the spouses actually moved to different places of residence, but during the marriage, it is subject to division.

Most often, citizens divide real estate and cars acquired during marriage. Such things are virtually indivisible, so the parties can receive monetary compensation or the provision of other valuables in return for those required. The latter is possible only by agreement.

State duty when dividing property through court

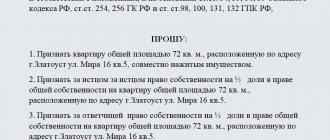

Division of property through the court is the filing of a claim of a property nature, subject to assessment. When dividing the property of spouses, the court determines what property is to be transferred to each of them. Shares in the common property of spouses are recognized as equal, unless otherwise provided by an agreement between the spouses. The court may deviate from equality of shares. The share is calculated not from the number of property objects, but from the estimated value of the objects.

Example: The married couple Anna and Matvey bought 2 cars: a Ford Transit cargo van and a Volkswagen Polo sedan. The husband used a truck, earning money by transporting goods. The wife used the car for personal purposes and for the benefit of the children. Matvey's car cost 2,500,000 rubles, and Anna's - 800,000 rubles. When dividing property, each spouse will receive 1 car, but Matvey must pay additional compensation to Anna, since his car is more expensive.

Calculation: 2,500,000 + 800,000 = 3,300,000 rub. - the cost of joint ownership. Each spouse is entitled to 1/2 share: 3,300,000: 2 = 1,650,000

The cost of Anna's car was 800,000 rubles, so Matvey must pay an additional 850,000 rubles. Anna will have to pay the state fee to the court, based on the price of the claim - 850,000 rubles.

Article 333.19 of the Tax Code of the Russian Federation establishes the amount of state duty when filing a claim of a property nature:

What determines the cost of a lawyer?

1. Presence of children and property (and its size)

Lawyers say family law is like Lego. It consists of different details, and these details are various legal relationships between people.

Firstly, if spouses bought something together during marriage, property relations arise between them. If, during a divorce, spouses decide to divide jointly acquired property, then there are certain rules by which they can do this, says Anna Agranovich, lawyer at the Moscow Bar Association.

“If the spouses borrowed some money (no matter where: in a bank, from a friend or relative), then debt obligations also arise,” says Anna Agranovich. “That is, not only the family’s property is common, but also debts.”

In addition, a couple could become parents during marriage. As soon as a baby is born, parents have the obligation to take care of him, raise him, and be responsible for his health, upbringing and education. In the event of a divorce, alimony relations arise between them. “Alimony cases are resolved quite quickly, but when the spouses begin to determine the child’s place of residence in court, the resolution of the dispute may drag on,” says Yulia Galueva, deputy general director for legal issues at NUS Amulex.

Thus, the cost of a divorce will depend on whether the divorcees have children, jointly acquired property, and whether the process is complicated by additional factors.

2. Experience, knowledge, promotion and self-esteem of a lawyer

Lawyers are classified as self-employed. “They don’t have a boss, an employer. They provide themselves with work, and if necessary and possible, they hire assistants, secretaries, accountants and pay for their work,” says Anna Agranovich. — Therefore, each lawyer, in principle, determines the cost of his services himself. A specialist who just finished his internship yesterday is worth money alone. A lawyer who has 20–30 years of experience is a completely different class and a different price tag.”

Yulia Galueva from NUS Amulex agrees that the cost is also determined by the name of the lawyer and his importance in the legal world. “Young professionals who have not built up a clientele tend to charge a lower price for their services,” says the expert. “Experienced lawyers with a staff of assistants and trainees, a large number of clients, of course, charge substantial fees.”

3. Region of residence

Capital prices, of course, are higher than in the regions. The cost can vary by a few percent or several times.

State duty for an agreement on division of property

Spouses can independently divide property by agreement (Article 38 of the RF IC). In accordance with the legislation of the Russian Federation, an agreement on the division of common property must be notarized. For certification of this agreement, Article 333.24 of the Tax Code of the Russian Federation provides for the payment of a state duty, which is 0.5 percent of the agreement amount, but not less than three hundred rubles and not more than twenty thousand rubles.

In what cases can you conclude an agreement on the division of property and how to draw it up correctly?

Grounds for division of property

In accordance with the RF IC, any property acquired during marriage is jointly acquired, even if one of the spouses did not work.

