According to the law, employers have the right to count on the offset of paid maternity benefits against the payment of insurance contributions to the Social Insurance Fund of the Russian Federation. In cases where the amount of the benefit exceeds the amount of contributions paid, the fund compensates the employer for the expenses incurred by him. However, offset and reimbursement of maternity benefits is not always possible. The most typical reasons for refusal of compensation for BUKH.1S were considered by tax expert Igor Karmazin

. And at the same time he answered the question about in what cases an organization can challenge such a refusal in court.

Article 4.6 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” directly states that if the amount of benefits paid to an employee exceeds the amount of contributions that the company must pay in FSS, the fund fully compensates the employer for all expenses incurred.

| Cheat sheet on the article from the editors of BUKH.1S for those who do not have time 1. Employers have the right to count off paid maternity benefits against the payment of insurance contributions to the Social Insurance Fund. 2. If the amount of benefits paid to the employee exceeds the amount of contributions that the company must pay to the Social Insurance Fund, then the fund will fully compensate the employer for all expenses incurred. 3. The Social Insurance Fund has the right not to accept for offset expenses for compulsory social insurance made in violation of the law. 4. The most common complaint against employers from the Social Insurance Fund is the hiring of female employees shortly before going on maternity leave. 5. To receive compensation, the employer usually needs to prove only a few points: the existence of an employment relationship between the policyholder and the insured person, the occurrence of an insured event, the fact of payment of benefits and its amount. Everything else is proven by the FSS. |

However, offset and reimbursement of maternity benefits

is not always possible. According to Article 11 of the Federal Law of July 16, 1999 No. 165-FZ “On the Fundamentals of Compulsory Social Insurance,” the insurer has the right not to take into account expenses for compulsory social insurance made in violation of the law. This may include incorrectly executed or forged documents, the creation of an artificial situation for the reimbursement of funds from the Social Insurance Fund in an inflated amount, and other violations.

The Social Insurance Fund may refuse to reimburse expenses incurred.

also if there are doubts about the integrity of the organization and its employees. The reason for such doubts can be a variety of circumstances, from the moment of employment to the suitability of the employee for the position held.

The insurer proceeds from the fact that reimbursement of funds from the fund is a restorative measure aimed at compensating the actual costs of the policyholder. Therefore, the occurrence of an insured event (pregnancy and childbirth) in itself is not a sufficient basis for receiving compensation. The employer will need to prove its good faith. At least, even before problems arise with the FSS and going to court, care must be taken not to incur the disfavor of controllers.

Working and unemployed mothers - the difference in benefits

Maternity benefits are provided to mothers regardless of the length of their work experience. But the amount of payments depends on the actual circumstances:

- employed mothers – 100% of average earnings;

- women dismissed due to liquidation of the enterprise - 300 rubles;

- female university students – scholarship amount;

- contract military personnel - monthly allowance.

On a note! The period of dismissal of an employee due to the liquidation of the enterprise should not exceed 12 months.

However, there are nuances here . If the insured woman’s work experience is less than 6 months, then she is entitled to a benefit in the amount of the minimum wage. That is, no more than 12,792 rubles. (01/01/2021). More details about maternity payments here.

At the same time, the law does not provide for the payment of maternity benefits for non-working women (Article 6 of the Federal Law of May 19, 1995 No. 81-FZ). Such mothers are entitled to only a one-time payment at the birth of a baby - 18,886.32 rubles. The father of the child can also apply for it.

Employed women apply for benefits through their employer, and non-working mothers apply for benefits through the social security authorities. If the child’s father will receive the payment, then he can do this through the employer. The papers are submitted to the accounting department at the place of work. The only condition is that the man must be listed as the father on the birth certificate.

But all women are entitled to child care benefits. Employed citizens are paid 40% of average earnings. However, the amount of payments must not exceed the minimum and maximum thresholds. The minimum benefit amount is 7,082.85 rubles, the maximum is 29,600.48. The number of children does not affect the amount of payments. More useful information here.

Conclusion! Employed women are in a better position than unemployed mothers. They are entitled to maternity benefits even if their work experience is less than six months.

Refusal cannot be refunded

So, an analysis of judicial practice

shows that not all claims by insurers can lead to a refusal to reimburse benefits. Individual signs of illegal reimbursement of funds are not yet a violation. To receive compensation, the employer only needs to prove a few points. This:

- existence of an employment relationship between the policyholder and the insured person,

- occurrence of an insured event,

- the fact of payment of benefits and its amount.

