When purchasing a home with a mortgage, a citizen can receive two property deductions for personal income tax at once: for actual expenses for the purchase of real estate and for mortgage interest paid (clauses 3, 4 of Article 220 of the Tax Code of the Russian Federation). If a citizen has income on which income tax is paid at a rate of 13%, he can return 13% of the amount up to 2 million rubles spent on purchasing housing, and 13% of the amount up to 3 million rubles paid as interest on mortgage To do this, you can apply for a deduction to your employer, having previously received a notification from the Federal Tax Service Inspectorate about the right to deduction, or submit a tax return form 3-NDFL to the Federal Tax Service Inspectorate. We will tell you how to fill out the 3-NDFL declaration on mortgage interest in this article.

Mortgage interest deduction

The property deduction for mortgage interest can only be used once and in relation to only one property. You can apply to the tax office for the right to deductions no earlier than the taxpayer’s ownership of the purchased housing has been registered. The declaration can be submitted at the end of the year in which this right arose.

For example, a citizen bought an apartment in 2021, the ownership of it was registered in March 2021 - which means he can file 3-NDFL in order to receive the main or mortgage deduction no earlier than 2022.

Complete a declaration to obtain the right to deduction, incl. on mortgage interest, it is possible after any period of time after the purchase of housing, but you will be able to return the tax for no more than the last 3 years (only pensioners have the right to transfer the balance of the deduction to periods preceding the year of purchase - clause 10 of Article 220 of the Tax Code of the Russian Federation) . The deduction is provided for the year in which ownership rights arose and for subsequent (later) years.

For example, if an apartment was purchased in 2015, but the deduction was declared only in 2021, the tax can be returned for 2021, 2021 and 2021 - it will no longer be possible to return the tax for earlier periods. And in 2021 you can receive a deduction for housing purchased, for example, in 2021, only for 2021 and for 2021.

The balance of the property deduction unspent in the current year, including the interest deduction, is transferred to the next year - this is repeated annually until the entire deduction amount is used. Accordingly, the declaration for the deduction is submitted annually until it is all exhausted.

The maximum amount of the main deduction is 260 thousand rubles. (2 million x 13%), and for mortgage interest - 390 thousand rubles. (3 million x 13%).

You can claim a deduction for mortgage interest at the same time as the main deduction, or when the main deduction has already been completely exhausted.

The 3-NDFL declaration is submitted before April 30 of the year following the reporting year, but this period is valid only for those who are required to declare their income. When the purpose of the declaration is only to claim a deduction, it can be submitted throughout the year.

The maximum period for a desk audit of a declaration received by tax authorities is 3 months. If the right to deduction is approved, another month is allotted for the transfer of money to the taxpayer (clause 2 of Article 78 of the Tax Code of the Russian Federation).

Return procedure: step-by-step instructions

- Step 1. You must take the original 2-NDFL certificate at work, and the original certificate of interest paid from the bank.

- Step 2. We fill out the 3-NDFL declaration, entering information from the documents specified in step 1.

- Step 3. We write an application for a tax refund.

- Step 4. We collect all the previously mentioned documents and take them to the tax office or MFC.

- Step 5. We expect the completion of the desk audit within 3 months.

- Step 6. A month after the tax office’s positive decision, we receive money into our account.

Documents for deduction

Before filling out 3-NDFL (mortgage interest), the taxpayer must prepare the following documents (letter of the Federal Tax Service No. ED-4-3/19630 dated November 22, 2012):

- Certificate of income and tax from each employer for the corresponding tax period (until 2021, the certificate was called “2-NDFL”);

- A copy of the mortgage agreement with all annexes and additional agreements;

- A copy of the purchase and sale agreement (or equity participation with an acceptance certificate) and documents confirming payment for the purchase;

- A copy of the certificate of ownership;

- A certificate from the creditor bank, other documents confirming the actual payment of interest on the mortgage.

