In addition to moral satisfaction from the work done, employees of any enterprise - be it a large holding company or a modest LLC - must receive payment for their work twice a month. The procedure for paying the required earnings is prescribed by law - in Art. 136 Labor Code of the Russian Federation. The employer needs to develop local regulations, which should indicate:

- specific days of the month on which payments are made;

- place of issue (company cash desk, account with a credit institution).

Question: How to reflect in an organization’s accounting the accrual and payment of monetary compensation to employees for failure to pay wages on time? Wages for the past month were paid to employees in violation of the terms established by the collective agreement for their payment. The amount of compensation for delayed payment of wages, calculated based on the minimum amount established by the Labor Code of the Russian Federation and the number of calendar days of delayed payment, is 12,478 rubles. Compensation due to employees was transferred to the employees' bank accounts. Operations related to the calculation and payment of wages are not considered in this consultation. For the purposes of tax accounting of income and expenses, the organization uses the accrual method. View answer

Before the payment of earnings, the employee must receive written notification of the composition and amount of accruals, types and justification of deductions, and the total amount due to be paid to the employee.

If an employer delays payments to employees, justifying the delay for any reason, he must compensate for his omission with monetary compensation.

Question: Does the labor inspectorate have the authority, when forcibly collecting unpaid wages from an employer, to include compensation for delayed payment of wages in the amount of the collection? View answer

Compensation for delayed payment of wages under the Labor Code of the Russian Federation

In times of crisis, many Russian companies, often small businesses, are increasingly delaying wages (hereinafter referred to as wages) to their employees.

In most cases, this is not the fault of the company: each of them is a link in a dependent chain of counterparties. Consequently, as soon as payment interruptions (payment under contracts from customers/purchasers are not received on time) occur in one link, this automatically affects all subsequent ones. As a result, this may lead to the fact that employees of one, or perhaps several levels, will not receive salaries on time. If this happens and the employees do not receive the wages due to them on time, then the employing company will subsequently be obliged to pay the employees not only their wages, but also compensation (which in its content represents interest on late payments). This is stated in Art. 236 Labor Code of the Russian Federation.

IMPORTANT! Failure to pay wages on time, among other things, gives the employee the right to temporarily suspend the performance of his labor functions, as well as apply for compensation for moral damage (Articles 142, 237 of the Labor Code of the Russian Federation).

Compensation for late payment of wages is accrued from the day following the established payment deadline until the day the employer repays the debt to employees, inclusive.

Example 1

If the salary, for example, was supposed to be paid on the 5th, but was actually paid on the 12th, then the compensation will be calculated for 7 days (from the 6th to the 12th inclusive).

If a delay did occur, the employing company will have to pay the employee appropriate compensation, regardless of whether it is directly to blame for the delay in the salary or not.

NOTE! Today, the situation is especially relevant when, due to the revocation of the license, the bank did not transfer the salary to the employees of the organization - the payroll client. This circumstance does not relieve the employer of the risk of falling under Art. 236 of the Labor Code of the Russian Federation, since the fact of guilt does not matter. Therefore, in order to minimize this risk, the company should more carefully select a bank for its salary project.

Moreover, if, for example, the bank is to blame for the delay (in particular, it did not fulfill the payment order of the client organization on time to transfer the salary to employees), then the company should remember that it has the right to make a recourse claim to the bank for the fact that it did not timely transferred the salary to the employees, which means he violated the terms of the salary project with the company. However, you will still need to pay workers' compensation first.

Disciplinary responsibility

According to Art. 19 Federal Law No. 10 of January 12, 1996, trade unions have the right to independently monitor compliance by employers with labor legislation, including issues of remuneration. The result of such control may be a corresponding statement to the employer about violations committed by management. The employer reviews it within a week, after which measures are taken to eliminate the violation and a certain disciplinary sanction is imposed on the perpetrators, which is reported to the applicant. The punishment is valid for one year from the date of its imposition by an appropriate order.

