Limitation period for receiving tax deductions

The right to receive a repeated tax deduction are those property owners who bought or built a property before 2001 and received the first tax deduction also before 2001.

The fact is that before this period, personal income tax refunds were made in accordance with the Law “On Personal Income Tax” dated December 7, 1991. The amount to be deducted was then relatively small.

Then the basis for the return of personal income tax became Art. 220 of the Tax Code of the Russian Federation, which allows you to apply a deduction first in the amount of up to 1 million rubles. (since 2003), and since 2008 - already in the amount of 2 million (at the personal income tax rate of 13%, the amount to be returned is 260 thousand rubles). When purchasing an object with a mortgage, you have the right to an additional property deduction of 3 million rubles. (amount to be refunded - up to 390 thousand rubles).

All the details of obtaining a property tax deduction for interest on a mortgage loan were reviewed by ConsultantPlus experts. You can access the explanations for free right now by signing up for a trial online access to K+.

The Constitutional Court of the Russian Federation, in its ruling dated April 15, 2008 No. 311-О-О, explained that if a person exercised the right to a tax deduction before the entry into force of Art. 220 of the Tax Code of the Russian Federation, this does not entail the loss of the right to use the deduction after the entry into force of this article.

In practice, this means that, having bought an apartment, house or share before 2001 and returned the personal income tax, a person can once again return the personal income tax for a property acquired, for example, in 2002 and later. This rule also applies to the mortgage interest deduction.

Deduction amount

One of the most popular tax deductions is the housing purchase deduction, which consists of three parts and applies to expenses for:

- new construction or acquisition on the territory of the Russian Federation of housing (shares in it), land plots for it;

- to repay interest on targeted loans (credits) received from Russian organizations or individual entrepreneurs, actually spent on new construction or the acquisition of housing (share(s) in it) in the territory of the Russian Federation, a land plot for it;

- to repay interest on loans received from Russian banks, for refinancing (on-lending) loans (credits) for the construction or acquisition of housing (share(s) in it) in the territory of the Russian Federation, a land plot for it.

However, it is impossible to apply this deduction if residential real estate or land was purchased with the funds of the employer (other persons), maternity capital or at the expense of budgetary funds, or from a citizen who is interdependent in relation to the taxpayer (relatives, spouses, etc.). )

The maximum amount for new construction or purchase of housing is 2 million rubles.

At the same time, since 2014, the taxpayer has the opportunity to receive a tax deduction not from one, but from several residential real estate properties, but the maximum amount of expenses will remain unchanged - 2 million rubles. according to paragraphs. 1 clause 3 art. 220 Tax Code of the Russian Federation. This can also include the cost of repairing an apartment if, under the contract, residential real estate was purchased without finishing (clause 5, clause 3, article 220 of the Tax Code of the Russian Federation). Since the sphere of mortgage lending for real estate is now actively developing, the government body also did not ignore the costs of repaying interest on loans or targeted loans and determined the maximum amount for such expenses - 3 million rubles. This is regulated by clauses 4 and 8 of Art. 220 Tax Code of the Russian Federation. In other words, the taxpayer has the opportunity to receive 13% on expenses of 2 million rubles. (260,000 rubles), and by 3 million rubles. (390,000 rubles) and thus the maximum amount of property deduction that a taxpayer can receive will be 650,000 rubles.

You can apply for a tax deduction when there is an act of transfer of rights to residential real estate (clause 6, clause 3, article 220 of the Tax Code of the Russian Federation). In other words, if a taxpayer purchased an apartment in a building under construction in 2021, and in 2021 the house was commissioned, then a tax deduction can only be received starting from 2021 (since the transfer and acceptance certificate can only be obtained after the house is put into operation ).

Unused balance

The Tax Code of the Russian Federation sets an upper limit on the amount that can be returned from the budget:

- 260 thousand rubles. for the purchase or construction of an object;

- 390 thousand rubles. for an object purchased with a mortgage.

