The cadastral value is understood as the price of a plot, which is established after a state assessment , which determines individual indicators on the basis of which the price is calculated for specific categories of plots.

In addition to the cost values established at the federal level, certain types of prices can be established as a result of consideration of individual cases in disputes initiated by plot owners.

How often does it change?

Cadastral value indicators have different values for individual categories of land, mainly differing in their purpose or useful quality .

From time to time, prices for certain categories of plots are revised. This is often due to the fact that key indicators change over time, which have a significant impact on its value.

In general, the revaluation procedure is determined by Federal laws, and the terms themselves are established by the State Real Estate Cadastre.

There are time frames within which the cadastral value revaluation procedure is carried out.

Thus, the maximum period is limited to 5 years , and the minimum is 2 years - in this case, the main factor on which they rely when revising prices is the region in which the site is registered.

In some cases, the revision of the cadastral value may be initiated ahead of schedule .

In particular, such cases may be:

- Changing the area of a plot of land towards decreasing or increasing;

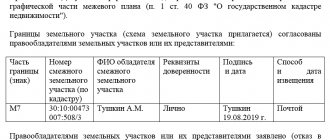

- Carrying out land surveying;

- Changing the purpose of areas. For example, the conversion from land for growing crops to plots for individual residential construction automatically increases the price;

- Commissioning of a facility built on a specific plot of land. As a rule, such actions significantly increase the price of the plot;

- With significant development of infrastructure around the land plot, since the presence of hospitals, schools, kindergartens and other facilities in close proximity to them significantly increases its value;

- Changes in indicators at current market prices.

Revaluation of land for previous years

A massive revaluation of land was carried out back in 2014 , and the result was such that in some regions the calculated figure significantly exceeded the market value of the plots.

This situation led to the fact that the owners of many plots, who did not agree with this fact, considered the increase to be unjustified, and initiated a large number of legal proceedings to challenge the value established at the state level.

An equally significant change in the cadastral value was the amendments to the laws introduced in December 2016 , when there was a significant increase in indicators for all categories of land plots.

Forecast

According to the adopted Federal Law No. 360 dated July 3, 2016, with amendments currently in force in all regions, the growth of cadastral value has been suspended for some time - it will not be revised until January 1, 2021 .

At the end of this period, the price for plots will be revised, but in accordance with Federal Law No. 237 “On State Cadastral Valuation”, this process will be carried out by independent public sector institutions under the supervision of Rosreestr.

How cadastral value and land tax are related: basic formula

The cadastral value of a land plot (hereinafter referred to as the CV) must reflect its real market value. It participates in the formula for calculating land tax (hereinafter - ZN):

ZN = KS × CH,

where CH is the land tax rate.

This formula is valid for the situation when:

- information about the KS is reflected in the state register before the start of the reporting period (the KS is included in the calculation as of January 1 of the reporting year);

- the KS indicator did not change during the accounting year.

See the Ministry of Finance's plans for land benefits here .

Find out what formulas you need to use if the CS has changed in the following sections.

What does the adjustment affect?

The value of the cadastral value has a significant impact on the following points :

- Calculation of payment for land lease under certain conditions;

- The amount of land tax, which is determined as a percentage of the cadastral value.

The most significant in this case is the impact on tax calculation, since almost every owner of a land plot, with rare exceptions of preferential groups, is obligated to make such transfers to the country’s budget.

It is on the basis of the cadastral value of one square meter of land that the total price of the plot is determined by multiplying the land area by a unit of indicator.

The tax is also calculated on the basis of a percentage determined for each individual category of land, while the average rate is at the level of 0.3% and can fluctuate significantly both up and down.

Formula 1 for tax recalculation

Formula 1 for recalculating land tax looks like this:

ZN = KSizm × CH,

where KSizm is the revised cadastral value.

This formula is used if the reasons for changing the Constitutional Code are (clause 1 of Article 391 of the Tax Code of the Russian Federation):

- Incorrect value of KS - after the error is eliminated, recalculation of land tax when the cadastral value changes occurs for the entire period from the moment its incorrect value was used in tax calculations.

