16

Entry into inheritance rights occurs after the death of the testator. Heirs can formalize an inheritance in 2 ways - by will or by law. When preparing papers, the heir incurs a number of expenses. The main payment is the state fee for issuing the certificate. Its value is determined by the norms of Tax legislation. Additional expenses include paying for the services of a notary who opens an inheritance case. Let's consider how the state duty is calculated when entering into an inheritance according to law and will in 2021.

State duty for inheritance: interest and amount

If previously citizens were required to pay a tax in order to enter into an inheritance, now it is only payment of a state fee for a specific notarial function - issuing a document indicating the right to own an inheritance. Produced at the end of the hereditary process.

A difference is revealed in the amount provided for payment of state duty. It is based on two fundamental indicators: the degree of closeness of the heir to the testator and the value of the inheritance received. Both indicators should be taken into account by both the heir and the notary representative.

For blood relatives

For close relatives, a reduced coefficient for determining the state duty is provided - 0.3% of the estimated (according to an independent examination) value of the inherited property. At the same time, there is an actual listing of relatives suitable for this role.

Who pays the reduced state duty when entering into an inheritance after the death of the testator:

- father mother;

- children;

- surviving husband/wife;

- brother/sister.

As for points 1 and 2, it does not matter whether these people are relatives or adoptive of the deceased. At the same time, it is worth separating the concept of adoption and guardianship under a foster family agreement. Equality of rights is ensured exclusively in the first case. The spouses must be official, which is confirmed by a marriage certificate.

These persons can be designated as representatives of the first and second priority in the distribution of inheritance according to the law. But here this information is not so important. Kinship is also taken into account during the testamentary division of the estate. These same citizens have the right to completely avoid paying state fees when entering into an inheritance.

For other heirs

It is worth knowing what percentage is charged to persons who are not blood relatives - this is an increased state duty rate of 0.6% of the price of the inheritance, determined during a specialized assessment.

The amount of state duty for performing notarial acts

For the performance of notarial acts by notaries of state notary offices, the state fee is paid in the following amounts:

- for certification of wills – 100 rubles;

- for opening an envelope with a closed will and reading out a closed will - 300 rubles;

- for taking measures to protect the inheritance - 600 rubles.

State duty for issuing a certificate of inheritance

The amount of the state duty for issuing a certificate of inheritance depends on the degree of relationship between the successor and the testator and the value of the inherited property.

Why do you need a property valuation when entering into an inheritance?

To determine the value of the property, an appraisal must be made.

- for the issuance of a certificate of the right to inheritance by law and by will:

- parents, spouse, children (natural and adopted), full brothers and sisters pay 0.3 percent of the value of the inherited property. The maximum amount of state duty is 100,000 rubles;

- other heirs – 0.6 percent of the value of the inherited property. The maximum amount is 1,000,000 rubles.

The value of inherited property is determined by specialized organizations and can be:

- inventory;

- cadastral;

- market;

- nominal.

Depending on the type of inherited property, data on its value can be obtained from a state or private company that has a license for such activities.

The notary has no right to determine the method of assessment. The payer himself chooses which document assessing the value of the property to provide for calculating the state duty. The appraisal report may indicate the market, cadastral, inventory or other (nominal) value of the property. If several documents are submitted indicating different values of the property, the lowest value is accepted to calculate the amount of the state duty (Article 333.25 of the Tax Code of the Russian Federation).

Features of paying state duty

For performing notarial acts, the state fee is paid taking into account the following features:

- in cases where it is impossible to perform notarial acts in a notary’s office or the notary travels at the request of the applicant, the amount of the state fee increases by one and a half times;

- if there are several heirs, the state duty is paid by each heir;

- the assessment of the value of the inherited property is made on the day of opening of the inheritance.

