Situations when it is necessary to return money mistakenly or excessively transferred to the account of a counterparty are not uncommon in financial practice. This situation is not pleasant, but it is not hopeless either - it can be resolved by sending a letter about the return of funds to the servicing bank.

In this review you will find information on how to correctly draw up a letter for a refund of funds (we will provide a sample for each of the possible situations), recommendations on the specifics of forming a letter in relation to each case, as well as explanations on how to write a claim letter for return of funds (sample with footnotes to the legislative framework), which is used in cases where the counterparty to whose current account the funds were received is in no hurry to return them.

When may it be necessary to request a refund?

The need to contact a bank or counterparty with a request to return the funds you transferred may arise in a number of cases. For example, in connection with:

- excessively transferred amount;

- erroneous sending of a payment to the counterparty who received it;

- incorrect indication of payment details (inaccuracy in writing the current account, or details of the bank servicing the payer's counterparty).

In each of these cases, in order to return the transferred funds, the payer must send a letter to the recipient, indicating the essence of the appeal and confirmation of the reason for the request.

Read also: Procedure for refund of overpaid taxes

Reflection of transactions in accounting

Let's consider the procedure for recording transactions in accounting accounts on the part of all participants in the transaction:

| № | Situation | Provider | Buyer |

| 1 | Excessive advance payment | Dt 51 Kt 62 - advance payment received; Dt 51 Kt 76/2 - excess amount received. | Dt 60 Kt 51 - prepayment transferred; Dt 76/2 Kt 51 - excessively transferred amount. |

| 2 | Incorrect enumeration | Dt 51 Kt 76/2 - erroneously received amount. | Dt 76/2 Kt 51 - erroneously transferred amount. |

| 3 | Termination or change of contract terms | Dt 51 Kt 62 - prepayment received. | Dt 60 Kt 51 - advance payment is transferred. |

When erroneous payments are returned, reverse accounting entries are made.

Nuances of accounting under the simplified tax system

Often, the supplier has disagreements with the tax authorities about the taxation of excess revenue. The fact is that the tax base is formed upon payment, i.e., at the time the money is received, income arises.

In case of erroneous or excessive transfer of payments, the amounts received are not taken into account when generating taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Until the circumstances are clarified, these funds do not fall under the definition of income from sales or non-operating income (Articles 249, 250 of the Tax Code of the Russian Federation).

The above does not apply to advances returned due to termination or change in the terms of the contract. At the time of receipt of the prepayment, the taxpayer has an obligation to increase income. When collecting advances received from buyers for the refunded amount, the income of the period in which the funds were returned is reduced (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Letter for refund: sample and form of document in specific situations

In the nomenclature grid of internal documents, a letter of refund is a petition, the essence of which is the payer’s request to return to the sender the money transferred excessively or erroneously.

There is no standard form for such a letter approved by law. However, in business financial correspondence, samples are used, the content and form of which have been developed taking into account many years of practice. In addition, forms recommended by specific banks whose clients are the payer can be used.

How to write a letter about a refund? The principle of forming the information contained in the letter and its sequence is identical to the requirements for the formation of business documents:

- a letter to the bank about the return of funds is drawn up on the payer’s letterhead; if there is none, the standard registration data and bank details of the applicant are indicated at the top of the sheet;

- a cap:

- Full name and position of the head of the counterparty company,

- the name of the organization he heads;

- document title

- the essence of the petition, set out in the following sequence:

- information about the payment made - when, on what basis (for example, an agreement, claim, clause or other documents) and in what amount the funds were transferred,

- reasons for the return,

- amount to be refunded

- the time frame within which a refund must be made;

- information in the signatory and the date the document was generated.

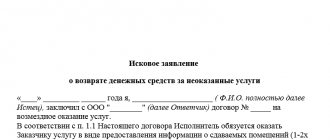

Please pay attention! If a letter of claim for the return of funds is sent to the counterparty (as a rule, the claim is sent if the recipient has not responded to the initial appeal), it includes an additional paragraph - information about the consideration of the claim through the court, the submission of demands for the accrual of penalties for illegal use of finances, liability in accordance with current legislation.

Letter of return of transferred funds: sample of options and nuances of formation

The principle of writing the information part of the application for a refund has a general concept, but its content varies depending on the reason for filing the application. Let's look at three options and nuances of writing letters.

First letter: return of erroneously transferred funds

This application option is relevant for cases where the payer sent funds to the settlement account of a counterparty for whom they were not intended. For example, for the return of erroneously transferred funds, a letter, a sample of which we are considering in this part, must be submitted if:

- the sender of the payment made an error when automatically selecting a recipient in the electronic form of the payment order;

- the payment was sent to the counterparty with whom the cooperation was completed;

- The bank transferred money using erroneous details.

- and in other similar cases.

In the first and second cases given, the refund claim is made in the name of the payee. In the third case, the claim is addressed to the bank, which in the above situation actually violated the rules for the bank to carry out payment transactions and is liable in accordance with Art. 866 of the Civil Code of the Russian Federation.