If the declaration is submitted electronically (for example, through the “Personal Account” on the Federal Tax Service website), files of scanned documents are attached to it.

What is the difference between shared and joint property?

If the property was purchased during marriage, both spouses may be entitled to a mortgage deduction and interest paid. In this case, the type of property registered in the name of spouses matters - joint or shared.

Joint ownership implies joint ownership of property without allocating shares to each of them.

Shared ownership involves allocating the exact share of each spouse. It can be anything - 1/2, 1/3, 1/4, etc.

When registering real estate as joint joint ownership, one certificate of ownership is issued to the spouses, and it does not matter who the owner is - both spouses or one of them.

When registering an apartment (house) as a common shared property, two certificates of registration of ownership are issued , which indicate the size of the share of each spouse.

Filling out 3-NDFL: mortgage interest

In 2021, Form 3-NDFL is in effect, approved by Order of the Federal Tax Service No. ED-7-11/615 dated August 28, 2020. The same order approved the filling procedure. The form is used for declaring deductions for the period starting from 2021. The appendices to the Procedure contain all the codes necessary to fill out the declaration.

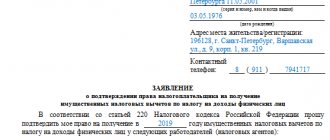

If the declaration is submitted only to obtain property deductions for the purchase of housing (including mortgage interest), the taxpayer fills out:

- Title page;

- Section 1 (personal income tax amount to be refunded);

- Appendix to Section 1 (application for tax refund);

- Section 2 (calculation of the tax base) with relevant appendices on taxable and non-taxable amounts of income (appendices 1-4);

- Appendix 7 (calculation of deductions for the purchase of housing).

3-NDFL (mortgage interest): example of filling

Let's look at an example of how to fill out a declaration for receiving an interest deduction.

Citizen Ivanov I.I. entered into a mortgage agreement with the bank in the amount of 8 million rubles. and in 2021 bought an apartment (cost - 9 million rubles). In the same year, they paid mortgage interest in the amount of RUB 61,500. Previously, Ivanov did not use property deductions.

According to the income certificate, in 2021 Ivanov’s taxable income amounted to 2,043,000 rubles, from which the employer (Russian organization) withheld and transferred to the budget 13% of personal income tax in the amount of 265,590 rubles. There was no tax-free income.

In 2021, Ivanov will submit a declaration in which he will reflect the information for receiving the deduction in the following order:

Title page:

- TIN of an individual - at the top of the page (as on each page of the declaration);

- Adjustment number (primary report – “0”), tax period (code “34”); reporting year (2020), Federal Tax Service code in which 3-NDFL is submitted;

- FULL NAME. (indicated on each page), date of birth, passport details, status code (resident), telephone;

- Number of pages of the declaration and sheets of attached documents;

- Date and signature of the taxpayer.

Appendix 1 to Section 2 “Income from sources in the Russian Federation” (information is filled out in accordance with the employer’s income certificate):

- Tax rate – 13%; income type code – “07”, meaning income under an employment contract from which the employer withheld personal income tax (Appendix No. 3 to the Procedure);

- TIN, KPP, OKTMO, name of employer (source of income);

- Page 070 and 080 - the amount of income and tax withheld by the employer in 2021 (2,043,000 rubles and 265,590 rubles, respectively).

If there are several employers, the corresponding number of application blocks is filled in.

Appendix 7 “Calculation of property tax deduction”:

- In lines 010-070, according to the title documents, information about the acquired object, the share in the right to the apartment, if the property is shared, the date of registration of ownership;

- On line 080 - the amount of acquisition costs within the permissible maximum basic deduction (2 million rubles);

- On page 090 - the amount of mortgage interest paid in 2021 (RUB 61,500);

- On page 140 – taxable amount of income for 2021 (RUB 2,043,000);

- On page 150 - purchase expenses confirmed by documents, accepted for deduction for the reporting period (2 million rubles);

- On page 160 - mortgage interest accepted for deduction in the reporting period (RUB 43,000);

Important: the sum on page 150 should not exceed the value on page 140, and the sum on page 160 should not exceed the difference between the values on page 140 and 150.