Everything else is proven by the FSS.

It should be taken into account that the law prohibits unjustified refusal to hire for reasons related to pregnancy. Hiring someone shortly before going on maternity leave is also not a crime, but a guarantee of respect for women’s rights. Family relations between an employee and the head of an enterprise cannot serve as a basis for refusal to pay benefits. Part-time work, high wages and other similar circumstances cannot serve as such a basis.

Source: https://www.buh.ru

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Conditions of the benefit

The conditions for payment of child benefit are determined by law. In this case, it is necessary to take into account the type of financial assistance and the status of the mother. For example, maternity benefits can be received at your place of work or study. If a woman is fired due to the liquidation of an enterprise, she must contact the social security authorities (clause 15 of Order No. 668 of the Ministry of Labor of the Russian Federation dated September 29, 2020). Payment of mandatory benefits from the state is made 10 days after submitting the application. An exception is cases of dismissal due to liquidation. This category of citizens receives payment no later than the 26th of the next month.

One of the parents can receive a lump sum benefit for the birth of a child. You can apply for financial assistance at your place of work. If a woman is not married and does not work, then she will need to contact the social security authorities.

If an unemployed mother is a university student studying full-time, then to receive a one-time payment she needs to contact the social security authorities (clause 27 of the order). The benefit is paid within 10 days from the date of submission of documents.

Combination of positions

Another circumstance that may attract unwanted attention from the Social Insurance Fund is the payment of benefits to an employee who combines positions in one or even several organizations at once.

The earnings of such employees will be higher. Accordingly, the benefit will be paid in an increased amount. When refusing to reimburse benefits, the Social Insurance Fund in most cases insists that a woman, especially a pregnant woman, is simply physically unable to simultaneously perform the duties of both her main job and a part-time job. By law, concluding employment contracts for part-time work is allowed with an unlimited number of employers. At the same time, the conclusion of employment contracts for part-time work with an unlimited number of employers is permitted subject to the provisions of Part 1 of Article 284 of the Labor Code of the Russian Federation.

Moreover, the duration of working hours when working part-time should not exceed a total of four hours per day. If the court finds that this restriction was not observed, and the employee’s wages were paid and taken into account in full, and not in proportion to the time worked, the court will refuse to reimburse the benefits.

One of these cases was considered by the Eighth Arbitration Court of Appeal in Resolution No. A70-11765/2015 dated June 10, 2016. The employee got a part-time job, the duration of which, as we have already noted, due to labor legislation, should not exceed four hours a day. But at the same time, she was hired on a full-time basis - from 9 a.m. 00 min. until 18:00 00 min., with a lunch break from 13 o'clock. 00 min. until 2 p.m. 00 min. Accordingly, her wages were paid in the amount of her full salary. In such circumstances, compensation to the employer was denied.

The court will refuse compensation even when a clear disproportion in the amount of wages at the main place of work and at an additional job is established.

As an example, we can consider the dispute resolved by the Eighteenth Arbitration Court of Appeal in Resolution No. A07-16176/2014 dated April 1, 2015. From the case materials it followed that the woman was hired as an administrator as a main employee with a salary of 6,800 rubles. In addition, a fixed-term employment contract on a part-time basis was concluded between the company and the employee. According to it, the woman worked from home as a project manager with a salary of 50,000 rubles. The court upheld the FSS's refusal to reimburse the benefits paid. According to the court, such a disproportion in earnings indicates a deliberate overstatement of income in order to obtain unjustified compensation from the Social Insurance Fund.

Federal benefits

Federal benefits:

- Early registration at the antenatal clinic - 708.23 rubles.

- Payments for a child under 3 years of age (for children born before 01/01/2020) – 50 rubles. per month.

- Maternity capital – 483,882.0 rub. for 1 child and 639,432.0 rub. for 2 or 3 kids.

Note. Monthly payments for children under 3 years of age are provided to non-working parents who care for children. Payments are made at the expense of the employer.

Unemployed women are entitled to all types of financial assistance, except for maternity benefits and payments for children under 3 years of age.

