Deductions from an employee’s salary can be made only in cases provided for by the Labor Code of the Russian Federation and other federal laws.

According to Part 2 of Art. 137 of the Labor Code of the Russian Federation, deductions from an employee’s salary to pay off his debt to the employer are made:

- to reimburse an unpaid advance issued to an employee on account of wages;

- to repay an unspent and not returned timely advance payment issued in connection with a business trip or transfer to another job in another area, as well as in other cases;

- to return amounts overpaid to the employee due to accounting errors, as well as in the event that the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards or downtime;

- upon dismissal of an employee before the end of the working year for which he has already received annual paid leave for unworked vacation days.

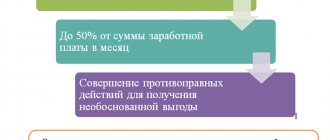

In Art. 138 of the Labor Code of the Russian Federation establishes a maximum amount of deductions depending on their grounds.

As a general rule, the amount of all deductions for each payment of wages cannot exceed 20 percent of the amount. In cases provided for by federal laws, the limit may be up to 50 percent of the payment (for example, when withheld under several executive documents). However, the employee must retain 50 percent of the amount due to him after deducting personal income tax.

The general rule does not apply to salary deductions:

- while serving correctional labor;

- when collecting alimony for minor children;

- when compensating for harm caused by an employee to the health of another person;

- when compensating for damage to persons who suffered damage due to the death of the breadwinner;

- when compensating for damage caused by a crime.

This list is contained in Part 3 of Art. 138 of the Labor Code of the Russian Federation and is closed. The amount of deductions from wages in these cases cannot exceed 70 percent.

The procedure for withholding on writs of execution is established by Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings.” In paragraph 1 of Art. 99 of this Law states that the amount of deductions from wages is calculated from the amount remaining after deducting taxes. Thus, after deducting taxes, an amount can be withheld to pay off the employee’s debt to the employer, if the total amount of deductions does not exceed 20 percent of wages.

Withholding is possible provided that the employee does not dispute its grounds and extent.

A withholding is any reduction in the amount of money that must be paid to an employee as wages.

To deduct from wages, the employer must obtain the written consent of the employee.

In the absence of consent to withhold, the issue of disputed amounts can only be resolved in court. Example 1 Does the employer have the right to reduce the employee’s salary in the current month if in the previous month he was paid a larger amount due to incorrect application of the rules for calculating average earnings?

The employer does not have the right to independently reduce the amount of the employee’s salary in the event that the latter was paid excess amounts in the previous month. According to Part 4 of Art. 137 of the Labor Code of the Russian Federation, overpaid wages can be withheld from an employee only if the accrual was made in connection with a counting error or unlawful actions of the employee established by the court. It should be taken into account that in accordance with Part 3 of Art. 137 of the Labor Code of the Russian Federation, deduction is made provided that the employee does not dispute the grounds and amount of deduction. In other words, the employee must agree to the amount of deduction and the deduction itself from his salary. The reduction in wages in the situation under consideration actually represents its deduction, made in violation of the requirements of the Labor Code of the Russian Federation. An employer can recover overpaid funds from an employee only in court (see Resolution of the Presidium of the St. Petersburg City Court dated May 30, 2007 N 44g-347). Thus, when paying over-accrued amounts to an employee, the employer can go to court to protect its interests by filing a claim for the return of these amounts. The employer has no right to withhold the corresponding amount of money from the employee’s salary (even with his consent).

Regulatory base of deductions

All types of legal deductions from employee income are enshrined in current legislation. First of all, the specifics of applying deductions from wages are prescribed in the Labor Code of Russia, namely in Articles 130, 136–138 and 248 of the Labor Code of the Russian Federation. In addition to labor legislation, the procedure for withdrawals is regulated in the Tax and Family Codes of the Russian Federation, as well as in some federal laws:

- Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”.

- Law of July 21, 1997 No. 118-FZ “On Bailiffs”.

- Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

- Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children.”

It is these legal acts that provide the legislative basis for regulating issues related to deductions from the earnings of Russian citizens.