- Page 180 - since the main deduction (2 million rubles) will be fully used in 2021, the unused balance of the mortgage interest deduction is transferred to the next year, i.e. 18,500 rub. (2,043,000 – 2,000,000 – 43,000).

Section 2 – calculation of the tax base and tax at a rate of 13%:

- Type of income – “3” (other);

- Page 010, 030 – the total amount of income received in 2021 (RUB 2,043,000) from line 070 of Appendix 1;

- Page 040 – total amount of deductions equal to the sum of lines 150 and 160 of Appendix 7 (RUB 2,043,000);

- Page 080 – total amount of tax withheld (RUB 265,590), according to page 080 of Appendix 1;

- Page 160 – amount of tax to be refunded (RUB 265,590).

Section 1 – tax to be paid or refunded from the budget:

- Page 010 – code “2” (return from the budget);

- Lines 020 and 030 indicate the current tax code and territory code OKTMO;

- Page 050 – personal income tax amount to be refunded (RUB 265,590).

At the last stage, the Application for offset/refund of the tax amount (appendix to Section 1) is filled out, on the basis of which, after approval of the deduction, the tax will be returned to the taxpayer:

- Line 095 indicates the serial number of the application in the reporting year;

- On page 100 – amount to be refunded (RUB 265,590);

- On page 110 - KBK tax, and on page 120 - OKTMO from page 030 of Section 1;

- Page 130 – tax period code “GD.00.2020”;

- Lines 140-180 indicate the details of the taxpayer’s bank account to which the Federal Tax Service will transfer the amount of the refunded tax.

Results

When purchasing (or acquiring through equity participation) an apartment, an individual can take advantage of two property deductions for personal income tax:

- in the amount of purchase or construction costs (within 2,000,000 rubles, but with the possibility of use for several objects);

- in the amount of interest on the mortgage (within RUB 3,000,000 and applicable only to one of the objects).

The right to deduction is checked and confirmed by the Federal Tax Service. And the tax itself can be reimbursed either at the place of work (by reducing current accruals), or by receiving the amounts overpaid for the year from the Federal Tax Service (after filing a declaration there at the end of the year of acquiring the right to deduction). Reimbursement of the full amount of tax may take several years. There is no need to write any application for reimbursement. But if you receive tax from the Federal Tax Service, you will need to apply for its refund. There is a specific form for such an application.

Sources:

- Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for filling out the declaration

To determine the procedure for filling out the declaration, first of all, it is important to understand how to calculate the amounts that must be transferred, since the owner does this independently.

The law sets the deduction limit at two million rubles. That is, if the apartment cost four million, then the deduction will be received only from two million, and from the remaining two you will have to pay income tax. If the amount is less than two million, then you can add to it the costs of repair and additional construction work, if any. If a property deduction is possible in connection with the purchase of an apartment under a mortgage agreement, then there are two options for determining the amount:

- from the cost of the apartment, which amounts to up to two million rubles;

- from the amount of interest that was transferred over fifteen years, if it amounts to two million rubles.

That is, the procedure will also be general, the declaration will be filled out according to the same scheme as when buying an apartment without a loan, but the possibility of receiving payments is expanded due to several options for determining the initial amount.

The tax return, which is submitted to receive the due deductions for the purchase of an apartment, must be filled out in only three parts; other fields should not be filled in, otherwise the documents will have to be redone and submitted again.

Those components that are included in the structure of the tax return and are filled out for property deductions include the following:

- Title page. It must contain information about the applicant.

- First section. It includes several sheets, but only some will be filled out. Sheet A, which indicates the profit that the applicant receives. Sheet G1, where information about the deduction itself is recorded. Sheet I, which includes information about the apartment and its price.