Maternity payments

Svetlana enters the office with a sick leave certificate. Soon she will become a mother. Of course, this is a joyful event, but what should the employer do? Of course, congratulations, and also do not forget about all the appropriate benefits.

What payments are due?

- Payments upon early registration - if Svetlana went to the antenatal clinic before 12 weeks of pregnancy. The benefit is paid by the employer. The amount is calculated from the minimum wage - 675.15. Depending on the region, a regional coefficient may be added (Article 148 of the Labor Code).

- Sick leave for pregnancy and childbirth - lasts 140 days during normal pregnancy. If the birth was difficult, then the sick leave increases to 156 days. 160 days are given to women who live in areas contaminated by radiation. The longest is 194 days for a mother who is expecting several children. The payment is calculated based on the woman’s average earnings over the last two years of work. If she has worked for less than six months or her average salary is less than the subsistence minimum, then vacation pay is calculated from the minimum wage.

- Payments upon the birth of a child are a one-time payment to an employed family member. Established by the state.

- Child care benefits up to 1.5 years old are paid by the employer. The amount is equal to 40% of the average salary for two years.

- Allowance for child care up to 3 years old - paid by the state since January 2021 to families whose subsistence level is less than double for one person.

When is the benefit paid?

- Sick leave for maternity leave - on the next payday after the pregnant employee has brought all the necessary documents. Payments from the insurance service can be received no later than the 26th day of the month after the application.

- Early pregnancy benefit - paid at the same time as sick leave for pregnancy and childbirth.

- A one-time benefit for the birth of a child is paid within ten days after application.

- Child care benefits up to 1.5 years old - no later than ten days after submitting the application during the period of payment of wages.

In some cases, the company may not be able to provide the full amount. The reason for this is debts, frozen accounts, bankruptcy, insufficient funds. Svetlana’s interests are protected by Article 4.6 of Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.” According to it, the employer can contact the Social Insurance Fund.

Appeal regarding the pilot project

According to the social insurance pilot project, a woman receives money directly from the Social Insurance Fund. The employer simply needs to obtain documents and fill out a form. At the moment, not all regions are included in the pilot ones. In 2021, their number will approach 77. You can find out the possibility of direct payments on the Social Insurance Fund portal. Moscow should join the project in 2021 (details in our article). The registration of maternity leave according to the pilot project is as follows:

- A woman gives her employer sick leave from the antenatal clinic. Then he fills out an application for maternity leave.

- Within 5 days, the employer must send this data to the Social Insurance Fund and attach information about wages.

- The FSS reviews the application within ten days and then makes a decision. If the answer is positive, payment is credited no later than the 26th day of the month after the application.

- The employer does not stop paying insurance premiums and pays them in full.

The region is not a pilot area

If the region is not connected to the pilot project, then the employer is required to make payments. The amount of maternity leave may be unaffordable for a small company, what should you do then? It is necessary to contact the FSS and prove insolvency. To apply, prepare an application and sick leave for the employee, as well as a certificate of income, a copy of the work record book, documents confirming your authority to represent the employee’s interests and information about the company’s account balance. Then the FSS reviews all the documents and makes a request for your accounts. If the request is confirmed, the required amount will be sent to the company’s account.

Refunds and credits

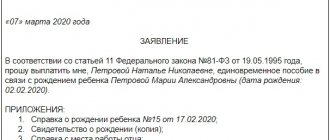

The employer can pay maternity benefits on their own, and then reimburse the expenses with the help of the Social Insurance Fund or take them into account in the payment of future contributions. If you choose a refund, you must apply after the billing quarter. To do this, you will need the following documents, which can be downloaded from 1C:

- Application in two copies.

- Certificate of invoice with information about contributions and expenses, credits and funds, and amounts owed.

- Breakdown of Social Security Expenses.

- Calculation of contributions for the previous quarter.

- Confirmation of submission of this report.

- A copy of the employee’s work record book, certified on every page. On the back of the last sheet you need to indicate that the person is still working today.

- Confirmation of benefit payment.

Payment of maternity benefits can be included in the FSS contributions: you simply do not pay contributions until the amount is exhausted. If the end of the year approaches, the remaining amount must be reimbursed.

Why can the FCC refuse to pay?

- The staffing table did not provide for the position until the employee arrived at work.

- The salary is much higher than other employees.

- Education does not allow you to hold a position.

- The benefits were calculated for a different period.

