7

Who doesn't want to become the heir to a house and land? It is especially pleasant if the testator left a will, and your name is among other applicants for the property.

The procedure and terms for registering an inheritance under a will are determined by law. The heirs will have to declare their rights, evaluate the property, collect documents and register ownership in Rosreestr. Violation of the procedure entails problems with registration of inheritance. For example, missing deadlines or lack of necessary documents is grounds for refusal to issue a notarial certificate.

How to correctly inherit a house and land under a will? After reading our article, you will be able to get a complete picture of the procedure and take into account all the nuances.

If you want to inherit a house and land, read the step-by-step instructions in the article “Registration of an inheritance under a will.”

The right to inherit a house and land after death

The testator's property passes after his death to close relatives or citizens specified in the will. When drawing up an order, the owner of the property independently determines the circle of heirs.

It may include family members, friends, acquaintances, work colleagues and even organizations , including the state as a whole.

The testator can include only his house and land in the property. Legally, this means that the owner must have title documents - a certificate or extract from the Unified State Register of Property Rights. Someone else's property cannot be included in a will!

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

It is important to note that entering into an inheritance of a house automatically adds a land plot to the property (clause 4, article 35 of the Land Code of the Russian Federation). An exception may be in the case of arrest or mortgage of land. In addition, you cannot inherit land if it belongs to another owner or is in municipal ownership. But the heir under the will will have the opportunity to use the land - under a lease agreement or through the registration of an easement (limited use right).

Example. Polezhaev purchased a plot of land and began construction of a permanent house.

However, a year after construction began, he died. A will was left that included his wife, daughter, sister and best friend. But since there was a lot of property, Polezhaev divided it during his lifetime in accordance with his preferences: his best friend received a share in the business, his sister received a monetary contribution, and his wife and daughter received an unfinished house in the private sector. The land plot under the house was also included in the inheritance - Polezhaev bought it at a municipal auction.

Additional certificates and passports

At the moment, due to legislative changes, cadastral passports are not issued. Instead, Rosreestr institutions provide applicants with an extract from the Unified State Register of Real Estate. It contains all the necessary data about the inherited property.

To calculate the amount of state duty, a potential heir has the right to make a report from an independent appraiser on the value of the building and land plot.

How to inherit under a will for a house and land?

If there is a written order from the testator, the procedure for preparing documents is somewhat simplified. Applicants do not need to prove kinship with a deceased citizen.

Sometimes the lack of such documents leads to lengthy correspondence and litigation.

To enter into property rights, applicants need to prepare a package of documents and contact a notary - no later than 6 months after the opening of the inheritance.

Typically, an inheritance case is opened at the registration address of the deceased citizen. You can find out the exact location using the electronic database of notaries - EIS. All you have to do is make a request to any office, and they will tell you where to go.

Order and procedure

Let's look at the instructions on how to inherit a house and land under a will:

- Contact the notary at the place of last registration of the testator (deceased).

- Find out what documents are needed.

- Order a cadastral valuation of the land and house.

- Receive an appraisal report, prepare the entire package with documentation.

- Visit a notary, pay the state fee, hand over the documents.

- Write a statement about your desire to inherit.

- Obtain a certificate of inheritance.

- Go to the MFC to register property rights in Rosreestr.

- Wait for an extract from the Unified State Register to be issued.

Pay attention to the assessment of the value of the land - it will be needed to calculate the state duty for entering into an inheritance. Let's talk about this below.

Land assessment

An important component of inheritance is the valuation of real estate. The procedure is initiated by the heirs themselves, if they are indicated in the will for the house and land. The assessment is carried out by licensed companies - public and private.

Immediately after the death of the testator, his relatives must submit an application to the appraisal firm. An invited specialist will visit the property, determine the boundaries, establish the intended purpose of the land and issue an appraisal report.

The following factors influence the cost of land :

- location of the site;

- adjacent infrastructure (in our case, a private house);

- accessibility of communications;

- access and passage to a plot of land;

- value of the territory;

- nature of the soil, etc.

The appraisal act contains the cadastral value of the land plot. If a private house is inherited, its assessment will also be required - this can be taken from the Unified State Register of Real Estate.

Application to a notary (sample)

Every notary has a sample application; a specialist will help you draw up the document.

Contents of the application for inheritance:

- name of the notary office/full name of the notary;

- Full name and residence address of the applicant;

- information about the deceased person;

- the essence of the request;

- date of application;

- heir's signature.