Thus, if a violation is actually proven, wages withheld through the fault of the manager or DP may give rise to one or another disciplinary sanction (reprimand, reprimand or dismissal) for these persons. This influence on the management of the organization is exerted by the employer.

Calculation of monetary compensation for delayed wages

The Labor Code of the Russian Federation does not establish in what specific amount the company must pay compensation to employees for delays in wages. The legislator gave organizations the right to independently determine this in a collective agreement.

At the same time, the lower limit of compensation has been determined - not less than 1/150 of the key rate for the period of delay in the salary, calculated for each day of delay:

MRK = ZPnach × Kl.St. / 150 × Dpr,

where: MRK is the minimum that the employer is obliged to pay to the employee for a delay in salary;

ZPnach - the amount of wages that should have been paid to the employee on a strictly established day (minus personal income tax);

Class.St. — refinancing rate (key rate) of the Central Bank of the Russian Federation for the period of delay;

DPR - the number of days for which the employer was late in paying employees wages.

In the collective agreement, the company can only increase the amount of compensation for delay; the organization does not have the right to set it in a smaller amount than according to the above formula.

Example 2

Salary in the company is paid, according to the collective agreement, on the 5th (for the second half of the previous month) and the 20th (for the first half of the current month) of the month. The collective agreement does not contain special provisions regarding compensation for late wages.

For the first half of February, the employee was accrued salary in the amount of 30,000 rubles. However, it was actually paid only on March 6.

The refinancing rate in force during the period under review (conditionally) was 7.5%.

Under these conditions, the organization should pay the employee on March 6, in addition to the salary, also compensation for delay for 15 calendar days in the minimum amount:

MRC = 30,000 × (100% – 13%) × 7.5% / 150 × 15 = 195.75 (rub.)

However, it is not enough to simply correctly calculate the amount of compensation for late salary payments. It is also important for an organization to clearly know whether personal income tax should be withheld from such compensation, whether insurance premiums should be charged and paid for such an amount, and what to do with expenses for profit tax purposes.

What is the period for payment of vacation pay provided by law?

The three-day period before the start of the vacation, during which the organization is obliged to pay vacation pay to the citizen, is determined by Article 136 of the Labor Code, and Articles 114 and 115 indicate that if these days fall on weekends or holidays, then the money is accrued in advance.

Important! Labor law prohibits the accrual of vacation pay in installments.

In practice, most employers tend to transfer them much earlier, since delays sometimes arise due to unforeseen circumstances: for example, a bank delay in a transaction.

In this case, the organization will be obliged to additionally pay the employee for each day of delay, regardless of the reason. Since payment of annual leave is the employer’s responsibility, he cannot justify the delay in transferring finances by ignorance of the employee’s retirement, lack of funds, etc.

Personal income tax on compensation for late payment of wages

On the one hand, the Tax Code of the Russian Federation establishes that it is not necessary to pay personal income tax to the budget on compensation if it must be paid to an employee due, in particular, to the performance of labor functions in the company (clause 3 of Article 217 of the Tax Code of the Russian Federation).

On the other hand, the Labor Code of the Russian Federation limits the scope for establishing a specific amount of compensation to a minimum limit. The upper limit is not standardized. Consequently, the employer can set arbitrarily high compensation by fixing it in the collective agreement.

The question arises: will the amount of compensation be subject to personal income tax (both in terms of the minimum and in terms of exceeding the minimum under the Labor Code of the Russian Federation)?

Regarding the minimum amount of compensation, the answer is transparent: it will not be subject to personal income tax. This has been confirmed more than once by the regulatory authorities in their explanations (letters of the Federal Tax Service of the Russian Federation dated 06/04/2013 No. ED-4-3 / [email protected] , Ministry of Finance of the Russian Federation dated 02/28/2017 No. 03-04-05/11096, 01/23/2013 No. 03- 04-05/4-54, etc.).