- Before going on sick leave due to pregnancy, wages were paid in triple the amount.

The FSS may have a question if the employee worked for less than six months before going on maternity leave. An FSS employee is conducting a desk audit of the case. He may request the necessary supporting documents. They must be provided within five days. Among the requested documents may be the employee's diploma, departure and arrival schedule, work reports and other information. If all errors are corrected and no more questions arise, the report is not drawn up.

FSS hotline

The insurance service provides a hotline. The number depends on your region. The call is paid. The service is designed to answer questions about the types of benefits, whether your region is included in the pilot project, and the amount of insurance premiums. The hotline does not resolve individual issues. To do this, you must visit the branch in person. Over the phone, they can only tell you the next steps to solve the problem, but this will significantly speed up the process.

How to submit documents to the FSS?

- Personal application - in this case, all documents in paper form must be submitted to the branch to which your company is attached.

- Through an acceptance gateway – documents are submitted electronically if the policyholder has an electronic signature.

- Web service – in electronic form from the policyholder’s information systems with an electronic signature.

The employer is the insurer of his subordinates. Pregnancy, childbirth and child care are included in the insured event. Even if the employer’s account does not have enough funds to pay benefits, the Social Insurance Fund can pay this money from the fund. If your region is connected to the pilot project, then all payments will be made immediately to the employee’s account. Unfortunately, not all regions have joined the program yet, so we will make payments through 1C.

Payments upon early registration

The company must pay Svetlana a lump sum of 675.15 rubles, since she registered with the antenatal clinic in advance and brought the appropriate certificate. We follow the path: “Salaries and personnel”, “Salary settings”, “Payroll calculation”, “Accruals”. We create a new accrual.

Fill in the billing information. In the title line we write: “One-time benefit for registration in the early stages of pregnancy.” Next, the form is filled out according to the sample.

If the reflection method does not contain the item “Dt 69.01 Kt 70”, then it needs to be created:

Let's move on to accruals: “Salaries and personnel”, “All accruals”, “Salary accruals”,

Add an employee and select the desired accrual.

Sick leave for pregnancy and childbirth

Svetlana brought a certificate stating that she needed disability leave for 140 days. Let's imagine that she only worked for two months and this is her first job. In the menu, go to the “Salaries and Personnel” tab, select “All accruals”.

In the window that opens, click “Create”, “Sick leave”.

Fill in the data and the system will automatically display the required amount.

Since Svetlana’s maternity leave is calculated based on the minimum wage, changes need to be taken into account. In 2021, the minimum wage will be 12,130 rubles. In 2019 – 11,380 rubles. Let's imagine another situation: Svetlana brought a certificate of income. Salary for 2021 – 600,000 rubles and for 2021 – 600,000 rubles. This information must be entered into the database.

The amount of payments has changed noticeably. Let’s try to calculate it: “Salaries and personnel”, “All accruals”, “Create”, “Sick leave”. Now you need to select Svetlana from the list of employees and in the “Accrue” section select “Sick leave”. The amount will be added automatically; after checking the data, the document can be processed.

One-time benefit for the birth of a child

At the birth of a child, an employed mother is entitled to a lump sum payment from the employer. Again, go to the “Salary Settings”, “Accrual” menu, create a new one and fill it out according to the template:

The amount of accruals will be 25,205.77, to calculate it you need to multiply the established amount (18,004.12 rubles) by the regional coefficient (1.4 is valid in most regions of Russia). We return to the “Salaries and Personnel” menu, “All accruals” and enter the required amount.

Payment for child care benefits up to 1.5 years

After Svetlana becomes a mother, she must provide documents confirming the birth of the child within six months. The employer's task is to pay benefits on time. In 1C: Accounting 3.0 there is no separate function for registering such leave, so we create a new accrual:

All we have to do is make sure that Svetlana receives payments every month. We create an accrual and indicate the amount of monthly payments.

During maternity leave, not only the mother, but also the employer worries, especially if you need to do the accounting yourself. 1C helps to calculate all the necessary indicators. To do this, you need certificates from the employee and payslips for two years. You can receive assistance with payments from the Social Insurance Fund immediately or receive compensation later. Maternity leave is not subject to personal income tax, so it’s enough just to pay insurance premiums on time. Additionally, starting from 2021, even parents of their first child can apply to the pension fund to receive maternity capital.