The basis for its division is the appeal of one of the parties to the court, while the distribution of shares is possible both during the marriage and during or after the divorce process. There is another option for the division - concluding an appropriate agreement with a notary. In this case, it is not the state duty that is paid, but the notary fee for certification of the transaction. An agreement can be drawn up if both spouses have agreed on the distribution of shares and have no objections. In other cases, it is necessary to go to court.

Valuation of property for calculating state duty

To calculate the state duty when filing a property claim, it is necessary to conduct an assessment of the property.

The cadastral value of the property is taken as the basis for the value of real estate. The cadastral value is indicated in the extract from the Unified State Register. You can contact an independent appraiser to calculate the cost and choose an acceptable option for calculation.

The valuation of movable property is carried out by an appraisal company or an independent appraiser. The appraiser must be a member of one of the self-regulatory organizations of appraisers and comply with the requirements of the Federal Law “On Valuation Activities in the Russian Federation” dated July 29, 1998 N 135-FZ.”

How to calculate the state duty when dividing property

The state duty when dividing the common property of spouses is calculated not from the value of the entire property, but from the value of the share in this property claimed by the plaintiff.

Claim price up to 20,000 rubles

Example: Spouses share a refrigerator worth 18 thousand rubles. The plaintiff claims 1/2 share. Calculation of state duty: 4% x 9,000 (claim price) = 360 rubles.

The amount of the state duty for a claim up to 20 thousand rubles cannot be less than 400 rubles, so the plaintiff will have to pay 400 rubles.

When submitting a settlement agreement to the court, the spouses have the right to independently determine who will bear what expenses, including payment of state fees.

The cost of the claim is up to 100,000 rubles

If the claim price is from 20,001 rubles to 100,000 rubles, the state duty is calculated as follows:

800 rubles (fixed amount) plus 3% of the amount exceeding 20,000 rubles.

Example: Spouses share a garage worth 100 thousand rubles. The husband filed a claim for recognition of his 1/2 share in this property. The cost of the claim is 50,000 rubles. Calculation of state duty:

800 rubles + 3% x 30,000 rubles (50,000 rubles – 20,000 rubles) = 1,700 rubles.

Claim price up to 200,000 rubles

If the claim price is from 100,001 rubles to 200,000 rubles, the calculation is:

3,200 rubles plus 2% of the amount exceeding 100,000 rubles.

Example: The claim price is 180 thousand rubles. Calculation of state duty:

3,200 rub. + 2% x 80,000 rub. (180,000 rubles – 100,000 rubles) = 4,800 rubles.

The cost of the claim is up to 1,000,000 rubles

If the claim price is from 200,001 rubles to 1,000,000 rubles, the state duty will be: 5,200 rubles plus 1 percent of the amount exceeding 200,000 rubles.

Example: During the marriage, the spouses purchased a car worth 900 thousand rubles. The wife claims 1/2 share. The cost of the claim is 450 thousand rubles. The state duty that the spouse will pay is:

5,200 rub. + 1% x 450 thousand rubles. (900,000 – 450,000) = 9,700 rubles

The cost of the claim is over 1,000,000 rubles

If the value of the claim is over 1,000,000 rubles, the state duty payable is calculated: 13,200 rubles (fixed amount) plus 0.5% of the amount exceeding 1,000,000 rubles, but not more than 60,000 rubles;

Example. Plaintiff Markov filed a claim for division of the jointly owned house. The cost of the house was 6 million rubles. The plaintiff claims 1/2 share in the house. The cost of the claim is 3 million rubles.

Calculation of state duty: 13,200 (fixed amount) + 0.5% (of the amount more than 1 million rubles) x 2 million rubles = 23,200 rubles.

Changing the price of a claim: how to calculate the state duty

During the court hearing, the value of the disputed property may change. The amount of the state duty in this case is also adjusted.

Example: Plaintiff Moiseeva filed a lawsuit for the division of production premises, which she valued at 5 million rubles. Since the husband used this premises for his own commercial purposes, Moiseeva demanded that she be paid compensation in the amount of 2 million 500 thousand rubles, and that ownership of the property be recognized by her ex-husband.

The plaintiff paid a state fee in the amount of:

13,200 rubles + 0.5% x 1,500,000 rubles (amounts exceeding 1,000,000 rubles) = 20,700 rubles

The court ordered an independent appraisal examination, according to the results of which the cost of the property amounted to 3 million 800 thousand rubles.