In the case of exceeding the minimum allowable amount, controllers take a similar position: the amount of excess is not subject to personal income tax, but only if such excess is consistent with an employment or collective agreement (letter of the Ministry of Finance of the Russian Federation dated November 28, 2008 No. 03-04-05-01/450, dated 06.08 .2007 No. 03-04-05-01/261).

NOTE! If a company abuses this exemption and, under the guise of compensation, pays, for example, the salary itself to employees, then this is fraught with disputes with inspectors and additional personal income tax amounts being assessed during the inspection. In this case, the court will most likely side with the inspectors, since content has priority over form: regular payments of compensation in an amount significantly exceeding the amount of wages accrued to employees prove that wages were actually paid. This means that it is necessary to pay personal income tax (resolution of the Federal Antimonopoly Service of the Ural District dated November 30, 2012 No. F09-11655/12 in case No. A60-7589/2012).

Whether it is necessary to accrue personal income tax when paying other compensation payments, read the materials in the section “Compensation and personal income tax” .

Where to go if you haven't paid your vacation pay

As practice shows, most issues of calculating vacation pay on time are resolved at the stage of notifying the manager of the employee’s intention to appeal to the labor inspectorate or court.

But if this does not bring results, the citizen can submit an application to the specified authorities to bring the company’s management to justice.

The application is drawn up in free form in compliance with the rules for maintaining official documentation and indicating the following information:

- Details: Full name of the person to whom the document is sent, Full name, registration address and contact telephone number of the applicant, full name of the employing organization indicating the form of ownership, contact telephone number, address of the head office and Full name O. manager.

- The essence of the complaint: the date of leaving on vacation according to the schedule, the amount due for payment, the expected date of payment, the number of days of delay.

- Link to the document on the basis of which the applicant cooperates with the organization (employment contract), its details.

- The applicant’s demands: consideration of the complaint, inspection of the enterprise’s activities, collection of debt from the employer along with compensation.

- Date of document preparation and signature.

Sample application for late payment of vacation pay to the labor inspectorate:

Insurance premiums for payment of compensation for late wages

If a company pays personal income tax as a tax agent, that is, at the expense of an employee, then the burden of insurance premiums falls directly on the organization.

So, is interest on late payments subject to insurance premiums? There are two points of view on this issue.

One is that amounts of monetary compensation for violation by the employer of the established payment deadline are not subject to inclusion in the base for calculating insurance premiums. This conclusion was reached, for example, by the judges of the Arbitration Court of the Far Eastern District dated December 21, 2017 No. F03-4860/2017 in case No. A73-2697/2017 (the decision of the Supreme Court of the Russian Federation dated May 7, 2018 No. 303-KG18-4287 refused to transfer the case to the court Collegium for Economic Disputes).

The arbitrators motivated their decision by the fact that compensation for late payment of wages is not remuneration, but a type of financial liability of the employer to the employee, which is paid by force of law to an individual in connection with the performance of his labor duties, providing additional protection of the employee’s labor rights. For this reason, compensation for late payment of wages is not subject to insurance contributions on the basis of subclause. “and” clause 2, part 1, art. 9 of Law No. 212-FZ (since January 1, 2017, similar provisions are given in paragraph 2 of Article 422 of the Tax Code of the Russian Federation).

See also “Compensation for non-payment of wages on time: contributions”.

Another point of view is that the types of payments not subject to insurance premiums are listed in Art. 422 of the Tax Code of the Russian Federation. Compensation for late payment of wages in Art. 422 of the Tax Code of the Russian Federation is not given, therefore, contributions must be calculated from this payment. This position is adhered to by the Ministry of Finance of the Russian Federation in letter dated March 21, 2017 No. 03-15-06/16239.

As you can see, this issue is controversial. And it's up to you to decide.

Salary for the first half of the month

The Labor Code does not contain the concept of “advance”. In accordance with the position of Rostrud (letter of Rostrud dated 09/08/2006 N 1557-6), when paying wages for the first half of the month, you must be guided by the information in the time sheet and pay wages according to the time actually worked.