Regional payments

The regional government has the right to assign additional types of financial assistance for the maintenance of children. For example, in Moscow and the Moscow region, large families are provided with compensation for expenses associated with the rising cost of living. The amount of payment for a family is 1315 rubles. (three children).

This also includes compensation for the cost of food. Payments are made for children under 3 years of age. The amount of assistance is 740 rubles. The full list of payments is enshrined in the Moscow PP dated 12/16/2020 No. 2260-PP.

Similar payments are made in St. Petersburg. You can find out more about the types of financial assistance on the City Administration website.

In some regions they make an additional payment to maternity capital. For example, in Nizhny Novgorod, citizens are paid 100,000 rubles. for the third child. The government is encouraging an increase in the birth rate in the region. The program is valid until December 31, 2026.

Thus, citizens receive double subsidies from the state (federal + regional payments). The procedure for receiving financial assistance is determined by the subject of the Russian Federation.

What to do if payments are delayed?

To begin with, if payment is delayed, it is recommended to contact the accounting department or speak directly with the manager. In some cases this really helps. An error could have occurred in the accounting department, it will be corrected and the situation will change.

But there is another option in case of what to do if the employer does not pay maternity benefits. You should submit your application directly to the FSS. After this, the money should arrive in the recipient's account.

If these actions do not bear fruit, this means that it is time to contact the labor inspectorate. After conducting an investigation and reviewing the situation, they may recommend sending the case to the court or prosecutor's office.

If the employer’s guilt is confirmed, then administrative liability will be applied to him. In this case, in addition to those payments that were assigned but not transferred, the court may determine additional ones. Also, the FSS can “freeze” payments if there is an error in the documents.

Then you just need to correct all the inaccuracies in the data. This may also happen due to the fact that the employer did not make contributions to the fund. In this case, you can only count on minimal maternity payments, and in the future this decision can be appealed in court.

Expert opinion

Irina Vasilyeva

Civil law expert

If an employer says that he cannot pay maternity benefits because he does not have the money for it now, this situation is unacceptable, since the benefit is paid by the Social Insurance Fund.

Monthly benefits

All types of financial assistance are divided into two groups - one-time and monthly. Monthly payments are mainly due to large families. The types and amounts of benefits are approved by the regional government. Monthly payments are compensatory in nature. Citizens can reimburse:

- expenses due to rising costs of living;

- costs due to rising food costs;

- expenses for the purchase of children's goods;

- costs of maintaining the apartment and paying for utilities;

- costs for using a landline telephone;

- costs of purchasing a set of children's clothing for school.

A list of available benefits and payments is usually presented on the local administration website.

Can the Social Insurance Fund not pay maternity benefits, what could be the reasons for this?

There are 4 reasons why the Social Insurance Fund may refuse to recalculate maternity benefits or to pay them.

Maternity pay was paid to an employee who was recently hired

In general, an employer cannot refuse to hire a woman solely because

the reason for her pregnancy. However, when hiring a pregnant woman, you should be prepared for the fact that FSS employees will consider this act an attempt to illegally obtain funds to pay maternity benefits.

There are several certain conditions under which social security has the right to refuse to pay money to a recently employed pregnant woman:

- lack of sufficient qualifications;

- failure by the employee to fulfill her job duties (i.e. formal employment);

- a significant excess of the pregnant woman’s salary over the earnings of other employees occupying similar positions;

- creation of a new position in the staffing table specifically for the hiring of a pregnant woman.

An employee's salary was unreasonably increased before maternity pay was accrued.

If an employee received a certain salary for a long period before maternity leave, and immediately before the benefit was issued it increased sharply, then the employer will have to clearly explain to the Social Insurance Fund employee the economic justification for this action. Good reasons may include: an increase in the length of the working day, an increase in the volume and complexity of work, as well as an increase in production load.

If social security considers such a sharp increase in wages unjustified, then maternity benefits will be recalculated at the previous level of wages.

Benefit paid to working pregnant woman

Maternity leave is a way to reimburse a pregnant woman for her previous earnings due to the impossibility of receiving it.

Therefore, they are not available to women who continue to work even with an officially issued sick leave. A similar rule also applies in cases where a woman who has received benefits in full decides to go on maternity leave later or, conversely, to return to work earlier. Then maternity benefits are considered to be accrued in excess, and part of the money must be returned or can be deducted from the current salary of the recipient of the benefit.