- Revision of the Constitutional Code by a court decision or a decision of the commission for the consideration of disputes on changes to the Constitutional Code - recalculation of land tax is carried out for the period in which an application for revision of the Constitutional Code was submitted (but not earlier than the period when the disputed Constitutional Code was entered into the state register).

Find out what register owners of cash register equipment should know about from the publications:

- “Which online cash registers are included in the Federal Tax Service register?”;

- “State register of cash register equipment - what does it include and where to find it?”.

Formula 1 is supplemented and expanded for other reasons for adjusting the CS (for more details, see below).

How to change if rights are violated

If prices are significantly inflated, each owner of a land plot has the opportunity to challenge the established value .

To challenge the price, you must first have grounds for such action.

It is worth understanding that the determination of cadastral value is carried out on the basis of specific indicators - location, characteristics of real estate, purpose of the plot, changes in the market.

If the cadastral value of a land plot has changed, and any factors were not taken into account or the data is distorted, the land owner has the right to challenge it.

Where to contact?

At the moment, there are two possible ways to change the cadastral value privately.

- Administrative method . In this case, an application is sent to Rosreestr from the direct owner of the land plot.

- Judicial . Going to court is possible only after a pre-trial settlement of the issue has taken place and Rosreestr has refused such an action.

When applying both administratively and judicially, the owner of the plot must have real grounds for reducing the cadastral value , which can be confirmed either by existing documents or by conducting an additional examination.

What documents are needed to revise the value?

When applying for the need to revise the cadastral value, the list of documentation is as follows:

- Cadastral passport of a plot of land;

- Report on the market price of land;

- Certificate of ownership of land;

- A separate expert opinion in the event that the market price differs from the cadastral price.

The Supreme Court recalled that the size of the cadastral value changes from the moment the regulation on this comes into force

The Judicial Collegium for Administrative Cases of the Supreme Court of the Russian Federation issued Cassation Ruling No. 18-KAD20-11-K4 dated September 23 on a dispute regarding an individual’s appeal of the tax inspectorate’s decision to calculate land tax based on old data on cadastral value in the presence of a new regional order approving the results of state cadastral valuation of land.

In 2021, Svetlana Koperskaya filed an administrative claim with the Oktyabrsky District Court of Krasnodar to invalidate and cancel the tax notice on the recalculation of land tax according to tax notices of the city Federal Tax Service of Russia No. 3. She explained that in December 2021, the Department of Property Relations of Krasnodar region determined the cadastral value of its plot of land by issuing Order No. 2640 dated December 14, 2021 “On approval of the results of the state cadastral valuation of lands of settlements in the Krasnodar Territory.” However, the tax office has calculated land tax for 2021 and 2021. based on the previously established cadastral value, which was higher. In this regard, the woman pointed out a violation of her rights by the Federal Tax Service of Russia and demanded that the court oblige the recalculation of the land tax on the plot based on the new tax base.

Three authorities refused to satisfy the requirements, citing the fact that Department Order No. 2640 cannot be considered as an act that improves the situation of taxpayers, since it does not contain rules directly indicating this. Such a regulatory legal act, they noted, both improves and worsens the situation of the taxpayer, therefore its provisions must be interpreted in their entirety. The courts also noted that the information on the cadastral value of land approved by the order was entered into the Unified State Register of Real Estate on February 1, 2021, as a result of which they are applied from January 1, 2018.

In her cassation appeal to the Supreme Court, Svetlana Koperskaya indicated that the lower courts incorrectly interpreted and applied clause 4 of Art. 5, paragraph 1, art. 391 of the Tax Code of the Russian Federation, and also ignored the provisions of the Law on Valuation Activities, due to which the date for determining the cadastral value of real estate as part of the state cadastral valuation is the date as of which the list was compiled, and not the date of entering information into the Unified State Register of Real Estate.