Benefits for paying state duty

Article 333.35 of the Tax Code of the Russian Federation provides benefits for certain categories of citizens. The following are exempt from paying state duty:

- citizens holding the title:

- Hero of the Soviet Union,

- Hero of the Russian Federation,

- full holders of the Order of Glory,

- veterans and disabled people of the Great Patriotic War,

- former concentration camp prisoners,

- former prisoners of war.

The benefit is provided upon availability of a document confirming membership in the preferential category.

Article 333.38 of the Tax Code of the Russian Federation provides benefits for certain categories of citizens when applying for notarial acts.

The following are exempt from paying state fees for notarial acts:

- disabled people of groups I and II – by 50 percent for all types of notarial acts;

- minor heirs;

- persons suffering from mental disorders over whom guardianship has been established;

- heirs of employees of internal affairs bodies and persons who died in connection with their official activities;

- individuals who lived together with the testator on the day of his death and continue to live in this house (this apartment, room) after his death.

Example. After the death of her mother, she was left with a three-room apartment. The only daughter, a group 2 disabled person, inherited this apartment. The cost of the apartment was 2 million rubles.

The state fee for issuing certificates of inheritance rights in inheritance is calculated at 0.3% of the cost of the apartment and is equal to 6,000 rubles.

Since the daughter is disabled group 2, she is entitled to a benefit of 50%. To obtain the document, your daughter needs to pay a state fee of 3,000 rubles.

Example. For the last 10 years, citizen Vinogradova lived with a man to whom she bequeathed her house. Since Vinogradova’s parents died a long time ago and she had no children, her partner Grechishkin inherited the house. The house was valued at three million rubles. In this case, the state duty is calculated at 0.6% of the cost of the house and will amount to 18,000 rubles.

Grechishkin is registered in the inherited house, lived with the testator on the day of her death and continues to live in this house after her death. The heir provided documentary evidence (an extract from the house register), testimony of witnesses and was exempt from paying the state fee for issuing a certificate of inheritance.

Benefits when registering an inheritance

Procedure and deadlines for paying state duty

The state duty is paid at the place where the legally significant action was performed:

- cash - at the cash desk of any bank. The fact of payment is confirmed by a receipt;

- non-cash form of payment. The fact of payment is confirmed by a payment order stamped by the bank.

Heirs pay a state fee when applying for a certificate of ownership - before the document is issued.

What is included in additional services

Technical and legal support is included in notary services taxed at the state rate. This includes consultations and all kinds of operations on drawing up, copying and printing documents, etc.

How is their value determined?

The price tag for a notary service is determined by state tariffs for purely notarial functionality, as well as prices for additional legal and technical services.

As for the fee for entering into an inheritance, the total amount of money that is paid within the framework of a particular inheritance case will depend on the number of persons appearing in it and their status in relation to the deceased.

When registering an inheritance under a will

There are two ways to accept an inheritance: by will and without it by law. When drawing up a testamentary disposition, the author can indicate any person as an heir, as well as independently designate the inheritance transferred to him and its full or partial expression.

Documents for calculating preferential rates, confirming family ties

The preferential category of heirs under the tax code does not pay state duty for inheritance. Applicants for inheritance with a reduced interest rate document their relationship. Only siblings (not cousins), legal spouses, and identified parents and children are counted.

Documents that need to be provided to confirm relationship:

- marriage certificate;

- birth certificate (which is important to confirm the status of the child and parent).

It is more difficult to confirm the relationship between brother and sister, because such information does not appear in the documents. You will have to prove your relationship through your parents and birth certificates. Passports are required to be presented.

Upon entry into property rights under the law

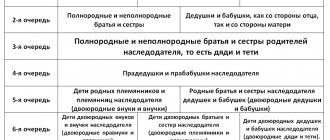

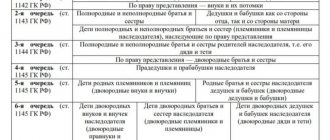

Inheritance by law involves a queue of groups of successors considered sequentially. The transition to the next category of waiting lists occurs due to the absence of representatives from the previous one. The deceased's dependents receive their share regardless of will or legal division. It is calculated as half of what they would have received in order.