The benefit was paid to the head of the enterprise or its founder

In this case, it is necessary to understand that the director of the organization is the same employee as his subordinates, therefore payment of maternity leave to him is mandatory! But under one condition: an employment contract must be concluded.

What to do if the employer does not pay wages? In our material you will find the information you need on this topic.

If your salary is delayed by more than two weeks, you are entitled to compensation. Read more in this article.

All about piecework payment for your work - find out about it here.

Social assistance for unemployed mothers

Unemployed people have access to different types of social assistance. This includes:

- Unemployment benefit.

- Payments upon birth of a child.

- Help for single parents.

- Social mortgage.

- Providing housing for temporary use.

- Maternal capital.

- Special food for children.

- Old age pension.

The procedure for providing assistance and the amount of payments depends on the date of birth of the child, the number of children and the specific region.

How to file a complaint

The requirements for the content of the complaint are defined in clause 3 of the Rules - when filing a complaint with the structural units of the FSS - and Art. 7 Federal Law No. 59 - when filing a complaint with the prosecutor's office. The complaint must contain:

- the name of the body to which the complaint is filed, or the name of the position and initials of the manager to whom the complaint is addressed;

- initials and address of the applicant or name and legal address for the company; telephone number for contact; email address if the applicant wants the response to be sent to him by email;

- date of filing the complaint;

- information about the action or decision of an employee of the Social Insurance Fund or a fund branch that is being appealed;

- the applicant’s arguments (links to regulations, documents, etc.), which confirm the presence of violations by FSS employees;

- the applicant's request to eliminate the violation of his rights.

The complaint in writing must be certified by the signature of the applicant or his representative.

For reference: you can write a complaint to the FSS or the prosecutor's office in free form on an A4 sheet, if the complaint is sent in writing; by hand or using printing technology. There is no formalized form or special requirements for filing a complaint.

Maternity benefit amount

The amount of maternity benefits depends on the status of the recipient (dismissed mother, student). The basis is the recipient’s income (scholarship, minimum wage) and the period of incapacity for work (140 or 156 days). Payment calculations are made using the following formula:

At the same time, citizens need to take into account restrictions on the maximum amount of daily earnings. More details about this here.

On a note! Maternity benefits are paid for the period of leave. If a woman refuses maternity leave and continues to work, then she will not be entitled to payments.

Registration of maternity benefits in 2021

To receive maternity benefits, a non-working mother will need the following documents:

- Application for assignment of payments.

- Certificate of pregnancy from the antenatal clinic (from 30 weeks).

- Excerpt from work book. The document must contain a link to the last place of work and be notarized.

- Certificate from the employment center (confirms the status of unemployed).

- Certificate from the university about full-time study (for female students).

Separately, a certificate from the Federal Tax Service may be required regarding the liquidation of the enterprise.

To apply for childbirth benefits, the following documents are required:

- passport;

- birth certificate;

- certificate of family composition;

- account details for depositing money;

- a certificate from the employment center confirming the absence of unemployment payments.

Documents are submitted to the social security authorities at the mother’s place of residence. The decision on the accrual and payment of benefits is made within 10 days from the date of submission of the application.

Paying benefits to yourself

In practice, many questions are raised by the situation when the director of an enterprise, who is the only founder and participant of this company, goes on maternity leave

. From the point of view of the Social Insurance Fund, the right to reimbursement of maternity benefits does not arise here at all.

The logic of insurers is approximately the following: the right to receive benefits arises for insured persons for all types of compulsory social insurance from the moment of concluding an employment contract with the employer. In turn, an employment contract between the company and the director, who is the sole founder and participant of this company, cannot be concluded. Accordingly, there is no need to talk about the right to benefits in this case.

Let us note that such arguments of the FSS were recognized as untenable in the Determination of the Supreme Arbitration Court of the Russian Federation dated June 5, 2009 No. 6362/09. The court explained that labor relations that arise as a result of election and appointment to a position are characterized precisely as labor relations on the basis of an employment contract (Article 16 of the Labor Code of the Russian Federation).

By virtue of Article 39 of the Federal Law “On Limited Liability Companies,” the appointment of a person to the position of director is formalized by the decision of the sole founder of the company. At the same time, the Labor Code of the Russian Federation does not contain rules prohibiting the application of the general provisions of the Code to labor relations when the status of the employee and the employer coincides in one person.