But the actual amount to be refunded depends on the individual’s income. It often happens that a taxpayer can return only part of the amount allowed for refund, because he did not pay a sufficient amount of personal income tax on his income to the budget.

In this case, the homeowner has an unused deduction balance, which can be received later. Thus, you can apply to the Federal Tax Service for a deduction not only once, but until the entire available limit is exhausted.

However, when applying to the Federal Tax Service again, you should keep in mind several nuances.

First, you need to take into account the year you purchased your home. If it was purchased between 2003 and 2007, you can return only 13% of 1 million rubles. If the property was purchased in 2008 or later, you can return 13% of 2 million rubles. Therefore, the amount of the unused deduction balance must be calculated correctly.

Secondly, when purchasing an object before 2014, the deduction can be obtained only for it, without transferring the balance of the deduction to another object. Since 2014, you can return the balance of the deduction when purchasing another home.

Same with the mortgage deduction. When purchasing an apartment with a mortgage before 2014, the deduction could only be used together with the main deduction and only for the same apartment.

But if a citizen purchased a property with a mortgage in 2014 or later and did not previously use the mortgage loan deduction, then it can be used when purchasing a new home (even if the main deduction was received before 2014). This is confirmed by officials (letter of the Ministry of Finance of the Russian Federation dated May 14, 2015 No. 03-04-07/27582). Thus, an individual has the right to receive an additional 390 thousand rubles.

If both deductions are used, then the owner’s spouse can receive a second deduction, provided that:

- the spouse has not yet exercised his right to deduction;

- the home was purchased during marriage.

Controversial issues related to a spouse receiving a property deduction for personal income tax when purchasing housing are discussed in the Encyclopedia of Disputed Situations regarding Personal Income Tax. You can get a free trial access to K+ and see how such controversial situations are resolved.

Deduction when purchasing property

Who can receive a property deduction

Deductions are provided for citizens who are tax residents of the Russian Federation, i.e. permanently residing in the Russian Federation for more than 183 calendar days a year. In addition, they must pay 13% personal income tax on their income, with the exception of income from dividends.

The property must be located on the territory of the Russian Federation, and the owner must have all the title documents. For a new building, it is enough to obtain an act of acceptance of the transfer; for secondary housing, an extract from the Unified State Register of Real Estate.

When real estate is purchased after marriage, both spouses are immediately entitled to a tax refund. The only obstacle can be a marriage contract.

How much can you get back from the budget?

The buyer of real estate can return:

- 13% of the cost, but not more than 260,000 rubles. (RUB 2,000,000 * 13%) and

- 13% of the amount of interest paid on a mortgage or target loan, but not more than RUB 390,000. (RUB 3,000,000 * 13%). Depending on the date of purchase, the size of the deduction and the procedure for transferring its balance change.

| Date of purchase | Property deduction | Property deduction from mortgage interest |

| From 01/01/2003 to 01/01/2008 | The deduction limit is 1,000,000 (the maximum tax refund is 130,000 rubles), the lost balance is not transferred to other objects. | no size limit |

| From 01/01/2008 to 01/01/2014 | The deduction limit is 2,000,000 (the maximum tax refund is 260,000 rubles), the lost balance is not transferred to other objects. | no size limit |

| after 01/01/2014 | The deduction limit is 2,000,000 (maximum tax refund is 260,000 rubles), the lost balance can be transferred to other objects. | limit 3 million rubles. |

The balance of the deduction can be transferred to other properties only when purchasing an apartment after 2014. This will not work with mortgage interest - this deduction is given only for one property.

When to apply for a deduction

Option 1 - Within the next year after receiving the title documents (in the case of a purchase and sale agreement - this is the Unified State Register of Real Estate, in the case of a DDU agreement - the transfer and acceptance certificate).

Whenever you purchase an apartment or other housing, after receiving ownership rights, you can claim a tax refund even after 2 years, even after ten years.

But at the same time, you can only return the tax for the last three years. For example: you bought an apartment in 2021, but decided to apply for a property deduction only in 2021, 5 years later. This means you can file tax returns for 2021, 2021, 2021. And further, if you have any unused deductions, for 2021 and subsequent years.