Types of deductions from wages

The current regulatory framework provides for the following types:

1. Mandatory deductions from wages are types of investigations from the wages of Russian citizens, which are carried out on the basis of legislative norms. For example, personal income tax, which must be withheld from almost all types of income and receipts in favor of individuals.

Mandatory deductions include not only personal income tax, but also deductions from wages based on a writ of execution: alimony, deductions from the earnings of convicted citizens. The key difference from other types is the presence of a legislative or administrative document on the basis of which deductions are made from debtors. An administrative document means a court decision, enforcement proceedings, a writ of execution, etc.

2. Optional - this is a type of deduction from earnings that is made by order of the employer, by agreement between the employer and the employee.

By decision of the employer, amounts excessively transferred to citizens, for example, as a result of a counting error, may be withheld from the income of subordinates. Also, money may be withheld from workers’ earnings in the following cases:

- by order of the body for resolving individual labor disputes, if the employee’s guilt in causing damage, failure to perform duties, or downtime has been established;

- a court ruling established that the employee’s wages were paid in excess due to his failure to fulfill his official duties;

- by decision of the employer, the unearned advance payment transferred towards future wages is withheld;

- by order of the employer, unspent and (or) unconfirmed advances for travel expenses, accountable amounts, and similar payments are withheld;

- compensation to the employer for material damage by financially responsible persons, etc.

There are many reasons for unnecessary wage garnishments. Let's look at some situations in more detail.

3. Voluntary - any type of deduction from earnings made at the employee’s own request, be it the transfer of additional insurance contributions to the funded part of a labor pension, trade union dues or amounts of voluntary donations.

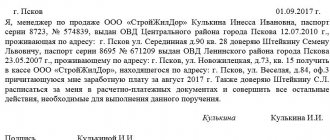

The main difference from other types is the presence of a statement from the employee, which indicates the conditions, amounts and purposes of the withheld amounts. An approximate sample can be downloaded at the end of the article.

4. Special or individual - this is a separate type of penalties that are provided for by local regulations of employers. For example, a company has introduced a penalty for being late. Please note that such penalties are not provided for in current legislation. Officials consider such deductions illegal. However, some employers continue to introduce a system of fines into the wage system.

How to withhold money from an employee

For mandatory deductions, orders from the manager or statements from the employee are not needed; a writ of execution or a copy of it with the order of the bailiff is sufficient.

For deductions initiated by the employer, the list of documents depends on the situation. For example, when withholding an overpaid advance, written consent must be obtained from the employee and an order from the manager to withhold. If a shortage occurs, in addition to these documents, a deficiency report must be drawn up, signed by the commission, and an explanatory note from the financially responsible employee.

General rules and restrictions

The responsibility to withhold funds from citizens' earnings is assigned to persons who accrue and pay income. For the most part, this function is performed by employers.

Withhold money from earnings based on key principles:

- Calculate personal income tax taking into account the requirements of fiscal legislation. Consider the taxpayer’s right to benefits, refunds, tax deductions and concessions.

- Income tax calculated on material benefits or income in kind cannot exceed 50% of earnings. This opinion was expressed by the Federal Tax Service in Letter No. BS-4-11 dated October 26, 2016/ [email protected]

- Calculate the amount to be collected (except for tax) from the amount of salary minus personal income tax. That is, income tax is withheld first. And only then are all other types of enforcement proceedings applied to the amount received.

- The maximum amount of recovery under writs of execution in terms of alimony, compensation for harm to health or damage in connection with the death of the breadwinner is 70%.

- The maximum amount of penalties for writs of execution on other grounds is set at 50% of income.

- When withholding at the request of the employee, no maximum restrictions are established. Any amount specified in the application may be collected. Such standards were outlined by Rostrud in Letter No. PG/7156-6-1 dated September 26, 2012.

- The maximum amount of any other penalties is 20%.

Example. An accounting error was made regarding the employee (a shortage was identified, the advance was overpaid, the report was not confirmed). The employer can withhold no more than 20% of the salary per month until the debt is fully repaid. However, if enforcement proceedings are already in force against this employee, for example, 25% for alimony, then it is unlawful to withhold the overpayment. Maximum withholding limits are not cumulative.