- Sixth section. It must contain the total amounts, that is, deductions determined by the applicant independently, taking into account the cost of the apartment and the interest rate.

Despite the presence of nineteen sheets in the declaration of the form in question, the remaining sections will not be filled out, since they are not related to the property deduction.

Thus, the tax return that is submitted when purchasing an apartment is mandatory, since it is necessary to pay tax on income, but it also allows the person to return part of the money that was paid. However, the law does not establish any restrictions on filing deadlines, with the exception of the duration of ownership of the purchased property.

How does distribution occur in shared ownership?

Shared owners-co-borrowers have the right to distribute the interest deduction in any proportion, regardless of the size of the shares. The proportions can be changed annually at your discretion.

The Petrovs bought an apartment as shared ownership in 2014 for 2 million rubles with a share size of 50/50%. For the first year of the mortgage, the owners paid 300 thousand interest and divided the deduction in half, receiving a deduction in the amount of 19,500 rubles for each (150 thousand * 13%).

In 2021, the husband was fired, so when submitting a declaration for interest deduction for 2015, the Petrovs decided to distribute the shares equally, as in 2014, and for 2016 in accordance with 100/0% (100% of the interest deduction will be received by the wife, and husband – nothing, since there was no income for this year).

Thus, for 2021, they declared a mortgage interest deduction in the amount of 39,000 rubles, which the spouse will receive (300 thousand * 13%).

In cases where spouses purchase an apartment in shared ownership and each of them invests a certain amount in the purchase, they have the right to declare the distribution of shares in accordance with the expenses incurred. In this case, all expenses must be documented . However, mortgage interest, according to the Family Code of the Russian Federation, is considered a joint expense of both spouses, so they can distribute the deduction in any proportion and change it every year.

Deadlines

The processing time and receipt of payments depends on the filing authority. If the employer has the papers, the review time is 30 calendar days. If the decision is positive, payments are made immediately after the employee submits a notice within a year in the form of termination of the deduction of 13% from wages.

If you submit documents to the tax office, the processing time for the papers is from one to three months, plus another month for the transfer of funds. The money will be paid throughout the year.

Where and how to submit

You can submit 3-NDFL through the Federal Tax Service or your employer. The declaration and package of collected documents are sent to the inspection in person. The main advantage is a basic inspection by an inspector and, in case of errors or missing documents, the possibility of correction on the spot.

The second method has another advantage - payments to the applicant are made faster than in the previous case. Submit the declaration online or offline.

You can fill out the declaration in the following ways:

- manually (in writing, referring to the sample filling in the Federal Tax Service);

- electronically (using a special program or through the taxpayer’s personal account).

Online

You can fill out and submit Form 3-NDFL for a mortgage remotely by following the following procedure:

- Receive a password for the taxpayer's account. The code is issued personally to the citizen at the tax office (the login is the TIN).

- To generate and send an electronic signature, for this you need to enter the citizen’s passport data and e-mail (the wait varies from an hour to a day).

- Information is entered into the declaration, everything happens step by step, some lines are filled in automatically (if they have already been entered before, they are also filled in automatically).

- After filling out, you need to scan and attach all documents (bulk papers should be scanned in a lower resolution).

- Enter your current account details and create an application for property tax.

- Send it to the tax office at your place of residence.

This method allows a citizen to track the progress of consideration of the declaration and application. If errors are found, they can be corrected immediately and all additional information can be provided when requested by the inspector.

Offline

For personal transfer of 3-NDFL you will need:

- Fill out the form in one of two ways (manually or through the Declaration program). When filling out, you need to pay attention to the filling example.

- Make copies of all attached documents (the originals must be with the applicant at the time of submission so that the employee can certify them).

- Send the prepared papers to the Federal Tax Service at your place of residence.

Not all tax services have employees point out errors, as this is not their responsibility.