Everyone is allowed to take ownership of property on only one basis, supported by documents. When dividing an inheritance, according to the law, we are talking exclusively about transferring property to blood relatives, so they need to provide documents confirming the level of relationship.

Features of payment of duties by several heirs

Feature 1. The state duty is paid in full from the value of the property received by each of the heirs, if there are several of them. But only if we are not talking about a share in the inheritance.

Example No. 2 . Kolesov G.V. bequeathed all his property to several people: a car - to his daughter Kolesova V., an apartment - to his son Kolesov D., a dacha - to his neighbor on the dacha plot Gritsenko L. Each of the heirs will have to pay the notary fee in full. But if, for example, he left his daughter both a car and half of the apartment, then the son would become the heir to ½ share of the apartment and would pay ½ part of the state duty for accepting the inheritance of the apartment.

Feature 2. When entering into rights to a share of the inheritance, the state fee to the notary is paid by the heir in accordance with his share. To do this, he needs to provide the notary with a document that will contain an estimate of the value of the inherited share.

Example No. 3 . Vyatkina A.’s father died. He did not leave a will, and therefore she will inherit the apartment that belonged to him by law. She has a brother, Vyatkin V., who has the same rights to this apartment as she does. The deceased had no other heirs except his daughter and son. Therefore, the inheritance will be divided between the brother and sister in equal shares - 1/2. In the same way, the state duty will be divided between them when registering an inheritance. The cadastral value of the entire apartment is 750,000 rubles. This means that the cost of ½ share of the apartment is 375,000 rubles. Then entering into inheritance according to the law will cost each of the heirs 0.3% x 375,000 rubles = 1125 rubles.

Standard situations: the amount of state duty when entering into an inheritance

The amount of the fee must be determined after the candidacy has been approved by a notary (and sometimes the court) and an application has been written to accept the due share. After the opening of the inheritance, six months pass before those who apply can actually receive personal certificates of the right to inheritance.

Within 6 months, the inheritance is assessed and the state fee is paid. Only after receiving the certificate can you file claims in court and register the property in your name in Rosreestr (also paying the state fee for registering property rights).

What does the payment amount depend on?

There are two basic indicators that determine the amount of state duty. Within each of them, different circumstances and digital variations are possible. Indicators influencing the state duty when entering into an inheritance:

- the cost of the inherited object;

- the percentage calculated from it: 0.3 or 0.6 depending on the position of the heir.

An ordered assessment of an inheritance from independent licensed organizations involves the calculation of market value. The remaining two options are calculated the same in all regions.

What affects the amount of state duty

You can vary the amount of the state duty depending on the status of the heir (close relative and other applicants) and the value of the inheritance. The inventory value is specified in the BTI, the cadastral value in Rosreestr. Market value is determined by the appraiser. The costs of its implementation can be divided equally between the applicants.

The most advantageous in terms of calculating the state duty is the inventory cost. It is reduced several times compared to the market price. However, citizens are recommended to always use the latter, as it can be useful for compensation for a share or for a full division of the inheritance between the persons involved.

What will the heirs have to spend on?

The fee for notary services is not regulated by the market and consists of a notary tariff (state fee) and fees for legal and technical services. When registering an inheritance, cost calculations are based on tax legislation and industry regulations. The Tax Code of the Russian Federation, the Fundamentals of the Legislation of the Russian Federation on notaries and the regulatory documents of the Federal and regional notary chambers on establishing the amount of fees for services of a legal and technical nature are of decisive importance for notaries. The documents provide a complete tariff schedule. Regional chambers have the right to approve reduced rates. Notaries are prohibited from independently changing the cost of technical and legal services.

State duty for inheritance

Tax rates are the same for all regions. If we are talking about a mandatory notarial act, the amount of the fee is determined in accordance with Art. 333.24 Tax Code of the Russian Federation.