This payment procedure causes difficulties, because... in accordance with the Tax Code and the position of the Ministry of Finance, personal income tax must be calculated based on monthly results, taking into account the provision of standard deductions. In addition, other deductions (for example, alimony) are also calculated from the salary for the entire month. Therefore, it turns out that if you make payments for the first half of the month according to the time actually worked, but without taking into account deductions from your salary, then the salary for the second half of the month will be less, because when calculating, you will need to take into account deductions from your salary for the entire month .

Therefore, most accountants calculate salaries for the first half of the month in the form of an advance: they set each employee an amount that is approximately half of the amount payable for the month (including deductions) and pay it without dividing it into specific additional payments, allowances and without withholding income tax. And after the end of the month, all types of accruals and deductions are calculated, the total amount payable for the month is determined and the advance payment already paid is subtracted from it. This is the salary for the second half.

Approach each employee individually. If an employee was on vacation for the entire first half of the month, he does not need to pay an advance, because he has already received vacation pay for this period. If the employee did not work for some reason or worked less time, then the amount of the advance must be reduced.

You won't miss anything in payroll

“Accounting is a convenient program. Thanks to the developers. I have been working with Kontur for a long time. And it’s convenient to manage personnel; you’ll never miss anything in payroll. Taxes are calculated on their own. All reports reach the recipient on time. Everything is updated with the times. I really like it, everything is convenient. And when something is unclear, you can call - and they will always come to your aid. Thanks again to the developers."

Natalia Abbasova, accountant, senior Veshenskaya, Rostov region.

Accounting for compensation for late wages in income tax expenses

Regarding income tax, the situation is somewhat more complicated. The Tax Code of the Russian Federation does not contain any provisions regarding whether such compensation can be taken into account as expenses or not.

The code only says that a company can include in its expenses compensation, the payment of which to employees is related to any working conditions (Article 255 of the Tax Code of the Russian Federation).

In addition, paragraph 13 of Art. 265 of the Tax Code of the Russian Federation allows sanctions for violation of contracts to be taken into account in expenses. However, no restrictions or sanctions have been established. There are also no special conditions regarding whether this rule applies only to civil contracts or to employment contracts as well.

Therefore, on the one hand, it is possible to consider compensation for the delay of the PO as a sanction and take it into account as part of the expenses. Previously, the courts agreed with this logic (resolutions of the Federal Antimonopoly Service of the Volga District dated August 30, 2010 in case No. A55-35672/2009).

At the same time, later the regulatory authorities took the position that such compensation cannot be included in expenses, since it is not related to working conditions (Article 255 of the Tax Code of the Russian Federation does not apply), and the norms of Art. 265 of the Tax Code of the Russian Federation does not apply to this compensation (letter of the Ministry of Finance of the Russian Federation dated October 31, 2011 No. 03-03-06/2/164).

Therefore, today it is quite risky to take into account compensation for delays in salary payments in expenses.

ConsultantPlus experts examined three points of view on this issue and presented arguments from officials and arbitrators in defense of each. If you do not have access to K+, get trial online access for free and go to the Encyclopedia of Disputed Situations on Income Tax.

Appeal to other authorities

It should be remembered that only a court can recover money from an employer. It is quite possible that you will be advised to file a complaint with the Prosecutor's Office or the labor inspectorate, and it is quite possible that these authorities will help you. However, please remember that:

- The prosecutor's office and labor inspectorates are extremely slow structures. The period for considering citizens' applications there is a month, but by the time you receive an answer, it may well take a month and a half.

- The orders of these authorities cannot oblige the employer to pay you.

- Contacting labor inspectorates does not suspend the running of the statute of limitations. If we assume that you waited a month and a half for the employer to pay voluntarily, then waited a month and a half for the inspectorate to wag its finger at the employer, then you have already missed the deadline for going to court.