How to avoid material gain when purchasing goods through an employer

The next question that may arise from an accountant of an organization that purchases goods, works or services for employees on account of their salaries is also related to personal income tax. But this time we will talk about the material benefits of saving on interest. Let us recall that material benefits arise from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs with whom the borrower has an employment relationship (subclause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

According to paragraph 1 of Article 808 of the Civil Code of the Russian Federation, in cases where the lender is a legal entity, the loan agreement must be concluded in writing, regardless of the loan amount. In this case, the written form of the agreement is considered to be complied with if, in confirmation of the loan agreement and its terms, a receipt from the borrower or another document is presented certifying the transfer by the lender of a certain amount of money (clause 2 of Article 808 of the Civil Code of the Russian Federation). And by virtue of paragraph 5 of Article 807 of the Civil Code of the Russian Federation, the loan amount transferred to a third party indicated by the borrower is recognized as transferred to the borrower.

Applying these rules to the situation under consideration, we obtain the following conclusion. An application to deduct from wages a certain amount of money that the organization transferred to a third party to pay for goods, work or services for an employee can be regarded as confirmation of a loan agreement concluded between the organization and the employee. And since the employee does not pay interest (only the cost of goods, work or services is deducted from the salary), he receives income in the form of material benefits from saving on interest for the use of borrowed funds (subparagraph 1, paragraph 2, article 212 and subparagraph 7 clause 1 article 223 of the Tax Code of the Russian Federation). Consequently, the lending organization is recognized as a tax agent. Therefore, the accountant needs, as of the last day of each month during the period for which the borrowed funds are provided (i.e. from the moment the company pays for the goods, work or service and until the date of actual deduction of money from the salary), calculate personal income tax on income in the form of material benefits. Matvygoda is calculated based on 2/3 of the refinancing rate of the Central Bank of the Russian Federation (clause 2 of Article 212, clause 3 of Article 226, subclause 7 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

For example, in October the organization paid for swimming pool classes for an employee. Money for these classes is withheld at the employee’s request from the October salary, which is paid in early November. In this case, the company’s accountant will have to calculate and withhold personal income tax on income in the form of financial benefits twice: as of October 31 and as of November 30, based on the number of days the loan was used in each month. This means that in fact, classes in the pool will cost the employee a little more. This can be avoided if you change the procedure for settlements with employees, making it advance payment. The algorithm is as follows. First, the employee writes an application for the transfer of part of his salary as payment for goods, work, and services. Based on this statement, the accountant withholds money from the employee’s salary. And only then the employee receives from the company the corresponding benefit for which he actually paid. In this case, the loan relationship no longer arises. This means there is no material benefit.

Fill out and submit 2‑NDFL certificates using the new form via the Internet Submit for free

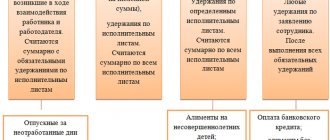

Collection procedure: table

What is the correct way and in what order to collect amounts from the earnings of subordinates? The table will help you figure it out:

| Queue number | Types of deductions | Maximum amount of deduction (based on the employee’s income minus personal income tax) |

| First of all | Alimony according to executive documents in favor of minor children, unemployed spouses or elderly parents | 70 % |

| Writs of execution for compensation for harm caused to health | ||

| Enforcement proceedings for compensation of damages in connection with the death of the breadwinner | ||

| Writs of execution for compensation of damage caused by a crime | ||

| First of all | Enforcement proceedings for compensation for moral damage | 50 % |

| Second stage | Enforcement papers and proceedings for withholding severance pay and wages of persons working (working) under an employment contract | |

| Withholding in enforcement cases of payments of remuneration to the authors of the results of intellectual activity | ||

| Third stage | Enforcement proceedings on mandatory payments to the budget and extra-budgetary funds | |

| Fourth stage | Withholding under enforcement documents for all other claims (for example, collection of a bank loan debt, collection of an administrative penalty in the form of a fine, compensation for property or material damage to the employer) |

If several sheets have been initiated against one individual, follow the rules:

- the requirements of each subsequent queue are satisfied only after the requirements of the previous queue are satisfied in full;

- within one queue (including in the presence of several writs of execution), claims are satisfied in proportion to the amount due to each claimant.

