1.What is shared between spouses?

The Family Code establishes a list of property that is jointly acquired and subject to division. So, in accordance with Art. 34 of the Family Code of the Russian Federation, it includes the income of spouses, except for those that have a designated purpose. For example, the amounts of financial assistance are not divided. In addition to the income itself, real estate purchased with it, cars, various securities, bank deposits and any other property, except personal belongings, are also subject to division. The main thing is that the property must be acquired using general income.

Important! Even personal property can be recognized as joint property if it is proven in court that during the marriage significant funds from the common property of the spouses were invested in it. Labor, monetary and property investments are taken into account. For example, if major repairs were made in the husband’s apartment, which he received by inheritance, at the expense of common funds, the court recognizes this apartment as common property.

Let's look at the situation: Andrey opened a bank account, and a year later he got married. During the marriage, due to the common funds of the spouses, the amount on it increased several times. In such a situation, the contribution will remain with Andrey, but he will have to reimburse his ex-wife half of the funds invested during the marriage.

As a general rule, all property belonging to the spouses remains with them; children have nothing to do with it. But there is an exception provided for in paragraph 5 of Art. 38 RF IC. Thus, items purchased exclusively for the child are not divided and are transferred to the spouse with whom the child remains. Such things include, for example, stationery for school, children's clothing, musical instruments, toys, laptop, etc. However, compensation in this case is not paid.

Important! A deposit opened in the name of a child, to which funds were deposited from the joint income of the spouses, is not divided after a divorce. He stays with the child. The child's property is excluded from the division. This also applies to real estate that was initially acquired into his ownership or was transferred during marriage.

Marina's new creditors

When the conditional Marina understands that the bankruptcy of her ex-husband will result in only losses in her personal well-being, then the temptation to quickly throw off all her existing property and be left naked as a falcon is very great. The logic is as follows: when the transactions are challenged, I will have to return everything received in kind. And if there is nothing to return, then bribes are fine.

But in reality it turns out a little differently: if Marina cannot return the property in kind, the plaintiff will assess the market value of the asset at the time of its alienation, and the court will oblige Marina to repay the debt in money.

Here you need to pay attention to 2 interesting points:

- The valuation is made at the time of disposal of the asset. It is important! For example, a wife received a car worth 6 million as a gift from her husband. So far, the bottom line is that 5 years have flown by. Marina managed to get a divorce, get a caret, smash her car into rubbish and successfully sell it to resellers. Pavel's exploits were more modest - he simply went bankrupt. And now the court, challenging the donation transaction, but not finding Marina’s car, will oblige her to return exactly 6 million rubles. for a car that now costs almost... nothing. And for such debts, Marina will be liable with all her personal property, and not just with jointly acquired property.

- After Marina’s successful loan, the financial manager can calmly file for her personal bankruptcy. Let's call it bankruptcy No. 2.

So what? The amount of debt is more than 500,000 rubles, which means bankruptcy is quite a measure. And the second round of the Ferris Wheel will begin: challenging Marina’s transactions with outbids, children and relatives. And they will definitely find something to challenge, because no matter how much you are taught not to give as a gift, you still give everything.

And don’t forget about the possibility of the financial manager to file a vindication claim (or, in Russian: a claim for the recovery of property from someone else’s illegal possession) against the final, “bona fide” acquirer of the asset. Moreover, this claim can be paralleled with bankruptcy petition No. 2: if the vindication is won and the assets are returned to bankrupt No. 1, then the bankruptcy case of his wife must be terminated. If it fails, then there is no reason to stop bankruptcy No. 2.

Thus, the bankruptcy plague will spread through all the relatives, friends and acquaintances of our Marina and Pavel until the creditors run out of patience or money (the latter is more likely).

2.1. IT IS IMPOSSIBLE TO AGREE WHILE INFRINGING ON THE INTERESTS OF THE CHILD

The ancient Romans had a saying - pacta sunt servanda, which literally means “agreements must be respected.” But this rule obviously does not apply to those cases where an agreement on the division of jointly acquired property leads to a significant deterioration in the quality of life of the joint child.

Therefore, an agreement on the division of property, according to which the ex-husband received everything, and the mother and the common child are forced to wander around rented apartments, will most likely be challenged.

Contents of the statement of claim

If the statement of claim is drawn up incorrectly, this may delay the consideration of the case.

Therefore, it is important to record all key information in the document.

The claim must include the following items:

- The name and address of the location of the judicial authority considering the case.

- Information about the plaintiff and defendant.

- Amount of claim.

- A list of circumstances that allow the plaintiff to recognize the signed document as invalid.

- A complete description of all aspects of the situation in which the defendant violated the legal rights of the applicant.

- The plaintiff’s demands to the defendant (to declare the agreement completely invalid, to make adjustments to the clauses of the document, etc.).

If the applicant believes that it is necessary to provide other information, they must be recorded in the statement of claim.

2.2. THE COURT WILL TAKE CONSIDERATION OF THE PRESENCE OF CHILDREN WHEN DECIDING THE ISSUE OF AWARDING PROPERTY IN KIND

“In kind” in legal translation means that one of the spouses will become the sole owner of any property, and the second will only have the right to demand monetary compensation.

Courts take into account the interests of children when determining what property the parent living with the child receives. For example, if a family has several residential apartments or houses, the parent remaining with the child will have priority in obtaining housing located closest to the school.

