The question “What will be the amount of child support for one child?” is equally of interest to both the parent who leaves the family and the one who remains with the child.

The first one (most often, this is the father) wants to know how much money he will have to pay from his salary every month. The mother, who is now entirely responsible for the strategic calculation of child support, is trying to understand what part of these expenses will be borne by her estranged ex-husband.

This article will help you calculate the amount of your alimony payment yourself.

How to calculate alimony if there is voluntary consent of the parties

If it is possible to conclude a voluntary agreement between the parties, alimony is calculated in accordance with the following rules:

- child support should not be less than the amount that the joint offspring could claim to receive in the event of an appeal to the court.

- The calculation of child support for one child must be a monthly share of the payer's income (0.25% of the parent's salary).

- For the maintenance of two children, 0.33% of the salary is withheld from the payer monthly.

- For the maintenance of three or more children, a parent is required to contribute half of his or her monthly earnings (50% of income).

Child support , if there is a voluntary agreement, can be paid as follows:

- As a share of the parent's income.

- In a fixed amount of money, which the payer undertakes to transfer periodically, but at least once a month.

- A lump sum of money paid in one lump sum.

- Alimony for the maintenance of a minor child can be presented in the form of certain property.

- Other methods specified in detail in the voluntary agreement of the parties.

From what time (what date) is alimony collected?

As a general rule, alimony is collected from the date of filing the claim (application for a court order) in court.

However, if initially there was a collection within the framework of writ proceedings, the debtor canceled the court order, and then a lawsuit followed, alimony should be collected precisely from the date of filing the application for the court order.

As for the collection of alimony for the past period, the legislation allows this, but only within the last three years and only if it is duly proven that the claimant had previously taken measures to obtain funds for the maintenance of children, but they were unsuccessful , the debtor evaded payments.

Telegrams, registered and email letters demanding payment of alimony, testimony of witnesses, contacting law enforcement agencies with a statement to search for the debtor, etc. can be accepted as such evidence. The Supreme Court of the Russian Federation recognized this approach as legitimate.

A civil case for the collection of alimony for the past period can only be considered according to the general rules of claim proceedings; in this case, a court order cannot be issued.

The basis for refusal to collect alimony for the past period is the mother’s demand not only to collect alimony, but also to establish paternity in relation to her minor child; before the claim to establish paternity was satisfied, the defendant was not actually recognized as the father of the child and had no obligation to pay alimony.

Ignorance of the laws of nature does not exempt you from paying alimony (folk).

How to calculate alimony when withholding through the court

child support payments by applying to a court, the calculation is made in accordance with the following standards:

- The payer monthly transfers 0.25% of his earnings for the maintenance of one child

- To support two children, a parent is required to transfer 0.33% of income monthly.

- If there are three or more children in a family, 50% of the payer’s income is allocated monthly for their maintenance.

In the last two cases, it does not matter into which family the child was born. Alimony payments in the form of shares of income are assigned if the payer has a stable income and is officially employed.

- If a parent who is obligated to pay alimony for the maintenance of a child who has not reached the age of majority does not have a permanent place of work or regular income, the court has the right to oblige him to pay alimony based on the calculation of the minimum wage in the region. Payments are assigned in shares of the minimum wage (in 2021, the amount of the minimum monthly earnings is 6,204 rubles).

- child support payments may be calculated in the form of a fixed sum of money. Compensation for alimony payments in the form of movable and immovable property is also allowed.

Debt on alimony

I specifically decided to prepare this article for those parents from whom alimony was collected in court for their children, but for various valid reasons they could not properly regularly pay alimony, as a result of which the bailiff (hereinafter referred to as the bailiff) calculated they owe tens or hundreds of thousands of rubles in alimony.

Debt for alimony for minor children is usually calculated by the bailiff on the basis of Article 113 of the Family Code of the Russian Federation (hereinafter referred to as the RF IC) and on the basis of Article 102 of Federal Law No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ ) at the request of the recipient of alimony or on his own initiative.

Indexing

The settlement agreement must necessarily stipulate the condition for indexing alimony payments. Otherwise, the process of indexation of payments will be regulated by the norms set out in Article 117 of the Family Code of the Russian Federation. The article establishes the need to index alimony:

- Payments are indexed in proportion to the increase in the cost of living for certain socio-demographic groups of the country's population. The minimum cost of living is established in each subject of the state. In turn, the subject is determined by the place of residence of the recipient of the payments.