The amount of the fee (notary fee) for issuing certificates of inheritance rights varies depending on the relationship. If spouses, children, parents or full sisters and brothers are involved in registering an inheritance, notaries withhold 0.3% of the appraised value. In this case, the limit of 100,000 rubles is observed. For the rest, a rate of 0.6% is applied and the maximum limit is 1,000,000.

Cost in Art. 333.24 of the Tax Code of the Russian Federation is adjusted only when a federal law is published. The current price level can be found in the “Tariffs” section.

Article 333.38 of the Tax Code of the Russian Federation establishes a list of beneficiaries. If they are involved in registering an inheritance, no fee is charged. There are not many reasons for providing free services by a notary:

- certification of wills in favor of the state, region or municipality;

- obtaining certificates of inheritance for the premises in which citizens lived together with the deceased;

- registration of rights to bank deposits, account balances, unpaid wages to the deceased, insurance compensation, royalties;

- transfer of property from citizens who died in the performance of public, state duties, saving people, maintaining law and order, killed due to political repression or died from diseases that arose within a year after such events;

- registration of rights in the inheritance of minor children or mentally ill wards;

- receiving insurance payments for the death of a citizen under mandatory programs or protection systems from the employer.

Disabled people of groups 1 and 2 are given a 50% discount. It is valid when applying for any notary services.

The cost of legal and technical services (LCTS) can be found on the website of the regional notary chamber.

What is UVHD

Technical and legal services are provided in Moscow according to the rules of the regional notary chamber. The association has approved a list of fixed prices. In addition, by decision of the board No. 02 dated December 29, 2020, the scope of support in each direction was determined. The approach completely eliminates abuse and imposition of services.

Separate sections of the regulations are devoted to the cost of legal and technical support when taking protective measures and organizing inheritance management. A table with current tariffs for notary services is published on our website.

It is impossible to refuse UTHD. The document that is certified is the one that was issued directly in the office. The notary is responsible for the accuracy of information and the legality of transactions. Doubts about the accuracy or completeness of the wording are unacceptable.

Don't forget about the state registration fee. Registration of inheritance for real estate, transport, securities, shares in the capital of companies cannot be done without this procedure.

If the deceased did not manage to repay the loans, responsibilities for them will pass to the new owners of the property. Claimants will be able to make claims up to the value of the assets.

Categories of persons who are entitled to benefits upon inheritance

In this case, everything is based on the category of benefit that applies to the payment of state duty. Benefits can be regulated by both the Civil and Tax Codes. The results when using them are different. In the first case, the specificity of the calculation is implied, and in the second, it eliminates the need to charge payments.

Categories of beneficiaries who do not need to pay a state fee at the notary when entering into an inheritance:

- blood relatives;

- exempt from state duty.

The list of documents depends on which benefit is applied under the Civil Code or the Tax Code of the Russian Federation. Exemption from payment of state duty is explained by the social vulnerability of persons who do not have a regular income and cannot provide for themselves due to age or illness.

Exemption from payment of state duty

Exemption is possible when inheriting deposits and money in bank accounts (if this is the only property or part of the estate from which it is removed). Also, the property of heroes who died while performing public duty is not subject to state duty.

Who is exempt from paying fees in the form of the established state duty upon entering into an inheritance:

- those who lived with the testator until his death in the same housing: an apartment, a house with a plot of land, etc.;

- minor heirs;

- mentally ill legal successors.

The first category of persons applying for benefits has more privileges and on this basis is exempt from payment. Citizens under 18 years of age are given access to the benefit regardless of the nature of the connection with the deceased. That is, it does not have to be his child, but, for example, a grandson or granddaughter by right of representation. The method of entering into inheritance also does not matter: by will or by law.

You can be freed from the need to pay a state fee for inheriting an apartment, house and land, as well as other property, only by confirming your right before a notary. To request the issued certificate, for which the state fee is paid, citizens must come to the office and provide the required portfolio of documents.