Required documents

The following documents must be attached to the application:

- original will - if other heirs have already contacted the office, the will is kept by a notary;

- identity card - Russian passport;

- death certificate of the testator;

- title papers for real estate (village house, land plot);

- technical documentation for the property - cadastral passport or extract from the Unified State Register of Real Estate;

- papers confirming the inventory and/or market value of the property - an appraisal report;

- a certificate from the place of registration of the deceased citizen - taken from the housing department or “passport office” (OVM at the Ministry of Internal Affairs);

- documents from the Federal Tax Service confirming that the testator has no tax debts;

- certificate of absence of arrests in relation to real estate - issued by the SSP;

- receipt of payment of duty.

In some cases, additional documents may be required; the notary will inform you about them.

Expenses

When registering an inheritance, applicants are charged a state fee. Its size is determined by the Tax Code of the Russian Federation. The amount of the fee depends on two factors - the value of the assets and the degree of relationship with the deceased citizen. The manner in which the property is received does not matter.

Basic rates:

- Close relatives pay 0.3% of the cost of the house and land. Close relatives are considered to be children, parents, brothers/sisters of a deceased person, as well as a living spouse - as a family member (Article 2 of the RF IC). At the same time, the law provides for certain restrictions. The marginal tax rate for close relatives is RUB 100,000, regardless of the assessed value of the inherited asset.

- The remaining heirs, incl. legal entities pay 0.6%. For this category of applicants, the limit tax amount is 1,000,000 rubles.

Additional costs include an appraisal, contesting a will, recognition of property rights in court, and notary services. Such expenses are considered on an individual basis. The average cost of notary services is from 1,000 to 5,000 rubles.

Successors

To enter into a dacha inheritance, you must adhere to the legal regulations established in Federal Law No. 146 of November 26, 2001. According to the current provisions, a legal successor is a citizen or group of persons who has the right to register real estate, provided that the former owner has died.

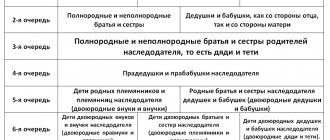

In this case, relatives are divided into several queues:

- The first includes close family members - mother, father, son and/or daughter, spouse of the deceased;

- In the second place they include a brother, sister, grandmother, grandson, etc.;

- The third and subsequent lines include distant relatives.

Order of succession by law

However, in addition to these citizens, persons who are dependent on the deceased person can claim the inheritance mass. Their inclusion in the registration process is mandatory - no matter the procedure under a will or law.

Civil Code of the Russian Federation (Part Three) dated November 26, 2001 No. 146-FZ

How to register an inheritance for a house and land after entering into an inheritance

Movable/immovable property must be registered with the registration authority. Without state registration, heirs will not be able to fully dispose of property: sell, donate, bequeath, exchange, mortgage, etc.

After receiving a certificate of right to inheritance, citizens do not become owners of inherited property.

Order and procedure

Registration of a land plot and/or house takes place in Rosreestr. In this case, we are talking about two independent real estate objects. A package of documents is prepared for each of them separately.

The procedure and deadlines for registering property rights are established by the provisions of the Federal Law dated July 13, 2015 No. 218-FZ. Typically, registering a property takes from 5 to 12 days. The speed is influenced by two factors - where the papers are fed and what action needs to be performed.

Algorithm of actions:

- Preparing a package with documentation.

- Make an appointment at the MFC or Rosreestr:

- through State Services;

- by telephone at the branch;

- through the coupon issuing terminal;

- by mail - by registered letter with a list of attachments.

- Filling out an application, paying state fees, transferring documents.

- Waiting for the issuance of a title document.

- Obtaining an extract from the Unified State Register of Real Estate.

Application (sample) 2021

Heirs under the will must submit an application to Rosreestr or MFC. A package of documents is attached separately to it. The list of papers depends on the type of property being registered.

The application must indicate:

- registrar name;

- what action needs to be performed;

- information about the applicant;

- the essence of the heir's appeal;

- on what basis is the registration of the right carried out - a certificate of the right to inheritance;

- what property is subject to registration;

- location of the property;

- method of submitting documents and receiving them;

- list of attached papers;

- date of application and signature of the copyright holder.

Required documents

The following documents must be attached to the application for registration of rights:

- applicant's passport;

- certificate of inheritance;

- technical papers for real estate - cadastral passport or extract from the Unified State Register of Real Estate;

- title documents for inheritance - certificate or extract;

- confirmation of payment of state duty - optional in paper form.

After checking the papers, the applicant is given a receipt. The deadline for issuing documents in the name of the heir is indicated here.

