The role of the power of attorney

Any work must be paid, and the worker can receive payment either personally in the company’s accounting department, or by transferring earnings to a personal salary card. The second option has recently become the most popular. This is due to its convenience: it does not require any extra effort on the part of the employee, everything happens automatically.

However, sometimes, for some reason, such methods of paying wages are impossible. For such cases, the law provides for the possibility of receiving wages through an authorized person presenting a written power of attorney.

Specifics of salary payment

The main issues relating to the payment of wages are regulated by Ch.

– 21 Labor Code of the Russian Federation. Wages are paid twice a month, at least every half month. The exact date of such payment is indicated in the collective or employment contract (it is also stated here when and where non-monetary earnings are paid) or internal labor regulations. The latest date is the 15th day of the month following the one to be paid. If this day is a weekend or holiday, wages are paid on the last working day before it. Vacation must be paid before it starts (at least three days in advance). Wages are paid (directly to the employee, unless a federal law or employment contract provides for another method) at the employer’s cash desk or to a bank card. In the latter case, the employee has the right to change the bank to which his remuneration for work is transferred. He must declare this in writing at least five working days before the payment date.

When paying wages, the employer is obliged to issue the employee a payslip (the form of which he also approves), which states:

- what specific earnings consist of;

- the amount of amounts accrued to the employee;

- how much was withheld and why (usually a specific order is indicated);

- the total amount of money paid.

Does an employer have the right to refuse to receive a salary by proxy?

According to the law, if a power of attorney is drawn up in accordance with all the rules, endorsed by a notary and presented on time, the employer does not have the right to refuse to pay wages to its bearer.

The only condition: simultaneously with the power of attorney, the employee’s representative must provide the cashier with his passport (or other document proving his identity).

When checking a power of attorney, the employer's representative must check all the data from it with the information from the proxy's passport in the most careful manner. You should also pay close attention to the signature of the principal himself: it must be certified by the head of the personnel department or another employee of the enterprise who has a document at his disposal that allows him to compare signatures.

It would be good if, before sending his representative to collect his salary, the employee of the enterprise finds the opportunity to warn the employer that he will not be able to personally receive the money he earned. This will avoid misunderstandings and unnecessary suspicions.

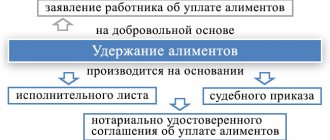

How to certify the authority of an attorney

Is it possible to draw up a power of attorney to receive a salary without a notary, or is a notarized form required? Notarization of such a document is not necessary. And the principal has the right to draw it up in compliance with the mandatory written form and inclusion of the necessary data.

Paragraph 3 of Article 185.1 of the Civil Code of the Russian Federation states that a power of attorney to receive a salary can be certified by an official of the employing organization or the administration of a medical institution. The certificate is issued without charging a fee.

On the part of the employing organization, the manager (general director) or other person authorized to carry out such actions by the organization has the right to certify the document.

For whom can a power of attorney be drawn up to receive wages?

A power of attorney can be issued to any legally capable person who has reached the age of majority and has a passport as a citizen of the Russian Federation. This could be a relative, work colleague or any other close person to whom the trustor can confidently entrust receiving the money earned.

From the moment the money is issued to the bearer of the power of attorney, responsibility for the safety of the funds, right up to their transfer to the principal, passes to him.

It should be noted that some powers of attorney can be drawn up with the right of substitution (only they must be certified by a notary), but in relation to this type of document it is better not to resort to the right of substitution.

Who is eligible to become an attorney?

An employee has the right to entrust the receipt of his salary to any legally capable individual. There are no legal restrictions on the list of attorneys. Typically, a power of attorney to receive a salary is written to a close relative, friend, or colleague.

According to this document, the attorney undertakes to receive funds and transfer them to the principal; he is responsible for the execution of the order. If the order is not properly executed, the principal has the right to revoke the powers of the attorney at any time.

The attorney does not have the right to entrust an order to receive wages to another person. The ban on this is established by paragraph 5 of Article 187 of the Civil Code of the Russian Federation.

Basic rules when drawing up a power of attorney

Today there is no single correct, unified power of attorney template, so employees of enterprises and organizations can write it in any form. The only thing that must be taken into account is that the structure of the power of attorney complies with the norms for writing this type of paper from the point of view of office work and the rules of the Russian language.

In addition, there are a number of requirements that the document must meet in terms of content. It should include:

- personal information about the employee: his position, last name, first name and patronymic, name, address of the organization and structural unit in which he works, as well as passport data (series, number, place and date of issue);

- information about the authorized person: his full name, again passport details and the date of execution of the document (without it it will not acquire legal force);

- the period during which the power of attorney will be considered valid;

- a complete and most detailed list of all rights and powers of the principal’s representative, including receiving wages and the right to sign statements and other payment documents. If the amount to be received by the principal’s representative is known, it must be indicated in the document in numbers and words.