Required documents

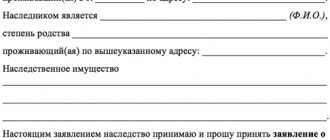

After opening the inheritance, its recipients present to the notary the death certificate of the testator, documents confirming their identity, relationship or legal marriage. After this, an inheritance case is opened, and those who wish to do so write an application to accept the inheritance and issue a certificate.

The property is assessed and a percentage is calculated to pay the fee for the final entry into the inheritance. The heirs come to the notary's appointment to actually receive the certificate with a passport and a receipt for payment of the state fee or proof of rights to an exemption from payment.

This may be a conclusion from the MSEC about mental illness or another supporting document. In case of incapacity and minority, the interests must be protected by an official representative, whose authority must also be confirmed.

How is the state duty on inheritance calculated?

There are many factors that influence the final payment amount. For example, the value of inherited assets, the number of participants, the share of each applicant, the availability of benefits.

Also, when calculating the amount of the fee, you can use different types of value (inventory, market, cadastral). The heir independently chooses the indicator for calculation.

The notary cannot insist on a certain type of assessment or make recommendations. The choice depends on the wishes of the heir.

However, the law prohibits the use of inventory value for apartments that were built after 2013. Since they are not technically registered. Since 2013, the powers to register real estate have been transferred to Rosreestr.

Example. After the death of my parents, I was left with a 2-room apartment. The heirs are two daughters who have reached adulthood. No will was made. The estimated cost of the object is 2,300,000 rubles. The tax amount for relatives of the 1st stage is 0.3%. The contribution amount is 6900 rubles. (2,300,000 x 0.3%). Consequently, each heir must pay 3,450 rubles. But, since one of the daughters has lived with her parents for the last 2 years, she is exempt from paying the mandatory fee.

Calculation of state duty: what factors influence the amount of payments

An example of how the state duty for a notary is calculated when registering an inheritance: 2 million rubles. (market value for an apartment issued as an inheritance) / 100 * 0.3 (if a wife claims inheritance after the death of her husband) = 6 thousand rubles. When using a special calculator, you can do without using a formula when calculating the state duty for inheritance cases.

The procedure for clarifying the state duty is the same in all situations, but with the replacement of variable indicators: the value of the property and the status of the heir. The notary explains in detail to the heirs about the existence of the possibility and advisability of using one of the proposed property values, and also determines the position occupied by the legal successors.

Inheritance tax: yes or no?

There is no inheritance tax. However, there is a special case: when you still need to pay. If monetary rewards are transferred as an inheritance to the heirs of the authors:

- works of science;

- literature;

- art;

- discoveries;

- inventions;

- industrial designs.

This tax is 13% of the amount received.

You will also have to pay personal income tax in the amount of 13% to those who sell inherited property within a three-year period after the death of the testator (the starting date is the day of the death of the testator, and not the day of acceptance of the property). There is no contradiction to the law in this, since the tax is paid not for accepting an inheritance, but for receiving income from the sale of an inheritance.

Property valuation

This procedure is necessary to determine the amount of the state duty. It is used in the process of conducting an inheritance case by a notary or for entering into an inheritance through the court. Market valuation of property must be carried out only by licensed specialists, otherwise the result of the examination will be invalid.

Why is this procedure needed?

Within the same case there are often several reasons for valuing transferred property. This can be avoided if there is only one heir, and he does not have to compete with other applicants.

Reasons for appointing an examination as one of the expense items when entering into an inheritance:

- drawing up a notarial consent on the division of inheritance (if this does not contradict the will of the testator);

- compensation for the lost share for various reasons (due to the inclusion of a preemptive right, distribution without taking into account the heir, who subsequently defended his right through the court, etc..;

- determination of the amount of state duty.

Inventory and cadastral values were initially intended for other purposes (taxation), but no one directly prohibits using them when calculating state duties.