The complaint also stated that the fact of untimely entry of information into the Unified State Register by authorized officials cannot worsen the situation of the taxpayer, imposing negative consequences on him. In addition, the cassator noted, the tax authority could reliably verify the correctness of the determination of the tax base, since as of the date of accrual of land tax to the administrative plaintiff, information about changes in the cadastral value of the disputed land plot had already been entered into the above-mentioned register.

The Judicial Collegium for Administrative Cases of the Supreme Court recalled that the regulatory legal acts of the executive authorities of the constituent entities of the Russian Federation on the approval of the cadastral value of land plots to the extent that they are in connection with the norms of Art. 390 and paragraph 1 of Art. 391 of the Tax Code give rise to legal consequences for citizens and their associations as taxpayers, act in time in the order determined by the federal legislator for the entry into force of acts of legislation on taxes and fees (Resolution of the Constitutional Court of the Russian Federation of July 2, 2013 No. 17-P, Determination of the Constitutional Court of the Russian Federation of September 29, 2021 No. 1837-0).

According to the general rule of Art. 5 of the Tax Code of the Russian Federation, acts of legislation on taxes and fees will come into force no earlier than one month from the date of their official publication and no earlier than the first day of the next tax period for the corresponding tax, with the exception of cases provided for by the Code. Acts of legislation on taxes and fees specified in paragraphs 3 and 4 of Art. 5 of the Tax Code may come into force within the periods expressly provided for by these acts, but not earlier than the date of their official publication.

As the Supreme Court explained, in the case under consideration, the order of the Department of Property Relations of the Krasnodar Territory dated December 14, 2021 No. 2640 contains a direct indication that it comes into force the next day after the day of its official publication. The regulatory legal act itself was published on December 15, 2021 on the official website of the administration of the Krasnodar region.

This circumstance implied the application of the provisions of the order (which reduced the cadastral value of the land plot and, as a result, improved the situation of the taxpayer Svetlana Koperskaya) no earlier than the first day of the next tax period for land tax - that is, from January 1, 2021, and not from January 1 2018, as the courts erroneously indicated in their judicial acts. Otherwise, as the Court emphasized, it would mean an arbitrary calculation of land tax.

“Thus, the conclusions of the courts on the legality of not using the cadastral value, approved by order of the Department of Property Relations of the Krasnodar Territory dated December 14, 2021 No. 2640 “On approval of the results of the state cadastral valuation of lands of settlements in the territory of the Krasnodar Territory”, when calculating the land tax to the administrative plaintiff tax for the tax period of 2021 in relation to a land plot with a cadastral number are based on an incorrect interpretation of the rules of substantive law governing the controversial legal relationship and subject to application in this case,” noted in the cassation ruling.

Thus, the Supreme Court overturned the judicial acts of the lower authorities regarding the refusal to satisfy the demands for declaring illegal and canceling the tax notice, the obligation to recalculate the land tax for 2021. In connection with this, the Armed Forces of the Russian Federation ordered the tax inspectorate to recalculate the land tax in relation to the controversial land tax plot for 2021 based on its cadastral value established by the above order. The rest of the appealed decisions were left unchanged.

In a commentary to AG, lawyer, senior partner of Borodin and Partners Law Firm Alexey Paul noted that the Supreme Court’s ruling raises the issue related to determining the moment from which the newly established cadastral value is applied. “And we are talking about the cadastral value, which has decreased compared to what was previously in effect,” he emphasized.