IMPORTANT!

No taxes, fees or contributions need to be withheld from amounts due to the claimant, unless otherwise provided by the requirements of the writs of execution.

Which document is more important?

Questions also arise when several executive documents are received for one employee. Is it necessary to take on all the documents at once or is it more correct to organize a “queue” and begin execution of each next one only after the execution of the previous one is completed?

There is no direct answer to this question in Law No. 229-FZ. But there are two rules:

- Deductions must begin from the date of receipt of the writ of execution (Article of Law No. 229-FZ). This rule applies regardless of whether this is the first document for the employee or not.

- The employer distributes the collected amounts among the claimants without taking into account when which executive document was received (clause 3 of Article 111 of Law No. 229-FZ).

Thus, there is no need to queue enforcement documents: they must be executed simultaneously. As soon as a new resolution is received, it is necessary to immediately carry out deductions on it along with existing writs of execution.

Retain without fail

These types of deductions include all amounts withheld by the employer from the earnings of a subordinate on the basis of legislation. That is, part of the earnings was withheld by force of law.

Personal income tax

The employer in this case acts as a tax agent and withholds the calculated income tax in the amount provided for by the Tax Code of the Russian Federation. For Russian citizens (residents of the Russian Federation) the tax rate is 13%.

Example 1.

Let's look at an example of how income tax is withheld from wages.

In September 2021, the following were accrued in favor of Ivan Petrovich Berezkin:

- salary in the amount of 50,000 rubles;

- disability benefits - 17,500 rubles;

- vacation pay - 45,000 rubles;

- financial assistance - 4000 rubles.

Berezkin does not have the right to tax deductions from wages.

Personal income tax calculation:

- For salary: 50,000 × 13% = 6,500 rubles.

- For sick leave: 17,500 × 13% = 2,275 rubles.

- For vacation pay: 45,000 × 13% = 5850 rubles.

- Financial assistance up to 4000 rubles. inclusive of personal income tax. Read more: “Is material assistance subject to personal income tax?”

In total, from Berezkin’s total income of 116,500 rubles (50,000 + 17,500 + 45,000 + 4000), 14,625 rubles will be withheld.

IMPORTANT!

Insurance contributions are not deducted from wages. The rule applies to all types of standard insurance coverage for citizens (OPS, OPS, VNiM and NS and PZ). Voluntary contributions, on the contrary, are deducted directly from the salary and other income of a specialist.

Deductions under a writ of execution from wages

Let us note that in terms of seizures under writs of execution we are talking not only about the collection of alimony in favor of minor children or elderly parents, but also about collections in favor of paying off overdue accounts payable (for example, proceedings on a mortgage or consumer loan), payment of administrative fines and other forms deductions under a writ of execution from wages in favor of legal entities and (or) individuals.

IMPORTANT!

In accordance with Art. 138 Labor Code of the Russian Federation, art. 99 of Law No. 229-FZ, deductions under writs of execution in terms of alimony, compensation for harm to the life and health of citizens, compensation for loss of a breadwinner cannot exceed 70% of total income. Research for other types of writs of execution - no more than 50% (writ of execution for repayment of debt under an agreement, loan, compensation for moral damage). Other types of deductions cannot exceed 20% of earnings (for example, compensation for shortfalls, correction of accounting errors, etc.).

Example 2. Writ of execution, alimony.

Let's look at a similar example of how to withhold alimony from your salary.

At the end of August 2021, the employer received three writs of execution against employee Kreditovaya Irina Pavlovna. The total debt amounted to 410,000 rubles, including in favor of:

- enforcement proceedings of Bank of Russia OJSC - 210,000 rubles;

- enforcement case of OJSC "Credit to everyone" - 120,000 rubles;

- executive papers of JSC "Loans bystry" - 80,000 rubles.

According to the terms of the writ of execution, deductions should be made monthly until the loan debt to the bank is fully repaid, but not more than 50% of the amount of income per month.