Related documents

- Claim to replace a product of inadequate quality with a similar product of proper quality

- Claim for violation of obligations under the passenger air transportation agreement

- Claim for poor quality of car repair work

- Claim for sale of defective goods

- Claim for termination of a purchase and sale agreement at a gas station for low-quality gasoline, diesel fuel, liquefied gas

- Claim under the terms of the Loan Agreement that infringes on the rights of the consumer

- Claim requesting a reduction in the purchase price and payment of a penalty

- Claim demanding termination of a car purchase and sale agreement

- A claim with a requirement to eliminate a defect in a product, terminate a sales contract, or make a replacement

- Claim from a car service station to eliminate deficiencies in the work performed

- Petition to obtain evidence in a labor dispute

- Request for evidence

- Application for deferment of payment of state duty

- Statement of claim for division of common property

- Claim for violation of construction completion date

- Claim for refusal to execute a purchase and sale agreement for an enterprise

- Statement of claim for divorce and division of property

- Statement of claim for the recovery of alimony

- Statement of claim for the release of property from seizure

- Sample application to lift the seizure of the defendant’s property

torgovyy_dom.jpg

Second letter: return of excessively transferred funds

This version of the letter is relevant in cases where the sender of the payment incorrectly indicated, and in particular, unlawfully inflated the amount of funds transferred, making an error in calculations or a mechanical error.

We give an example of how a letter for the return of overpaid funds should be written, a sample of which contains an indication of the type of error, and additional documents - a reconciliation report confirming the overpayment.

avtoperevozki.png

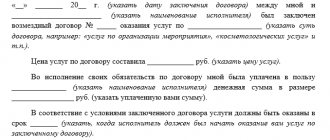

Third letter: for a refund from the supplier

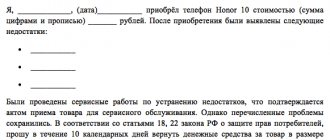

A letter requesting a refund for a product is no longer so much an application for a refund as a full-fledged financial and legal claim, which must be formalized accordingly.

The content of this letter, which in turn can subsequently become a documentary argument when considering a claim in economic arbitration, must necessarily include:

- a footnote to the provisions of the Goods Supply Agreement,

- indication of non-arrival or inadequate quality of goods;

- failure to fulfill obligations by the supplier regarding compliance with delivery deadlines.

This type of claim for a refund implies the mandatory availability and provision of supporting documents to the bank - a supply agreement and a reconciliation report.

Procedure for returning the prepayment

In accordance with the legal norms of the legislation, the buyer has the right to refuse the goods when carrying out the following sequential actions:

- drawing up a claim in two copies and mandatory registration of the document. Filling out is carried out in any form with the obligatory indication of all necessary details;

- indication of demands for the return of money or payment of compensation in case of obvious violations of the contract;

- delivering the document in person or sending it by registered mail with mandatory notification to the trade establishment;

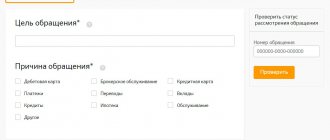

- Waiting for a response within the established time frame of up to 10 days. If, after time has passed, the store ignores the submitted application, then further appeal to the court or other self-government bodies is possible;

- consideration of the case in court and the subsequent issuance of a decision that will force the trading establishment to pay the assigned amount along with all costs and compensation for moral and material damage.

Important! Signing an agreement is a procedure that has legal confirmation when considering a case in court. If this document is missing, then the likelihood of the claim being satisfied is sharply reduced.

In order to correctly draw up a claim, you should contact qualified consultants on these issues, since consideration of the case in court requires irrefutable evidence that the buyer is right and that his rights have actually been violated.

Prepayment for online purchase

Purchasing a product or service via the Internet with prepayment implies a mandatory return of the deposited amount in accordance with the rules of distance trading.

However, the procedure has some nuances:

- return shipping of goods of proper quality at the request of the buyer requires payment for postage, since the trading establishment in this case is not obliged to pay for this service;

- the time for receiving funds may increase due to the return shipment of goods;

- the money is returned to where the payment was made (bank card, cash on delivery by mail).

If, after the expiration of the established period, the goods have not arrived to the buyer, then you can demand a refund of the amount spent and payment of a penalty for violating the terms of the contract when concluding a purchase and sale transaction.

Before signing the document, you must carefully read all the points and if a controversial situation arises, know your rights as a buyer.

You need to know this - consumer rights during the life of a gas stove.

Find out whether it is possible to return a Russian Post parcel back.

About additions to the application for a refund

Although the main document when applying for a refund is a Letter, it is not always recognized as a self-sufficient document.

In a number of cases (when returning funds for goods, excessively transferred money), the bank can and has the right to request additional documents such as:

- supply contract or agreement;

- Act of reconciliation;

- a copy of the invoice;

- a bank statement indicating that funds have been debited from the payer’s account;

- and so on. settlement and payment documents.

Results

If the seller has not yet switched to the online checkout and the buyer purchased the goods for cash, and then changed his mind and decided to return it, then the seller needs to fill out the KM-3 act.

In the case of using an online cash register, when returning money, a form in the KM-3 form may not be issued, but issuing a check with the sign “return of receipt” and cash settlement is required. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.