Consequently, labor relations with the director as an employee are formalized not by an employment contract, but by the decision of a single participant. Accordingly, such an employee who has an employment relationship with the company has the right to compulsory social insurance on a general basis.

An additional argument in favor of the refusal of the FSS would be the dismissal of the former director by the founder and the appointment of himself in his place immediately before the birth itself. Moreover, without justifying the reasons for the change of leadership. However, even in such situations, the courts side with the policyholders. If the fund does not prove that the woman in the position of manager did nothing, and the salary assigned to her significantly exceeds the earnings of the previous director.

One of these situations is addressed by the Decision of the Arbitration Court of the Chelyabinsk Region dated October 19, 2015 No. A76-15704/2015. The dispute concerned the payment of benefits to the director of the company, who was appointed to the position 3 months before the birth. The FSS insisted on the economic inexpediency of appointing a new director and the creation of an artificial situation for the illegal reimbursement of funds from the fund. The court confirmed that the economic feasibility of any actions of a legal entity is determined by the legal entity itself. Personnel issues are also within his competence. The FSS has no right to dictate to the organization either personnel policy or the adoption of any strategic decisions.

The FSS did not provide evidence of the insured person’s lack of education or work experience meeting the requirements for the position held. He also did not prove that the woman in the position of director did not perform any work. Under these circumstances, the court decided that there were no grounds for refusing compensation.

The same applies to situations where the employee and the director of the company are in a family relationship. And they are, say, spouses. In resolving such disputes, the courts proceed from the fact that the current legislation does not establish prohibitions on hiring employees, subject to the execution of an employment contract and the actual performance of work activities.

Accordingly, the assignment of benefits to persons who are related or related to the employer does not entail any adverse consequences for the employer. This was noted, in particular, by the FAS of the East Siberian District in Resolution No. A33-20918/2013 of August 27, 2014.

Additional types of government support

Additional types of benefits:

- for children under 3 years old – 50 rubles. per month;

- for children from 3 to 7 years old – 50% of the subsistence minimum;

- for children from 7 to 16 years old – 1003 rubles. (Saint Petersburg).

Separately, citizens can receive one-time assistance in the amount of 10,000 rubles. (RF RF dated 11.05.2020 No. 652). The payment is made regardless of family income or whether parents are employed.

On July 1, 2021, Federal Law No. 151-FZ of May 26, 2021 comes into force. Single parents are entitled to another payment in the amount of 50% of the subsistence level. It is made for children from 8 to 17 years old.

Single mothers and mothers of many children are also entitled to partial reimbursement of expenses for maintaining a child in kindergarten, free medicines, housing subsidies and free travel on public transport. You should check with your local administration about the list of available benefits.

Inconsistency with the position held

Basically, judges agree that in order to receive compensation from the Social Insurance Fund,

a woman must work in her own profession or in a related profession (accountant - economist, lawyer - executive director, cook - waiter, etc.). At a minimum, a position held by a woman outside her specialty should not require special skills and knowledge acquired in educational institutions. By the way, this was repeatedly pointed out earlier by the Supreme Arbitration Court of the Russian Federation (Determination of the Supreme Arbitration Court of the Russian Federation dated 08/09/12 No. VAS-10757/12, Determination of the Supreme Arbitration Court dated 04/26/12 No. VAS-4427/2).

If a woman merchandising specialist is hired as a programmer, then in most cases controllers will consider such employment a scheme to obtain unjustified benefits. When a certified economist is hired as a secretary, there are no grounds for refusing reimbursement of benefits. If an employee can work as an economist or lawyer, then he will be able to perform the duties of a secretary.

The Arbitration Court of the Perm Territory, in its Decision dated April 13, 2016 No. A50-30985/2015, considered the following situation. During pregnancy, the woman was employed as a secretary-assistant. The Social Insurance Fund refused to reimburse the benefits paid to this employee. The reason was that she had no experience in this specialty, and had previously worked as an accountant. The court indicated that the lack of previous work experience as a secretary-assistant, while having experience as an accountant, does not indicate an inability to perform job duties. The fact that the position of secretary-assistant provided for in the staffing table subsequently became vacant, and the functions were distributed between the head of the company and the lawyer, does not entail a refusal to reimburse the benefits. A short period of work (12 shifts) in the presence of a real employment relationship also does not indicate the applicant’s abuse of the right to reimbursement of expenses. As a result, the FSS decision was declared illegal.