Expenses

A state fee is also charged for registering property rights.

Tax rate:

- Real estate – 2,000 rubles.

- Land plot for dacha farming – 350 rubles.

- Allotments of agricultural land – 350 rubles.

- Registration of part of the common shared ownership of agricultural land – 100 rubles.

- Registration of easement – 1,500 rubles.

Nuances with property shares

The inheritance does not always go completely to only one heir - there are often situations related to the division of the house into shares, one for each heir, and in addition, the deceased could be the owner of not the whole house, but part of it. If there is one heir, in the second case the part is inherited in its entirety, but several claimants are forced to divide or redeem the property.

By inheriting shares, each applicant can receive a personal certificate, or you can order one common one for everyone - any options are relevant. Shares can be redeemed, it is also possible to redeem them at the expense of other property from the same inheritance mass - mutual agreement and consent of relatives in this matter will provide many significant advantages.

Features of inheritance:

If the testator did not have time to complete the documents

This situation is far from uncommon. Very often, citizens postpone the issue of paperwork until better times. Putting papers in order occurs in emergency situations.

For example, when you need to sell or exchange real estate, or enter into an inheritance. When the owner is alive, paperwork is much easier to complete. After his death, the heirs will have to go to court.

Moreover, there are two ways to gain rights:

- acceptance of inheritance after the fact;

- filing a claim to establish inheritance rights.

If applicants continued to use the property after the death of a relative, they can formally apply to a notary to obtain a refusal to issue a certificate.

Then you need to file a claim for recognition of ownership. The claim must be accompanied by documents confirming ownership in the name of the deceased citizen.

For example, if the house and land were transferred to a deceased subject by inheritance, which he accepted in fact. If there is a judicial act, the heirs will have to draw up documents in their name.

If there is a right to an obligatory share

The testator has the right to determine the size of the shares of each applicant.

The only limitation is that the testator cannot deprive the property of obligatory heirs: disabled family members and dependents (Article 1149 of the Civil Code of the Russian Federation). Their rights are protected by law - even if they were not bequeathed any share, they will receive it.

Who has the right to an obligatory share of the inheritance:

- disabled husband/wife;

- disabled mother and father of the testator;

- minor children;

- cohabitant and other persons - if they were in the care of the deceased during the last year.

Dependents are entitled to half of the share they would have received by law. Therefore, even if the deceased did not include his father in the will, the parent will receive part of the house or land.

Example. Ignatov was in a quarrel with his wife. The young people wanted to get a divorce, but it didn’t come to that - Ignatov died of a heart attack. However, knowing about his illness, the man left a will for the house and land that he had received before marriage. The wife was not indicated in the will, although at the time of Ignatov’s death she was on maternity leave and could not go to work. Knowing that she was entitled to a mandatory share in her husband’s property, the wife filed a lawsuit in order to receive the due share. Confirmation was provided by medical and social certificates, checks, receipts for the purchase of children's things, and orders for maternity leave. Having familiarized itself with the wife’s arguments, the court recognized her right to an obligatory share in Ignatov’s property. According to paragraph 2 of Art. 1149 of the Civil Code of the Russian Federation, the wife received half of the unbequeathed part of the property - a cash contribution, a collection, part of the furniture. The private house and land were distributed among the heirs according to the will.

If the procedure for using inherited property has not been established

If the testator has assigned his property to different persons, after completing all the documents and receiving a certificate, they can enter into an agreement among themselves.

It can determine not only the size of the heirs’ shares, but also the procedure for using the property. Determining legal boundaries is relevant if the land and house are owned by two or more heirs.

Example. Ivanova will get a room in the house, Petrova will get a second room - and the rest of the living space will be shared. In other words, the heirs will be able to register ownership of the rooms, and the corridor, hallway, living room, bathroom, kitchen, annex and attic will remain in their common shared ownership.

If the deadline has passed

By registering the inheritance correctly and within the prescribed period, you will avoid the need to go to court. If you miss the deadline for contacting a notary's office, you will most likely receive a refusal from the notary. The notary has the legal right not to accept the application of a latecomer.

In this case, the issue remains to be resolved in court. This will be considered the entry into inheritance rights in fact, since the applicant is considered as the actual owner of the property left by the deceased.

In this case, instead of a certificate issued by a notary, the applicant will receive a court decision having the same force. It is important for the heir to provide a valid reason why he did not appear on time.

Finally, we note that recently the right to inheritance can be registered at the MFC.