As a result, the judge made a decision recognizing the defendant’s ownership of the disputed property and ordered him to compensate his ex-wife for the cost of her share in the amount of 1,900,000 rubles, which is 1/2 of the price of the property.

Thus, the plaintiff must pay a state fee in the amount of:

13,200 rubles + 0.5% x 900,000 rubles (amounts exceeding 1,000,000 rubles) = 17,700 rubles

The overpayment amount was 3,000 rubles. The defendant will pay a state fee in the amount of 17,700 rubles, of which 3,000 rubles will be collected in favor of the plaintiff (compensation for overpaid fees) and 14,700 rubles to the budget.

If the value of the disputed object had not changed, then a fee in the amount of 20,700 rubles would have been collected from the defendant.

Who pays the state fee?

The obligation to pay the fee rests with the plaintiff.

When making a decision on the division of property, the court recalculates the duty based on the amounts awarded to each party. Also, the state fee is collected from the defendant, being calculated based on the value of the property awarded to him.

If the plaintiff paid an amount that exceeded the amount due, then the court has the right to recover from the defendant the excess amount paid by the plaintiff in his favor. The remaining part, calculated based on the value of the property awarded to the defendant, is subject to credit to the budget.

If the spouses agreed in court to resolve the issue amicably and submitted a settlement agreement to the court for approval, then it is necessary to determine the fate of the court costs incurred, including the fee. As a rule, everyone is left with their own expenses, but spouses are not deprived of the right, on a contractual basis, to distribute expenses in any convenient way. For example, put them on one of the sides.

Procedure for paying state duty

The state fee is paid before filing the claim. Details for payment must be clarified in the court in which the claim is filed. Most courts have details on their website, where you can also print a completed receipt for payment.

You can pay the state fee at any bank branch with the help of a bank specialist or yourself through a terminal. It is important to correctly indicate the purpose of the payment - payment of the state duty and the details of the payer (the citizen filing the claim).

The fact of payment of the state duty is confirmed by a payment document. When paying via Internet banking, the document must have a bank mark.

Grounds and procedure for refund of state duty

The paid state fee is subject to partial or full refund in the following cases:

- payment of state duty in a larger amount than provided for by the tax code;

- return of application or refusal to accept;

- termination of the proceedings or leaving the application without consideration;

- refusal of the person who paid the state duty to go to court.

An application for a refund of the overpaid amount of state duty is submitted by the payer to the tax authority at the location of the court in which the case was heard.

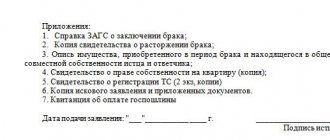

The following must be attached to the return application:

- decisions or certificates from courts about the circumstances that were the basis for the return;

- payment documents:

- genuine if the duty is fully refundable;

- copies of payment documents if part is being returned.

Refunds of overpaid state fees are made within one month from the date of filing the application for refund.

How can I pay

Who pays

According to the general rule, in accordance with the norms of the Civil Procedure Code, the state fee for consideration of a claim by judicial authorities must be paid by the plaintiff before filing an application.

Deferment and installment payment

However, if the plaintiff, due to certain circumstances, for example, difficult financial situation, is unable to pay the full cost of the fee, then the court may, by its decision, grant him a deferment or oblige him to pay the state duty in installments. This legislative norm is very relevant for young mothers who are on maternity leave to care for a young child and because of this do not have an independent source of income.

How to achieve a deferred payment?

- You write an application to the court for an installment plan or deferment of payment of the state fee.

- Attach to the application a corresponding document confirming your words that you are currently unable to pay the required amount of money to the state.

- The judge reviews your papers and makes a decision to grant or deny your request.

Where to find out details

You can view the details for payment on the official website of the court to which you plan to apply for protection, and also ask them from the secretary of the court session, to whom you will bring your statement of claim.

What does a sample form look like?

A blank form that needs to be filled out with payment details looks like this:

the form is available at

.

Where can I pay?

Due to the wide variety of methods that can be used to pay state fees, this procedure is unlikely to be very difficult for you. Let's look at the most typical ways in which mandatory government payments are currently usually paid:

- Contact the operator of any bank and provide him with a form with completed details. If you pay state duty through Sberbank, then, as a rule, the operator knows the details of the most popular payments and will process them without any problems. Don't forget to pick up a receipt and check confirming your payment.