Pensioners can return personal income tax for four years at once: for the year in which the purchase was made and the three preceding ones.

Option 2 - Apply for a deduction to the employer in the year of the purchase and registration of documents for the property. Only citizens working under an employment contract can afford this. Please note that the date you applied for a refund does not affect the rule for distributing deductions from 2014.

SberSolutions will help you prepare your declaration and send documents to the tax office without leaving your home.

Apply for a deduction

How to get a property deduction

If you choose the second return option, you must act through your employer. To do this, you need to receive a notice of the right to deduction from the tax office and take it to your place of work. Accounting will stop withholding personal income tax from current earnings, and will also return the tax withheld from the beginning of the year.

Submitting a declaration yourself allows you to return a large amount at once . To do this, during the year we collect income certificates from all employers, prepare documents confirming the purchase, and fill out the 3-NDFL declaration. A desk tax audit should not exceed 3 months, then another 30 days remain for transfer to a bank account.

With the introduction of a simplified procedure for obtaining personal income tax deductions in May 2021, the need to prepare and submit declarations has not completely disappeared. The simplification applies only to certain expenses:

- costs of new construction, acquisition of an apartment, house, room, shares in them, land for individual housing construction;

- interest on mortgages and other targeted loans;

- as well as for an individual investment account.

In addition, the simplified scheme will only work if the bank and local authorities transfer information about the purchase of real estate to the Federal Tax Service. Therefore, you should not rely on such conditional process automation. It is safer and faster to apply for a personal income tax refund yourself.

What errors prevent you from receiving a refund:

- Submission of documents by a person who does not have the right to deduction . Close relatives of the seller cannot receive a tax deduction. Recipients of maternity capital do not have the right to include it in the amount for deduction.

- Errors in paperwork. You can confirm the purchase costs with a handwritten receipt, receipt, payment slip or bank statement. The receipt does not need to be certified by a notary, but if you are confirming expenses with a purchase and sale agreement, it must be certified and contain a clause stating that the seller received the money.

- Missing the deadline for filing a declaration. There is no statute of limitations for property deductions, but there is a limit on the number of years for which you can submit Form 3-NDFL and get the money back. Therefore, if you did not file a deduction immediately, but want to do it later, then remember that you can submit a declaration for no more than three previous years.

- Using the wrong form 3-NDFL . The Federal Tax Service periodically updates declaration forms, so it is important to use the form that was in force in the corresponding reporting year.

Results

Persons who used the right to deduction before 2001 have the right to re-deduction for another item. Taxpayers are also entitled to receive the remainder of the unused deduction. For clarification of your rights in each specific case, it is best to contact a tax consultant with a package of documents for the apartment, and then with an application to the inspector of the Federal Tax Service.

Find out about the nuances of taxing employee income with personal income tax in our “Personal Income Tax” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Where to begin?

First you need to determine how you want to receive the deduction.

There are two ways:

- one-time, for the entire amount of personal income tax paid for the previous period;

- monthly, without withholding personal income tax from income.

Let's take a closer look at the first method of obtaining.

Technical capabilities allow us to send all the necessary documents without leaving home. To do this, we gain access to the taxpayer’s account on the official website of the Federal Tax Service.

If you have a confirmed account on the State Services resource, then you can access the taxpayer’s account through this account.

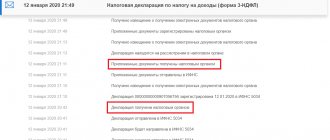

Go to the main menu of your personal account, select the “Life Situations” menu. Here we select “Fill out the 3-NDFL declaration” - one of three options:

- fill out a new declaration online;

- send a declaration previously filled out in a suitable program (for example, in 1C);

- download the program for filling out the declaration.

In my opinion, the best option is the first one, since it allows you to fill out the 3-NDFL declaration without having any special education and with a minimum of labor costs. Filling out the declaration online will take no more than 30 minutes.