No inaccuracies or errors are allowed in the text of the power of attorney. If any such errors occur during the preparation of the document, they do not need to be corrected; a new form should be drawn up. Abbreviating words and entering abbreviations in the text of the document is also prohibited.

The document is drawn up in a single copy and after presentation to the organization’s cash desk, the cashier must put a note in the payroll statement that the salary was issued by proxy.

Results

If circumstances prevent an employee from receiving a salary in person at the company’s cash desk, he can entrust this operation to another person.

To do this, you will have to issue a power of attorney, in which you must indicate information about yourself and the authorized person, list his powers, set the date for issuing the power of attorney and certify it accordingly.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What to pay attention to when registering a power of attorney

There are also no strict criteria for drawing up a power of attorney: it can be written in handwriting (with a ballpoint pen, but in no case with a pencil) or printed on a computer.

It is important to comply with only one condition: it must contain two signatures - the principal, as well as the person certifying his autograph (a notary or, for example, an employee of the HR department of an enterprise). In this case, the use of facsimile signatures, i.e. printed in any way is not allowed when drawing up a power of attorney.

How long is the document valid?

Indicating the validity period of the power of attorney to receive salary by hand is not a mandatory requirement. If the period is not specified in accordance with paragraph 1 of Article 186 of the Civil Code of the Russian Federation, it will be valid for a year. But if the parties wish to specify a longer period of validity, they are free to do so.

Both the principal and the attorney have the right to terminate the powers of the representative before the expiration of the specified period. In this case, the party terminating the powers of the attorney is obliged to notify in writing not only the other party to the document, but also everyone affected by the action of the assignment. In this case, it is the employer who pays wages on its basis to the employee’s representative.

What rules must be followed

The employee can draw up the document manually or in printed form. In the first case, you must adhere to the general rules:

- no errors or corrections;

- legible handwriting;

- reliability of all information.

The employer must carefully study the contents of the document so that no claims arise later. Particular attention should be paid to the validity period and information about the right to receive funds. Subsequently, this document is attached to the cash receipt and/or payroll.

Legislative regulation

Legal information about the power of attorney is contained in Art. 185-189 Civil Code of the Russian Federation. For a document to be valid, it must be correctly drawn up on paper and signed by the head of the organization.

According to Art. 185.1 of the Civil Code of the Russian Federation, a power of attorney issued by a legal entity does not require notarization; only the signature of the manager is sufficient.

If a power of attorney is drawn up by an individual to order to collect money from an organization, then it must be certified by a notary. Only then will it have power.

It is not necessary to indicate the validity period of the document. But, as stated in Art. 186 of the Civil Code of the Russian Federation, if the period is not specified, the power of attorney will be valid for 1 year from the date of its signing.

Do I need to get it certified by a notary?

For registration, a simple written form is used; it is not necessary to have the documentation certified by a notary.

For certification of the principal’s signature, you can contact the hospital management if the person is being treated. You can contact the management company at your place of residence. If a person cannot receive a salary due to being in prison, then the signature is certified by the head of the correctional institution.

If an employee plans to leave in advance and wants to transfer the right to receive money to another person, then a power of attorney can be written in advance, having his signature certified by the employer.

Kinds

This document can be drawn up under various circumstances. This has a significant impact on the type of power of attorney. Such a document has three types:

- A one-time power of attorney is issued to perform a specific action . For example, this could be receiving one salary, a scholarship, or a money transfer. The document specifies the event for which it was created.

- Special . The most common type of trust document. The company grants authority to the employee who receives regular transfers.

- Generalka . The document gives the representative all the rights that the principal also has. The holder of such a power of attorney is allowed to receive any amounts at any time. He can also be a representative of the principal in any transactions involving funds, both cash and non-cash.

Nuances of filling

When entering information into a document, you should pay attention to its accuracy. For example, information about the representative must be identical to the passport data. There should be no blots or corrections here. Any unreadable information may cause the document to be invalidated.

Also, do not forget that receiving funds is a rather serious procedure. In this regard, the document almost always must be notarized. It is quite logical that the party issuing the money will require a trust document from the representative. If there is no notary signature here, it is considered void. If for some reason this fact was not established and the money was received, the transaction can be challenged. The party that issued the money has the right to go to court, which will declare the transaction invalid.

( Video : “Executing a power of attorney to receive a pension”)

Although in some situations the services of a notary are not required. For example, under certain circumstances, a document may be certified by other authorities. When notarized, the trust document is recorded in the register of documents. It also contains information about which particular notary certified such a power of attorney.