Where to go

A cadastral extract is issued upon application to the Federal Service for Registration, Cadastre and Cartography, and an inventory extract is issued to the Bureau of Technical Inventory. This can also be done in electronic format on the official websites of institutions. To find out the price for your property, you need to provide the information requested by the service about it.

It is worth knowing how you can apply for information. Alternative methods in Moscow and other regions:

- through the portal “State Services”;

- in MFC departments.

Contacting professional expert services is important if you intend to identify the market value. Professionalism is assessed from the point of view of the existing state license, how long the organization has existed, guarantees for high-quality performance of work (for example, the willingness to defend the result of the work done in court).

Timing of assessment work

The duration of the assessment depends on the volume of work, as well as on how much the private activities of the expert company cost (its tariffs). Regarding the criteria for the assessed inheritance, its actual scope and the method of its production/construction directly affect the timing.

If an object is included in the spectrum of wide consumption and has a lot of analogues on the market, then its assessment is simplified. Exclusive real estate and movable objects, things, jewelry (made to order or produced by the manufacturer in small quantities) are much more difficult to analyze. Often in this situation, the involvement of highly specialized specialists is required.

Legal costs

A statement of claim is not filed in court in every case. However, if there is a dispute about the law, litigation is inevitable. Grounds for filing a claim:

- Missing the deadline for submitting an application;

- division of property;

- infringement of the interests of compulsory heirs;

- priority right to an indivisible thing;

- refusal of a notary to issue a certificate;

- contesting a will;

- debt collection through inheritance.

The list is not exhaustive. Interested parties may file a claim on other grounds.

When submitting an application, payment of the state fee is a mandatory condition. Without supporting documents, the court leaves the statement of claim without progress.

The applicant is given a period to eliminate the comments. The amount of the fee depends on the type of legal proceedings and the nature of the claims. Property claims are subject to a higher tax rate.

The payment amount is calculated based on the claim price. The link goes to the estimated value of the inheritance. The fee amount is calculated according to two criteria - a fixed rate and a floating percentage. It decreases as the amount of claims increases (Article 333.19 of the Tax Code of the Russian Federation).

If the plaintiff's demands are satisfied by the court, the applicant may recover attorney's fees from the defendant. These include expenses for filing a claim, legal support, and property valuation.

Calculation of fees for property claims

In accordance with the Tax Code, the duty is calculated based on the value of the disputed property.

| No. | Property value (r.) | Fixed amount (r.) | Percentage of property value |

| 1 | Up to 20,000 | — | 4% |

| 2 | From 20,001 to 100,000 | 800 | 3% |

| 3 | From 100,001 to 200,000 | 3 200 | 2% |

| 4 | From 200,001 to 1,000,000 | 5 200 | 1% |

| 5 | From 1,000,001 and more | 13 200 | 0,5% |

Important! The minimum payment when filing a property claim is 400 rubles, and the maximum is 60,000 rubles .

The fee is calculated based on the value of the claim. If the subject of the dispute is a share of the object, then the value of the share is taken as the basis.

Example. Citizen S. was the owner of a residential building. An assessment after the death of the owner established the value of the house at RUR 3,000,000. the heirs of the deceased are his wife, two children and mother. The mother of the deceased actually lived in the house. The wife submitted an application to the notary to enter into an inheritance on her own behalf and on behalf of the children. The deadline for inheritance has passed. The wife and children became the owners of the house. The mother of the deceased went to court in order to recognize the actual entry into the inheritance and recognition of the rights to the house through inheritance. Since during the entire specified period she lived in the house, took care of it, and paid the bills. She was entitled to ¼ share. Its cost was 750,000 rubles. Calculation of duty – 7500 (5200+2300) rub.

If the heir missed the deadline for filing an application, he can submit an application according to a simplified scheme. The amount of the fee for cases within the framework of special proceedings is 300 rubles . If a will is contested, a similar amount is withheld.

If the applicant accepted the property in fact, but was unable to provide convincing documents to the notary, then he will have to recognize the ownership of the inheritance through the court (Article 1153 of the Civil Code of the Russian Federation).