- Payments for child are indexed in proportion to the increase in the cost of living for socio-demographic groups for the country as a whole (the measure is taken into account if the minimum amount is not provided in the constituent entity of the Russian Federation).

Alimony, which is paid on the basis of a court decision, is also subject to indexation in accordance with similar rules.

The concept of “clean” and “dirty” wages

Before you find out the procedure for calculating enforcement payments, you need to understand the types of salaries. “Dirty” wages are the total income that the payer receives from one employer without taking into account taxes.

Everything that an employee receives monthly after deducting tax deductions through a cash register or on a bank card is called net wages.

Individual entrepreneurs also pay alimony from wages on a general basis, only the calculation base will be the amount of their income registered in tax returns. The procedure for confirming income for individual entrepreneurs is enshrined in the joint Order of the Ministry of Labor, the Ministry of Finance and the Ministry of Education of the Russian Federation No. 703n/112n/1294 dated November 29, 2013.

For those individual entrepreneurs who conduct their financial and economic activities on the PSN (patent), profitability will be determined in the income book for the patent system (Order of the Ministry of Finance No. 135n dated October 22, 2012).

Obviously, the salary before taxes is significantly higher than the final amount. That is why many people have questions regarding what kind of salary alimony is calculated from - “clean” or “dirty”?

The accountant is responsible for calculating all payments in accordance with current legislation. Next, we will look in detail at how exactly the amount of alimony is calculated.

Types of income that may be subject to alimony payments

Alimony payments are subject to recovery from the following types of income of the payer:

- Any types of wages (monetary rewards, maintenance).

- Additional remuneration (for example, for overtime hours).

- Allowances and additional payments to fixed salaries (for class, for length of service, etc.).

- Prizes and rewards.

- Vacation amounts.

- All types of pensions.

- Scholarships.

- Benefits (for example, disability or unemployment, others).

- Income from business activities.

- Income received as a result of concluding civil contracts.

Types of income from which deduction is not possible

Alimony payments cannot be withheld from the following income of the payer:

- Amounts paid as compensation for damages caused to health.

- Amounts received as a result of injury in the performance of official duties.

- Payments in the form of compensation (for example, after man-made disasters, for caring for disabled relatives, etc.).

- Income arising from business trips.

- Income related to compensation for wear and tear of working equipment.

- Survivor pensions.

- Humanitarian assistance.

Punishment for non-payment of alimony

To combat debtors, alimony laws provide for various measures:

- Revocation of a driver's license.

- A ban on certain forms of government services, such as obtaining a passport or taking a traffic police exam.

- Public posting of photos of debtors. Although this point has not yet been fully finalized, a significant reduction in the number of willful defaulters is expected.

- Ban on leaving the territory of the Russian Federation. This sanction is due to the fact that alimony recipients purposefully hide their true income, while still having the opportunity to travel abroad.

- Standard punishments are fines, penalties, correctional labor or imprisonment.

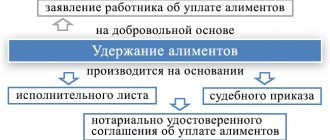

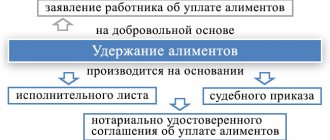

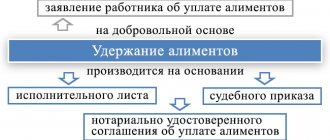

Grounds for collecting payments

Alimony payments are collected if the following documents are available:

- Performance list. The document is issued by the court after a positive decision is made to satisfy the claim for the collection of alimony payments.

- Court order. The document is issued by the court without legal proceedings in cases where the payer’s obligation is undeniable (for example, if an alimony agreement has been concluded between the interested parties).

- Alimony agreement. This is a notarized agreement that has the legal force of a writ of execution.

- The basis for collecting alimony payments is the presence of a relative or other family connection between the interested parties.

Which court should I file for alimony?

Until October 1, 2021, disputes regarding the collection of alimony were the jurisdiction of magistrates, but after amendments to the procedural legislation came into force, all claims related to alimony obligations began to be considered by district courts. Thus, a statement of claim for the collection of alimony should be filed in the district court, but if you go to the magistrate’s court, the application will be returned. An application for a child support order is still submitted to the Magistrate's Court. The territorial jurisdiction has not changed; you can apply both at your place of registration and at the place of registration of the defendant. The applicant has the right to choose the most convenient option for him (alternative territorial jurisdiction).