Where is it served?

The claim is filed exclusively in the district court at the location of the real estate. If there are several real estate objects subject to division, then the claim must be filed at the location of the largest part of them or at the location of the most expensive property.

When it is not possible to determine where most of the property is located, it is possible to bring a claim at the location of the defendant. If the court returns the claim, then the application will need to be filed at the location of the disputed apartment or appeal the decision to return the claim.

2.3. THE PRESENCE OF CHILDREN MAY AFFECT THE SIZE OF THE SHARE

As a general rule, jointly acquired property is divided in half between spouses. But the court has the right to deviate from this rule if it is necessary to protect the interests of the spouses’ common children. Courts may increase the share of the parent remaining with the child in the apartment or house where the child lives (or award this entire property); the share of such parent in the total debt obligations of the spouses may also be reduced.

But in exceptional cases (unscrupulous behavior of the second spouse or serious illness of the child), the court may award a larger share of the entire property to the one who remains to live with the child.

Paragraph 2 of Article 39 of the RF IC allows the court to deviate from the principle of equality when dividing property and allocate a larger share to one of the parents in the interests of the children. However, their mere presence as a dependent does not affect the size of the former spouse’s share. This is a right, not an obligation of the court. There is no uniform judicial practice on this issue, however, having studied court decisions, one can find a number of reasons why judges often deviate from equality of shares.

Let's consider the main ones:

Risk period

It must be understood that any transfer of assets between former spouses is an ordinary transaction. Even if such a transfer is formalized by a prenuptial agreement, an alimony agreement, a settlement approved by the court, or simply an order to the bank to transfer money from account to account, all of these are transactions that can be challenged. We talked in detail about how this happens in a comprehensive article - “Everything about challenging the debtor’s transactions in bankruptcy proceedings”; now we will only draw brief conclusions.

So, in order for Marina to understand which transactions between her and her ex-husband can be challenged first, you need to do the following:

1) Go to the file of arbitration cases;

2) Enter your ex’s name in the top left field;

3) Click search and sort the dropped cases by “bankruptcy grounds”;

4) In the drop-down list, in the “Defendant” column, find the ex-spouse, taking into account the region of his residence. Then get involved by clicking on the active number;

5) In the card that opens, we find the first instance and, by clicking on the plus sign, expand the case materials;

6) Scroll down all the way and, clicking on the numbers, go to the very beginning of the matter. There we should see a bankruptcy application and a court ruling to accept it for proceedings.

In this line we are interested in the date indicated on the left. In the random example above, this is 09/11/2019. We count back 3 years from this deadline and write down on a piece of paper all transactions, payments and documents that were made between you and your ex-spouse in the period from 09/11/2016 to the present.

Congratulations! You have just compiled a list of assets that are highly likely to be repossessed. In legal language, these transactions are called suspicious and are disputed in accordance with the rules of Chapter III.1 of the Bankruptcy Law.

The situation is a little easier if transactions between former spouses go beyond the three-year period of suspicion. For example, in our example, they will be committed BEFORE September 10, 2016. In this case, it will not be possible to challenge them on bankruptcy grounds and creditors will have to challenge them according to the provisions of the Civil Code. This can be done within 10 years from the date of the transaction, but the chances of the transaction being canceled will be much less.

Let’s skip the small details that professionals already know but will only confuse ordinary readers, and summarize:

- It is easiest to lose property if a transaction with it is made during a period of suspicion. The period of suspicion is 3 years BEFORE the bankruptcy petition is accepted.

- It is much more difficult to lose assets if they were acquired more than 3 years before the ex-spouse’s bankruptcy. If 4-5-7-9 years have passed, then the challenge is carried out according to the norms of the Civil Code of the Russian Federation. It is possible to challenge these standards, but it is difficult. Much more difficult than bankruptcy. You can read more about this here.

- In any case, the limitation period is 10 years (counted forward from the date of the transactions). Thus, transactions with property that were executed only more than 10 years ago will be completely safe.

If you look at it this way, then a priori almost every transaction with property falls under the distribution. But not everything is as bad as it might seem at first glance. Whether the transaction will be challenged or not depends not so much on the period of its completion, but on exactly how the property was formalized and how it was divided. And these nuances are where all the juice is.

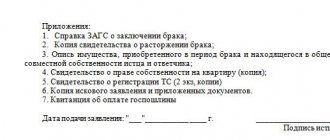

List of required documents and evidence

In order for the claim to be satisfied, the applicant must support his application with comprehensive evidence. Evidence must be documented. Nothing is accepted in court without evidence.

The list of evidence includes the following items:

- description of the controversial situation on behalf of both parties. They must be supported by documents;

- witness's testimonies. It is best if they are recorded in audio or video format;

- documents: contracts, receipts, acts, certificates, etc.;

- conclusion of a forensic medical examination. This evidence is relevant if we are talking about concluding an agreement with a person who was in an inadequate state at the time of drawing up the document.

When examining the evidence base, the court takes into account only that evidence that was obtained legally and is not questioned.

In addition to documents serving as evidence, the applicant must provide the following papers:

- A copy of your passport.

- Agreement being appealed in court.

- A receipt confirming the fact of payment of the state fee.

- Copies of documents attached to the claim (according to the number of participants in the process).

It is important to remember that the statement of claim is filed at the place of residence of the defendant.