The services of a lawyer or representative under a power of attorney are paid separately. The cost of the trustee's remuneration is determined by agreement of the parties.

When filing a claim, not all citizens pay the state fee. The law provides for tax breaks for disabled people of groups 1–2 .

Such citizens are exempt from paying the fee in full. The only condition is that the amount of the claim should not exceed 1,000,000 rubles . (Article 333.36 of the Tax Code of the Russian Federation).

If this mark is exceeded, plaintiffs will have to pay part of the state fee. The calculation is made minus the established limit, taking into account the provisions of Art. 333.19 Tax Code of the Russian Federation.

Procedure for paying state duty

Along with the question of how to calculate the state duty on an inheritance, it is also worth considering how it is paid. To do this, you should clarify the payment details for the state duty with the notary. Registration of inheritance is also available through the MFC, then the details will be provided by the center’s specialists.

Via ATM

There are no restrictions on paying state fees through an ATM or at a cash register. Using terminals allows you to deposit money in an accelerated manner. Large banks provide access to paying taxes and state duties via the Internet in your personal account.

Cash

Handing over money to a notary is not allowed. In cash, the state duty is paid through a bank specialist and guarantees that the details are filled out correctly.

Payment period

Six months are given to register the inheritance, this is the same as the deadline for paying the state fee. But it should be paid only after writing an application for appropriation of the inheritance with a request to issue a certificate. Perhaps the notary will not let the heir through. In this case, as well as when transferring a larger amount than necessary, the client will be able to return his funds.

In some cases, the deadlines for accepting and closing state duty obligations by all participants are shortened or extended. The first is related to the final registration of the circle of heirs and the provision of evidence about this to the notary, and the second is related to legal proceedings between opponents or when challenging a will.

What additional costs are there?

In addition to the standard assessment of property and payment of state fees for registering an inheritance, legal successors sometimes face additional tasks and unclear questions. It all depends on the specific situation. For example, if the applicant for an inheritance is not aware of certain objects and assets, then the notary makes inquiries to the necessary authorities at the request of the heir.

It may be necessary to draw up a voluntary agreement on the division of the inheritance between the heirs. Recently, requests from the testator himself when drawing up a will have also become popular. For example, from 2021, he can accompany the will with a requirement to organize an inheritance fund or draw up an agreement with the beneficiary.

The amount of state duty when going to court

In order to take ownership of an apartment or other property by inheritance, citizens registering it sometimes must pay for additional operations and claim costs. This may be establishing the fact of ownership of property in the region of residence of the testator (at the plaintiff’s place of residence), identifying the property owner of a specific property (according to the region of opening of the inheritance).

In this case, you will have to pay not only the state fee for issuing a certificate of inheritance, but also for the consideration of the case in court. The amount will depend on the specifics of the claim. Basically, for all considered claims in inheritance cases, a state duty of 300 rubles is charged. One legal proceeding may contain several such petitions.

When do you need to pay inheritance tax for close relatives in 2021?

However, there are exceptions in which individuals receiving income from certain types of past activities of the testator must pay this fee.

In 2021, inheritance tax for close relatives will have to be paid if the testator’s estate includes:

- patented scientific activities;

- trade in art objects;

- author's literary works;

- industrial inventions.

Important! When opening an inheritance for property, the heirs will have to pay a tax rate of 13%.

Also, an inheritance with an estimated value of over 850 thousand rubles received before 2006 is subject to a payment exception. Thus, it will be necessary to first pay the tax on property registered by inheritance, and only then enter into inheritance rights.

What circumstances affect the payment of inheritance tax?

Which method, by will or without a will, the inheritance was received does not play a role when determining the amount of tax on the inheritance of close relatives.

Here, such circumstances are taken into account as: the degree of relationship of the heir to the testator, the estimated value of the inheritance, whether the heir lived with the testator in the same house or apartment, whether the heir has appropriate benefits, his physical capacity.