Earnings for September amounted to 46,500 rubles.

IMPORTANT!

The calculation of the amount of how much to withhold under writs of execution is made after calculating personal income tax! There is no need to issue additional orders or obtain the employee’s consent.

Calculation of deductions:

46,500 – (personal income tax 46,500 × 13%) = 40,455 rubles.

Amount of deductions: 40,455 × 50% = 20,227.50 rubles.

We distribute the amount between banks as a percentage of the total amount of debt:

- Writ of execution of OJSC Bank of Russia: 20,227.5 × (210,000 / 410,000 × 100%) = 20,227.5 × 51.2% = 10,356.48 rubles.

- Executive documentation of Credit to Everyone OJSC: 20,227.5 × (120,000 / 410,000 × 100%) = 20,227.5 × 29.3% = 5926.66 rubles.

- Implementation requirements of JSC Loans bystro: 20,275.5 × (80,000 / 410,000 × 100%) = 20,227.5 × 19.5% = 3944.36 rubles.

Next, the employer will repay debts to banking organizations until the resulting debt in enforcement cases is fully repaid.

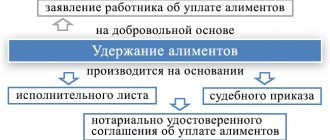

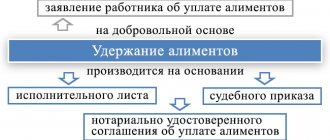

Alimony by agreement

The provision of minor children is not always paid by parents according to writs of execution. In some situations, the employer withholds money from the employee's earnings under a notarial agreement. This agreement is concluded between the parents of a minor child in the presence of a notary. It specifies the amounts, frequency of payments, as well as other conditions.

How to withhold alimony from your salary, example 3.

Sergey Nikiforovich Ivanov entered into a notarial agreement with his wife Ivanova Marya Yakovlevna to pay alimony for their minor children Alena and Peter. The amount of monthly payments in favor of children is 35% of S.N. Ivanov’s income.

Official salary of Ivanov S.N. — 100,000 rubles, worked for a full month.

Calculation:

100,000 – personal income tax 13% = 87,000 rubles.

87,000 × 35% = 30,450 rub. - transferred alimony in favor of minor children.

Let us note that it is possible to withhold alimony in favor of an employee’s minor children on the basis of his application, and not only by agreement or enforcement proceedings.

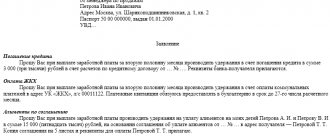

Application for deduction from wages (sample)

Alimony for children and spouses

The employee received three retention orders. The first is for the maintenance of a spouse in the amount of 0.6 of the subsistence minimum for the working-age population in our region monthly (currently this is 11,907 × 0.6 = 7,144.20 rubles). The second is to support my son in the amount of 1/4 of my monthly income. And third - to support my daughter in the amount of 1/6 of my monthly income. What will be the maximum amount of deductions in this situation? How to distribute the recovered money among three dependents?

As already mentioned, when collecting alimony for minor children, the amount of withholding can reach 70% of wages. As follows from Article 90 of the Family Code of the Russian Federation, amounts paid for the maintenance of a former spouse are also recognized as alimony. But since they are not child support, no more than half of the earnings can be withheld to satisfy these requirements.

At the same time, while establishing the order of repayment of claims under several writs of execution, the legislator did not separate child support from other alimony. This means that penalties for all three writs of execution will relate to one priority - the first (Clause 1, Article 111 of Law No. 229-FZ). Therefore, in this case, it is necessary to apply the rule of paragraph 3 of Article 111 of Law No. 229-FZ. It states: if the amount of money collected from the debtor is insufficient to satisfy the demands of one line in full, then they are repaid in proportion to the amount due to each collector specified in the writ of execution.

This means that the algorithm of actions in this case will be as follows. First, the amount of alimony for the maintenance of the spouse and both children must be withheld within 50% of the employee’s earnings. The resulting amount is distributed among all claimants in proportion to the amount due to each of them. After this, you need to make additional withholding of child support, but so that the collection does not exceed 70% of earnings. The additional amount withheld is distributed only among the children in proportion to the amount due to each of them.