According to the expert, previously the Supreme Court of the Russian Federation and the Constitutional Court of the Russian Federation formed the position that regulations establishing the cadastral value come into force taking into account the norms of tax legislation, if their provisions are necessary for calculating taxes. “As a general rule, acts of tax legislation come into force no earlier than the 1st day of the tax period, starting after one month from the date of their official publication (Clause 1, Article 5 of the Tax Code of the Russian Federation). Regarding regulations that improve the situation of taxpayers, clause 4 of Art. 5 of the Tax Code of the Russian Federation provides for retroactive effect if they directly provide for this - it is this norm that was interpreted differently by lower courts and the Supreme Court of the Russian Federation. Apparently, the lower courts proceeded from the literal meaning of the norm, and, not finding in the normative act that established the new (lower) cadastral value, a direct indication of retroactive effect, they came to the conclusion that this act should be applied taking into account the general rule of paragraph 1 of Art. . 5 Tax Code of the Russian Federation. In addition, the lower courts took into account that this regulatory act contains rules that not only improve, but also worsen the situation of the taxpayer,” noted Alexey Paul.

He added that the Supreme Court, based on the meaning of the normative act and taking into account that it reduces the cadastral value (which improves the situation of the taxpayer), concluded that this is sufficient for the non-application of the general rule of paragraph 1 of Art. 5 of the Tax Code of the Russian Federation and, in fact, giving it retroactive effect. “Such an approach will be able to adjust the practice of applying the rules on the operation of tax legislation over time, primarily regarding taxes whose tax base is the cadastral value (property taxes, land tax),” the expert concluded.

Natalya Ryabova, head of the tax practice for individuals at FBK Legal, explained that improving the taxpayer’s situation does not automatically give the rule retroactive effect if the act does not directly indicate the period from which it comes into force. “Therefore, the new assessment of the cadastral value cannot be applied in the tax period in which the act establishing a lower cadastral value was adopted,” she noted.

According to the expert, when the executive body of a constituent entity of the Russian Federation issues an act on changing the cadastral value, the tax base is determined taking into account the new cadastral value in the manner established by Art. 5 of the Tax Code: no earlier than one month from the date of its official publication and no earlier than the first day of the next tax period. “At the same time, it does not matter (as the courts of three instances considered) the date of entering new information into the Unified State Register, on the basis of which the tax base is formed in accordance with Art. 391 of the Tax Code of the Russian Federation,” the lawyer explained.

Lawyer, partner at Five Stones Consulting Ekaterina Boldinova believes that the case under consideration is one of those where the Supreme Court actually restored justice by correcting the judicial error of the lower authorities. “It is noteworthy that the case was considered in the system of courts of general jurisdiction, and the Supreme Court recalled the rules for the entry into force of acts of legislation on taxes and fees. In fact, the essence of the dispute came down to the moment at which new data on the cadastral value of a land plot should come into force for the purpose of calculating land tax.

The expert emphasized that the Court’s conclusions are absolutely in line with existing judicial practice, correspond to the position of the Constitutional Court of the Russian Federation, but are not new and only confirm an already established rule. “It’s even a pity that the search for justice on this simple issue brought the parties to the highest court,” the lawyer noted.

Is there a tax increase planned?

The issue of increasing taxes on land plots and increasing the cadastral value of land is inextricably linked and currently worries both ordinary citizens and individuals and legal entities, since for many of them the amount of the annual contribution to the budget becomes a fairly large expense.

Over the past few years, there has been a trend towards selling properties that are not profitable and become a burden on their owners who do not have enough income to pay the full tax.

It is worth noting that the new principle of calculating tax based on cadastral value began to be applied not so long ago - even before 2015 it was calculated based on the book price of land.

At the moment, a gradual transition is being made to calculations based on cadastral value , and therefore the amount of taxes is increasing and this trend will continue in the near future.

In general, the increase in taxation is carried out in stages - from 2015 to 2021, the rate increases gradually (by 20% annually) and, in connection with this, the amounts payable for the property also become larger.

On the one hand, according to experts, increasing the amount of revenue to the country’s budget is a necessary measure that will help raise funds for infrastructure development and financing the modernization of various facilities.

However, on the other hand, each individual owner of a land plot cannot always allocate such an amount of funds.

Entrepreneurs belonging to small and medium-sized businesses are most concerned about the significant increase in costs, especially those engaged in activities in the agricultural sector - it is for these categories that the cadastral value has increased the most recently.