The procedure for calculating alimony based on the subsistence level

The procedure for calculating alimony (in a fixed amount) depends on the place of residence of the recipient of the funds. To calculate the amount, you should follow the following rules:

- At the time of the court decision, the amount of the subsistence minimum must be determined.

- The multiple of the subsistence minimum to the amount of alimony payments in a fixed amount is determined.

- The multiple is multiplied by the cost of living at the time the amount is calculated.

For example, the recipient of alimony lives in Moscow. He was given an amount of 10,500 rubles. At the time of the court decision, the cost of living for the region was 10,443 rubles. The multiple was 1.005 (10500/10443). The amount of alimony will be 10,552.5 rubles monthly (10,443 * 1,005).

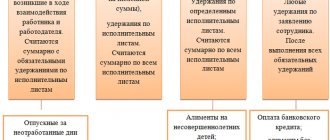

Ways to deduct alimony from wages

It is rare that a parent independently solves the problem of withholding child support from his own salary: only responsible persons are ready for this, who will not allow debt to arise, much less withholding in the amount of 70% of earnings (the maximum percentage of withholding if there is a debt), therefore they are ready to immediately pay the entire amount alimony payments.

Child support is withheld from wages in two ways:

- voluntarily;

- forcibly.

Voluntary payment of alimony

When voluntarily paying alimony to the parent in whose favor the amounts will be transferred, there is no need to contact the judicial authorities. The basis for the transfer may be a child support agreement, which has the force of a writ of execution, an agreement between the child’s parents, or simply a desire to provide assistance in raising the child.

The employee independently writes a statement to the employer with a request to make deductions as a percentage or as a fixed amount in favor of his child. The application shall indicate:

- the organization in which the alimony payer is employed;

- Full name and passport details of the payer;

- Full name and passport details of the alimony recipient;

- Full name and date of birth of the child in whose favor deductions will be made;

- income from which alimony will be withheld;

- amount of deductions (percentage or fixed amount);

- frequency of deductions per month;

- transfer period (at least until the child reaches adulthood);

- the date from which the amount must be withheld;

- Bank details of the recipient of alimony payments.

Collection of alimony in court

Writ proceedings are a simplified procedure involving the issuance of a court order. The process is considered to be the most effective. To consider a claim under simplified proceedings, you must submit the following list of documents:

- Certificate of family composition.

- Documents confirming the presence or absence of sources of income, the amount of income.

- Certificate of place of residence.

- A certificate indicating that you are in an official family (marriage) relationship.

- Birth certificates for children dependent on their parents.

Claim proceedings are a universal method of resolving issues related to the calculation and collection of alimony payments. Alimony can be assigned as a share of the payer’s income or as a fixed sum of money. You can also go to court to recover funds for the previous period.

To open legal proceedings, you must provide the following list of documents:

- A copy of the plaintiff's passport.

- Copies of children's birth certificates.

- A copy of the certificate of conclusion and dissolution of the marriage union.

- Certificate of family composition from the place of residence of the applicant and the defendant (if available). Original document required.

- Calculation of the amount required to cover the costs of child support (a comprehensive, detailed justification of the costs is required).

Author of the article

Kuznetsov Fedor Nikolaevich

More than 15 years of experience in the legal field; Specialization - resolution of family disputes, inheritance, property transactions, disputes over consumer rights, criminal cases, arbitration processes.

Does the father of the children have other child support obligations?

The number of children of the debtor for whom he pays alimony is important not only for determining the share of income that will be collected for each of the children, but also for the procedural side of the civil case.

For example, if there are alimony obligations for 5 children, the share of each is 1/10; when the first child reaches adulthood, it will change to 1/8, and so on until all the debtor’s children reach adulthood.

If there is no dispute about paternity, that is, the debtor is listed on the child’s birth certificate, does not bear any other alimony obligations, and has an official stable income, then you should apply to the court to issue a court order to collect alimony in a proportion to income, which will be considered by a judge within 5 days without calling the parties.

A court order for the collection of alimony is an executive document and is subject to immediate execution. But the debtor, having not agreed with it, has the right to cancel it within 10 days after receipt. Then you will need to go to court again with a statement of claim, which will be considered by the court with the parties summoned to court hearings.

Applying to the court immediately with a statement of claim for the recovery of alimony (bypassing receiving a court order) in the case described above will entail its return, since the claim can be considered in the order of writ proceedings. This is explained in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 27, 2021 No. 62.

If it is known that the debtor already has alimony obligations, or it is intended to collect alimony in a fixed sum of money, then a claim should be immediately filed in court; such claims cannot be considered without calling the parties.