Let's look at an example. Let's assume that an employee's salary is RUB 10,000 and he is entitled to a standard deduction for both children. Then the amount of wages from which deductions are possible will be 9,064 rubles. (10,000 - (10,000 - 1,400 × 2) × 13%). Now, based on this amount, we will determine the payments due to the children: the son should receive 2,266 rubles. (9,064 × 1/4), and the daughter - 1,510.67 rubles. (9,064 × 1/6).

Now we keep half of the earnings (4,532 rubles) and distribute this amount among all three claimants. The spouse's share will be (4,532 ∕ (7,144.2 + 2,266 + 1,510.67)) × 7,144.2 = 2,964.74 rubles. The son's share will be (4,532 / (7,144.2 + 2,266 + 1,510.67)) × 2,266 = 940.36 rubles. The daughter's share will be (4,532 ∕ (7,144.2 + 2,266 + 1,510.67)) × 1,510.67 = 626.90 rubles.

As we can see, the children received less than their due. So, let's move on to additional deductions. To do this, we first determine the amount that can be withheld for child support (within 70% of earnings). It is equal to 1,812.8 rubles. (9,064 × 70% - 4,532). We keep it and distribute it between the two children in proportion to their shares. The son’s share is (1,812.8 ∕ (2,266 + 1,510.67)) × 2,266 = 1,087.68 rubles, and the daughter’s share is (1,812.8 ∕ (2,266 + 1,510.67)) × 1,510.67 = 725.12 rub.

In total, the spouse will receive 2,964.74 rubles, the son - 2,028.04 rubles. and daughter - 1,352.02 rubles.

Calculate your salary according to current rules, taking into account all current local and regional coefficients and allowances

Voluntary contributions

Some amounts may be withheld from employees on a voluntary basis. For example, trade union dues that an employee decided to transfer to a trade union organization. Or voluntary contributions for insurance coverage of citizens. The most common option is to pay contributions to form the funded part of the pension to non-state pension funds.

The group also includes amounts withheld from an employee in order to repay loans, credits and credits previously issued by the enterprise. For example, a specialist received an interest-free loan from an employer. It is repaid through deductions from accrued wages in a fixed amount.

Withholding of any amounts based on a written statement by the employee, as well as by agreement between the employee and his employer, also falls into the group of voluntary penalties.

Example of a request to terminate deductions

Written if the date of termination of deductions was not indicated in the first application.

Director of Felix-M LLC Kolobkov P.A. caretaker N.L. Solovykhina

STATEMENT

I ask you to stop deducting 8,000 rubles from my salary starting September 12, 2021. in favor of Solovykhina E.N., since the girl for whose maintenance these funds were transferred became an adult.

I am attaching a copy of the birth certificate of E.N. Solovykhina to the application.

01.08.2021

/Solovykhin/ N.L. Solovykhin

How to recover accountable amounts

Overpayment of an advance on travel expenses or on accountable money is a common situation. It is almost impossible to plan future expenses down to the penny, so unspent accountable funds are constantly encountered in the work of an accountant.

In fact, the employee must return the money himself. But this is ideal. If a subordinate does not want to return the accountable money on his own, the employer can withhold the overpayment from his earnings.

IMPORTANT!

You can deduct from your salary not only the amount of overpayment, but also the debt on an unapproved advance report. For example, if the employer did not approve the advance report due to the lack of supporting documentation.

The action plan is outlined in the Letter of Rostrud dated 08/09/2007 No. 3044-6-0. To make deductions from wages of accountable amounts:

- within one month from the date of expiration of the period for compensation of the resulting overpayment, issue an order to withhold money from the employee’s salary.

IMPORTANT!

If the deadline is missed, then it is unlawful to collect accountable amounts from earnings. In such a situation, the overpayment can only be reimbursed through the court.

- After issuing a deduction order, familiarize the debtor with the order against signature. The employee must state in the order that he agrees with the collections from the salary. Otherwise you will have to go to court.