A special case of the described problem is the creation of a new position in an organization specifically “for an employee.” Let’s say that a company has been doing without a full-time lawyer for several years, and suddenly such a position in the company appears and is filled by a newly arrived pregnant employee.

Moreover, as a rule, after going on maternity leave, the newly created position is abolished by itself, and the employee’s responsibilities are distributed among other employees. Of course, such a situation will entail a number of reasonable questions. First of all, inspectors will check whether a new employee was needed at all.

The FAS of the Ural District, in Resolution No. A60-26050/2015 dated February 17, 2016, considered the situation when the FSS refused to reimburse an individual entrepreneur for benefits on the basis that there was no need to create a new position. The pregnant employee was hired for the position of deputy director, and the position of the director himself was not available as such (he was the individual entrepreneur himself). The court took into account that the individual entrepreneur proved the fact that the employee was employed and fulfilled her job duties. In addition, payment of all necessary contributions to the Social Insurance Fund was proven. Based on this, the decision to refuse compensation for benefits was declared illegal.

FAQ

No. 1. Are unemployed women entitled to maternity benefits?

This type of social assistance does not apply to unemployed citizens. An exception is dismissal due to the liquidation of the enterprise. No more than 12 months must have passed from the date of dismissal.

No. 2. How long does it take for child benefit to be paid?

Maternity payments and childbirth benefits are paid 10 days after submitting the application. An exception is dismissal due to liquidation of the enterprise. In this case, the mother will receive the payment no later than the 26th of the next month.

No. 3. Where to apply for benefits?

Employed persons submit an application at their place of work, and unemployed persons submit an application to the social security authorities. University students apply for and receive benefits at their place of study.

Increased salary and bonuses

The amount of the benefit directly depends on the woman’s average salary for the two calendar years preceding the year in which the woman goes on maternity leave.

Accordingly, the higher the salary and bonuses, the greater the benefit. Therefore, if a woman held the position of accountant during 2014 and 2015, and in mid-2015, say, in the second month of pregnancy, she was promoted to financial director and her salary was doubled, then this situation will naturally raise many questions from the Social Insurance Fund. As a general rule, a high salary level does not entail a refusal to reimburse benefits. As well as a salary increase during pregnancy. According to Article 129 of the Labor Code of the Russian Federation, an official salary is a fixed amount of remuneration for an employee for performing job duties of a certain complexity for a calendar month, excluding compensation, incentives and social payments.

By law, an employer has the right to hire any person and set him a remuneration in any amount. At the same time, taking into account the established circumstances of the case, reimbursement of expenses for the payment of compulsory social insurance benefits cannot be made dependent only on the employer’s authority in the field of civil law relations.

The salary of a pregnant employee in an accountant position cannot be two or three times higher than the salary of her fellow accountants. Otherwise, a high salary will only attract unnecessary attention from inspectors and will become an additional plus in the FSS’s collection of arguments (Decision of the Supreme Court of the Russian Federation dated August 22, 2016 No. 306-KG16-10153).

To obtain the right to reimbursement of benefits from the Social Insurance Fund

the employer is required to prove that hiring a pregnant employee was due to production necessity, and that the employee herself actually performed a job function. Moreover, the employee’s earnings must correspond (at least approximately) to the average level of earnings in the company in the same specialty and for performing the same amount of work.

If these conditions are met, the employee’s increased salary will not be a reason to refuse reimbursement. This, in particular, was confirmed by the Arbitration Court of the Krasnodar Territory in Decision No. A32-15862/2015 dated August 12, 2016. Here we were talking about doubling the salary of a pregnant employee - from 9 to 18 thousand rubles. The court indicated that, by virtue of Articles 132 and 135 of the Labor Code of the Russian Federation, establishing the amount of wages for an employee falls within the exclusive powers of the employer. Moreover, the Social Insurance Fund does not have the right to influence the level of salaries. The law does not contain such powers for the insurer.

At the same time, an increase in an employee’s salary during pregnancy in itself does not prove the employer’s dishonesty when confirming the payment of wages and the calculation of contributions.