- The court may recognize the missed deadline as valid due to the fact that you were waiting for a response from the labor inspectorate. Or maybe he won’t admit it. Just remember that the courts are overloaded with work, and every new lawsuit is a tragedy for the judge. Therefore, almost any judge will do everything possible to get rid of both you and your claim.

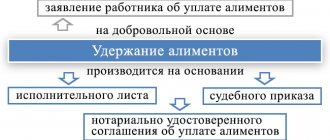

Procedure for paying compensation for delayed wages

The mechanism for documenting payment for delays in the Labor Code of the Russian Federation has not been established.

Therefore, a company can, for example, provide in a local regulatory legal act that when paying compensation, an order is issued from the manager (for personnel). It is compiled in any form. However, such an order should indicate that compensation is paid specifically for the delay in payment of the salary, and also indicate the period of delay.

Such an order must be brought to the attention of the employee under his personal signature.

A sample order for payment of monetary compensation to an employee for delayed wages is available in the ConsultantPlus system. Get free trial online access to K+ and proceed to the document.

As a result, we note that the employer bears administrative and criminal liability for delays in payment of wages. The amounts of fines and other types of penalties are given in the ConsultantPlus system. Get a free trial of K+ and start exploring the implications.

Criminal liability

According to Art. 145.1 of the Criminal Code of the Russian Federation, a fine for non-payment of wages is imposed on the head of an enterprise, an individual employer, or the head of a particular structural unit of the company, if such non-payment was committed by them for selfish or other personal interest.

For partial non-payment (less than 50% of the due amount) for more than three months, the fine will be up to 120,000 rubles. or will be equal to the income of the convicted person for a maximum of one year. Other punishment options for this act are a ban on holding specific positions or engaging in certain activities for a period of up to a year, or forced labor for a period of up to two years, or imprisonment for a maximum of one year.

For complete non-payment of earnings that lasts more than two months, you will be fined 100,000–500,000 rubles. or the amount of the offender’s income for a maximum of three years. Other punishment options in this case may be either forced labor for up to three years with a ban on holding certain positions or carrying out specified activities for the same time or without it, or imprisonment for a maximum of three years with a ban on holding specific positions or working in a certain way ( or without it) for a maximum of three years. Similarly, they will be punished for paying wages below the minimum wage (currently 11,163 rubles) if this continues for more than two months.

In case of serious consequences (loss of ability to work, illness, death of a person, damage or loss of property, graduation due to the inability to pay for it, etc.) that resulted from the above acts, penalties will increase as follows:

- fine for late wages - 200,000–500,000 rubles. or the offender’s income for one to three years;

- imprisonment - two to five years plus a ban on holding certain positions or engaging in any activity (or without it) for a maximum of five years.

Results

Calculating compensation for delayed wages is not a difficult task for an accountant, since the calculation formula is directly provided for in the Labor Code of the Russian Federation and does not require any complex data and calculations.

It is enough to know the size of the overdue salary, as well as the current refinancing rate. Employees should understand that they can count on such compensation in any case, even if the employer is not to blame for the delay. It is important for the company not to forget that personal income tax may not be charged on the amount of compensation, but insurance premiums will have to be paid. In relation to income tax, it will most likely not be possible to include compensation as expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documents attached to the application

The statement of claim will need to be accompanied by documents indicating, firstly, that you have an employment relationship with the employer, and secondly, documents confirming your claims.

Thus, in general terms, the list of attached documents should look like this:

- An extract from the work book, which can be obtained from the personnel service or from the accounting department of the enterprise.

- Employment contract.

- Interest calculations that you can do using the calculator.

- Optional documents, for example, indicating that you missed a deadline for a good reason or the costs of a lawyer that you are asking to recover from the employer.

- Copies of statements of claim at the rate of “one for the court, one for the defendant.”

When submitting an application, it would be useful to have an additional copy with you, on which the court employee will put a mark of acceptance.