Accountable money that is not returned to the employer is not the employee’s income and is not subject to personal income tax, since it is a debt to the employer.

If the employee does not repay the debt on accountable money within a month from the date of expiration of the period established for their return, charge insurance premiums on the unreturned amount. The premiums can then be offset if the employee does not repay the money. Or return it if the accountant provides supporting documents (Letters from the Social Insurance Fund dated April 14, 2015 No. 02-09-11/06-5250, Ministry of Labor dated December 12, 2014 No. 17-3/B-609).

Components of an order

It is advisable to print the text of the order on the organization’s letterhead. The paper must contain:

- Date of preparation;

- city (place);

- order number;

- reason for withholding funds;

- what percentage of the salary is the amount of withheld funds;

- the amount of the withheld amount in rubles;

- hold date;

- grounds for withholding (supporting documents);

- signature of the head of the organization;

- signature of the employee whose salary is being withheld.

In most cases, the written consent of the employee will be required to draw up an order to withhold funds from wages. This is the only way to achieve legal literacy in matters of the relationship between employer and employee. In the absence of mutual agreements, they resort to recourse to the courts, but this rarely happens.

How to keep records

Account for deductions from wages using the following standard entries:

| Operation | Debit | Credit |

| Salary accrued | 20 | 70 |

| Personal income tax withheld | 70 | 68 |

| The amount under the writ of execution was withheld | 70 | 76.41 |

| The amount under the writ of execution is transferred in favor of the recipient | 76.41 | 51 |

| Amounts of unused sub-report are withheld | 70 | 71 |

| Repayment of the issued loan is reflected | 70 | 73.1 |

| Union dues withheld | 70 | 76 |

Retention order - sample

There are situations when it is necessary to make a hold:

- for fully completed vacation upon dismissal before the end of the year;

- if the advance payment is greater than the accrued amount for the time worked;

- in case of a counting error;

- if a shortage is identified from the financially responsible person.

In this case, it is necessary to issue an order for deduction from wages - a sample can be viewed here.

The order is issued on the organization’s letterhead and contains a number and date. It must indicate the basis for the withholding, its amount, and the person responsible for executing the order. The employee should be familiarized with the order and signed.

More information about the specifics of registering deductions can be found in the article “Deduction for vacation used in advance upon dismissal.”

The organization’s procedure for identifying a shortage and withholding it is described in detail in the article “Regulations on the financial responsibility of employees - sample.”

You can check whether you are correctly deducting from an employee’s salary with the help of explanations from ConsultantPlus experts. Get trial demo access to the K+ system and go to the Guide to Personnel Issues. It's free.

Special types of deductions

Some employers provide a bonus labor system to motivate employees. For example, a guaranteed salary is only a small part of earnings, the rest of the amount is determined based on the specialist’s performance indicators.

The system of fines for employees is becoming increasingly popular (example: wages in large corporations, supermarket chains, holding companies, etc.). This remuneration system is aimed at motivating specialists to achieve their goals. In other words, if the employee did not fulfill the plan or committed any misconduct, the employer has the right to punish the specialist with a ruble.

However, according to the labor inspectorate, such a system is considered illegal, since collecting a fine from an employee is equivalent to non-payment of part of the salary, even if the punishment itself is supported by an order and other documents. For this, the employer can be punished under Art. 5.27 Code of Administrative Offences.

What percentage of funds should be retained?

In most situations, it is enough to keep 20%. This applies to property damage, shortages, etc. If there is more than one writ of execution, then it is permissible to withhold up to 50% of the total amount issued for the month. Labor legislation provides for cases when up to 70% of wages are deducted. This:

- alimony payments;

- if a crime was committed, resulting in material damage;

- there has been a death of the breadwinner;

- the employee was subject to punishment in the form of corrective labor.

If the employer does not have this information and withholds, for example, 100% of wages for any violation, then the negligent employee has the right to even go to court regarding this incident. If everything is formalized properly, he will win the case regarding the violation of his rights. In any case, both parties should be aware that 20% is that part of the salary that can be withheld by the employer from the employee for valid reasons. And for the rest it will be necessary to look for reasons in the labor code.