- Another convenient option is to pay the mandatory fee through an ATM. Due to the fact that the interface of ATMs at different banks is often noticeably different from each other, it is impossible to give precise recommendations on how to make a payment through a bank terminal. If you need assistance, please contact a bank employee.

- You can pay the fee online. You will need to go to the Internet bank of the banking institution where you are served, find payment of the state duty in the “Payments” tab, enter the appropriate details and transfer the money. After completing the transaction, do not forget to print a check to submit it to the court.

- If you have access to the State Services portal, you can pay the state fee through it.

- Check the website of the court you are interested in. It may be equipped with a service that allows users to make payments for legal services from courts.

Receipt validity period

As for fees paid for legal services of the courts, there are no such strict rules as there are, for example, in relation to fees paid for a driver's license or passport replacement, which are valid for a limited period of time. The fact is that the amount of money that is transferred to the state by the plaintiff in a property division case depends on the assessment of the value of this property. In this regard, the receipt becomes invalid only in one case: if the price of the claim changes. In this case, the plaintiff must take one of two actions:

- Pay the missing part of the funds;

- Demand a refund of overpaid funds.

Is it possible to return payment and how to do it

The state grants you the right to a refund of the money spent in certain cases specified by law, namely:

- You have abandoned your claim in court;

- The court did not accept your statement of claim;

- The court has terminated proceedings on your claim;

- Your claims were left unconsidered by the judicial authority;

- You have overpaid beyond the required amount.

- In the event of your death, your heirs can return the state fee if they refuse to support your claims in court.

To get your money back, you will first need to submit an application, with the help of which you justify the legality of the return of the state duty, to the same court that heard your case. Based on the results of consideration of the application, the judge makes a decision. If it was accepted in your favor, you will need to wait fifteen days until it comes into force.

Next, go with this determination and an application for a refund to the tax office located in the locality of your registration. After submitting documents to the tax office, expect funds to be transferred to your account within a month.

Lawyer's answers to frequently asked questions

My husband and I share a common apartment worth 3 million rubles. What share will I receive and how much state duty will I have to pay?

If the apartment is jointly owned, you are entitled to 1/2 share. The state duty will be calculated from the cost of your share, equal to half the cost of the apartment (1,500,000 rubles):

13,200 rubles + 0.5% (of the amount exceeding a million) x 500,000 rubles (1,500,000 – 1,000,000) = 15,700 rubles.

My wife and I divorced and filed for division of property. I am disabled group 1. Do I have benefits when paying state fees?

According to Article 333.36 of the Tax Code of the Russian Federation, when filing claims of a property nature with courts of general jurisdiction, as well as magistrates, plaintiffs (administrative plaintiffs) - disabled people of group I or II, are exempt from paying state duty, if the cost of the claim does not exceed 1,000,000 rubles.

If the price of the claim exceeds 1,000,000 rubles, these payers pay the state duty in the amount calculated in accordance with subparagraph 1 of paragraph 1 of Article 333.19 of the Tax Code and reduced by the amount of the state duty payable if the claim price is 1,000,000 rubles.

When should I pay the state fee when filing a claim for division of property in court?

The state fee must be paid before filing a claim. A receipt for payment of the state duty is submitted to the court with an application and a package of necessary documents.

Can property valuation be done by any company?

Property valuation can be done by an independent appraiser or appraisal company that is licensed to engage in this activity.

Deferment or installment payment

Some citizens, having calculated how much the division of property will cost in 2021, fall into a slight panic. Especially if family members are not rich, although they have expensive property (for example, good housing was privatized for free). It is difficult for them to pay several tens of thousands of rubles in duties at once.

The plaintiff has the right to apply to the court for an installment plan. The application must be supported by documents confirming the difficult financial situation at the moment. Certificate of low salary, temporary lack of income, or being on maternity leave.

So, we figured out how much property division costs in 2020. The main criterion is the cost of the claim. The more assets spouses need to divide, the higher the legal costs will be. Therefore, it makes direct sense to agree on a division out of court.

If you have any questions or need help in the divorce process, we recommend that you seek advice and legal assistance on the prav.io website.

Experienced family lawyers will help you carry out the process with the least material costs and stress.